Here’s my first property forecast for 2017…

Most property forecasts will be wrong!

You see…if 2006 taught us anything, it taught us to expect the unexpected.

So while I won’t pretend to know what 2007 will bring, let’s have a look at 7 trends that are likely to shape our property markets in 2017:

1. House prices will increase but more slowly than last year

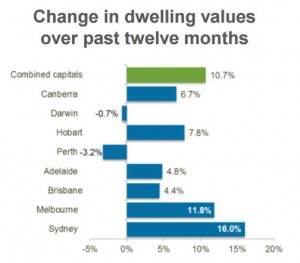

The property markets around Australia were very fragmented in 2016, not only from state to state, but also the various submarkets within each state.

Source: Corelogic – 12 months to January 2017

Sydney and Melbourne were the standout performers with well located houses, townhouses and villa units generally outperforming apartments.

It is likely things will be much the same in 2017 but the national property market will grow more slowly than in the last two years.

This is likely to be more of a moderation, as opposed to a slowdown as the pace of growth, especially on the east coast, and particularly in the Sydney and Melbourne housing markets, is unsustainable.

However, property prices within 10 -15 kilometers of our 3 big east coast CBD’s will be buoyed by our increasing population, jobs and wages growth (in certain industries) and an undersupply of the right type of property for sale at a time when more people will be wanting to get into the property market – both homebuyers and investors.

Prices growth for houses will continue to outpace that for apartments, but with people wanting to live near where they work, more will compromise and trade their backyards for balconies and move to medium and high density living.

The problem is we’re building the wrong product – too many small, poorly finished, high density apartments in generic monolith towers that are not user friendly to the new wave of affluent owner occupiers.

2. There will be a lot more talk about housing affordability

The debate on housing affordability will continue as young families will find it more difficult to save a deposit to enter the property markets, especially in eastern seaboard capital cities.

The trend of rentvesting will continue.

This is renting where you want to live, but can’t afford to and investing your money where you can afford to buy a property.

At the same time more people will be renting through choice to give them freedom and flexibility in lifestyle options.

3. Interest rates will increase

3. Interest rates will increase

Our languishing economy and low inflation rate are likely to keep official interest rates low for much of 2017.

However, due to the increased cost of funding and the fact that some lenders are too highly exposed to residential lending, it is likely that the banks will once again increase rates out of step with RBA interest rates.

And I think we can expect APRA to deliver further macro prudential measures to restrict lending to property investors.

4. Apartment oversupply

I’m concerned about the apartment market in the CBD’s of Melbourne, Brisbane and to a lesser extent Perth’s CBD.

There is a significant oversupply of apartments being completed at a time when investors, particularly foreign investors will have difficulty obtaining finance to complete their purchases.

This is likely to lead to fallout because of the banks tighter lending restrictions to local investors for new inner city apartments, and that fact that they’ve almost completely stopped lending to foreign investors and expats at a time when valuations on many newly completed apartments are coming in considerably below contract price.

5. Fewer properties for sale

There will be fewer properties for sale in 2017 as more homeowners will stay put and renovate rather than move, as this is often the easier and more affordable option.

Similarly, Baby Boomers planning to downsize are likely to stay put as their plans to downsize to a modern apartment or townhouse and be left with some money in their pockets are shattered due to the cost of new medium density dwellings.

6. Foreign Buyers Aren’t Going Away

Australian property will remain in strong demand by foreign investors, fueled in particular by buyers from China, who are looking for safe places to store their wealth in a relatively safe haven by comparison to the uncertainty in the United States and Britain.

7. Global Political Uncertainty

We’re currently being entertained by the daily antics of President Trump, but these could lead to global political tensions, a global trade war and rising global interest rates.

The bottom line

2017 will be another interesting year.

The doomsayers will be out again and the media will give us plenty of reasons to sit on the sidelines waiting for more certainty before investing.

But looking back over the years the continual white noise in the media, especially around political events, really just created a distraction and those who took a long term perspective and accumulated “investment grade” properties have done particularly well.

Having said that, 2017 will be a year when correct asset selection will be critical for investors as not all properties will increase in value and the markets are likely to remain as fragmented as ever.

WHAT ARE YOU GOING TO BE DOING IN 2017?

Are you going to take advantage of the property markets in 2017 or are you going to get caught by the traps ahead?

If so and you’re looking for independent advice, no one can help you quite like the independent property investment strategists at Metropole.

Remember the multi award winning team of property investment strategists at Metropole have no properties to sell, so their advice is unbiased.

Whether you are a beginner or a seasoned property investor, we would love to help you formulate an investment strategy or do a review of your existing portfolio, and help you take your property investment to the next level.

Please click here to organise a time for a chat. Or call us on 1300 20 30 30.

When you attend our offices you will receive a free copy of my latest 2 x DVD program Building Wealth through Property Investment in the new Economy valued at $49.

from Property UpdateProperty Update http://propertyupdate.com.au/7-property-trends-that-will-shape-2017/

3. Interest rates will increase

3. Interest rates will increase

No comments:

Post a Comment