Sydney was the strongest property market at the end of 2019 and since bottoming out in May 2019, Sydney dwelling values have recovered most of the losses sustained in previous years and were heading for anew peak in the second quarter of 2020.

Now coronavirus has made all those forecasts of double-digit capital growth for Sydney property fall by the wayside.

The length of the coronavirus shut down, the levels of unemployment and the fall in consumer confidence will determine what happens to Sydney property

So…is it the right time to get into the Sydney property market?

Clearly our housing markets won’t be immune to the Coronavirus economic fallout, but the impact on property values will depend on how long it will take to contain the virus.

Transaction levels are likely to be significantly impacted over the next two months, particularly with restrictions in place limiting people’s ability to leave their homes.

Transaction levels are likely to be significantly impacted over the next two months, particularly with restrictions in place limiting people’s ability to leave their homes.

But this doesn’t mean property values will plummet.

So while property values may fall a little in the next few months, that won’t really be a reflection of their “intrinsic value” but more a reflection of the market lockdown.

And sooner rather than later we’ll come to a point where property transactions and prices will reflect the fundamentals of the Australian economy, as opposed to the current structural changes taking place.

On the flip side of the coin, suppressed transaction activity means we expect to see a build-up of latent demand and the markets will rebound in the second half of the year.

It is understandable that many Australians expect the property markets to behave like it did during previous economic downturns such as the Global Financial Crisis in 2008.

However, unlike previous downturns that were essentially financially lead, this downturn is a medical problem that morphed in an economic issue because of a short-term shutdown of our economy.

That is very different from a recession preceded by economic excess and speculation.

Based on the predicted pace of the post-recession recovery, I would expect the pandemic to have a more limited and shorter-lived impact on house prices than either the early-1990s recession or the Global Financial Crisis.

So, in the short term:

So, in the short term:

- “Investment grade” properties and A grade (above average) homes could fall in value by around -5%

- B grade (average) homes could fall in value by up -10%,

- C grade (less than perfect) will be the hardest hit as there will be a flight to quality.

But this will be on a on very low levels of transactions and he pace of recovery from that point will depend on the state of the wider economy.

The worst affected market will be the more expensive properties that will suffer because of the stock market crash.

And properties in the blue-collar areas and new housing estates where young families are likely to have overextended themselves financially and with many people will be out of work for a while.

On the upside, households and property investors whose incomes remain stable and secure will be able to take advantage of historically low interest rates.

This should support a return to stronger levels of price growth in the medium term.

Now read: Coronavirus and our property markets – what should you be doing now?

But remember… Sydney is not one property market…

It is divided by geography price points and type of property into many submarkets – this means you can’t just buy any property and count on the general Sydney property market to do the heavy lifting over the next few years, so careful property selection will be critical.

So to help give you a better understanding of what’s really going on I’m going to explore the nitty-gritty behind Sydney’s market trends, the areas where long-term growth is still likely, and the impact of shifting demographics on the city’s future performance.

This blog is a little longer than normal, so if you’re looking for a particular element of the Sydney property market, use these links to skip down the page.

Fast facts about the Sydney Property Market

1. Sydney Property Market Prices

Data from Domain reveals a whopping 78 suburbs now boast a median house price of $2 million or more.

Five years ago the list was limited to just six suburbs. That’s the cost of living in an international city on the water offering unparalleled lifestyle

Prior to COVID-19 the Sydney property market was on the move having recorded its quickest turnaround in decades.

Since bottoming out after the election in May, Sydney dwelling values have recovered and are up 14.3% over the past year.

- Sydney house values increased by 0.3% last month (+15.8% over the last year)

- Sydney unit values increased 0.6% last month (+11.0% over the last year.)

The recovery Sydney was experiencing was most concentrated across the premium end of the housing market where values were previously falling more rapidly.

At the other end of the market, investors and home buyers had already abandoned the off the plan apartment sector for many reasons including concerns about construction standards,.

And many of those who purchased off the plan a few years ago are now going to have trouble settling with valuations coming in on completion at well below contract price at a time when banks are more reluctant to lend on these properties.

Policies restricting open homes and on-site auctions have recently been lifted, which could see activity across the local market pick up, however, some downside risk remains due to Sydney’s exposure to overseas migration as a source of housing demand as well as the likelihood that consumer confidence will remain at low levels.

