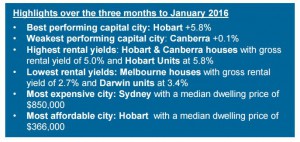

The Sydney market finished the month as the most expensive capital city with a median dwelling price $850,000.

The largest month-on-month gains was recorded in Sydney (+1.0%).

Sydney (+2.7%) and Melbourne (+2.4%) also posted strong increases over the rolling quarter.

Sydney stood out as recording the highest annual capital gains with dwelling values up 16.0% over the past twelve months; the highest annual rate of growth since the twelve month period ending September 2015.

Since the growth cycle commenced in June 2012, Sydney dwelling values have increased by a cumulative 70.5%.

The gross yield on both houses and units reached a new record low in January across Sydney and Melbourne, while unit yields in Darwin also reached a record low.

While rental yields plumb new lows, investment in the housing market has been consistently ratcheting higher which implies that investors are speculating on further capital gains in the housing market.

The latest housing finance data from the Australian Bureau of Statistics indicates investors comprise 47% of the value of new mortgage demand (excluding refinances), with investors in New South Wales accounting for 58% of new mortgage demand and investors in Victoria comprising 45.0% of new mortgage demand.

The jump in settled sales was heavily influenced by an 8.4% rise across the Sydney housing market over the second half of the year.

Importantly, as off-the plan unit sales move through to settlement, there will be some upwards revision to these numbers.

Affordability constraints are likely to become more pressing, particularly in Sydney, where the dwelling price to income ratio was approaching 8.5 times in September 2016.

YOU MAY ALSO BE INTERESTED IN READING:

Melbourne Housing Market Update [Video] – February 2017

from Property UpdateProperty Update http://propertyupdate.com.au/sydney-housing-market-update-video-february-2017/

No comments:

Post a Comment