The Melbourne property market has been one of the strongest and most consistent performers over the last few decades.

However after peaking in November 2017 the market is now taking a breather.

But the Melbourne real estate market is not crashing as some property pessimists predict – it is experiencing a soft landing.

There are no forced sales by desperate vendors, instead we’re seeing an orchestrated slowdown created by our regulators who’ve tightened the screws on lending, particularly to investors.

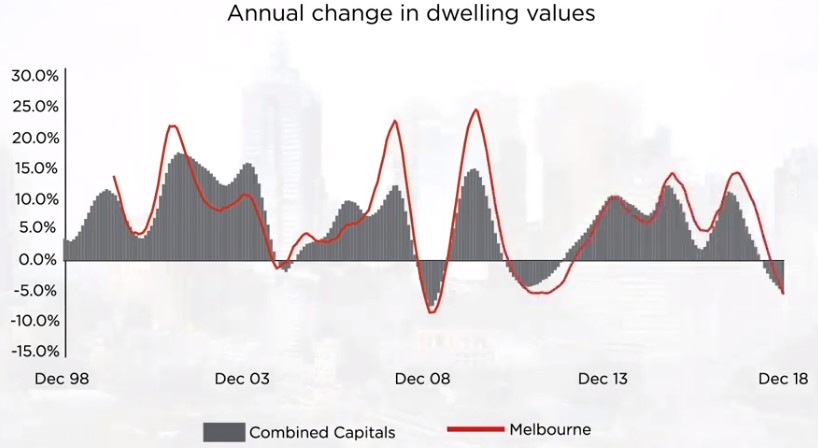

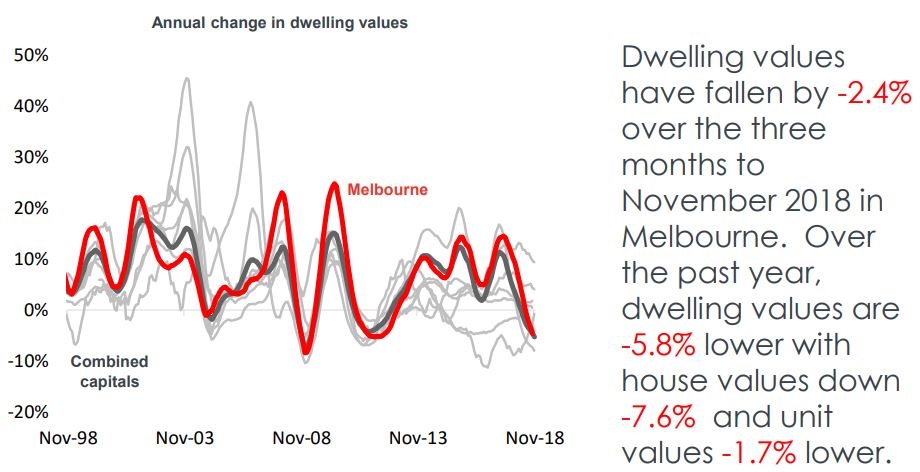

Here are some stats from Corelogic showing the cyclical nature of the Melbourne real estate market over the last 20 years…

While Melbourne property values are declining, it’s not all bad new; dwelling values remain significantly higher than they were five years ago and the recent declines have provided an improvement to housing affordability.

So…is it too late to get into the Melbourne property market?

Like most things in real estate the answer is – it depends.

While some areas still have strong growth ahead, certain sub markets should be avoided like the plague.

I’m going to examine the many factors that are driving Melbourne’s various property markets in detail in this blog which is a little longer than normal, so if you’re looking for a particular element of the Melbourne property market, use these links to skip down the page.

If you’re looking for some key pointers to the future of Melbourne property consider these:

- The Victorian economy continues to strengthen creating more (higher paying) jobs

- Record international and interstate migration will continue.

- 1,500 new households are being formed in Melbourne each week and the supply of new housing is struggling to keep up with this burgeoning demand.

