How long does it take for the value of a property to double?

After all capital growth is one of the main reasons people invest in residential real estate.

It’s often said that over the long-term the average annual growth rate for well-located capital city properties is about 7 per cent, which would mean properties should double in value every 10 years.

The problem is naive investors believe this myth and buy any old property and think its value will double in a decade – I guess that’s why so many investors fail.

But as with any good myth there is always partial truth.

So the truth is…some properties do double in value every 7 to 10 years but many (most) don’t!

Currently Australia is still working its way through the effects of its first recession in almost 3 decades and even though our property markets have rebounded, all those failed forecasts of last year show you how it is difficult to predict where property prices will be in three months, let alone seven to 10 years into the future.

We are moving into a period of low inflation with low interest rates and lower wages growth, so in my mind, it’s unlikely we’ll see the same level of property price growth moving forward as we saw over the last few decades.

But let’s dig deeper…

The following chart from CoreLogic shows that all property markets, other than Melbourne, finished 2020 higher than they started, and Melbourne has made up most of its lost ground and is likely to reach new heights again shortly.

In fact the modest coronavirus induced housing correction came to an end in the middle of October 2020 and that our housing markets are clearly on the move again.

History shows that some properties outperform others with regard to capital growth by 50 to 100%, meaning there is no reason why strategic property investors who buy an investment grade property in 2021 will not see the value of that property double within the next seven to 10 years (or one full property cycle).

The problem is…in my mind only around 4% of the properties on the market currently are what I would call “investment-grade.”

The rule of 72

For a simple way to work out how long it has taken a property or an area to double in value, divide 72 by the annual growth rate.

If you want to know how many times it has doubled over a particular time frame replace the annual rate by the average annual rate over the same time period.

For example if you think a property will grow 10% per annum, just divide 72 by 10% and that tells you that it’ll take 7.2 years to double.

But let’s take a long term perspective and see what’s happened in the past.

According to Corelogic research reported by Aussie, nationally the median house value has delivered an annual growth rate of 6.8% over the 25 years to 2018 and have risen in value by 412%, from $111,524 to $459,900 over that quarter of a century.

Apartments delivered an annual growth rate of 5.9% and have increased in value by $392,000 (+316%) since 1993.

In 1993 the median house value across Australia was just $111,524 and interesting apartments showed a slightly higher median value, at $123,840.

It’s the old story…who wouldn’t like to buy the home their parents bought for the price they paid?

Source: Corelogic and Aussie

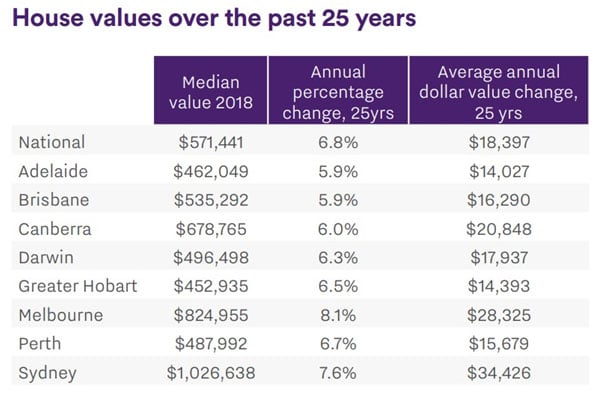

But as always growth rates were diverse with average rates of growth over that 25 years being:

Source: Corelogic and Aussie

Of course a significant trend in the last few decades has been Australia’s adoption of apartment living.

Here’s how apartments have been performing:

Of course there are markets within markets, so by geography, some by price point and some by the type of property.

That’s why you can’t really use capital growth figures for a city like Sydney or Melbourne and make broad brush conclusions.

You need to examine capital growth a a particular suburb, to be more accurate a particular neighbourhood within a suburb.

It’s also important to remember that…

Property markets move in cycles

This means that each state has its own property cycle and there are cycles within each cycle.

Different areas, different price points and different types of property have their own cycle.

Looking into these further, you’ll find that in each 10-year period there seems to be three or four years when the market is flat and in some cases the property values fall.

Then there are three or four years of low capital growth followed by a few years of strong price growth during the boom stage of the cycle.

As a property investor it’s important to be aware of and prepared for these cycles and your best chance of achieving above average capital growth is buying the right property, at the right price and most importantly in the right location as location will do around 80% of the heavy lifting for your property’s capital growth.

A study by the Australian Housing and Urban Research Institute found that both in percentage terms and in absolute terms over the long haul, suburbs located reasonably close to the CBD where demand is high, close to employment and where the most people want to live and where there is no land available for release, outperformed the outer suburbs with regard to capital growth.

Research by John Lindeman of Understand Property confirmed that, in general, capital growth is greater in our capital cities than in regional centers.

This means that while the value of well located properties in our capital cities have averaged around 6.8% growth over the last quarter of a century, overall regional growth has been lower.

So what’s ahead?

While past performance isn’t always the best predictor of the future, and clearly some housing trends are likely to change after many of us lived in a Coronavirus cocon; if property prices were to rise in the future at the same rate as over the past twenty five years, here’s what Aussie’s report forecasts:

Source: Aussie and CoreLogic Median values have been extrapolated based on applying the annual compounding growth in median values over the past twenty five years to current median house and unit values.

Yes, it’s hard to believe that the median house in Sydney’s value could be $6.35 million and $5.82 million in Melbourne.

