Australians will spend most of their 30s correcting the financial mistakes of their 20s according to new research from Finder.

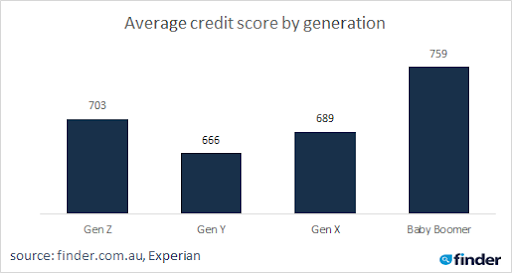

Finder analysed over 14,000 credit reports, and found that Millennials have the worst credit score of any generation, with an average score of 666.

A credit score reflects a person’s credit history and ranges from 0 to 1,0001.

This score helps lenders assess a credit application such as home loans or a line of credit.

Kate Browne, personal finance expert at Finder, said a bad credit score is not something to ignore.

“Many Australians may be wondering how the Banking Royal Commission will impact their ability to borrow, a good first step is to make sure your credit score is in good shape.

“A poor credit score at 30 is particularly troubling as it could make it more difficult to take out a loan for a house, car or even a personal loan for a wedding.

“Lenders know your score, so why shouldn’t you? If you don’t know your score, jump on Finder and learn what it is for free.”

The average credit score nationally is 685, which places the average Aussie at the high end of the “good” score bracket (between 625-699).

Anyone with a “very good” credit score (between 700-799) has an above average credit history.

Baby Boomers doing well

Baby Boomers scored the highest of any generation with an average rating of 759.

Following a survey of 2,003 people, Finder research showed 61% of Aussies don’t know their credit score. T

his is made up of 13% who don’t know how to access it and 6% who don’t know what a credit score is.

“Next to your age and income, your credit score is one of the most important numbers in your life.

“Knowledge is power. If you know you have a bad credit score, you can start to do something about it,” Browne said.

Top tips to improve your credit score

- Find out what your score is: You can get your credit report and credit score for free with Finder. Then you can get a clearer understanding of your finances, including your credit score and any credit listings that are hurting your rating. It’s good to check your credit report regularly for both incorrect listings and areas you can improve.

- Your credit score is based on how much available credit you have. If you have a large credit limit that you aren’t using, you could consider lowering it. Not only will this curb any temptation to overspend, but it could have a positive impact on your credit score

- Make credit card and loan repayments on time: Under Australia’s comprehensive credit reporting system, your credit file contains both positive and negative information about your credit history. A track record of making timely payments towards your debt can demonstrate your improved financial discipline.

- Space out credit enquiries: Don’t make multiple credit applications in a short period of time, as this will lower your credit score and indicates to lenders that you are under financial stress.

from Property UpdateProperty Update https://propertyupdate.com.au/millennials-lowest-credit-scores-tap-woe/

No comments:

Post a Comment