- Melbourne’s rental market is tightening, with low vacancy rates and rising rentals.

- First home buyers are back in the market

- There continues to be strong foreign interest in Melbourne from tourists, migrants, investors and developers

Melbourne’s Many Markets

Melbourne’s Many Markets What’s So Special About Melbourne?

What’s So Special About Melbourne? What types of properties perform well in Melbourne?

What types of properties perform well in Melbourne? How do Melbourne’s areas compare?

How do Melbourne’s areas compare? Advanced Strategies & Things to Look For

Advanced Strategies & Things to Look For How do I choose an investment property in Melbourne?

How do I choose an investment property in Melbourne? How can I keep up with the market?

How can I keep up with the market?Clearly Melbourne isn’t “one” property market

There are multiple markets in this diverse sprawling city; divided by geographic location, price point and property type.

Currently some markets are still hot, while others are not.

So to help you better understand what’s going on in Australia’s second largest property market are 29 things you should know if you’re considering investing in Melbourne property:

1. Melbourne Property Market Prices

Over the past couple of years Melbourne home values have risen at the second fastest pace of all capital cities.

Auction clearance rates have consistently been high and discounting and time on market levels have fallen across the city over the year showing strong market depth from a range of home buyers and investors.

While future capital growth will be a little slowly than in the last few years, Melbourne’s property prices will continue to be underpinned by its strong population growth and the influx of 35% of all overseas migrants.

Melbourne now rates as one of the 10 fastest growing large cities in the developed world, with its population likely to increase by around 10% in the next 4 years.

At the time of this update of this article – January 2019 – the decline in Melbourne dwelling values is concentrated across the most expensive end of the market, with dwelling values down 9.9% over the past twelve month across the top quartile of the market, while the most affordable quarter of the market has actually seen values post a rise of 1.7%.

A similar trend can be seen across the sub-regions comprising Melbourne.

The prestigious Inner East of the city has seen value drop 11.9% over the past twelve months while the slightest falls have been in the West and along the Mornington Peninsula.

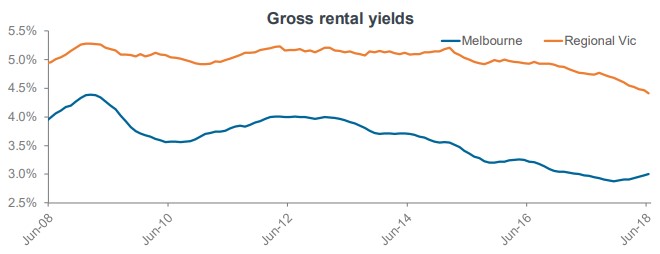

Although value growth has slowed rapidly over the past year in Melbourne, regional Vic continues to see comparatively stronger growth, driven by housing being much more affordable than it is in Melbourne.

To help you understand what’s ahead for Melbourne property I’m going to provide you with a lot of detail but the bottom line is – everyone is coming to Melbourne and they’re looking for somewhere to live.

Currently new household formation in Melbourne is creating the demand for 1,518 new dwellings each week, but we’re only supplying 1,019 new dwellings each week

In other words we’re not building enough houses and that’s what’s driving Melbourne property prices.

2. Long Term Melbourne Property Market Trends

Historically, the city’s property market has gone from strength to strength.

In 1966, the median house price in Melbourne was just $9,400.

Values have doubled more than six times since then, with the median crashing through the $100,000 barrier in 1988, and pushing through the half-million dollar mark in 2010.

Today one in three Melbourne suburbs have a median house price of at least $1 million, with 90 per cent of suburbs within 10km of the CBD have a million-dollar median house price and almost 50 per cent of suburbs in the middle ring also in the million-dollar club.

Source: CoreLogic.com.au

However dwelling price growth in Melbourne has been very fragmented. While some suburbs has just chugged along others are strongly outperforming.

