What’s ahead for our property markets for the second half of 2020 and into next year?

That’s a common question people are asking now that our real estate markets have been hit by the triple threat of:

- The Coronavirus crisis

- A recession

- Social unrest

And with a second wave of Coronavirus now emerging, particularly in Melbourne, many are wondering if those dire predictions of 20-30% falls for our property markets that were made earlier in the year by those property pessimists are now going to come true.

The simple answer is NO – our property markets are not going to crash – in fact they’ve remained remarkably resilient.

Sure there are problems in some of our rental markets and certain sectors of our real estate markets are suffering, but having invested in property for almost 50 years I’ve found that whenever there has been an economic threat, recession, interest rate spike, or credit squeeze, the residential markets always bounce back, usually more quickly than projected, demonstrating the resolve of the Australian community to maintain its embrace of real estate and homeownership.

While there are still many challenges ahead for our economy and our property markets, there are also reasons to be optimistic about certain segments of the Australian property market, particularly in the long term, and that’s what I’ll be discussing in this article.

- WHAT’S AHEAD?

- PROPERTY PRICE FORECASTS

- SYDNEY PROPERTY MARKET FORECAST

- MELBOURNE PROPERTY MARKET FORECAST

- BRISBANE PROPERTY MARKET FORECAST

- CANBERRA PROPERTY MARKET FORECAST

- PERTH PROPERTY MARKET FORECAST

- HOBART PROPERTY MARKET FORECAST

- ADELAIDE PROPERTY MARKET FORECAST

- WHAT CAN YOU DO TO STAY AHEAD IN THE CURRENT MARKET?

It wasn’t that long ago that the media was forecasting a property bust and that Australia’s housing markets could fall up to 30%.

It wasn’t that long ago that the media was forecasting a property bust and that Australia’s housing markets could fall up to 30%.

This was predicated on the worst case scenario of a long drawn out COVID-19 pandemic and a deep world wide recession, but Australia’s property markets look like they’ll be in for a soft landing.

Despite our economy being in poor shape, housing price falls are likely be modest, and much smaller than predicted at the height of the COVID-19-related shutdowns earlier this year.

In fact, so far the property markets have remained resilient to a material correction.

And, other than Victoria, with restrictive policies being progressively lifted or relaxed, the downwards trajectory of housing values will be milder than many first expected.

Of course there are two substantial downside risks to the property market.

- A significant second wave of Coronavirus infections would slow our economic recovery, but other than in Victoria, we seem to have the infection under control.

- There is a lot of concern that at the end of the current deferral schemes and government support packages Australia is going to fall off of a “Financial Cliff.”

Clearly the significant financial stimulus and support measures provided by our governments have kept the doors of many local business open and many people in their jobs.

At the same time rental relief packages have kept tenants in their homes and mortgage support has meant that there have been very few forced sales.

But remember…the government and the Reserve Bank have clearly stated that they will do anything and everything they can to support our economy and minimise the impact of the coronavirus on businesses and our economy.

I can’t see the government which has spent so much time, money, effort and publicity building a “bridge” to get us across to the other side, to allow us to fall off a cliff rather than to extend that bridge even further.

Fact is, the economic downturn and the impact on the property market due to the pandemic is likely to be a little more severe than forecast only a month or two ago on account of the renewed lockdown in Melbourne.

2021 is likely to be a year of economic recovery after. challenging end to 2020

However let’s start with the current situation:-

Source: Corelogic July 2020

Source: Corelogic July 25th 2020

What’s ahead for our economy?

We all know Australia is going into recession, but how bad will it be and how long will it last?

The International Monetary Fund has forecast that the Australian economy will contract by 6.7 per cent in 2020 due to the coronavirus lockdown.

However, the IMF expects the domestic economy to rebound by 6.1 per cent in 2021, assuming that measures to contain the virus are successful.

Of course the whole world is experiencing an economic downturn.

The following infographic from Visual Capitalist shows how the various economies are likely to recover over 2020 – 2021.

What about house prices?

