Property sales over the past 12 years and compares them to the original advertised price to see if they sell for more, less or the same as that price and whether these trends are changing.

Over the three months to October 2018, more than three quarters (75.4%) of properties that sold transacted for less than their original purchase price.

By comparison, over the same period, 7.0% of properties sold for their originally listed price with the remaining 17.6% selling for more than the originally listed price.

Over the past decade, even in periods where dwelling value growth was quite strong, the majority of properties sold nationally continued to sell for less than the original list price, highlighting that even during the boom times vendors will need to be flexible on their price expectations and buyers will seek out room to negotiate.

Since the middle of 2015, which is prior to value growth starting to slow but at a time where credit availability was tightening and transaction volumes were starting to fall, the share of properties selling for less than the original list price has been trending higher.

Geographically the rising trend of a greater share of properties selling with a discount is being driven by the Sydney and Melbourne markets where buyers have endured a long period of low advertised stock levels, rapidly rising prices and intense FOMO (fear of missing out).

As housing market conditions have weakened, buyers have more stock to choose from and far less urgency.

They are gaining more leverage, negotiating harder and a growing proportion of vendors are selling at prices lower than their original advertised price.

Outside of Sydney and Melbourne the trends are quite different, with the proportion of properties selling below the original list price holding reasonably firm.

Hobart, where housing market conditions have been strong relative to the other cities, is the exception, with an ongoing reduction in the proportion of properties selling below the original list price.

Across the combined capital cities, 73.6% of properties sold for less than list price over the past 3 months compared to 21.5% for more than list price.

Between 2013 and 2015 value growth was particularly strong and at that time a relatively high proportion of properties were selling above their list price.

It’s a very different story across the combined regional markets over recent years with very few properties selling above the original list price.

At its peak, 18.1% of properties sold in excess of the original list price, by comparison over the past three months 78.9% sold for less than their original list price and 13.0% sold for more than the original list price.

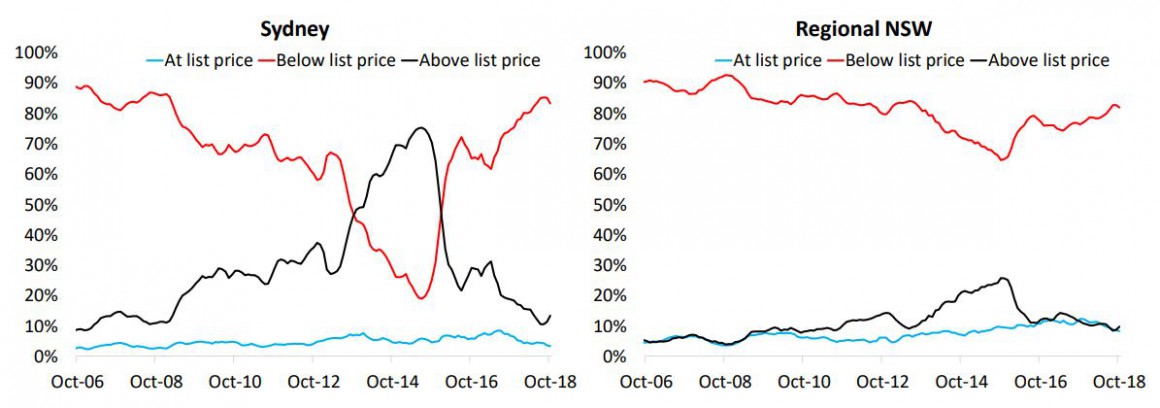

Sydney has been one of the strongest markets for value growth over recent years however, a big spike in listings and tighter credit conditions has made selling much more difficult.

At one point in mid-2015 more than three quarters of properties sold for more than the original list price.

Fast forward to the current market and 83.3% of properties are selling for less than the original list price compared to 13.3% selling above the list price.

Sydney vendors are now discounting their asking prices by 7.3% on average in order to make a sale, compared with only 5.4% a year ago.

At the peak in October 2015, 25.8% of properties in Regional NSW sold for more than the original list price highlighting that over recent years selling conditions were never quite as strong as those in Sydney.

Over the past 3 months, 82.0% sold for less than the original list price while 9.8% sold in excess of that price.