Many inner south eastern, more affluent suburbs have well outperformed these averages.

In particular suburbs property prices for homes within top Victorian government school enrolment zones have rocketed up to 32 per cent over the past year.

3. Melbourne’s Average Rental Yield

While over the long term rentals have grown in line with property values, more recently rental growth has remained moderate.

The lower yield investors have been achieving is a reflection of higher capital growth and the value of Melbourne properties

But things are slowly changing and now a shortage of rental properties at a time of strong and increasing demand means the Melbourne rental market is tightening with vacancy rates falling and rents slowly rising.

What’s so special about Melbourne?

4. Melbourne’s demographics

As Australia’s second-largest city, Melbourne is home to around 4.82 million people which accounts for 19.05% of national population.

In fact Melbourne has been ranked the world’s most liveable city for 7 years in a row, up until 2018 when it was just pipped to the post by Vienna, Austria

Melbourne is Victoria’s business, administrative, cultural and recreational hub of the state.

On an average day around 854 ,000 people use the city, and each year Melbourne hosts over a million international visitors.

The culturally diverse and creative city is home to residents from an estimated 180 countries, who speak over 233 languages and dialects and follow more than 100 religious faiths.

Of the 130,000-odd thousand people who live in Melbourne’s inner city (the CBD), more than half are aged between 15 and 34, and they are generally living in single-person households or as couples without children.

According to Census data, this is strongly influenced by the high number of higher education students (both domestic and international) that reside in the city.

Immigration from China and India accounted for 32% of overall growth in population numbers, making Mandarin the second most commonly spoken language in the city.

5. Melbourne’s Layout

A well-planned city that is amply serviced by a range of public transport options, Melbourne is laid out under the ‘Hoddle Grid’, so named after its designer Robert Hoddle, which runs roughly parallel to the Yarra River.

As with most large cities, greater Melbourne is divided into ‘east’ and ‘west’ neighbourhoods; those in the east are more established and generally considered more affluent, while those in the west are more affordable, newer suburbs with less established reputations.

6. Melbourne’s Infrastructure

Melbourne residents enjoy the use of some of Australia’s most advanced and well-connected systems of road, rail and tram infrastructure, which give locals plentiful options when deciding how to get around the city and its surrounding suburbs.

The city received a perfect score of 100 for its world-class infrastructure in the 2013 EIU Liveability Report, where ongoing investment in Melbourne’s infrastructure was highlighted as being one of the factors that keeps Melbourne at the top of the index.

And the State government is spending a lot on infrastructure recognising that good infrastructure is not an end in itself, but an enabler of better social, economic and environmental outcomes.

Meanwhile, Melbourne Airport handles more than 30 million passengers annually along with 350,000 tonnes of air freight, making it Australia’s largest air freight hub.

The city is also home to a number of world-renowned universities.

However as Melbourne suburbs sprawl further and further out from the CBD, the difference in level of amenities between the inner suburbs and the poorly serviced outer suburbs is becoming more glaring, causing people to pay a premium to leave closer to the CBD and the better serviced inner suburbs.

7. Melbourne’s Economy

As a cosmopolitan, creative city that is served by a number of industries, Melbourne residents enjoy employment in diverse industries, from tourism, hospitality and entertainment to commerce, industry and trade.

Almost half the jobs created in Australia over the last decade have been created in Melbourne and Sydney.

Over the last 10 years more than 500,000 new jobs were created in Melbourne as Victoria is transitioning from a manufacturing state to one driven by service industries, which is creating strong job growth and resultant overseas and interstate migration.

At the same time the momentum of the Melbourne property market is creating a “wealth effect” for many of its residents have higher paying jobs at a time that they are feeling wealthier as the value of their homes keep increasing

The unemployment rate in Victoria has fallen substantially over the past year.

Vic’s trend unemployment rate was recorded at 5.5% in June 2018 which was down from 6.1% a year earlier.