What will happen to our property markets will depend upon how soon our economy picks up, the level of unemployment reached and importantly the level of consumer confidence coming out of our recession.

At the same time, with banks extending borrowers a lifeline in the form of deferred mortgage payments, there is no forced selling at present and this plus the lack of new properties being listed for sale is underpinning property values.

Fortunately, our Federal government has learned a lot about handling monetary and fiscal policy during economic downturns resulting in the slashing of interest rates, the introduction of Quantitative Easing and our spending $300Billion plus to build a bridge to get us through this and will now doubt spend a lot more to kickstart the economy.

And of course the State governments have introduced their own support and stimulus packages.

Clearly our housing markets won’t be immune to the Coronavirus economic fallout, but the impact on property values will depend on how long it will take to contain the virus.

Transaction levels are likely to be significantly impacted over the next few months while many buyers and sellers work their way through the uncertainty, but sellers are returning to the market and in general vendors are selling for lifestyle reasons, rather than for financial reasons.

In other words they’re not panicking about the state of the market but choosing to move into a bigger or a smaller home, or move to a school catchment area, or they want a bigger backyard rather live in a small space recognising that life is going to be different moving forward.

Some want room for a home gym or a Zoom Room.

At the same time buyer confidence has rebounded over the last few months, but they are being more selective.

They’re not in a hurry and there is clearly a flight to quality, especially since there are now more properties being put to sale by auction than there were a few weeks ago.

Well located A Grade homes and investment grade properties are attracting strong competition, but buyers since being very selective (and so they should be.)

This strong buyer demand is being shown by realestate.com.au’s Weekly Search Report

Although there has been some recent softening of weekly for sale search volumes, they remain 36.3 per cent higher than a year earlier showing just how much more interest there is in Australian property.

The largest year-on-year increases in for sale search volumes have occurred in Australian Capital Territory (99.5%) and Western Australia (45.6%) while the the smallest jumps have been in Victoria (26.3%) and South Australia (29.9%).

There is also mounting evidence that this interest is translating into sales with the data showing an upward trend in transactions

The most likely scenario by end of 2020 is modest price falls

The most likely outlook for property is for prices to fall modestly in some areas and be broadly steady in others, combined with a slow increase in transactions from weak levels.

Source: ANZ Bank

I think the forecasts shown in the above chart by the ANZ Bank are realistic.

However the problem with making these type of forecast is lumping all properties together.

There is not one Australian property market.

In fact, there’s not one Sydney or Melbourne property market either.

There are markets within markets dependent upon price point, type of property and geographic location.

So which part of Australia’s property market is predicted to fall in value by 10%?

Is it all properties? That’s unlikely.

Is it median house prices? Or will certain types of property fall in value much more than the other than others?

Not all property market will be affected equally,

And while I don’t disagree that “overall” our property market could easily fall 10% in the short term:

- “Investment grade” properties and A grade (above average) homes could fall in value by around -5%

- B grade (average) homes could fall in value by up -10-15%,

- C grade (less than perfect) will be the hardest hit as there will be a flight to quality.

But this will be on a on very low levels of transactions and the pace of recovery from that point will depend on the state of the wider economy.

The key factor supporting prices so far is that few people have been forced to sell their homes due to losing their jobs or having their incomes cut.

This has been enabled by the government’s financial support packages assisting households whose income has fallen, in combination with banks allowing people in financial difficulties to defer mortgage repayments.

The worst affected residential markets will be:

- Apartments in high-rise towers – in fact this is these properties are likely to be out of favour for quite some time.

- Off the plan apartments and poor quality investments stock (as opposed to investment-grade) apartments, particularly those close to universities.

- Established homes in the outer suburban new housing estates, where young families are likely to have overextended themselves financially and with many people will be out of work for a while. Currently many first home buyers are taking advantage of the various incentive packages including HomeBuilder to buy newly constructed homes, leaving established houses in these locations languishing.

- Properties in the blue-collar areas.