Yes, it’s hard to believe that the median house in Sydney’s value could be $6.35 million and $5.82 million in Melbourne.

Obviously these are simple extrapolations and don’t, in fact can’t, account for the many economic, demographic and political variables that will play out over the next quarter of a century.

However Australia has a “business plan” to keep growing its population.

This plus the ongoing wealth of our nation should underpin the growth in value of our property markets.

Sure our borders are closed at present but prior to that Australia’s annual population growth of 1.4 percent added around 340,000 people to our population each year, and this is likely to be the case again once a Covid19 vaccine is available.

While 1.4% growth may not sound like much, we’re adding the equivalent of one new Darwin every 20 weeks or a new Tasmania is stuffed into our capital cities every 18 months.

Sydney was growing much faster than the national averages and was on track to add almost two million people to its population by 2037, which is the equivalent of adding a new Perth into Sydney.

Sydney was growing much faster than the national averages and was on track to add almost two million people to its population by 2037, which is the equivalent of adding a new Perth into Sydney.

Of course Melbourne was Australia’s fastest-growing city, growing 18% faster than Sydney, meaning Melbourne is set to overtake Sydney as Australia’s biggest city sometime in the 2030’s

How do you outperform the market averages?

The system that we use at Metropole which has helped many clients build substantial property portfolios by identifying properties that do in fact double in value in less than 10 years uses what I call our top down approach (going from the macro to the micro):

This starts with examining the macro factors affecting our property markets and drills down to the micro level.

- We start by looking at the big picture – the macro-economic environment.

- Then we look for the right state in which to invest. One that will outperform the Australian market averages because of its economic growth and population growth.

- Then within that state,we look for the suburbs that will outperform with regards to capital growth.

We’ve found some suburbs have 50 to 100 per cent more capital growth than others over a 10-year period. Obviously those are the suburbs we target. And it’s all about demographics. These will be areas where more owner occupiers will want to live because of lifestyle choices and one where the locals will be prepared to, and can afford to, pay a premium price to live because they have higher disposable incomes. These are often gentrifying neighbourhoods as well

Obviously those are the suburbs we target. And it’s all about demographics. These will be areas where more owner occupiers will want to live because of lifestyle choices and one where the locals will be prepared to, and can afford to, pay a premium price to live because they have higher disposable incomes. These are often gentrifying neighbourhoods as well

- Then we look for the right location within that suburb. Some liveable streets will always outperform others and in those streets, some properties will always be more desirable than others.

- Then within that location we look for the right property. And finally, we only buy at…

- The right price, but I’m not suggesting a “cheap” property – there will always be cheap properties around in secondary locations. I mean the right property at a good price.

So how do they know which is the right property to buy?

We follow our 6 Stranded Strategic Approach and only buy a property:

- That would appeal to owner occupiers.

Not that we’re planning to sell the property, but because owner occupiers will buy similar properties pushing up local real estate values.

This will be particularly important in the future as the percentage of investors in the market is likely to diminish - Below intrinsic value – that’s why we avoid new and off-the-plan properties which come at a premium price.

- With a high land to asset ratio – that doesn’t necessarily mean a large block of land, but one where the land component makes up a significant part of the asset value.

- In an area that has a long history of strong capital growth and that will continue to outperform the averages because of the demographics in the area as mentioned above.

- With a twist – something unique, or special, different or scarce about the property, and finally…

- Where they can manufacture capital growth through refurbishment, renovations or redevelopment rather than waiting for the market to do the heavy lifting as we’re heading into a period of lower capital growth.

By following our 6 Stranded Strategic Approach, you minimise your risks and maximise your upside.

Each strand represents a way of making money from property and combining all six is a powerful way of putting the odds in your favour.

If one strand lets you down, they have two or three others supporting their property’s performance.

When you look at it this way, buying a property strategically takes a lot of time, effort, research and something most investors never attain – perspective.

What I mean by this is you can gain a lot of knowledge over the Internet or by reading books or magazines but what you can’t gain is experience.

It takes many years to develop the perspective to understand what makes an investment grade property.

Remember:

There are both macro and micro factors which help determine how long is takes for property prices to double.

The big picture factors are those nationally and globally, such as supply and demand, consumer and business confidence, interest rates and affordability, availability of finance, Government incentives, the cost of renting and the global economic markets.

On the micro levels, it is the economy of each state which can affect the rates at which property prices grow.

Now is the time to take action and set yourself for the opportunities that will present themselves in property this year.

If you’re wondering how to take advantage of the new property cycle you can trust the team at Metropole to provide you with direction, guidance and results.

Whether you are a beginner or a seasoned property investor, we would love to help you formulate an investment strategy or do a review of your existing portfolio, and help you take your property investment to the next level.

In “interesting” times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s what you exactly what you get from the multi award winning team at Metropole.

In “interesting” times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s what you exactly what you get from the multi award winning team at Metropole.

If you’re looking at buying your next home or investment property here’s 4 ways we can help you:

- Strategic property advice. – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! This will give you direction, results and more certainty. Click here to learn more

- Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $3.5 Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment grade property. Click here to learn how we can help you.

- Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

- Property Management – Our stress free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years and our properties lease 10 days faster than the market average.

from Property UpdateProperty Update https://propertyupdate.com.au/property-values-really-double-every-7-10-years/

No comments:

Post a Comment