House prices are likely to fall further according to the ANZ Bank and stall any interest rate movement by the RBA, but this won’t derail Australia’s economic outlook.

A recent report to ANZ’s institutional, professional or wholesale clients suggested that the weakness in Australia’s housing market has persisted longer than they expected.

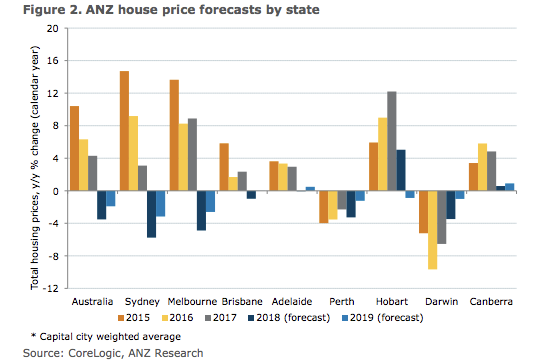

The bank has revised its forecasts and now expects to see peak-to-trough price declines of around 10% in Sydney and Melbourne, with smaller declines elsewhere.

But even if this level of price decline occurs, his would still leave Sydney house prices around 60 per cent higher than they were in 2012.

Similarly Macquarie Bank believe national dwelling prices will keep falling, eventually declining around 2 per cent in 2018 for a total decline of as much as 6 per cent from last year’s peak.

This week AMP Bank’s Shane Oliver said a property crash is not on the cards.

You may want to read: Why this expert believes a property crash is unlikely

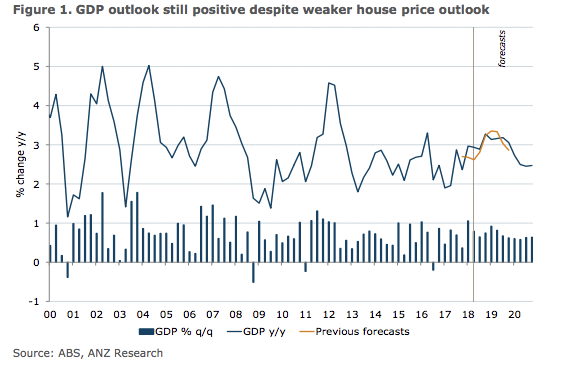

However, the ANZ says this doesn’t derail Australia’s economic outlook.

According to the bank the weaker housing market reflects a regulatory induced tightening in the supply of credit rather than tighter monetary policy.

As a result, the impact on the economy will be less pervasive.

There are also offsets to the weaker housing market according to ANZ.

For instance, the bank revised up its outlook for wages in the very near term, and larger-than-expected tax cuts are a positive development.

Some more key points from the ANZ report

- ANZ thinks GDP growth for 2018 will stay around the 3% level reached in Q1. They expect similar growth in 2019, before a slowdown in government spending, investment and net exports sees growth drop to around 2.5% in 2020.

- Growth in the order of 3% for this year and next is expected to push the unemployment rate down to 5% by the end of 2019.

In turn this tighter labour market supports higher wage growth. The lift in wages helps the outlook for inflation, with core inflation lifting to 2.3% y/y by the end of 2020. - Falling unemployment and rising wages would allow the RBA to conclude that sufficient progress is being made toward the mid-point of the inflation target, which may prompt it to reduce monetary accommodation in 2019.

Previously, ANZ expected the RBA to tighten in May 2019. Our weaker house price outlook makes this timing challenging. While the RBA does not specifically target house prices, ANZ think it will be reluctant to start tightening policy if house prices are still falling.

Hence ANZ have pushed the first hike to August 2019 to allow more time for stability to emerge, with another to follow in November and then for the cash rate to sit at 2% in 2020. - The obvious downside risks to the bank’s outlook come from: the threats to global trade, the possibility that house prices fall by more than we expect and/or that they have a more negative impact than we assume. An upside risk could be a much lower-than-assumed AUD, as the RBA lags the Fed further.

from Property UpdateProperty Update https://propertyupdate.com.au/house-prices-to-fall-further-but-wont-derail-the-economy/

No comments:

Post a Comment