I’ve often said that until you have invested through a full property investment cycle, you won’t fully appreciate how the real estate market actually works.

So if you’re a little confused about what’s happening in our property markets and keen to understand what’s going to happen to the value of your home or investments, I’m going to share with you what you need to understand about property cycles.

You see…though it’s often said that the value of well located capital city properties increase by about 8 each year in Australia, this is not constant each and every year.

Looking at the 2 charts below from Aussie using Corelogic data you can see that values tend to rise in waves.

In some years there will be strong growth and in others there will be no growth and in every property cycle there are times when property values fall.

How a property cycle develops

A really simplistic version of the cycle goes something like this…

As our population grows there is an increased demand for real estate and this causes an increase in rents and in demand for new homes from owner occupiers.

Slowly this causes property values to increase because of the forces of supply and demand.

Some people buy new homes while others get started in real estate investment.

At the same time builders and developers hop on board and start constructing new dwellings to meet the increased demand.

However the pendulum tends to swing too far and over time we get to an oversupply of dwellings which eventually results in rent reductions and slumping home values.

Yes…despite what many agents will tell you, real estate values may fall and often have.

Of course in other years, values may rise by over 20%.

How long do property cycles last?

Putting a timeframe to these cycles is not easy.

Looking back over the past few decades, cycles in Australia have generally lasted about seven to nine years and property growth has peaked in the following years: 1981; 1987; 1994; 2003; 2010, 2017

But these cycles don’t exist because a number of years have passed.

They occur because of a combination of factors and influences such as the state of the economy, social and political issues.

The fact is that looking back over the last 30 or 40 years well located properties have seen their values double every 10 years or so.

However, at some stages of the cycle values increase and at other times they stay flat or decrease.

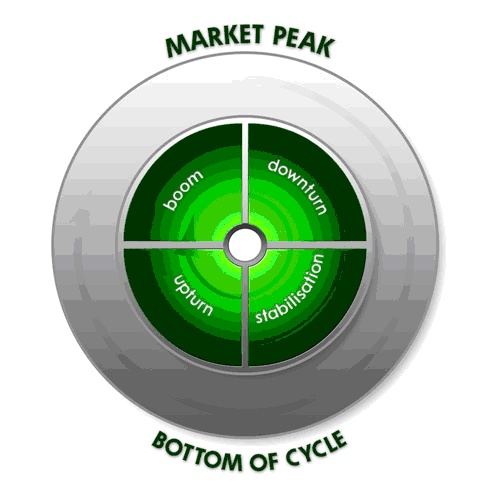

As shown in the graphic above, at certain stage in the cycle property values exceed the underlying long term trend (such as in boom times) and at other stages they fall short of this long term intrinsic value (such as during property slumps.)

As I’ve said the pendulum always swings too far in the world of property investment.

History shows that the property cycle consistently passes through 4 phases:

© 2007 -2019

© 2007 -2019

The BOOM PHASE

This tends to be the shortest phase of the cycle.

During the boom real estate prices increase rapidly – often by more than 20% per annum.

Remember Sydney in 2015-17?

The boom often begins slowly but brings a whole new generation of investors coming into the market, driven by property seminars, the press, TV shows and the like.

At the same time as home owners push up demand for houses and together this leads to increasing property prices.

Greed starts to kick in, as does speculation.

Often potential investors who can’t really afford to buy property extend themselves and speculate. Some even buy “off the plan” hoping to sell at a profit, expecting prices to keep rising.

At this stage of the cycle banks often encourage investors with easy credit, sometimes lending them 80, 90 or even 100 per cent of the cost of their investment properties, causing some to over-commit themselves financially.

Fear also drives property booms as investors see property prices going up all around them.

They are worried that thy may miss out on the profits the boom has delivered to other investors.

You’ll often find them willing to negotiate to buy at considerably above the asking price at a time when sellers keep racking up their expectations as they notice the high prices achieved for neighbouring properties.

Not understanding the dynamics of a property cycle, many of these beginning investors become overconfident at a time when they probably should be the most cautious and they are prepared to overpay just to get into the property market, pushing up property prices to levels that are (in the short term at least) unsustainable.

Vendors also become greedy pushing up asking prices and this just feeds the property boom.

As the boom moves on many builders and developers flood the market with new properties to meet the increasing demand from owner occupiers and investors, but invariably they eventually flood the market with too many properties.

