The problem facing the Australian economy in 2017 is the absurd ‘official’ measurement of unemployment.

The true level of real unemployment and under-employment is under-reported.

This is having a major impact on our policy settings and shows just how divorced our politicians have become from the reality.

The same sentiment applies to the Reserve Bank of Australia.

A swift dose of reality is needed, or our current crop of seat warmers will face the same election outcomes as witnessed overseas last year.

Using the ‘official’ unemployment figures, as produced by the Australian Bureau of Statistics (ABS), allows the Government to rely on inflated figures of real employment while simultaneously down-playing the real levels of (much higher) real unemployment and under-employment.

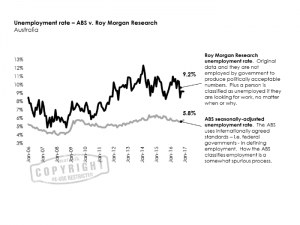

According to the latest ABS figures, 5.8% (741,000) of Australians are unemployed.

In contrast, the more accurate measure of unemployment by independent research firm, Roy Morgan Research, estimates that 9.2% (1.2 million) of Australians are unemployed.

To be full-time employed you need to work over 35 hours each week and to work part-time, less than 35 hours.

This 35 hour rule applies across all jobs.

So you can hold five jobs, working eight hours per week in each, and be deemed as full-time employed.

The process used by Roy Morgan differs importantly from the ABS.

They conduct once-off, Australia-wide, face-to-face interviews.

A person is classified as unemployed if they are looking to work, period.

In addition, Roy Morgan estimates a further 1.4 million Australians (10.8% of the workforce) are under-employed.

These people are employed but want more work.

So, the real employment estimates suggest that 20% (2.6 million) of Australians are either unemployed or under-employed.

Got doubts?

Well, go to any major shopping centre in the middle of a weekday and look for yourself.

Alternatively, sit in an inner city café for a few hours and observe.

Despite the real level of unemployment and under-employment in Australia being far higher than officially reported, the RBA insists on keeping Australian interest rates higher than any comparable country in the world.

For the record, Australia’s official interest rate is 1.5%.

They are 0.5% in Canada and the United States, plus 0.25% in the United Kingdom.

In addition, our business taxes are way too high and we are suffocating in miles of red tape.

There were several ‘wake-up’ calls delivered to Australia’s political class over the last 12 months – Brexit and Trump, of course – but remember that close to a quarter of voters shunned the major parties and voted for minor parties and independents at last year’s Australian federal election.

Unfortunately, despite these three unexpected events, it appears that Australia’s political class has yet to grasp the reality of what is really going on in the Australian economy.

For mine, the future performance of residential property is all to do with jobs.

The nature of work is also changing, and this will have a major influence on housing demand in the future.

This will be a continuing theme of future Matusik Missives this year.

Several of our new reports will also have a renewed focus on job creation, employment forecasts and household incomes.

from Property UpdateProperty Update http://propertyupdate.com.au/wake-up-australia/

No comments:

Post a Comment