Vic has created 64,000 jobs over the 12 months to June 2018.

Based on the 64,000 jobs created over the past year, total employment has increased by 2.0% and 20.0% of all jobs created nationally last year were in Vic.

.

.

8. Melbourne’s growth

Victoria remains the nation’s population growth powerhouse but growth has started to slow a little.

Melbourne’s population now stands at over 5 million people and Melbourne is still the fastest-growing cities in the country, growing at around 2.4% per annum.

Think about that… this means Melbourne’s population will increase by around 10% over the next 4 years or so!

Victoria’s population increased by 143,420 persons over the 2017 calendar year which was the state’s smallest increase in population since December 2015 however, it still accounted for 37.0% of the nation’s population increase

Looking at the components, the 143,420 person population increase was comprised of 42,312 from natural increase, 84,722 persons from net overseas migration and 16,386 persons from net interstate migration.

While natural increase was at an historic high level, net overseas migration was the lowest it’s been since September 2016 and net interstate migration has been falling for three consecutive quarters and is the lowest it’s been since March 2016.

As you can see from the graph below, more than three quarters of net overseas migration has been into NSW and Victoria, most of this coming from China and India.

Most of these permanent migrants are coming for jobs and are of household formation age.

Many initially rent the homes, but many want to eventually buy a home as part of their “status” of being an Australian.

A large chunk of this population growth is happening in Melbourne’s outer west, where the number of residents has increased by a figure equal to the population of Hobart over the last decade.

In fact, seven of the country’s top 10 growth areas were outer suburbs of Greater Melbourne, with international migration a big driving force behind Melbourne’s population growth.

The ripple effect of house price growth caused significant house price growth in Melbourne’s outer suburbs over the last few years.

Similarly, some regional centres including Geelong have performed well, but moving forward it is likely that the more affluent middle rings suburbs which are going through gentrification are likely to exhibit the best property price growth.

![]()

By the way…

Just because there is significant population growth in these areas doesn’t mean there is strong capital growth of property values in these areas.

In fact there isn’t!

That’s why I would avoid investing in these new outer suburbs as they lack the demographic and economic drivers to push up property values as opposed to the inner and middle ring suburbs where there is more “old money.”

Melbourne is set to overtake Sydney and become Australia’s largest city by the 2030’s according to demographer Bernard Salt.

And that’s not really that far away, is it?

If these forecasts pan out, and they are likely to be correct, they will underpin the strength of the Melbourne property market and deliver surety to investors who own property in the right locations.

Why is Melbourne attracting more growth than Sydney?

Melbourne offers what Sydney cannot or will not offer: access to affordable housing on the urban fringe.

Melbourne planned for growth from the Kennett years resulting in the formation of a plan for five million residents at 2030 and announced in 2002.

Either way, Sydney’s lead is now closer to 350,000 but is narrowing at a rate of 20,000 a year.

If present rates were to continue Melbourne would replace Sydney as Australia’s largest city at some point in the 2030s.

9. Melbourne’s culture

The city of Melbourne is nothing if not multicultural, with dozens of different cultures and nationalities – 140 to be exact – living side-by-side.

The city’s Multicultural Hub was launched as a friendly, supportive environment for Melburnians of all cultures to get together and work, share and learn, while the city’s diverse and awarded restaurant scene is highly influenced by immigrants from diverse backgrounds including Chinese, Italian, Greek and Lebanese.

What types of properties perform well in Melbourne?

10. Melbourne Houses

Decades ago, the Australian property market was dominated by demand for freestanding houses.

The appetite for ‘the Australian dream’, complete with a comfortable home on a big block with a picket fence and a pet dog, was insatiable, and home buyers as well as investors flocked to houses as a preferred investment type.

Today, the concept that land goes up in value is still well recognised, but not all land is created equal.

What’s more, changing demographics and evolving family situations have shifted dynamics to the point where more Melbournians are trading backyards for courtyards and balconies meaning apartments, units and townhouses can be just as highly sought as freestanding homes.