In general, booms are stopped when the Reserve Bank (RBA) increases interest rates to slow down the economy, and in the past it’s been quite effective at doing this.

More recently (in 2014-18) the Australian Prudential Regulation Authority (APRA) has made the banks tighten their lending criteria to investors to deliberately slow a market that it judged to be overheated.

Each peak is accompanied by a chorus of voices who deny the top is anywhere in sight and it’s impossible to predict with any accuracy the moment when the cycle turns, however a peaking market is likely to have several of the following characteristics:

- Property values have risen strongly for a number of quarters

- Auction clearance rates are at high levels indicating a strong sellers’ market.

- High levels of credit growth have occurred because consumers are borrowing more

- Banks’ lending criteria have loosened and there are lending instruments. In the last big boom, no–doc and low-doc loans proliferated allowing almost anyone to get a loan to buy property

- Builders and developers become over-confident and a high level of construction leads to an oversupply of properties and higher vacancy rates

- Housing affordability becomes stretched

- Speculation is rife with a new generation of investors getting involved in property hoping to “get rich quick”

- The RBA tries to dampen speculation by raising interest rates

- A credit crunch occurs and banks tighten their lending criteria.

The DOWNTURN PHASE

Booms are always followed by a downturn or slump phase that is often characterised by an oversupply of properties due to the over-exuberant activity of builders and developers during the preceding boom.

This causes increasing vacancy rates and decreasing investment returns.

Property prices stop growing and sometimes drop by around 5-10%.

This phase lasts a number of years, but prolonged booms are usually followed by a longer and deeper slump phase with a greater likelihood of prices falling further.

During the slump, property is out of favour in the media and investors often struggle with decreased cash flows, higher interest rates and stalling values.

This is the time many consider selling their properties.

However, when they do this in a falling market with few willing buyers, they exacerbate their problems and crystallise the loss in value of their properties.

Near the end of this phase of the cycle interest rates slowly drop as the RBA tries to stimulate consumer confidence and the economy, because the prevailing sentiment is often fear and desperation.

Around this time the banks becoming more “investor friendly” and start loosening their lending criteria.

The STABILISATION PHASE

Eventually the market moves on.

Falling interest rates, rising rents and pent up demand during the slump phase set the stage for the next property upturn.

But prices don’t suddenly start escalating wildly.

The downturn is usually followed by a period of time when buyers tentatively move back into the market soaking up the properties for sale, but as the number of buyers and sellers is in rough equilibrium, property prices remain flat or only move up slowly.

This is a time of great opportunity, yet it is not easily recognised by most investors, despite it still being a buyer’s market.

The UPTURN PHASE

In time the cycle moves on and eventually we move into the upturn phase when vacancy rates slowly fall, rents start to rise and property values begin to increase.

At this stage of the cycle property is generally affordable, returns from property investments are attractive and home buyers and smart investors begin to enter the market.

This is obviously a great time to buy property and while professional investors take advantage of the opportunities in the upturn phase, many beginner investors take longer to be convinced that property is a good investment.

However, this is a time of great opportunity to get set for the property boom that will eventually follow.

This is also when many builders and developers begin work on new development projects, aiming to have them completed by the late upturn or boom phases of the cycle.

At the beginning of the upturn phase of the property cycle interest rates are usually low and it is easier to get finance.

As the upturn phase rolls on (remember this stage could last three or four years) more investors and first-home buyers enter the market as conditions seem more favourable.

They see property values increase and are concerned that they may miss out if they don’t buy a property.

While property values increase, they tend to do so much more gently than the “heady” price rises of the boom phase, which is just around the corner.

At the end of the upturn phase real estate prices will have risen substantially and property starts to become less affordable to many Australians.

And…..we start all over again.

WHAT CAN YOU DO TO STAY AHEAD?

As signs point to softer growth conditions for Australian property over the coming months, independent professional advice and careful consideration will be as important as ever in navigating Australia’s varied market conditions.

If you’re looking for independent advice, no one can help you quite like the independent property investment strategists at Metropole.

Remember the multi award winning team of property investment strategists at Metropole have no properties to sell, so their advice is unbiased.

Whether you are a beginner or a seasoned property investor, we would love to help you formulate an investment strategy or do a review of your existing portfolio, and help you take your property investment to the next level.

Please click here to organise a time for a chat. Or call us on 1300 20 30 30.

from Property UpdateProperty Update https://propertyupdate.com.au/understanding-property-cycles/

No comments:

Post a Comment