But this will be on a on very low levels of transactions and he pace of recovery from that point will depend on the state of the wider economy.

The worst affected market will be the more expensive properties that will suffer because of the stock market crash.

And properties in the blue-collar areas and new housing estates where young families are likely to have overextended themselves financially and with many people will be out of work for a while.

On the upside, households and property investors whose incomes remain stable and secure will be able to take advantage of historically low interest rates.

This should support a return to stronger levels of price growth in the medium term.

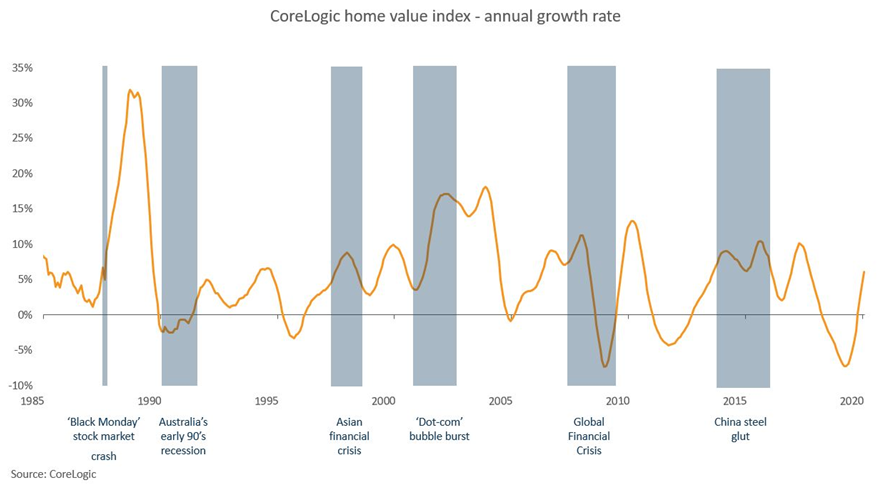

The following chart shows how Australian residential property has historically fared well against negative economic shocks

In fact, as an asset class, bricks and mortar has performed exceptionally well during previous economic shocks.

What the above and the following charts show is that negative economic shocks do not necessarily lead to severe declines in property prices.

Property does not show the same volatility of shares during a downturn nor the same decline in values because it is used to living and therefore not a speculated upon the shares.

Additionally it cannot be bought or sold as quickly as shares meaning price movements are not as volatile.

This time round, with the banks giving mortgage deferments or holidays, it is unlikely that we will have a large number of forced or mortgagee sales that could undermine market confidence.

Source: ABS and Metropole Research by Kate Forbes

Some areas will suffer more

As I said, moving forward some suburbs are likely to only experience minimal falls in value while others will suffer more significantly.

Just think about the typical demographic who bought in the new housing estates in the outer suburbs of our capital cities.

Residents there are typically at the same stage of their life cycle, getting their foot on the property ladder, setting up their families, paying a large mortgage and carrying significant credit card debt.

These are the types of locations where residents are more likely to suffer mortgage stress, and if people need to sell up, at a time when their neighbours are in the same boat, property values could drop significantly.

The same is true for the many investors who have bought cookie cutter apartments in and around our CBDs and who now have minimal or even negative equity in their properties.

With few new investors buying this type of property, CBD apartments are likely to fall in value significantly.

On the other hand, the demographics of our established middle ring capital city suburbs are very different as they are populated by a range of families at different stages in their lifestyle.

Some residents would have bought their property 30 to 40 years ago and paid off their mortgage a long time ago.

Others may have purchased the property 15 years ago and paid off a significant portion of the debt while living in the same street there would a few newer residents who have significant level of debt against their homes.

In these suburbs demand currently demand is higher than the undersupply of properties available and values in the suburbs are likely to hold up well.

The following chart suggests that Hobart will be more affected than other capital cities by the strict social distancing measures imposed to prevent spread of COVID-19.

At the other extreme in the ACT, where employment is more concentrated amongst public Inspiration, employment and incomes not as broadly affected.