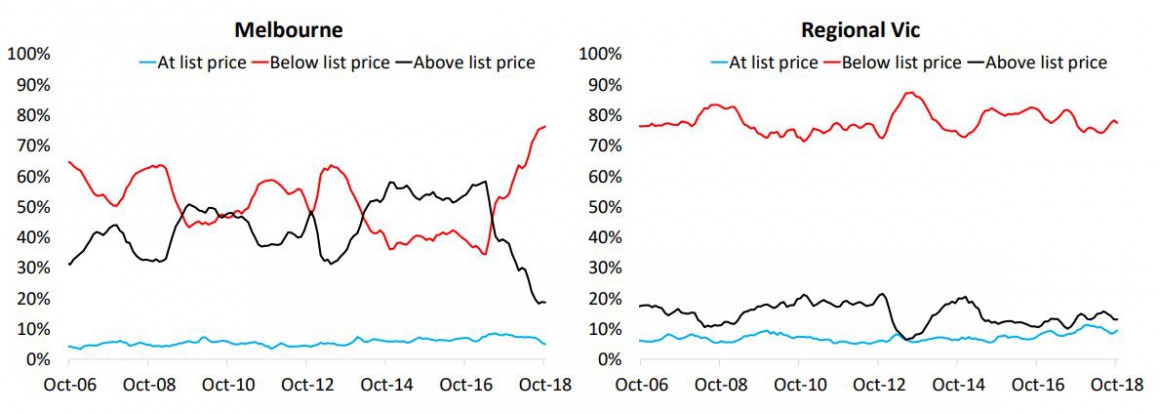

Melbourne is currently seeing 76.3% of properties selling below the original list price which is the highest share in at least 12 years.

As recently as April last year, when values were rising at a double-digit annual rate, 34.4% of properties were selling for less than the original list price.

By comparison today, only 18.7% of properties have sold over the past three months for more than the original list price and vendors are, on average, discounting their prices by 6.1% to make a sale.

There has never been a particularly large share of properties selling above their original list price across Regional Vic.

Currently, 9.5% sell for the original list price, 77.5% sell below list price and 13.1% sell above.

Brisbane’s housing market has seen very little value growth over the past decade and as a result a majority of properties has consistently sold for less than the original list price.

Over the past three months, 65.7% of properties sold for less than the original list price compared to 28.8% selling in excess of the list price.

Vendors are discounting their asking prices by an average of 5.7% in order to make a sale, which is roughly the same level of discounting relative to the same time last year.

The weakness that has been evident across parts of Regional Qld, especially those areas associated with the mining and resources sector, has seen a significant majority of properties over recent years sell for less than the original list price.

Over the past 3 months; 76.5% of property sales were less than the original list price compared to 17.0% selling for more.

When the Adelaide market was experiencing surging values in 2007 more than 60% of properties were selling above their list price however, over recent years, with housing values holding reasonably steady, very few properties have sold above the list price.

Over the past 3 months; 72.8% have sold below the list price and 21.3% have sold above the list price.

The ongoing weak housing conditions in Regional SA means that in terms of the original list price most purchasers have bought at a discount to that figure.

Over the current period; 86.3% of properties sold for less than the list price and 5.9% sold for more than the list price.

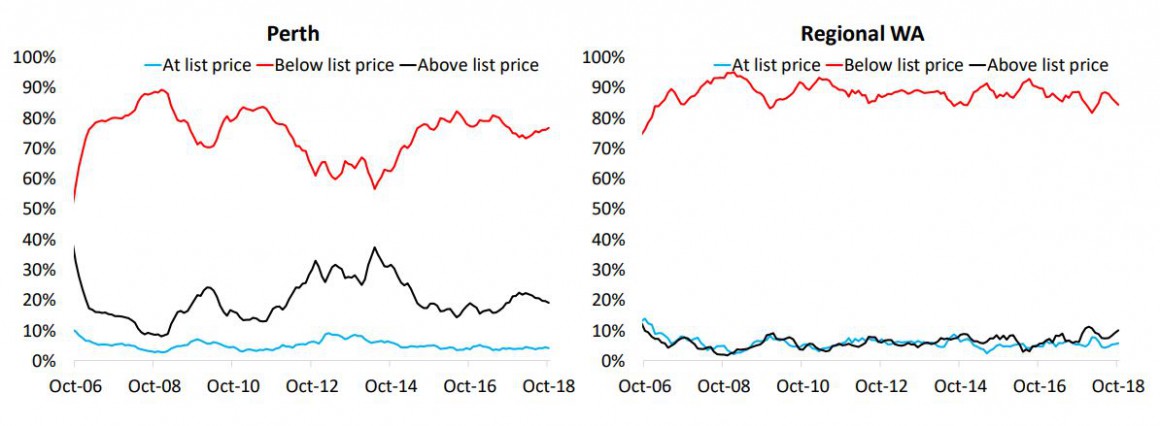

The ongoing weak housing market conditions in Perth over the past decade has meant that the majority of properties have sold for less than the original list price.

