What’s ahead for our property markets in the next year or two?

That’s a question people are asking now that our real estate markets have been hit by the Coronavirus crisis.

- WHAT’S AHEAD?

- PROPERTY PRICE FORECASTS

- SYDNEY PROPERTY MARKET FORECAST

- MELBOURNE PROPERTY MARKET FORECAST

- BRISBANE PROPERTY MARKET FORECAST

- CANBERRA PROPERTY MARKET FORECAST

- PERTH PROPERTY MARKET FORECAST

- HOBART PROPERTY MARKET FORECAST

- ADELAIDE PROPERTY MARKET FORECAST

- WHAT CAN YOU DO TO STAY AHEAD IN THE CURRENT MARKET?

It wasn’t that long ago that the media was predicting another property boom following the remarkable turn in Australia’s housing markets, with the rebound in house prices considerably stronger than many expected

It wasn’t that long ago that the media was predicting another property boom following the remarkable turn in Australia’s housing markets, with the rebound in house prices considerably stronger than many expected

After our housing markets bottomed in mid 2019 Melbourne enjoyed it’s strongest property price recovery ever and Sydney property recorded the fastest rebound in decades.

No wonder that those of us interested in property started 2020 full of optimism.

But boy have things changed…

COVID-19 and the shut down measures associated with its containment has derailed our housing recovery.

Weaker household income, falling consumer confidence, reduced population growth and weaker investment demand will combine to depress our property markets over the next year or two.

However I don’t see a property markets collapsing, in fact house prices are holding up pretty well in our capital cities.

This is in part due to lack of supply of A grade properties and also because the banks are deferring home loan repayments which will prevent forced or mortgagee sales.

So in this detailed blog, I’m going to have a look at what is ahead for our economy and also for the various property markets around Australia.

However let’s start with the current situation:-

Source: Corelogic May 2020

So what’s ahead for our economy?

We all know Australia is going into recession, but how bad will it be and how long will it last?

The International Monetary Fund has forecast that the Australian economy will contract by 6.7 per cent in 2020 due to the coronavirus lockdown.

However, the IMF expects the domestic economy to rebound by 6.1 per cent in 2021, assuming that measures to contain the virus are successful.

When the economy does recover, which countries will see the largest growth? That’s what the following infographic from Visual Capitalist shows.

What about house prices?

What will happen to our property markets will depend upon how soon our economy picks up, the level of unemployment reached and importantly the level of consumer confidence coming out of our recession.

At the same time, with banks extending borrowers a lifeline in the form of deferred mortgage payments, there is no forced selling at present and this plus the lack of new properties being listed for sale is underpinning property values.

Fortunately, our Federal government has learned a lot about handling monetary and fiscal policy during economic downturns resulting in the slashing of interest rates, the introduction of Quantitative Easing and our spending $300Billion plus to build a bridge to get us through this and will now doubt spend a lot more to kickstart the economy.

At the same time, the State governments have introduced their own support and stimulus packages.

Clearly our housing markets won’t be immune to the Coronavirus economic fallout, but the impact on property values will depend on how long it will take to contain the virus.

Transaction levels are likely to be significantly impacted over the next two months, particularly with restrictions in place limiting people’s ability to leave their homes.

But this doesn’t mean property values will plummet.

ANZ Bank has amended its forecasts citing weaker household income, sharply rising uncertainty for households, reduced population growth, and much weaker investor demand (given the collapse in the rental market) as some of the factors that will depress our housing markets over the next year or so.

ANZ suggest that while the deferral of home loan repayments will help prevent forced sales, the decline in demand will push prices down around 10% (peak-to-trough) on average across the capital cities.

ANZ anticipate prices will bottom out in mid-2021, before a modest recovery on improved affordability.

Source: ANZ Bank

I don’t disagree.

However the problem with making these type of forecast is lumping all properties together. There is not one Australian property market.

In fact, there’s not one Sydney or Melbourne property market either.

There are markets within markets dependent upon price point, type of property and geographic location.