Rental markets are likely to see weaker conditions due to the reduction in migration rates and less student demand, as well as a short term rental stock transitioning into the permanent rental pool.

Sydney rents were down 0.7% over the month, dragging the gross rental yield to a new record low of 2.9%.

While A grade homes and investment grade properties are likely to fall a little (5- 10%) moving forward, this is a great time for cashed up investors and homebuyers planning to upgrade to buy a property considerably cheaper than they would have had to pay a few months ago, and for considerably less than they will have to pay this time next year.

B grade (secondary) dwellings may fall in value by 10-15% and C grade properties are likely not to sell at all.

Sure there are fewer good properties for sale at the moment, and almost all the good ones are for sale off market, however if you’d like to know a bit more about how to find these investment gems give the Metropole Sydney team a call on 1300 METROPOLE or click here and leave your details.

To help you understand what’s ahead for Sydney property I’m going to provide you with a lot of detail but the bottom line is Sydney is a world class city, which is land locked with limited room to grow to accomodate all those moving to Sydney looking for somewhere to live.

NOW READ: Is now a good time to buy property?

2. Sydney’s Property Market Trends

Historically, the city’s property market has gone from strength to strength.

Over the last 40 years Sydney’s average capital growth was 7.4% meaning many properties doubled in value every decade.

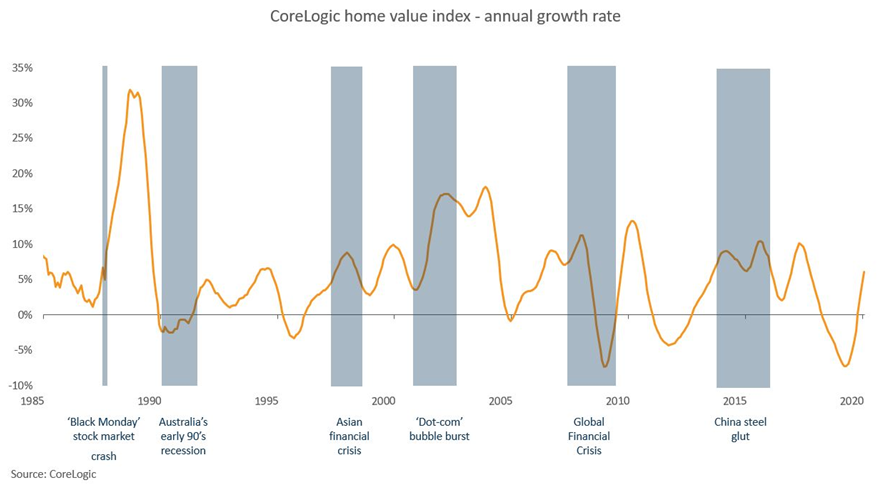

But as you can see from the chart below, the Sydney property market is very cyclical (like all property markets.)

And changing demographics is playing a big role in driving shifting market trends.

The big house on a big block is no longer a sure-fire strategy for success, as single-person homes and households without children are increasingly favouring living in medium density inner city and waterfront apartment properties.

Meanwhile, families are trending towards locations that offer effective transport infrastructure, with access to amenities and quality education.

Upgrades to major highways and new rail links may close the gap between suburbs that were previously closed off by poor infrastructure.

Of course, we are currently in the middle of a financial crisis caused by COVID-19, but the following chart shows how Australian residential property has historically fared well against negative economic shocks

The following chart from Dr Andrew Wilson of My Housing Market shows how Sydney dwelling sales have slumped.

Currently there as many property transactions in a month than there used to be in a week in “the good old days.”

Currently investors and home buyers are abandoning the off the plan apartment sector for many reasons including concerns about construction standards, and many of those who purchased off the plan a few years ago are now having trouble settling with valuations coming in on completion at well below contract price at a time when banks are more reluctant to lend on these properties.

At the same time interest from foreign investors has slumped.