Not surprisingly people working in the accommodation, food services and recreation industries have been hardest-hit in losing jobs over the last few months – see chart below.

If you think about it, many of these people will be younger and living in rental accommodation rather than being home owners.

This suggests our rental markets will be harder hit than our housing markets, and that’s actually how things are playing out .

Supply and demand

For the last few decades, continued strong population growth has been a key driver supporting our property markets.

Australia’s population was growing by around 360,000 people per annum, meaning we needed to build around 170 to 180,000 new dwellings each year to accommodate all the new households.

Since 60% of our growth is dependent on immigration, in the short-term population growth will fall, but they should increase again as soon as overseas immigrants will be allowed to come to our shores.

In the meantime, the oversupply of dwellings in many Australian locations is now dwindling and there are very few new large projects on the drawing board.

Considering how long it takes to build new estates or large apartment complexes, we’re going to experience an undersupply of well-located properties in our capital cities in the next year or two.

In the next few months supply will be constrained because of very few vendors are putting their properties on the market.

Think about it… unless you really had to sell you wouldn’t place your property on the market today would you?

The lack of good stock at a time when there is still reasonable demand by purchasers looking to take advantage of the opportunities the market presents means it is unlikely house prices will fall dramatically.

What about affordability?

With interest rates at historic lows, housing affordability is as cheap as it ever has been.

I’m not saying the properties are cheap – they never have been if you want to live in great locations in major world class cities.

But for those first home buyers wanting to get a foot on the property ladder, or established home buyers wanting to upgrade, or investors looking to hold onto a property, the holding costs are less than they ever have been.

And the RBA has declared that interest rate will not increase until unemployment is back to within their preferred range of around 4.5%.

They have said this will be unlikely to occur in the next three years.

In other words we are in unprecedented times where we don’t have to worry about rising interest rates the foreseeable future.

House price forecasts

In the medium term, property values will be linked to the extent that quarantine measures affect income, employment, borrowing capacity and credit availability.

Some sectors of our economy and housing markets will be affected more than others.

The largest and most direct industry shocks from the coronavirus are expected in:-

- Tourism, local restrictions will ease up before and overseas travel restrictions may take some time to lift;

- Hospitality, where social distancing leads to a decline in café, bar and restaurant patronage;

- Education, due to fewer foreign students being able to travel;

- Retail, which will be dragged down by low consumer confidence levels; and,

- Recreation, theatres, cinemas and art galleries have closed down.

However, I’m comfortable with the underlying long term fundamentals supporting our property markets int he medium to long term. Let’s look at a couple of them…

- Population growth

As I said, in the short-term population growth will fall, but this should increase again as soon as overseas immigrants will be allowed to come to our shores.

Australia is likely to be seen as one of the safe haven’s in the world moving forward.

- Declining housing supply

The oversupply of dwellings in many Australian locations is now dwindling and there are very few new large projects on the drawing board.

Considering how long it takes to build new estates or large apartment complexes, we’re going to experience an undersupply of well-located properties in our capital cities in the next year or two.

- Interest rates are low and will go down further

The prevailing low interest rate environment is making it easier to own a home, either as an owner occupier or investor.

In fact, it’s never been cheaper for investors to own a property with the “net outlay” – the out-of-pocket expenses – being the lowest they’ve been for decades considering how cheap finance is today.

- Smaller households are becoming the norm

Sure many people live in multigenerational household, but pretty soon Millennials will make up one third of the property market and their households tend, in general, to be smaller as are the households of the booming 65+ year old demographic.

More one and two people households means that, moving forward, we will need more dwellings for the same number of people.

- More renters

Soon 40% of our population will be renters, partly because of affordability issues but also because of lifestyle choices.

The government isn’t providing accommodation for these people. That’s up to you and me as property investors.

- First home buyers are back

First home buyers are back with a vengeance, in part thanks to the government’s new scheme to encourage them, but also because of cheap finance and rising property values.

As opposed to established homebuyer who have a “trade in” that is increasing in value, if first home buyers wait to get into the market they’re finding the market moving faster than they can save, so they’re hopping on board the property train as quickly as they can.