With median house values in Melbourne virtually doubling in the last decade, many people can’t afford freestanding homes, so they smartly start their home buying or investment journey with apartments instead.

11. Melbourne Town Houses

The term townhouse originally referred in British usage to the city residence of a member of the nobility, as opposed to their country estate.

Today the term refers to medium density (often multi story) dwellings that may be, but not necessarily, terraced (row housing) or semi detached.

In fact the 2016 Census showed an 11% increase in the number of people living in townhouses – a popular style of Melbourne accomodation where people live in modern accomodation on compact blocks of land close to ammenities in the middle ring suburbs.

Yes Melbournians are trading their backyards for courtyards and balconies.

12. Melbourne Units

Units (sometimes called villa units) is the name given to single-story, older-style dwellings, mainly built in the 1960s and 70s.

Today, developers rarely build in this style because it’s not as profitable as building ‘up’.

This style of property makes an attractive investment, as they are increasingly popular with small families and young tenants, who enjoy the privacy with no one above or below and the small yard.

13. Melbourne Flats / Apartments

If you invest in a flat you are generally buying an apartment that has other dwellings attached to it; these could be above or below, next door, or a combination of the above.

They are the preferred style of accommodation for young Melbournians and are generally easy to tenant and therefore, if well located, make great investments.

As the entry costs are lower, they are also the first type of accommodation bought by many first home buyers.

14. Commercial, Retail and Industrial properties

Commercial properties, (retail shops, factories, warehouses and office spaces) are in a very different league residential property and out of the domain of the every-day investor.

Whilst there are many benefits of investing in commercial properties, they are more suitable for the sophisticated and experienced investor, particularly as they are more yield-driven than capital growth-driven.

Consider it this way: for most advanced investors, your job is to build your asset base.

Once your portfolio is big and robust enough, you begin transferring into a cash flow strategy and at this point, a commercial property can be a good investment.

How do Melbourne’s areas compare?

15. Inner City

Melbourne’s inner city core has a population of around 29,450 people, a figure that is expected to double to 59,900 over the next 20 years.

As a result, there is much more property development activity in Melbourne CBD than anywhere else in the larger metropolitan area, with the majority of these developments comprising of high-density high-rise apartment buildings.

The area of Southbank, just south of Melbourne’s CBD, currently boasts over 9,000 distinct dwellings, the majority of which are family households (45%).

The number of residential properties is set to rise to more than 26,000 over the next 20 years.

Currently I’m worried by the large number of poorly built inner city apartments on the market or planned for completion.

Many, in fact most, of these are being bought by overseas investors and as these are likely to become the slums of the future.

Just to make things clear…I would avoid this segment of the Melbourne property market.

16. Bayside and South-Eastern Suburbs

Melbourne’s south eastern suburbs boast distinct communities, neighbourhood attributes and differing property growth cycles.

However while intricate, they’re considered by many to be the best Melbourne property investment suburbs.

The inner south eastern and bayside suburbs of Melbourne make great locations to invest.

17. Eastern Suburbs

These include some of the most affluent areas of Melbourne – the residents of the eastern suburbs enjoy a median personal income of $1,164 per week, according to ABS figures.

Around 33% of properties are owned outright or mortgaged here, with 20% of housing comprised of townhouses or semi-detached homes, and only 33% of residential properties being high-rise apartments.

This is a dramatic difference from the inner city, where apartments are the dominant dwelling type.

The inner eastern suburbs of Melbourne also boast some great investment locations.

18. Western & Northern Suburbs

While the outskirts of Melbourne’s west and north is home to several of the city’s fastest-growing outer-suburban areas including Truganina, which increased by 18%, Tarneit (16%), Point Cook (12%), Melton South (11%) and Wyndham Vale (10%).

However these more blue collar areas have lower average wages growth and therefore lower ability to sustain capital growth.

