Auction clearance rates around Australia started 2020 on a strong note.

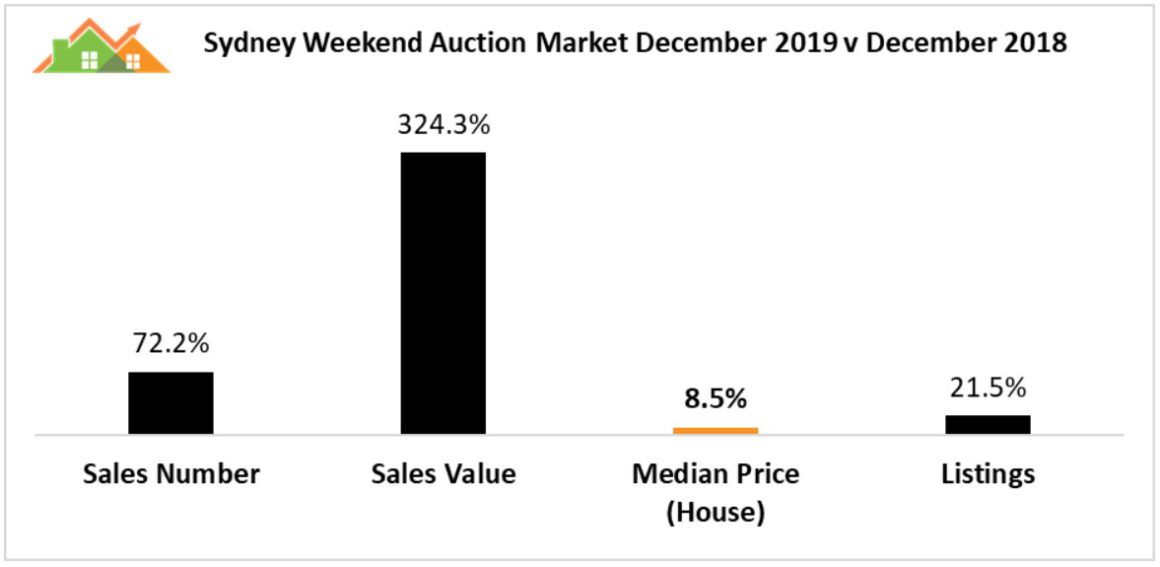

The year is finishing with auction markets producing remarkable results compared to last year with clearance rates sharply higher and increases in sales volumes, sales turnover and auction prices.

Sure the reported clearance rates were a bit lower than their highs of September this year, but that tends to happen as the auction season draws to a close for the year,

Sydney produced another very strong performance recording an 76% clearance rate.

Melbourne auction clearance results were a little lower but still a strong 72% despite the fact that almost 1,226 properties went to auction.

Clearly lower interest rates and banks’ bigger appetite for lending at a time of increased consumer sentiment and confidence are driving our property markets.

This reflects what our teams at Metropole’s offices in Melbourne, Sydney and Brisbane are finding on the ground – increased buyer enquiry and strong general interest in our housing markets because of the expectation of continual rising prices. ⠀

The prospect of easier access to finance, falling interest rates and positive media has boosted buyer confidence, driving strong auction results across Australia.

Here are the auction clearance rates as reported by Domain

Melbourne real estate auction results

The preliminary auction clearance rate for Melbourne as reported by Domain today was a moderately strong 65% with 138 properties put to auction this weekend.

So far only 85 results have been reported and 9 properties were withdrawn from sale.

The final clearance rate is likely to drop to around 60%.

Realestate.com.au reported that there were also 704 private sales in Melbourne this week.

A year ago in 2019 the auction clearance rate was 36.6 % and 108 properties were listed for sale by auction.

The following graph from Dr. Andrew Wilson of Auction Insider clearly shows how things have changed over the last few years.

Sydney real estate auction results

The preliminary auction clearance rate for Sydney as reported by Domain today was a very strong 77% with 138 properties listed for sale under the hammer.

So far 95 results were reported and 14 properties were withdrawn from sale.

The final clearance rate is likely to drop to around 69%- 71% – much the same as last weekend’s final auction clearance rate which was revised to 71%.