The Sydney Apartment Market

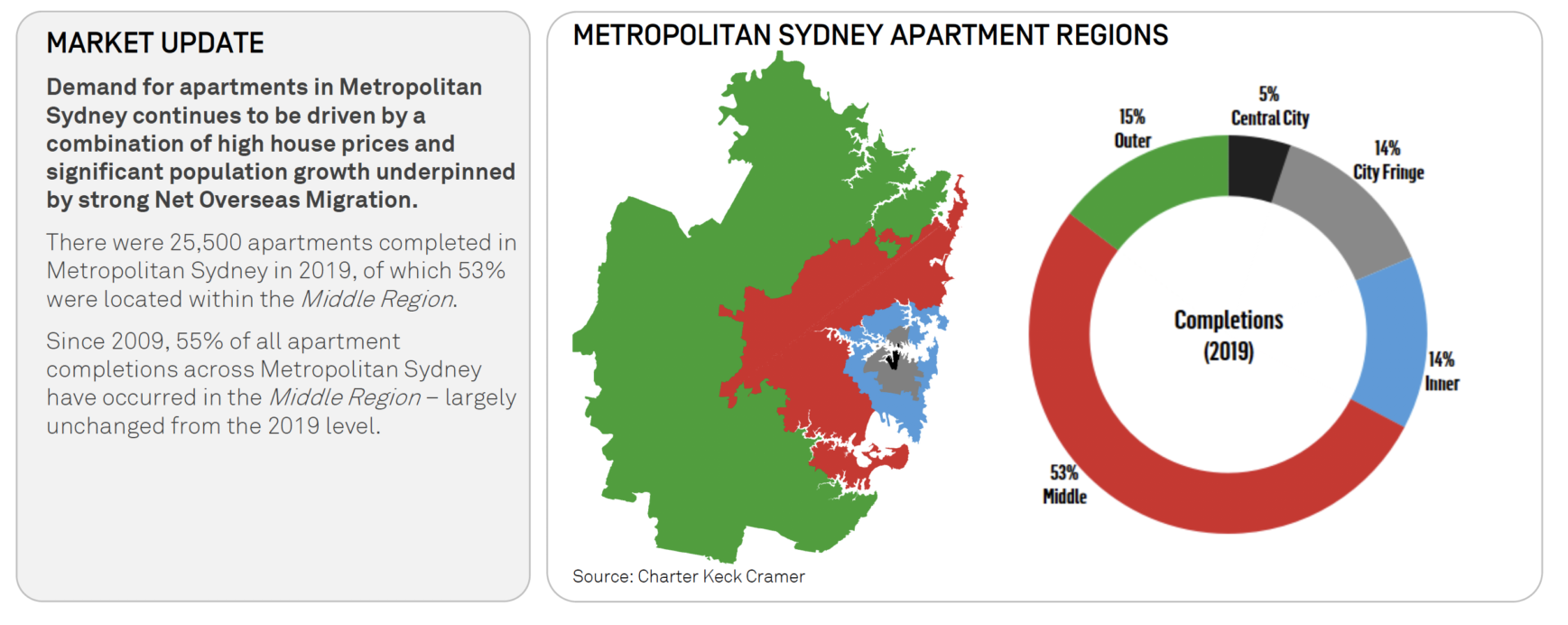

Underpinned by continued overseas and interstate migration, metropolitan Sydney requires about 41,000 additional dwellings per annum to accommodate its current level of growth.

To meet this demand the delivery of new apartment projects is vital, particularly as affordability pressures, demographic trends, changing household types and lifestyle preferences drives the need for more diverse housing options.

Investor purchases of “off the plan apartments” reach peak levels in 2015 and 16, but this was followed by a collapse in the investor apartment market as the welcome mat was pulled out from under the many foreign investors purchasing these properties and at the same time local investors found it more difficult due to the introduction of more stringent lending practices, new APRA rules and directives and more recently fears about building standards given all the media publicity about a number of high-profile buildings with significant structural problems.

Over the last few years, an apartment over supply and other regulatory and non-regulatory factors have resulted in the collapse of investor demand for Sydney “off the plan” apartments.

The reduced sales volumes have made it more difficult for developers to achieve the pre-sale hurdles required by the banks to finance developments, and a few new projects are on the drawing board.

This means that undersupply of apartments is looming.

Only 25,500 apartments were completed in metropolitan Sydney in 2019.

This represents a 17% in decrease from the record 30,900 apartments completed in 2018 and suggests that the oversupply of the better quality apartments on the market will soon disappear.

