The January result showed capital city dwelling values rose by 0.7% over the first month of the year.

This was lower than the 1.4% rise recorded in December, but higher than the readings for October and November last year, when capital city dwelling values rose by 0.5% and 0.2% respectively.

Commenting on the January results, the positive result was broad-based with every capital city (excluding Darwin) recording a rise in dwelling values over the month.

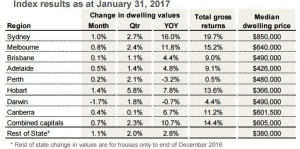

The largest month-on-month gains were recorded in Hobart (+1.4%), Sydney (+1.0%) and Melbourne (+0.8%).

On a quarterly basis, the CoreLogic January index results confirmed that all capital cities recorded a rise in dwelling values, with Hobart in the lead, recording a 5.8% rise in dwelling values over the three months to the end of January.

Sydney (+2.7%) and Melbourne (+2.4%) also posted strong increases over the rolling quarter.

The annual trend in dwelling value appreciation remained steady when compared with last month.

The annual growth rate across the combined capital cities was 10.7% over the twelve months ending January 2017, compared with 10.8% over the previous rolling twelve month period.

The quarterly capital gain across Hobart was the highest of any capital city at 5.8%, taking the annual capital gain to 7.8%.

While the growth trend in smaller cities such as Hobart can show higher levels of volatility, clearly the Hobart housing market is now well into its growth cycle.

Strong housing market conditions are being driven by positive affordability of housing, as well as improving economic conditions and stronger migration trends.

Buyers still have a great deal of leverage in these markets, with listing numbers remaining high, long selling times and high rates of discounting.

However, in another indication that conditions may be moving through the bottom of the cycle, transaction volumes moved higher across both markets prior to the seasonal downturn in December and January, whilst the average selling time reduced from previously higher levels.

With economic and demographic conditions remaining weak in these markets, a recovery in dwelling values is likely to be a slow process.

Gross rental yields slipped to a new record low across the combined capitals index in January, with the gross yield on a house now recorded at 3.20%, falling from 3.50% a year ago and 4.12% five years ago.

The gross yield on a unit also reached a new record low in January, recorded at 4.01% across the combined capitals; down from 4.25% a year ago and 4.86% five years ago.

The latest housing finance data from the Australian Bureau of Statistics indicates investors comprise 47% of the value of new mortgage demand (excluding refinances), with investors in New South Wales accounting for 58% of new mortgage demand and investors in Victoria comprising 45.0% of new mortgage demand.

Transaction numbers experienced the normal seasonal slowdown during December and January, however prior to the festive season, transaction numbers had been tracking higher.

Comparing the second half of 2016 with the first half shows a 1.5% rise in the number of settled sales nationally and a 2.1% increase across the combined capitals.

While the pace of capital gains remained strong in January, our view is that growth rates will trend lower over 2017, with several factors likely to dampen the strong capital gains trend.

Affordability constraints are likely to become more pressing, particularly in Sydney, where the dwelling price to income ratio was approaching 8.5 times in September 2016.

The deposit hurdle is becoming a larger barrier to entry with additional costs such as stamp duty adding to the high entry costs for housing.

While mortgage serviceability remains reasonably healthy, mortgage rates are already edging higher on the back of higher funding costs, which could progressively take some heat out of investment demand.

In addition, with house prices continuing to increase, the supervisory focus from APRA and risk committees can only be expected to increase in 2017, suggesting a continued trends towards tighter credit policies amongst regulated institutions.

Investors comprise almost 50% of new mortgage demand nationally, so a downturn in investment activity would likely reduce housing demand and remove some of the pressure on value growth.

When the previous APRA speed limits came into effect we saw the rate of value growth slow throughout the second half of 2015.

If we continue to see investor participation rising across the housing market, additional regulatory changes may come into play.

This may occur in any event, depending on developments in the international regulatory arena in 2017, the large number of high-rise units currently under construction as another factor that may slow overall housing market performance.

from Property UpdateProperty Update http://propertyupdate.com.au/national-housing-market-update-video-february-2017/

No comments:

Post a Comment