At their peak in mid 2011 (a time at which values were declining), 90.2% of properties sold for less than the originally listed price.

Over the past three months; 76.8% of properties sold below list price which is slightly lower than a year ago but still elevated and 19.0% sold in excess of the list price.

Housing conditions in Regional WA have been weaker than those in Perth culminating in almost all properties selling for less than the originally advertised sale price.

Over the past three months; 84.4% sold for less than their list price and only 9.9% sold for more than their list price.

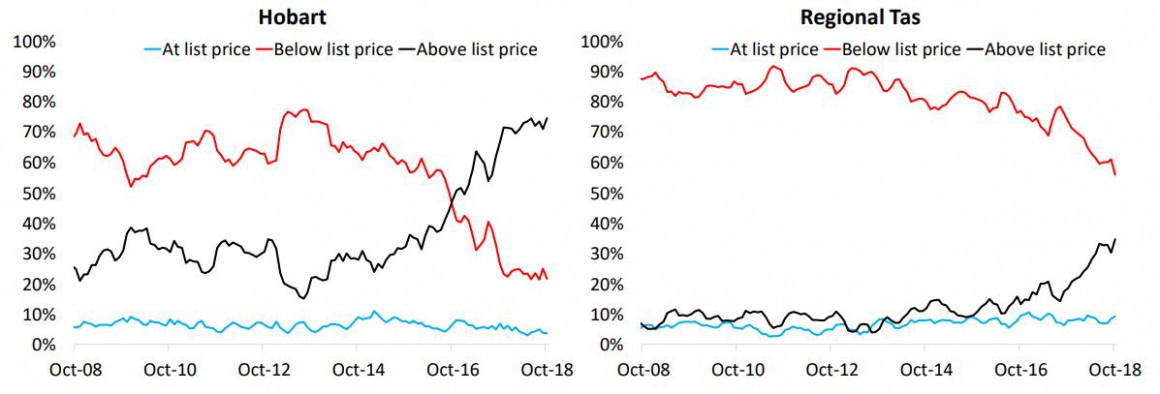

As value growth has strengthened in Hobart, an increasingshare of properties have sold for above the initially advertised price.

This is a function of relatively few properties for sale and values rising at an almost double-digit rate over the past year.

Over the past three months; an historic high 74.6% of sales have occurred in excess of the listed price compared to 21.7% below the list price.

As the rate of dwelling value growth is accelerating across Regional Tas, an increasing share of properties are selling in excess of the initially listed price.

Over the past 3 months; 34.8% of properties sold in excess of the list price compared to 55.9% selling below list price and 9.4% selling at list price.

With dwelling values falling for a number of years, very few properties in Darwin sell for more than the originally advertised sale price.

Over the past three months; 86.5% sold for less than the list price and 7.7% sold for more than the list price.

Reflecting the tough selling conditions, Darwin vendors are discounting their prices by an average of 11.7% in order to make sale which is substantially higher than any other capital city.

Regional NT is experiencing stronger housing market conditions than Darwin and subsequently a higher share of sales are occurring above the originally listed price.

Over the past three months; 16.7% sold for more than the list price and 70.8% sold below the list price.

A much higher share of properties in Canberra are selling at their original list price (14.4%) compared to other regions across the country.

Canberra is also seeing a relatively high proportion of properties selling above the list price (44.3%) although it is trending lower as sales below list price lift to 41.4% of all sales.

The recent decline in sales above the original list price is reflective of the softening housing market conditions across the city.

The data highlights the importance of setting an appropriate asking price on a listed property, and allowing some room for negotiation on the property transaction.

Finding the right balance can be a fine art.

Although the list price is often (not always) known a sale is a negotiation and as this data shows very few properties actually sell for the original list price.

As a result most properties end up selling below their original list price except in very strong markets such as Sydney and Melbourne over recent years and Hobart currently.

The data also shows that in very strong markets, vendors and real estate agents are at times not able to accurately gauge what price a property will sell for with many selling above the list price.

Equally in weak or falling markets a heightened number of properties only sell after the initially targeted sale price is reduced.

from Property UpdateProperty Update https://propertyupdate.com.au/a-majority-of-vendors-sell-below-their-original-list-price/

No comments:

Post a Comment