But be careful –many of the new Legoland apartment high-rise towers will always remain secondary quality and become the slums of the future – steer clear of these.

The looming undersupply of new projects will lead to lower vacancy rates, rental growth and eventually property price growth of these new apartments and in turn will help fuel increase price growth of well located establish a purpose in Sydney.

3. Sydney’s Rental Market

While over the long term rentals have grown in line with property values, more recently rental growth has slumped, in part due to the influx of rental properties that were previously let on short-term leases such as AirBnB and student accommodation.

As a consequence, overall yields have declined over the past few years as can be seen from the following chart from SQM Research.

Traditionally in Sydney, vacancy rates have been tight; hovering well below the level of 2.5% vacancies, which traditionally represents a balanced rental market.

However currently the overall vacancy rate in Sydney has crept up to close to 4%, but this varies in different locations.

At Metropole Property Management our vacancy rate is less than half this rate, in part because our clients have chosen investment grade properties, but we’d like to think it also has a bit to do with our proactive property management policies.

4. Sydney’s Average Capital Growth

In 1993, the average house price in Sydney was $188,000.

However, dwelling price growth in Sydney has been very fragmented.

While some suburbs has just chugged along others are strongly outperforming.

You see…Sydney is comprised of dozens of smaller markets, each of which has their own drivers and supply/demand issues.

Sydney’s more affluent inner eastern, Lower North Shore and inner western suburbs have well outperformed these averages.

Houses: In September 2019, only 5% of Sydney suburbs had a median house value lower than $500,000, compared with 22% five years ago.

The proportion of suburbs with a median house value of $1 million or higher was 47% in September 2019, up from 34% five years ago.

Units: 29% of Sydney suburbs recorded a median unit value of $500,000 or less in September 2019, down from 49% five years ago.

The proportion of suburbs with a median value of $1 million or higher jumped from 2.9% five years ago to 14.4% in September 2019.

Overall Sydney is a city in gentrification, with the fingerprints of a younger demographic upping the desirability of the city lifestyle.

What’s so special about Sydney?

5. Sydney’s demographics

Sydney is Australia’s most populous city and is also the most populous city in Oceania.

ABS statistics showed the population of Greater Sydney, which includes the Blue Mountains and Central Coast, reached 5,005,400 at the end June 2016 after adding a million people in just 16 years.

That was an increase of almost 83,000 on the previous year, and the city’s fifth largest annual population increase in absolute terms since 1901 with Sydney absorbing 78 per cent of NSW’s total population increase in 2015-16.

Sydney’s population grew by 1.7 per cent last financial year while the rest of NSW grew by 0.8 per cent giving the State an overall annual population growth of 1.6%.

Of course with our borders currently closed, immigration is going to be virtually non-existent in 2020, but once we reopen our borders, it is likely that Australia’s appeal to overseas immigrants is only going to be stronger and Sydney has always been a preferred destination .

Firstly it is an iconic world-class city, but also Sydney offers strong job opportunities.

It took the harbour city almost 30 years, from 1971 to 2000, to grow from 3 million to 4 million people but only half that time to pile on its next million.

This makes Sydney Australia’s only global city and a key city within the Asia-Pacific region.

Today Greater Sydney’s population is estimated to be 5.57 million people.

Interestingly around half of its population were born overseas, making Sydney the world’s most multicultural and ethnically diverse city, with over 250 spoken languages.

In fact more than 70 percent of the state’s population growth comes from overseas migration.

In fact New South Wales represents around 32% of Australia’s total population.

The median age of Sydney residents was 35 years, and households comprised an average of 2.7 members.

But drilling down deeper, within the CBD, the majority of dwellings are occupied by two adults without children, with the average age of residents reducing to 32.

With distinct areas of trendy, modern districts, Sydney has undergone incredible change since its early days as a settlement city.

Formerly gritty housing zones, originally built for labourers, are being revived and modernised, increasing their allure for those after a modern city lifestyle.

The Rocks is an excellent example of an area going through gentrification, with prime waterfront government housing transitioning to private dwellings.

These types of renewal projects are sure to bring new life – and growth.

Similarly gentrification if changing the face of Sydney’s Inner West.

Looking back European settlement in Sydney began in 1788, and in 1800 Sydney had around 3,000 inhabitants.