While these areas are experiencing strong population growth and they have enjoyed strong capital growth over the last few years as the rising tide of the strong Melbourne proeprty market lifted all ships, now that the cycle has reached its mature stage, many of these locations, especially the blue collar suburbs will struggle.

In general there are better investment opportunities in Melbourne’s inner eastern and south eastern suburbs.

19. Melbourne has high standards

Melbourne has been named as the world’s most liveable city by the Economist Intelligence Unit’s liveability survey for 7 years in a row and for very good reason!

Boasting excellent healthcare services, premium education facilities (including world-class universities), a stable and diverse economy, solid investment in infrastructure and a thriving, creative culture, it’s easy to see why Melbourne received an overall score of 97.5 out of 100.

With such a high standard of living and ready access to good quality facilities and amenities, it comes as no surprise that people continue to choose to call Melbourne home.

In addition, with over 120 suburbs with a median house price of over $1million, Melbourne has the second highest median price in the country (behind Sydney).

20. Avoid Melbourne’s poor-quality apartments

Just because Melbourne has a well-deserved reputation for quality, that doesn’t mean the city is flawless – far from it.

In fact, the Melbourne CBD (Central Business District) is riddled with poor quality apartments, with one report stating that an estimated 55 per cent of the city’s tallest apartment buildings are of “poor” quality, with common design flaws.

No one wants to live in a sub-standard apartment, regardless of how affordable it is, and there are only so many people who would find a hotel-sized apartment appropriate for full-time living.

The fact that an estimated 40 per cent of apartments in Melbourne are smaller than 50 square metres, according to the Melbourne City Council’s planning department, shows just how big this issue has become – particularly when you consider that the minimum size a single bedroom apartment can be in Sydney, London and Adelaide is 50m2 or above.

Not only are the apartments lacking in breathing room – literally – they’re also flawed in a number of other ways, with kitchens placed in hallways, a lack of ventilation and natural light, and poor storage.

All of these design faults make these types of developments less attractive to potential tenants, which reduces the desirability of these properties.

Investors would be well advised to steer clear of apartments that don’t tick all the boxes.

Shoebox-sized living spaces, alongside common design flaws in the building itself, should raise some serious red flags for buyers.

The problem is many overseas buyers are purchasing these properties which will become the slums of the future.

21. Look for Melbourne’s best properties in the inner and middle ring suburbs.

Studies – and time – have shown that properties close to the city’s CBD (but not in it) and in bayside suburbs close to water will increase in value more quickly than other properties and suburbs.

The demand for property is higher in these regions, as there is no land available for release, but the areas remain close to employment or desired locations.

Not only are properties closer to the CBD closer have better access to amenities and more employment opportunities, but transport costs are often lower and, as a result, people are willing to pay a premium to live there.

The end result for property investors in Melbourne is that the inner and middle ring suburbs will (generally) out-perform the averages for suburbs located further from the city.

22. Be mindful of a Melbourne inner city apartment oversupply

Melbourne’s property market has been typified by strong population growth and to keep up with surging housing demand, there have been a huge number of new developments – mostly in the form of high-rise apartment buildings, in and around the CBD – that have been approved.

While the population growth is soaking up much of this new dwelling stock, the city is still over-supplied with too many new inner city apartments.

With such a large number of development projects either completed, begun or approved in recent years, the risk for property investors in Melbourne is that there will be an oversupply of properties in and around Melbourne’s CBD.

This oversupply will result in minimal capital growth and sluggish rental growth on your investment – so avoid Melbourne CBD and near CBD properties

There is still an historic high number of dwellings are under construction across Victoria

According to the ABS there were 73,290 dwellings • under construction across Vic at the end of March 2018, which was an historic high.

The 73,290 is split between: a record high 23,804 new houses, an historic high 48,971 new apartments and 515 non-new dwellings.

There was a significant rebound in the number of dwellings under construction across the state over the quarter with the number under construction now 7.6% higher than the previous record high.