So which part of Australia’s property market is predicted to fall in value by 10%?

Is it all properties? That’s unlikely.

Is it median house prices? Or will certain types of property fall in value much more than the other than others?

Not all property market will be affected equally, and while I don’t disagree that “overall” our property market could easily fall 10%., in the short term:

- “Investment grade” properties and A grade (above average) homes could fall in value by around -5%

- B grade (average) homes could fall in value by up -10-15%,

- C grade (less than perfect) will be the hardest hit as there will be a flight to quality.

But this will be on a on very low levels of transactions and the pace of recovery from that point will depend on the state of the wider economy.

The worst affected residential markets will be:

- Apartments in high-rise towers – in fact this is these properties are likely to be out of favour for quite some time.

- Off the plan apartments and poor quality investments stock (as opposed to investment-grade) apartments, particularly those close to universities.

- Outer suburban new housing estates house and land packages, where young families are likely to have overextended themselves financially and with many people will be out of work for a while

- Properties in the blue-collar areas.

But this will be on a on very low levels of transactions and he pace of recovery from that point will depend on the state of the wider economy.

The worst affected market will be the more expensive properties that will suffer because of the stock market crash.

And properties in the blue-collar areas and new housing estates where young families are likely to have overextended themselves financially and with many people will be out of work for a while.

On the upside, households and property investors whose incomes remain stable and secure will be able to take advantage of historically low interest rates.

This should support a return to stronger levels of price growth in the medium term.

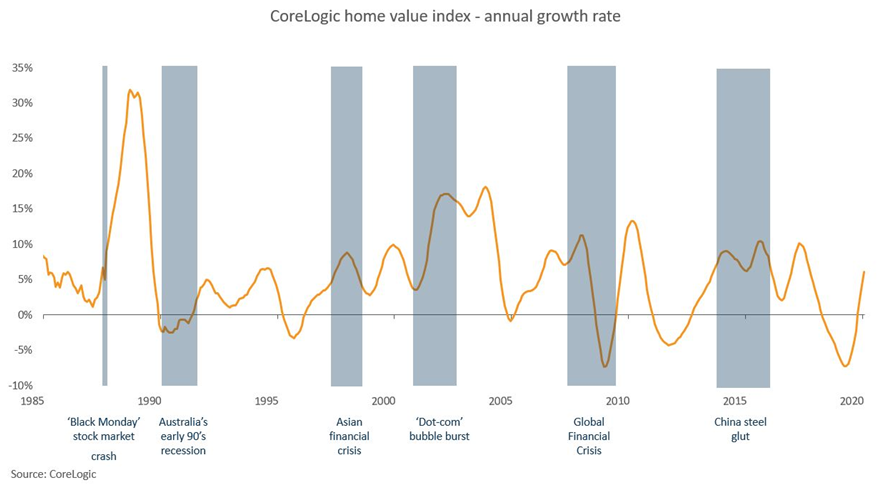

The following chart shows how Australian residential property has historically fared well against negative economic shocks

In fact, as an asset class, bricks and mortar has performed exceptionally well during previous economic shocks.

This time round, with the banks giving mortgage deferments or holidays, it is unlikely that we will have a large number of forced or mortgagee sales that could undermine market confidence.

Some areas will suffer more

As I said, moving forward some suburbs are likely to only experience minimal falls in value while others will suffer more significantly.

Just think about the typical demographic who bought in the new housing estates in the outer suburbs of our capital cities.

Residents there are typically at the same stage of their life cycle, getting their foot on the property ladder, setting up their families, paying a large mortgage and carrying significant credit card debt.

These are the types of locations where residents are more likely to suffer mortgage stress, and if people need to sell up, at a time when their neighbours are in the same boat, property values could drop significantly.

The same is true for the many investors who have bought cookie cutter apartments in and around our CBDs and who now have minimal or even negative equity in their properties.

With few new investors buying this type of property, CBD apartments are likely to fall in value significantly.