It took time for its population to grow – in 1851 its population was only 39,000, compared with 77,000 in Melbourne.

Sydney overtook Melbourne as Australia’s most populous city in the early twentieth century, and reached the million inhabitants milestone around 1925.

The opening of the Sydney Harbour Bridge helped pave the way for further urban development north of Sydney Harbour.

Post-war immigration and a baby boom helped the population reach two million by 1962.

Read more: There’s a 6 month moratorium on evictions – what should I do?

6. Sydney’s layout

One of the largest cities in the world, the metropolitan area has about 650 suburbs that sprawl about 70 km to the west, 40 km to the north, and 60 to the south.

Greater Sydney extends from the coast at the east back to the foothills of the Blue Mountains, with a relatively compact CBD located around i ts famous harbour.

ts famous harbour.

South of the harbour are the desirable inner suburbs and densely populated beaches, including Bondi Beach.

North Sydney, connected to the CBD by the Sydney Harbour Bridge and tunnel, is home to a thriving business district and some of Sydney’s most affluent suburbs, including the Upper and Lower North Shores.

Plans are underway to build a motorway link to open up access between the pricey eastern suburbs and the western district, which makes up the majority of metropolitan Sydney.

Changes in positioning of major companies to outlying ‘mini-cities’ like Parramatta may see a shift in buyers heading to these cheaper housing areas and employment opportunities.

Developers have anticipated this, but as is often the case, they’ve gone overboard and there is now a significant oversupply of new and off the plan apartments in Parramatta

7. Sydney’s infrastructure

With leading universities, premier shopping districts, iconic landmarks and lively urban flavour, it’s clear why Sydney is considered one of Australia’s most desirable cities to live in.

Built around the world’s largest natural harbour, Sydney offers three efficient modes of transport in, around, and out of the city: road, rail and ferry.

Anyone who lives in Sydney knows all too well that driving more than an hour each way to and from work is the norm.

But this is likely to change with light rail playing an important part in the future of transport in Sydney providing quick transportation around the CBD.

Further construction is underway to connect outlying suburbs to existing rail lines, with plans to extend the light rail system to the Eastern suburbs.

Sydney Airport, the busiest in Australia, handles over 35 million passengers a year, is located only 8km from the city and connects directly to 100 destinations around the world.

Proximity to major highways and rail systems can either boost capital growth or hinder it, and all aspects must be taken into account when considering any property purchase.

8. Sydney’s economy

Largely a manufacturing city in its heyday, Sydney has evolved into a metropolis of high-end, knowledge-based jobs in the business and financial services sector, earning itself the title of Asia-Pacific’s economic hub.

Tourism and hospitality are its next leading employment industry.

Of course jobs creation and rising confidence also leads to population growth, which further fuels the property market.

Inner-city employees earn an average individual wage of $888 per week, compared with $619 for those working in the Greater Sydney area.

Sydney’s eastern and northern suburbs reported an unemployment rate of between 2 and 2.4%, with Parramatta and Blacktown topping 8%.

With the recent boom in property prices, many buyers are finding themselves locked out of the property market, which may signal an increase in long-term rentals.

More than 55% of dwellings in the city are rentals, where occupants – primarily single professionals and couples without children – are willing to pay a premium to live in the heart of the city near to their work and all the action.

9. Sydney’s growth

Since the 1970’s, Sydney and Melbourne have been locked in a head-to-head race for highest population growth, with both cities adding 1.7 million new residents over 40 years.

Overall, Australia’s growth rate is amongst the highest in the world, with the Australian Bureau of Statistics estimating that 66% of residents live in our capital cities.

With an estimated population of 8,046,070 persons, the population has increased by 123,813 persons or 1.6% over the past year, which is in-line with the national rate of growth.

The 123,813 person increase was the greatest since September 2017 and was made-up of natural increase of 53,711 persons, net overseas migration of 91,999 persons and a loss of 21,897 persons due to net interstate migration.

Natural increase of 53,711 persons was the greatest on record while the 91,999 persons increase due to net overseas migration was the largest increase in 12 months.

The loss of 21,897 residents due to net interstate migration was slightly lower than the previous quarter but up from 19,299 persons a year earlier.