- The underlying fundamentals are strong

Sure our economy is taking a hit and the share market is volatile, but our property markets are underpinned by the fact that 70% of property owners are home owners who are there for the long term.

They’re not going to sell up their homes – they’d rather eat dog food than give up their homes.

And the Australia’s banking system is strong, stable and sound.

Even though a few home buyers have overcommitted themselves financially, there should be no real concern about household debt because, in general, it is in the hands of those who can afford it.

There is currently a very low rate of mortgage default of mortgage to increase.

As the community starts to become more concerned about the economic impact of the corona virus, it is likely that there will be a flight to quality assets, and bricks and mortar have always stood the test of time.

In other words, the share market volatility will make some investors look to real estate as an alternative secure investment vehicle underpinned by 7 million homeowners in Australia.

In fact, it the only investment market not dominated by investors.

Sydney Property Market Forecast

Prior to COVID-19 the Sydney property market was on the move having recorded its quickest turnaround in decades.

But Sydney home values slid for a second month in June, down a cumulative 1.2% since a recent peak in April.

The largest falls are occurring across the top quartile of the market where home values have dropped by 1.3% over the June quarter, while the least expensive quarter of the market has actually recorded a subtle rise up two-tenths of a percent over the same period.

Sydney property values are -3.5% below their highs reached in July 2017.

- Sydney house values decreased by -0.9% last month (+14.5% over the last year)

- Sydney unit values decreased by -0.6% last month (+10.6% over the last year.)

While home values are trending lower, rents have also declined, falling by 0.8% over the month to be 1% lower over the year.

The weakest rental conditions are confined to the unit market where rates are down 2.1% over the June quarter.

From a more positive perspective, our estimate of sales activity is up by around 40% from the April low and auction clearance rates have averaged 61% through June.

This implies an improvement in buyer demand and a better fit between buyer and seller pricing expectations.

While A grade homes and investment grade properties are likely to fall a little (- 5- 10%) moving forward, this is a great time for cashed-up investors and homebuyers planning to upgrade to buy a property considerably cheaper than they would have had to pay a few months ago, and for considerably less than they will have to pay this time next year.

B grade (secondary) dwellings may fall in value by 10-15% and C grade properties are likely not to sell at all.

Sure there are fewer good properties for sale at the moment, and almost all the good ones are for sale off market, however if you’d like to know a bit more about how to find these investment gems give the Metropole Sydney team a call on 1300 METROPOLE or click here and leave your details.

Melbourne Property Market Forecast

Before Coronavirus hit our markets, Melbourne property prices were surging with dwelling values up 12% higher to reach new highs.

However, Melbourne housing values recorded a third consecutive month of declines in June resulting in 2.3% drop in values over the quarter.

Melbourne’s top quartile properties are recording the largest declines, down 3.7% over the second quarter.

Lower quartile values fell by only half a percent.

Previous phases of the housing market have shown a very similar trend with the most expensive segment of the marketplace leading the growth phase as well as the downswings.

Melbourne rents were down six-tenths of a percent in June.

The unit sector recording more substantial downwards pressure on rents than houses.

Despite lower values housing demand has gathered some pace across Melbourne after sales dropped by a third in April, our estimate of sales in June was up almost 60% on that April low.

- Melbourne house values dropped -1.3% last month (+10.6% over the last year.)

- Melbourne unit values decreased -0.7 last month (+9.3% over the last year.)

The monthly fall comes after a strong rebound in housing values since June last year which saw Melbourne dwelling values reach a new record high in February.

Like in Sydney, A grade homes and investment grade properties in Melbourne are likely to fall a little (5- 10%) moving forward.

B grade (secondary) dwellings may fall in value by 10-15% and C grade properties are likely not to sell at all.

At Metropole we’re finding that strategic investors with a long-term view and homebuyers looking to upgrade are still in the market, picking the eyes out of the off market properties.