On the other hand, the demographics of our established middle ring capital city suburbs are very different as they are populated by a range of families at different stages in their lifestyle.

Some residents would have bought their property 30 to 40 years ago and paid off their mortgage a long time ago.

Others may have purchased the property 15 years ago and paid off a significant portion of the debt while living in the same street there would a few newer residents who have significant level of debt against their homes.

In the suburbs demand currently demand is higher than the undersupply of properties available and values in the suburbs are likely to hold up well.

Supply and demand

For the last few decades, continued strong population growth has been a key driver supporting our property markets.

Australia’s population was growing by around 360,000 people per annum, meaning we needed to build around 170 to 180,000 new dwellings each year to accommodate all the new households.

Since 60% of our growth is dependent on immigration, in the short-term population growth will fall, but they should increase again as soon as overseas immigrants will be allowed to come to our shores.

In the meantime, the oversupply of dwellings in many Australian locations is now dwindling and there are very few new large projects on the drawing board.

Considering how long it takes to build new estates or large apartment complexes, we’re going to experience an undersupply of well-located properties in our capital cities in the next year or two.

In the next few months supply will be constrained because of very few vendors are putting their properties on the market.

Think about it… unless you really had to sell you wouldn’t place your property on the market today would you?

The lack of good stock at a time when there is still reasonable demand by purchasers looking to take advantage of the opportunities the market presents means it is unlikely house prices will fall dramatically

What about affordability?

What about affordability?

With interest rates at historic lows, housing affordability is as cheap as it ever has been.

I’m not saying the properties are cheap – they never have been if you want to live in great locations in major world class cities.

But for those first home buyers wanting to get a foot on the property ladder, or established home buyers wanting to upgrade, or investors looking to hold onto a property, the holding costs are less than they ever have been.

And the RBA has declared that interest rate will not increase until unemployment is back to within their preferred range of around 4.5%.

They have said this will be unlikely to occur in the next three years.

In other words we are in unprecedented times where we don’t have to worry about rising interest rates the foreseeable future.

House price forecasts

In the medium term, property values will be linked to the extent that quarantine measures affect income, employment, borrowing capacity and credit availability.

Some sectors of our economy and housing markets will be affected more than others.

The largest and most direct industry shocks from the coronavirus are expected in:-

- Tourism, local restrictions will ease up before and overseas travel restrictions may take some time to lift;

- Hospitality, where social distancing leads to a decline in café, bar and restaurant patronage;

- Education, due to fewer foreign students being able to travel;

- Retail, which will be dragged down by low consumer confidence levels; and,

- Recreation, theatres, cinemas and art galleries have closed down.

However, I’m comfortable with the underlying long term fundamentals supporting our property markets int he medium to long term. Let’s look at a couple of them…

- Population growth

As I said, in the short-term population growth will fall, but this should increase again as soon as overseas immigrants will be allowed to come to our shores.

Australia is likely to be seen as one of the Safehaven’s in the world moving forward.

- Declining housing supply

The oversupply of dwellings in many Australian locations is now dwindling and there are very few new large projects on the drawing board.

Considering how long it takes to build new estates or large apartment complexes, we’re going to experience an undersupply of well-located properties in our capital cities in the next year or two.

- Interest rates are low and will go down further

The prevailing low interest rate environment is making it easier to own a home, either as an owner occupier or investor.

In fact, it’s never been cheaper for investors to own a property with the “net outlay” – the out-of-pocket expenses – being the lowest they’ve been for decades considering how cheap finance is today.

- Smaller households are becoming the norm

Sure many people live in multigenerational household, but pretty soon Millennials will make up one third of the property market and their households tend, in general, to be smaller as are the households of the booming 65+ year old demographic.

More one and two people households means that, moving forward, we will need more dwellings for the same number of people.

- More renters

Soon 40% of our population will be renters, partly because of affordability issues but also because of lifestyle choices.

The government isn’t providing accommodation for these people. That’s up to you and me as property investors.

