Housing data released by SQM Research have revealed that the number of national residential vacancies fell in January, with 78,364 rental homes vacant and available for rent, giving a national vacancy rate of 2.4%.

Year on year, National vacancies are steady.

Key Points

• Nationally, vacancies rose slightly during January 2017, recording a rate of 2.4%.

• Perth continues to record the highest vacancy rate of the capital cities at a rate of 4.8%

• Year-on-year vacancy rates are down for Canberra, Darwin, Hobart and Melbourne.

• Hobart recorded the lowest vacancy rate of 0.7%.

All capital cities recorded falls in January.

Hobart now has the lowest vacancy rate of just 0.7%, reflecting very tight rental conditions which are also been experienced in other parts of Tasmania (Launceston is at 1.6%).

While Perth continues to record the highest vacancy rates for any capital city at 4.8%.

Elsewhere, Sydney vacancies fell to 2.0% (from 2.3% recorded in December). While Melbourne also fell to 2.0% (from 2.5% recorded in December

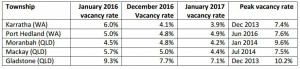

Mining Towns recording ongoing falls

SQM Research notes that a number of mining towns are recording ongoing falls in vacancies, signalling that the housing bust in the mining towns is possibly coming to an end.

Residential vacancies in Karratha, Port Hedland, Mackay and Gladstone are all down compared to his time last year.

Asking rents

Reflecting its high vacancy rate, Darwin continues to record big falls in asking rents of with units falling by another 2.5% for the month (houses down 0.1%).

Perth continues to record the largest yearly declines however rents did rise slightly for the month at 1.1$ for houses and 0.5% for units.

Meanwhile Hobart is the strongest rental market in the nation with rents up by 6.7% for houses and 11.6% for units.

As noted, Hobart also has the lowest vacancy rate of all capital cities at just 0.7% Brisbane remains a flat rental market with falls in rents being recorded for units in the inner ring of between 2.5% to 5% declines.

Overall rents continue to rise at about 2% pa nationwide with some variability reflecting the mixed Australian housing market.

So far the feared oversupply for Sydney and Melbourne has not yet eventuated and we are aware of some scaling back of developments, particularly in the Melbourne rental market.

While Brisbane does remain oversupplied for units which has assisted Brisbane tenants in achieving better rental terms.

Source: www.sqmresearch.com.au

from Property UpdateProperty Update http://propertyupdate.com.au/vacancy-rates-fall-in-january-after-seasonal-rises-over-holiday-period/

No comments:

Post a Comment