It’s likely that they see the long-term fundamentals, as Melbourne rates are one of the 10 fastest-growing large cities in the developed world,.

Melbourne’s population was forecast to increase by around 10% in the next 4 years.

Clearly this will slow down now, with restricted borders protecting Australia, but once we “cross the bridge” Melbourne will remain one of the most liveable cities in the world.

If you’d like to know a bit more about how to find investment grade properties in Melbourne please in the balance of this year give the Metropole Melbourne team a call on 1300 METROPOLE or click here and leave your details.

Brisbane Property Market Forecast

Understandably, the coronavirus crisis is creating uncertainty for those interested in the Brisbane property market, however while Brisbane home values have lost their upwards momentum through 2020, but they’ve held reasonably firm through the past few months.

Looking back over the last few years Brisbane’s property downturn in 2018-9 was quite shallow compared to the big two capital cities and following its recent upturn property values growth has slowed.

Brisbane’s housing market has been holding up better than the largest cities with home values recording less downwards pressure.

Despite the relative resilience dwelling values have slipped by 0.2% over the June quarter.

However, Brisbane property prices are still about 55% of Sydney’s while household incomes are only around 12% lower, underpinning the value of Brisbane real estate.

- Brisbane house values have decreased over the last month -0.4 (+4.9% over the last year.)

- Brisbane unit values decreased -0.8% last month (-1.0% over the last year.)

Unit values were down a larger 0.8% while detached House values held firmer down 0.1%.

Brisbane rents have also recorded a mild downturn falling by 0.6% over the June quarter.

However, local rental yields remain well above the combined capital city average tracking at a gross 4.2% for houses and 5.2% for units.

Sales activity has shown a sharp rise over the past two months up by an estimated 74% since activity plunged in April.

In a positive sign of buyer confidence with an easing or removal of some of the COVID related restrictions, sales activity jumped by 22% in May.

But what’s going to happen to the Brisbane housing market moving forward?

With less reliance to overseas migration as a source of housing demand and the largest number of interstate migrants, the Queensland market may be less exposed to downwards pressure in housing values.

Of course Queensland is highly exposed to the Chinese economy, in particular tourism, education and foreign property purchases.

On the flipside, once travel bans are lifted, the Queensland economy and property market should benefit from more local travel by Australians as it is likely that overseas travel will still be restricted.

Not all Brisbane property will be impacted equally.

Clearly there is not one Queensland property market.

Regional Queensland is likely to suffer more while the Brisbane real estate market is underpinned by multiple pillars, and therefore likely to suffer less than areas like the Gold Coast and Sunshine Coast or regional Queensland.

But even Brisbane does not have ‘one’ property market.

Based on the predicted pace of the post-recession recovery, I would expect the pandemic to have a more limited and shorter-lived impact on house prices than either the early-1990s recession or the Global Financial Crisis.

Just to make things clear…I have confidence in the long term future of the Sunshine State capital.

Brisbane is one of the world’s great cities.

Liveability, affordability, scale and future economic prospects all suggest that Brisbane is a market where you can confidently buy.

While it’s true that once we come through the Coronavirus pandemic Brisbane is likely to be the one of the best performing property market over the next few years, there is not one Brisbane property market.

While some locations in Brisbane have strong growth potential, and the right properties in these locations will make great long term investments, certain submarkets should be avoided like the plague.

Now read: Brisbane property market – how will Coronavirus affect it?

In the long term, Brisbane’s economy is being underpinned by major projects like Queen’s Wharf, HS Wharf, TradeCoast, Cross River Rail, the second airport runway and the Adani Coal Mine, but jobs growth from these won’t really kick-off for a few more years.

There is minimal further downside for the Brisbane housing market and now is an excellent time to ride the next property wave in Brisbane

Our Metropole Brisbane team has noticed a significant increase in local consumer confidence with many more homebuyers and investors showing interest in a property.

At the same time we are getting more enquiries from interstate investors there we have for many, many years.

If you’d like to know a bit more about how to find investment grade properties in Brisbane please give the Metropole Brisbane team a call on 1300 METROPOLE or click here and leave your details.