- First home buyers are back

First home buyers are back with a vengeance, in part thanks to the government’s new scheme to encourage them, but also because of cheap finance and rising property values.

As opposed to established homebuyer who have a “trade in” that is increasing in value, if first home buyers wait to get into the market they’re finding the market moving faster than they can save, so they’re hopping on board the property train as quickly as they can.

- The underlying fundamentals are strong

Sure our economy is taking a hit and the share market is volatile, but our property markets are underpinned by the fact that 70% of property owners are home owners who are there for the long term.

They’re not going to sell up their homes – they’d rather eat dog food than give up their homes.

And the Australia’s banking system is strong, stable and sound.

Even though a few home buyers have overcommitted themselves financially, there should be no real concern about household debt because, in general, it is in the hands of those who can afford it.

There is currently a very low rate of mortgage default of mortgage to increase.

As the community starts to become more concerned about the economic impact of the corona virus, it is likely that there will be a flight to quality assets, and bricks and mortar have always stood the test of time.

In other words, the share market volatility will make some investors look to real estate as an alternative secure investment vehicle underpinned by 7 million homeowners in Australia.

In fact, it the only investment market not dominated by investors.

Sydney Property Market Forecast

Prior to COVID-19 the Sydney property market was on the move having recorded its quickest turnaround in decades.

Since bottoming out after the election in May 2019, Sydney dwelling values have recovered and are up 14.3% over the past year.

- Sydney house values increased by 0.3% last month April 2020 (+15.8% over the last year)

- Sydney unit values increased 0.6% last month April 2020 (+11.0% over the last year.)

The recovery Sydney was experiencing was most concentrated across the premium end of the housing market where values were previously falling more rapidly.

At the other end of the market, investors and home buyers had already abandoned the off the plan apartment sector for many reasons including concerns about construction standards.

And many of those who purchased off the plan a few years ago are now going to have trouble settling with valuations coming in on completion at well below contract price at a time when banks are more reluctant to lend on these properties.

Policies restricting open homes and on-site auctions have recently been lifted, which could see activity across the local market pick up, however, some downside risk remains due to Sydney’s exposure to overseas migration as a source of housing demand as well as the likelihood that consumer confidence will remain at low levels.

Rental markets are likely to see weaker conditions due to the reduction in migration rates and less student demand, as well as a short term rental stock transitioning into the permanent rental pool.

Sydney rents were down 0.7% over the month, dragging the gross rental yield to a new record low of 2.9%.

While A grade homes and investment grade properties are likely to fall a little (5- 10%) moving forward, this is a great time for cashed-up investors and homebuyers planning to upgrade to buy a property considerably cheaper than they would have had to pay a few months ago, and for considerably less than they will have to pay this time next year.

B grade (secondary) dwellings may fall in value by 10-15% and C grade properties are likely not to sell at all.

Sure there are fewer good properties for sale at the moment, and almost all the good ones are for sale off market, however if you’d like to know a bit more about how to find these investment gems give the Metropole Sydney team a call on 1300 METROPOLE or click here and leave your details.

Melbourne Property Market Forecast

Before Coronavirus hit our markets, Melbourne property prices were surging with dwelling values up 12% higher to reach new highs.

However, Melbourne experienced the first month on month fall in home values since May last year.

- Melbourne house values dropped -0.3% last month (+12.4% over the last year.)

- Melbourne unit values increased 0.1% last month (+11.5% over the last year.)

The monthly fall comes after a strong rebound in housing values since June last year which saw Melbourne dwelling values reach a new record high in February.

Melbourne has relatively high exposure to overseas migration which is likely to be one of the factors behind Melbourne’s weakness, along with the policies restricting on-site auctions and open homes.

Melbourne rental rates were also down over the month, falling by half a percent.

Rental markets are likely to experience weaker conditions relative to home values due to higher supply of rental properties, and less demand.

Like in Sydney, A grade homes and investment grade properties in Melbourne are likely to fall a little (5- 10%) moving forward.

