There has been a significant fall in deferred loan repayments according to APRA, yet another sign of economic recovery which boosts the ability of banks to extend lending.

Last year many borrowers put their loan repayments in deep freeze because of the uncertainty fuelled by the 2020 coronavirus pandemic.

Our banks offered homeowners and small businesses loan payment ‘holidays’, allowing people facing financial hardship to suspend repayments up until March 2021.

Loan deferrals peaked in May last year amid Australia’s nationwide lockdown – with almost 490,000 mortgages left unpaid, worth $192 billion.

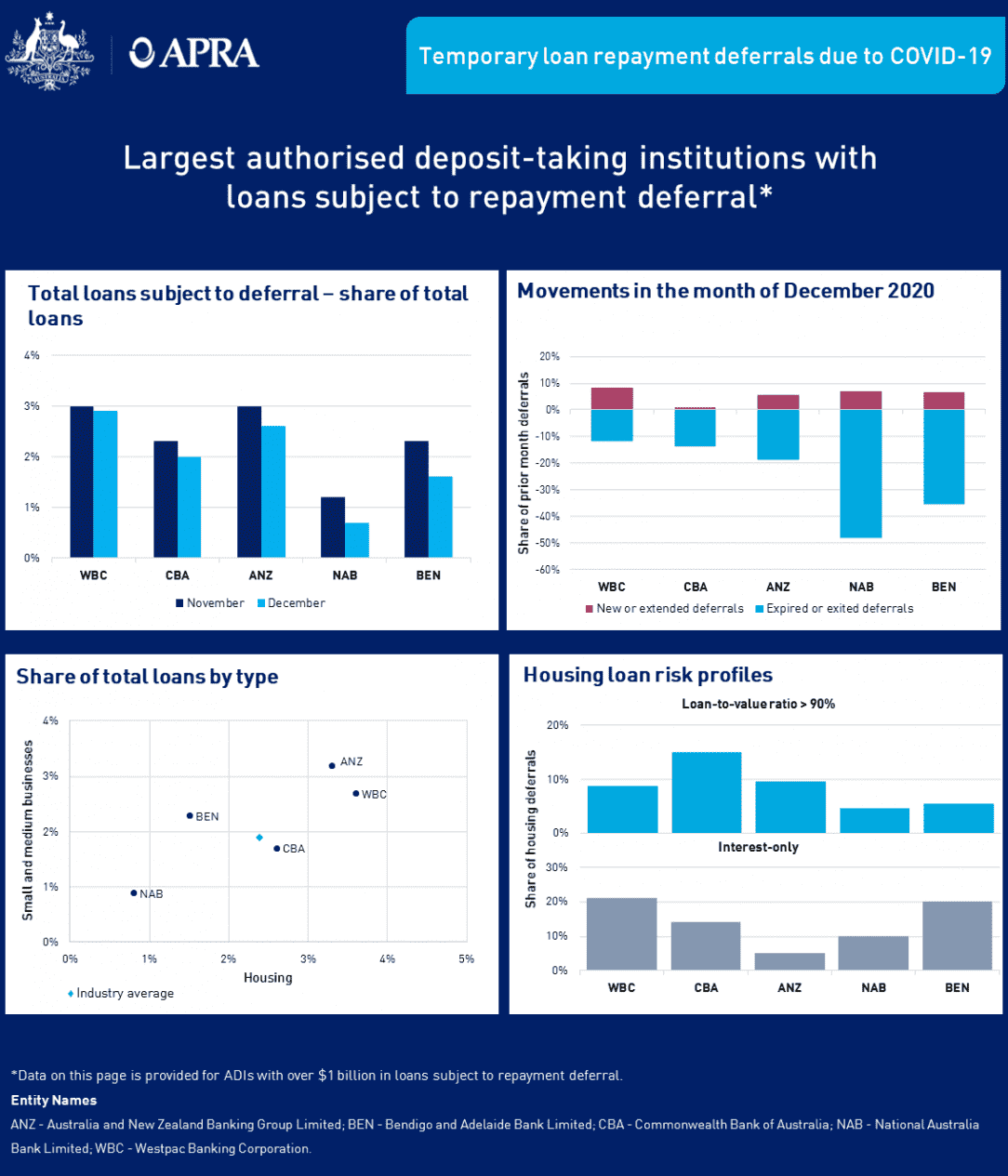

However, new figures from APRA show a rapid decline in deferrals over the last few months with more than 80 per cent of deferred loans being paid back now.

Loan deferrals peaked in May last year amid Australia’s nationwide lockdown and about 10 per cent of borrowers accepted and paused their payments, but recently released figured from APRA show that now only 2.4% of all loans are still on pause.

As of the end of December 103,000 home loans were postponed, worth $43 billion, a large reduction from the peak total in May of $192billion.

It was a similar story for small business loans with deferrals dropping from a May peak of 227,000 to just 20,000 in December.

It seems that many borrowers took out the safety net of loan deferrals but didn’t actually require them, and most have now started repaying their loans.

This means banks do not have to allow for as many potential bad dates on their books and the unofficial word is they are open for business and very keen to lend money again.

Remember bank are just “money shops”, they can’t make a profit and pay their shareholders dividends unless they lend money to customers.

And while our banks were very cautious last year, not willing to take on new loan commitments in the uncertain economic climate, their appetite for new business has definitely changed.

Treasurer Josh Frydenberg explained:

“As more households and businesses resume loan repayments, banks are in an even stronger position to continue lending … helping those wanting to buy a home, invest or grow their business.”

Exits from deferral continued to outweigh new entries for the sixth straight month in December, with $12 billion in loans expiring or exiting deferral and $3 billion entering or being extended.

Victoria remains the state with the highest proportion of loans subject to deferral eligible for capital concession amongst the states and territories, with 2.8 per cent of loans deferred compared with the rest of the country at 1.4 per cent.

from Property UpdateProperty Update https://propertyupdate.com.au/heres-why-the-banks-are-going-to-be-more-willing-to-lend-you-money-this-year/

No comments:

Post a Comment