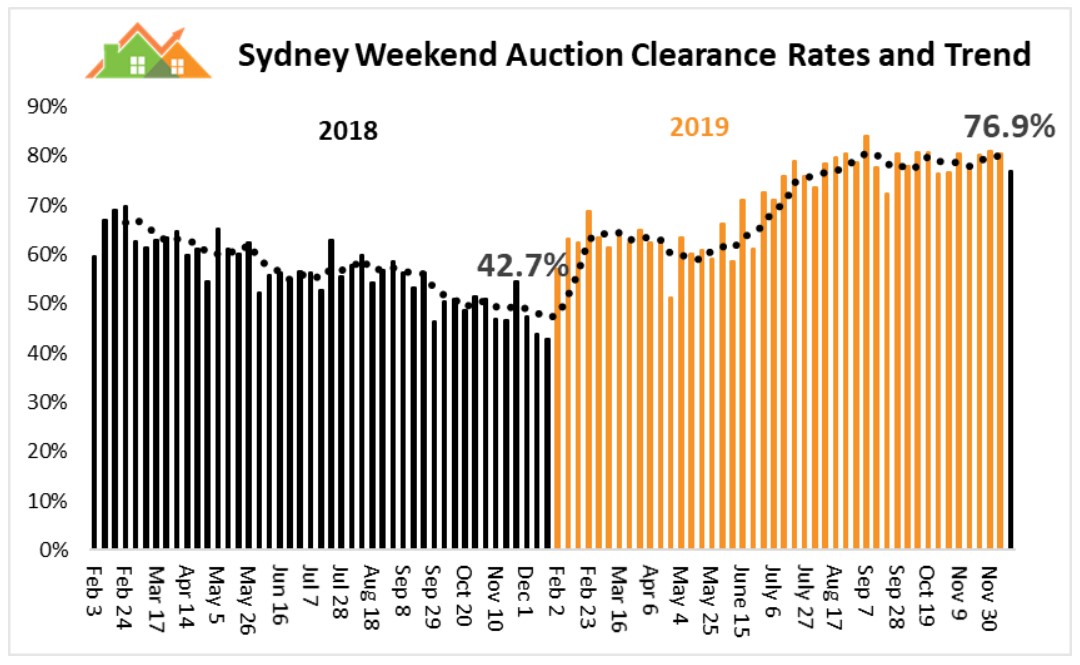

This year started with a typical Sydney auction clearance rate in the low 60%’s, so there has been a significant increase in sentiment.

Realestate.com.au reported that there were also 838 private sales in Sydney this week .

A year ago in 2019 the auction clearance rate was 45.2% on 114 auction listings.

The following graph from Dr. Andrew Wilson of Auction Insider clearly shows how things have changed.

Commentary:

Both Melbourne and Sydney home auction markets continue their strong trends.

Buyer and now seller confidence has clearly regenerated with results continuing to track well above those recorded a year ago, but the auction clearance rates are flattening a little.

There is no mistaking it – there is a lot of energy in the markets of our 3 big capital cities and this should continue well into next year

Buyers are back with a little FOMO (Fear Of Missing OUT) now that the media keeps reporting that dwelling values in Sydney and Melbourne have risen in each of the past five months ending a near two-year slide that saw prices tumble 15% from their July 2017 peak in Sydney and around 12% in Melbourne.

These trends reflect what our teams at Metropole’s offices in Melbourne and Sydney are finding on the ground – increased buyer enquiry and general interest in our housing markets because of the expectation of rising prices.

The following graph from the ANZ bank shows how in previous cycles rising dwelling prices followed on from rising auction clearance rates, however tighter credit and soft economic conditions will constrain property price growth once Melbourne and Sydney regain their lost ground.

With 3 interest rate cuts this year and another almost certain early next year, the markets will continue to strengthen.

See the graph from ANZ below which shows how interest rate cuts (red squares) led to rising property values in previous cycles.

If cheaper mortgage rates lead to rising property values, this will create a policy dilemma for the RBA which doesn’t really want this to occur, but clearly its focus is on jobs creation.

from Property UpdateProperty Update https://propertyupdate.com.au/this-weekends-auction-results-what-happened-in-sydney-melbourne-brisbane-adelaide-canberra/

No comments:

Post a Comment