B grade (secondary) dwellings may fall in value by 10-15% and C grade properties are likely not to sell at all.

At Metropole we’re finding that strategic investors with a long-term view and homebuyers looking to upgrade are still in the market, picking the eyes out of the off market properties.

It’s likely that they see the long-term fundamentals as Melbourne rates as one of the 10 fastest growing large cities in the developed world,.

Melbourne’s population was forecast to increase by around 10% in the next 4 years.

Clearly this will slow down now, with restricted borders protecting Australia, but once we “cross the bridge” Melbourne will remain one of the most liveable cities in the world.

If you’d like to know a bit more about how to find investment grade properties in Melbourne please give the Metropole Melbourne team a call on 1300 METROPOLE or click here and leave your details.

If you’d like to know a bit more about how to find investment grade properties in Melbourne please in the balance of this year give the Metropole Melbourne team a call on 1300 METROPOLE or click here and leave your details.

Brisbane Property Market Forecast

Understandably, the coronavirus crisis is creating uncertainty for those interested in the Brisbane property market, however Brisbane home values continued to edge higher in April, up 0.3% over the month.

Looking back over the last few years Brisbane’s property downturn in 2018-9 was quite shallow compared to the big two capital cities and following its recent upturn property values growth has slowed.

However, Brisbane property prices are still about 55% of Sydney’s while household incomes are only around 12% lower, underpinning the value of Brisbane real estate.

However, Brisbane property prices are still about 55% of Sydney’s while household incomes are only around 12% lower, underpinning the value of Brisbane real estate.

- Brisbane house values increase 0.3% last month – April 2020 (+4.2% over the last year.)

- Brisbane unit values increased 0.5% last month – April 2020 (+2.3% over the last year.)

- Rental markets have started to see some weakness though, with rents down 0.4% in April, reflecting a rise in rental supply as well as a reduction in demand.

But what’s going to happen to the Brisbane housing market moving forward?

With less reliance to overseas migration as a source of housing demand and the largest number of interstate migrants, the Queensland market may be less exposed to downwards pressure in housing values.

Of course Queensland is highly exposed to the Chinese economy, in particular tourism, education and foreign property purchases.

On the flipside, once travel bans are lifted, the Queensland economy and property market should benefit from more local travel by Australians as it is likely that overseas travel will still be restricted.

Not all Brisbane property will be impacted equally.

Clearly there is not one Queensland property market.

Regional Queensland is likely to suffer more while the Brisbane real estate market is underpinned by multiple pillars, and therefore likely to suffer less than areas like the Gold Coast and Sunshine Coast or regional Queensland.

But even Brisbane does not have ‘one’ property market.

Based on the predicted pace of the post-recession recovery, I would expect the pandemic to have a more limited and shorter-lived impact on house prices than either the early-1990s recession or the Global Financial Crisis.

Just to make things clear…I have confidence in the long term future of the Sunshine State capital.

Brisbane is one of the world’s great cities.

Liveability, affordability, scale and future economic prospects all suggest that Brisbane is a market where you can confidently buy.

While it’s true that once we come through the Coronavirus pandemic Brisbane is likely to be the one of the best performing property market over the next few years, there is not one Brisbane property market.

While some locations in Brisbane have strong growth potential, and the right properties in these locations will make great long term investments, certain submarkets should be avoided like the plague.

Now read: Brisbane property market – how will Coronavirus affect it?

.

In the long term, Brisbane’s economy is being underpinned by major projects like Queen’s Wharf, HS Wharf, TradeCoast, Cross River Rail, the second airport runway and the Adani Coal Mine, but jobs growth from these won’t really kick-off for a few more years.

There is minimal further downside for the Brisbane housing market and now is an excellent time to ride the next property wave in Brisbane

Our Metropole Brisbane team has noticed a significant increase in local consumer confidence with many more homebuyers and investors showing interest in a property.

At the same time we are getting more enquiries from interstate investors there we have for many, many years.