The NSW government is planning extensive additions to its transport infrastructure to support future growth, with new motorway extensions providing an uninterrupted connection from Sydney’s south to the north, and major road expansions on the plans to ease city congestions.

Outlying suburbs such as Parramatta and Liverpool are developing into regional cities, and with improved infrastructure in the works, there is likelihood we will see significant population growth in these areas further from the CBD.

10. Sydney’s culture

Sydney is truly a global city, welcoming a broad range of ethnicities from all over the globe.

Sydney is truly a global city, welcoming a broad range of ethnicities from all over the globe.

In fact, nearly half of the people who call Sydney home were born overseas, creating the most dynamic and culturally diverse metropolis in the world.

Each year Sydney celebrates its famous multiculturalism with the month-long Living in Harmony festival, which brings its residents together to celebrate and promote cross-cultural understanding.

Housing in the inner city is attractive to those who love the city life, with tenants looking for properties that include the following features:

- Location – above all.

- Security.

- Storage space.

- Amenity including balconies.

- With street noise generally a given in city living, smart tenants are looking for added features – like double-glazed windows – to minimise the city sounds.

- Cooling – especially over summer

- Technology

- Healthy mobile phone signals

- Great WiFi connectivity.

- Multiple power points

Which Sydney areas are worth investing in?

11. Upper North Shore

Statistically one of Sydney’s safest areas, with beautiful parks, large land sizes and an easy train commute to the city, the prestigious suburbs of the Upper North Shore have seen a stable increase in pricing over the years.

Incorporating Pymble, Turramurra, Wahroonga, Warrawee, Killara, Lindfield and Roseville, the Upper North sees a ‘generational’ cycle, with wealthy families moving in to gain access to esteemed private education and excellent public schools. The family moves on once children are out of school, thus allowing the next generations of young families to begin the cycle again.

This trend has maintained steady supply and demand, making the Upper North Shore area one to consider for stable growth, particularly as it sits in the middle ring of the CBD.

In August 2015, the Upper North topped the auction leaderboard with a median dwelling price of $1.4 million.

12. Lower North Shore

Located just over the Sydney Harbour Bridge and featuring a boon of waterfront properties overlooking the Sydney Harbour, Middle Harbour and Lane Cove River, the Lower North Shore is considered one of Sydney’s most desirable places to live.

While the Upper North Shore attracts families due to the larger land lots and houses, the Lower North has a higher population density with a greater proportion of apartments and units, making it appealing to young professionals who work in the CBD.

The Lower North Shore consists of the suburbs of Mosman, Castle Cove, Cremorne, Neutral Bay, Kirribilli, Milsons Point, McMahons Point, Wollstonecraft, Greenwich, Longueville, Riverview, Linley Point, Lane Cove West, and Chatswood.

According to Domain Group data, the median auction price for a dwelling in the Lower North in August 2015 was $1.3 million, coming in third place behind the Upper North Shore and Northern Beaches.

13. City and East

Recently positioning itself at 6th on Sydney’s best-performing auction rankings, with a median dwelling value of just over $1 million, the suburbs in East Sydney and the city centre are home to Australia’s highest property earners, including Edgecliff, Rushcutters Bay, Darling Point and Point Piper.

Densely populated and with land at a premium, most properties are small terraced housing or units/apartments, with a higher proportion of renters in the Eastern suburbs than elsewhere in the city.

Suburbs in the city’s inner ring such as Darlington, Chippendale and Darlinghurst have shown interesting changes in their demographic make-up recently, revealing a very high proportion of young, single residents who have populated the area for the social scene and city lifestyle.

Eastern Sydney is also highly desirable, as the home of the famous beachside suburbs of Bondi, Tamarama and Coogee.

While there is no train access to these coastal neighbourhoods, there are strong bus networks.

Read more (and watch the video): How will COVID-19 impact on your banking and loans?

14. Inner West

There is no end of demand from home buyers and investors who want to live in Sydney’s gentrifying inner Western suburbs.

In suburbs like Annandale, Croydon Park, Dulwich Hill, Enmore, Lewisham, Lilyfield, Marrkickville, and Newtown.

The suburbs within the region are characterised by medium to high-density housing and while they’ve been subject to gentrification, this process will continue for decades as the older workers and migrants make room for upwardly mobile high income earners.