Canberra Property Market

Canberra’s property market has been a “quiet achiever” with dwelling values having reached a new peak after growing 6.3% over the last year .

Considering a large percentage of Canberra population is employed by the government or industries supporting the public sector, Canberra’s property market is less likely to be affected by the upcoming recession than our other capital cities.

- Canberra house values increased 0.1% last month (+7.4% over the last year.)

- Hobart unit values increased 0.3% last month (+2.1% over the last year.)

Perth Property Market Forecast

Perth’s long awaited recovery has been interrupted by COVID-19 with values falling over both May and June to be down 1.4% over the quarter.

Prior to COVID, Perth home values had avoided the fall for six months straight.

Although home values have dropped housing activity has shown a sharp rise over the past two months, with our estimate of sales more than doubling from the low base set in April.

Rents have continued to rise through the June quarter as well up almost 1% to be one of the few capital cities where rents are continuing to rise.

- Perth house values fell -1.1% last month (-2.5% over the last year.)

- Perth unit values fell -1.3% last month (-2.3% over the last year.)

Hobart Property Market Forecast

Hobart was the darling of speculative property investors and the best performing property market in 2017- 8, and while dwelling values reached a record high in February 2020, its boom is now over and values fell slightly in March and April.

However Hobart houses and units exhibited a slight rise in May.

- Hobart house values increased +0.4 last month (+7.1% over the last year.)

- Hobart unit values increased 0.0% last month (3.8% over the last year.)

It’s likely the Hobart market will continue to lose its momentum over the year as its local economy is very dependant on tourism which is a sector of the economy that will suffer more than most.

Adelaide Property Market Forecast

Adelaide remains one of the most stable capital city housing markets.

Dwelling values were down by 0.2% in June which was the first month on month fall since the market bottomed out from a mild downturn in August last year.

- Adelaide house values decreased -0.2% last month (+1.1% over the last year.)

- Adelaide unit values decreased -0.3% last month (+2.2% over the last year.)

Adelaide rents have continued to rise through the COVID period up one tenth of a per cent over the June quarter.

The detail in the data shows that unit rents have recorded a 0.2% decline over the quarter while house rents were up by 0.2%.

Across the broad valuation cohorts Adelaide’s more expensive properties have recorded a slightly higher growth reading than lower value properties.

The upper quartile values rose by 0.9% over the June quarter while lower quartile values were up a smaller 0.7%.

A similar trend can be seen across Adelaide’s sub-regions with the Western suburbs recording a 2.1% rise in values over the quarter, while at the other extreme values across the southern region of Adelaide were down 0.1% over the same period.

Now is the time to take action and set yourself for the opportunities that will present themselves as the market moves on

If you’re wondering what will happen to property in 2020–2021 you are not alone.

You can trust the team at Metropole to provide you with direction, guidance and results.

In challenging times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s what you exactly what you get from the multi award winning team at Metropole.

If you’re looking at buying your next home or investment property here’s 4 ways we can help you:

- Strategic property advice. – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! This will give you direction, results and more certainty. Click here to learn more

- Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $3Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment grade property. Click here to learn how we can help you.

- Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

- Property Management – Our stress free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years and our properties lease 10 days faster than the market average.

You may also be interested in reading:

- What can history teach us about what’s ahead for property

- How to Choose a Property Advisor

- What’s ahead for Brisbane’s property market?

- Property Investment In Sydney – 20 Market Insights

- Property Investment In Melbourne – 29 Real Estate Market Tips

from Property UpdateProperty Update https://propertyupdate.com.au/property-predictions-for-2021-revealed/

As flagged in Governor Lowe’s speech, the RBA forecasts a very large fall in activity of 10% over the first half of 2020 with unemployment peaking at 10% in Q2.

As flagged in Governor Lowe’s speech, the RBA forecasts a very large fall in activity of 10% over the first half of 2020 with unemployment peaking at 10% in Q2.

No comments:

Post a Comment