If you’d like to know a bit more about how to find investment grade properties in Brisbane please give the Metropole Brisbane team a call on 1300 METROPOLE or click here and leave your details.

Canberra Property Market Forecast

Canberra’s property market has been a “quiet achiever” with dwelling values having reached a new peak after growing 4.7% over the last year .

Considering a large percentage of Canberra population is employed by the government or industries supporting the public sector, Canberra’s property market is less likely to be affected by the upcoming recession than our other capital cities.

But the current excessive Land Tax in Canberra is keep investors away from the Canberra property market.

Perth Property Market Forecast

It looked like the Perth market was finally starting to pick up.

Yet despite renewed growth, the median house value across Perth remains the lowest of any capital city.

Perth home values have avoided a fall for six consecutive months which is the longest run of growth since the market peaked in mid-2014.

The April figures showed a 0.2% lift in values over the month taking the market 1.1% higher over the year to date.

- Perth house values increased 0.3% last month – April 2020 (-2.5% over the last year.)

- Perth unit values fell -0.2% last month – April 2020 (-3.0% over the last year.)

Local rents also edged higher, rising 0.1% in April with Perth the only capital city to avoid a drop in rents over the month.

Despite the positive monthly reading for values and rents, it’s clear that activity has reduced.

New listing numbers are down about 46% compared with a year ago and our estimate of buyer numbers has more than halved over the month, suggesting buyers and sellers have retreated to the sidelines.

Hobart Property Market Forecast

Hobart was the darling of speculative property investors and the best performing property market in 2017- 8, and while dwelling values reached a record high in February 2020, its boom is now over and values have fallen slightly.

It’s likely the Hobart market will continue to lose its momentum over the year as its local economy is very dependant on tourism which is a sector of the economy that will suffer more than most.

- Hobart house values fell -0.2% last month – April 2020 (+6.1% over the last year.)

- Hobart unit values increased 0.5% last month – April 2020 (+1.0% over the last year.)

Adelaide Property Market Forecast

Adelaide was one of the few capital city markets where the pace of capital gains in April was higher than six-month average.

The rise in values was broadly based, with each of Adelaide’s sub-regions recording a rise in home values over the month, led by Adelaide West where values were nine-tenths of a percent higher in April.

New listing numbers were down 38% compared with a year ago, reflecting a substantial drop in advertised supply levels, and rental markets softened, with rents slipping 0.1% in April.

- Adelaide house values increased 0.4% last month – April 2020 (+1.3% over the last year.)

- Adelaide unit values increased 0.7% last month – April 2020 (+2.5% over the last year.)

However, Adelaide will not be immune to the coronavirus led recession, particularly as it does not have multiple pillars supporting it economy.

WHAT CAN YOU DO TO STAY AHEAD IN THE CURRENT MARKET?

If you’re looking at buying your next home or investment property here’s 4 ways we can help you:

Sure our property markets are improving, but correct property selection is even more important than ever, as only selected sectors of the market are likely to outperform.

Why not get the independent team of property strategists and buyers’ agents at Metropole to help level the playing field for you?

We help our clients grow, protect and pass on their wealth through a range of services including:

- Strategic property advice. – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more

- Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $3Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment grade property. Click here to learn how we can help you.

- Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

- Property Management – Our stress free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years and our properties lease 10 days faster than the market average.

You may also be interested in reading:

- What can history teach us about what’s ahead for property

- How to Choose a Property Advisor

- What’s ahead for Brisbane’s property market?

- Property Investment In Sydney – 20 Market Insights

- Property Investment In Melbourne – 29 Real Estate Market Tips

from Property UpdateProperty Update https://propertyupdate.com.au/property-predictions-for-2021-revealed/

As flagged in Governor Lowe’s speech, the RBA forecasts a very large fall in activity of 10% over the first half of 2020 with unemployment peaking at 10% in Q2.

As flagged in Governor Lowe’s speech, the RBA forecasts a very large fall in activity of 10% over the first half of 2020 with unemployment peaking at 10% in Q2.

No comments:

Post a Comment