What advice do you have for new Sydney investors?

15. Look for Sydney’s best properties in the inner and middle ring suburbs

A review by the Australian Housing and Urban Research Institute has found that suburbs located within 5 to 15 km of the CBD consistently see a level of capital growth that outperforms suburbs.

These inner and middle ring suburbs continue to see long-term increases in value because:

- They are close to employment nodes.

- They offer a desirable city lifestyle.

- There is no further land available for release, keeping supply in check and demand high.

Gentrification has changed the look and stigma of ‘ugly duckling’ areas into increasingly attractive places to live.

Sometimes, changes to an area, such as improved road and rail access or a change in demographic, can spur on the gentrification process in a neighbourhood, transforming it into an area that enjoys a steady increase in desirability.

While a rising tide lifts all ships and house prices have risen throughout Sydney, in general the outer and western suburbs have not had the same level of capital growth as Sydney’s inner and middle ring suburbs.

16. Steer clear of the new high rise Sydney apartment towers

We’ve seen an oversupply of newly built apartments happen Sydney.

The problem is not all apartments are the same.

Some will make great investments increasing substantially in value over the long term, but many of the high-rise towers built in the last fifteen years will continue to underperform with poor, if any, capital growth in the foreseeable future.

Of course these Lego Land apartment blocks never made good investments.

They offered little scarcity and had no owner occupier appeal having been built with investors in mind, and often overseas investors who didn’t fully understand the needs of the local market.

Worse still… because of the high developer margins and marketing costs, many investors paid too much to start with and have since found that on completion their properties were worth considerably less than their contract price.

The sad reality for these investors is that today, in light of the many media reports of structural problems in some of these high rise towers, there is a crisis of confidence with apartment owners concerned about what unknown issues and liabilities may lie ahead for them and potential purchasers are holding back not wanting to buy themselves futures problems.

This sector of the property market has lost the trust of the buying public and confidence will take quite some time to restore as various stakeholders including state and local governments as well as the construction industry including building surveyors and certifiers scramble to shore up building sector.

You see…there tend to be three major types of building issues faces by apartment owners:

- Structural defects – These are the ones that grab the headlines but, in reality, major structural issues only relate to a small number of buildings.

- Fire issues – These often relate to inferior cladding used during construction. Cladding audits are ongoing, but so far 629 affected buildings have been identified in Victoria alone.

And now it’s been revealed that there’s a list of list of nearly 450 buildings across the state of NSW with potentially flammable cladding that the State Government is keeping it secret due to security concerns.The list, developed by the cladding taskforce and provided to State Parliament, was given public interest immunity, which restricts public access.NSW Police Counter Terrorism Command advised the addresses should not be published due to safety concerns.The unit said the information risked prejudicing the interests of building and apartment owners. - Water issues – These are very common and occur to some extent in almost every new building – things like leaking balconies, showers and roofs. While these are a nuisance and can be expensive, they can usually be rectified.

Fact is, the buildings with major problems requiring mass evacuation are the outliers, but for those involved their losses will be significant as they will have hefty repair bills and have no real market for the sale of their apartment in buildings that could well become the slums of the future.

Two tiers of apartments in the future

These issues will lead to a flight to quality, meaning well constructed, medium density apartments and townhouses will continue to be strongly sought after and will keep increasing in value, making them great investments.

At the same time tighter future construction standards will lead to increased building costs and therefore higher eventual asking prices for the next round of apartments to be built, underpinning the future value of soundly built established apartments.

Similarly, the solidly build older established two and three story walk up apartments built in the 60’s and 70’s that used to be called “flats” have stood the test of time and will continue to make good investments.

On the other hand, owners of poorly constructed high rise apartments in the many “me too” buildings built in the last decade or two will find the value of their properties will languish.

While some of these owners may be keen to cut their losses, they will find their properties difficult to sell and many will not be prepared to or financially able to crystalize their losses, just like many of the unfortunate investors who bought in mining towns during the mining boom are still finding they are stuck with underperforming properties which are worth considerably less today than they paid for them many years ago.

17. Consider making the most of investing in Sydney properties

Sydney properties have exhibited strong capital growth over the long term and are likely to do so in the future.

But with their current low yields comes the challenge of negative gearing.