More recently approvals for new apartment have fallen well down from their peak, yet house approvals are climbing

- In May 2018, there were 6,435 dwellings approved for construction in Vic which was 11.8% higher over the month and 18.3% higher year-on-year.

- Over the month there were 3,714 houses approved for construction, an increase of 9.7% over the month and a 7.9% increase year-on-year.

- While unit approvals are down from their peak, the 2,721 approvals in May 2018 was 14.8% higher over the month and 36.4% higher year-on-year.

23. Make the most of Melbourne properties through negative gearing

While most investors understand the concept of negative gearing, just in case you’re not up to speed, here’s a quick refresher:

A property is negatively geared when the costs of owning it – interest on the loan, bank charges, maintenance, repairs and depreciation – exceed the income it produces.

A property is negatively geared when the costs of owning it – interest on the loan, bank charges, maintenance, repairs and depreciation – exceed the income it produces.

Since the costs of producing an income are generally deductible against the taxpayer’s other income, property investors can effectively offset some of the interest expense against their wages.

Why would anyone go into a business deal to make a loss?

Generally it’s because property investors in Melbourne hope that their income losses will be more than offset by their capital gains when they eventually sell (or refinance) their property.

And in Australia capital gain is not taxed unless you sell your property, and then it is concessionally taxed; again evoking the argument that it favours wealthy landlords.

Of course negative gearing is more favourable for taxpayers who earn high incomes and just to make things clear…

Negative gearing is not an investment strategy – it’s just the way a property is financed at a particular point in time.

How do you choose an investment property in Melbourne?

We believe that 80% of your property’s performance is related to it’s location (one that outperforms the averages ) and 20% or so is related to buying the right property in that location.

Here are some of the factors to look for when selecting an investment grade property:-

24. Buy a property for below its intrinsic value

I’m a big believer in buying property for below its intrinsic value – that’s why I avoid new and off the plan properties, which generally attract a premium price tag.

I also look for properties with a high Land to Asset ratio – but remember apartments have an attributable land value underneath them

25. Buy a property in a location that outperforms the averages

In other words in an area that has a long, proven history of strong capital growth and one that is likely to continue to outperform the averages, and this is largely because of the demographics in the area and the future economic prospects for the area.

These suburbs tend to be those where a large number of owner occupiers desire to live in the area, because of lifestyle choices of offer.

I look for suburbs where wages (and therefore disposable income) is increasing above average.

This translates to being an area where locals are able to and prepared to pay a premium price to live there, putting a financial floor under your investment property.

26. Buy a property with a twist

An investment must have something unique, or special, or different or scarce – some ‘X factor’ that makes it stand out from its neighbours – in order to land on my shortlist.

27. Buy a property where you can manufacture capital growth

An ideal investment is one in which you can manufacture capital growth through refurbishment, renovations or redevelopment.

How can I stay on top of current information?

28. Get property news, updates and advice by email

There is so much information available about various property investing trends, strategies and market information that it can be overwhelming knowing where (or how) to get started.

Join the 120,000-plus Australians who subscribe to my weekly newsletter, which offers a diverse range of analysis, articles and expert commentary that is essential for successful property investing.

Why not subscribe to the Michael Yardney Podcast where each week you’ll learn something new about property, success and money in around 20 minutes

You can also sign up for my personal market updates by getting a daily dose of insightful commentary in your inbox each morning.

Join here; this is free and different to our newsletter subscription.

29. Take advantage of investment advice

Whether you are new to property investing, or a seasoned landlord with many years of experience in the trenches, the team at Metropole would love to help you formulate an investment strategy or review of your existing portfolio, with a shared goal of helping you acquire your next A-grade investment property.

We can help you take advantage of opportunities currently available in the property market, by offering independent, unbiased advice.

from Property UpdateProperty Update https://propertyupdate.com.au/property-investment-melbourne/

No comments:

Post a Comment