While this understandably concerns many first-time investors, I see it as a cost of doing business.

Here’s a quick explanation of negative gearing:

A property is negatively geared when the costs of owning it – interest on the loan, bank charges, maintenance, repairs and depreciation – exceed the income it produces.

Since the costs of producing an income are generally deductible against the taxpayer’s other income, property investors can effectively offset some of the interest expense against their wages.

This has made some argue that other, less fortunate, taxpayers help these property investors meet their costs.

Why would you buy a property that makes a loss?

Generally it’s because property investors hope that their income losses will be more than offset by their capital gains when they eventually refinance or sell their property.

And in Australia capital gain is not taxed unless you sell your property, and then it is concessionally taxed; again evoking the argument that it favours wealthy landlords.

The truth is that negative gearing is more favourable for taxpayers who earn high incomes.

Imagine an investor had excess interest expenses of $10,000.

If they were on a marginal tax rate of 15 cents in the dollar they could use their loss and reduce their tax by $1,500.

But to a taxpayer in a higher tax bracket, one who pays 30 cents in the dollar tax, they could reduce their tax by $3,000.

So the benefits of negative gearing are greater the more you earn and the higher your tax rate.

While negative gearing has its critics, in my mind property investment is about capital growth of your assets rather than cash flow.

Cash flow will keep you in the game, but capital growth will get you out of the rat race.

In the long term well located properties in the inner and middle ring suburbs of Sydney will continue to be highly sought after and keep increasing in value creating wealth for their owners, be they home owenrs of real estate investor.

18. How I choose a strong investment property in Sydney.

If I accept that in the short term I’ll be negatively geared, then I must ensure I buy an investment grade property that will outperform the market averages with regards to capital growth and to do this I use my 6 Stranded Strategic Approach.

- I would only buy a property that would appeal to a wide range of owner occupiers. Not that I plan to sell my property, but because owner occupiers will buy similar properties pushing up local real estate values. This will be particularly important in the next few years as the percentage of investors in the market is likely to diminish.

- I would buy a property below its intrinsic value – that’s why I avoid new and off the plan properties which come at a premium price.

- In an area that has a long history of strong capital growth and that will continue to outperform the averages because of the demographics in the area. This will be an area where more owner occupiers will want to live because of lifestyle choices and one where the locals will be prepared to, and can afford to, pay a premium price to live because they have higher disposable incomes. In general these are the more affluent inner and middle ring suburbs of our big capital cities

- I would buy a property with a high land to asset ratio.

- I would look for a property with a twist – something unique, or special, different or scarce about the property, and finally

- I would buy a property where I can manufacture capital growth through refurbishment, renovations or redevelopment rather than waiting for the market to deliver me capital growth.

How can I stay on top of current information?

19. Get news, updates and advice by email

The easiest way to stay current with all the changes happening in our real estate markets is to receive the latest news to your inbox.

Currently over 115,000 Australians subscribe to my weekly newsletter, which delivers in-depth analysis, articles and commentary by a team of expert writers with a varied knowledge base in real estate, investment and finances – all essentials for successful property investing.

But if you have a voracious appetite, I recomend you subscribe to my daily market commentaries by clicking here.

Every day at least 8 commentaries, blogs and articles are published featuring leading experts in field of property investment, property investment finance, tax, economics aand personal finance.

It’s a great way to keep up to day – subscribe now by clicking here.

And why not subscribe to the Michael Yardney Podcast where you’ll learn something new about property, success and money in around 20 minutes each week.

Read more: There’s a 6 month moratorium on evictions – what should I do?

20. Take advantage of independent, unbiased investment advice

If you’re looking at buying your next home or investment property here’s 4 ways we can help you:

Sure our property markets are improving, but correct property selection is even more important than ever, as only selected sectors of the market are likely to outperform.

Why not get the independent team of property strategists and buyers’ agents at Metropole to help level the playing field for you?

We help our clients grow, protect and pass on their wealth through a range of services including:

- Strategic property advice. – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more

- Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $3Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment grade property. Click here to learn how we can help you.

- Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

- Property Management – Our stress free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years and our properties lease 10 days faster than the market average.

from Property UpdateProperty Update https://propertyupdate.com.au/property-investment-sydney/

No comments:

Post a Comment