Remember how the property pessimists were worried that we would fall off the cliff due to the many deferred home loans?

Many banks gave temporary relief to borrow is impacted by COVID-19, allowing them to defer of payments for a period of time.

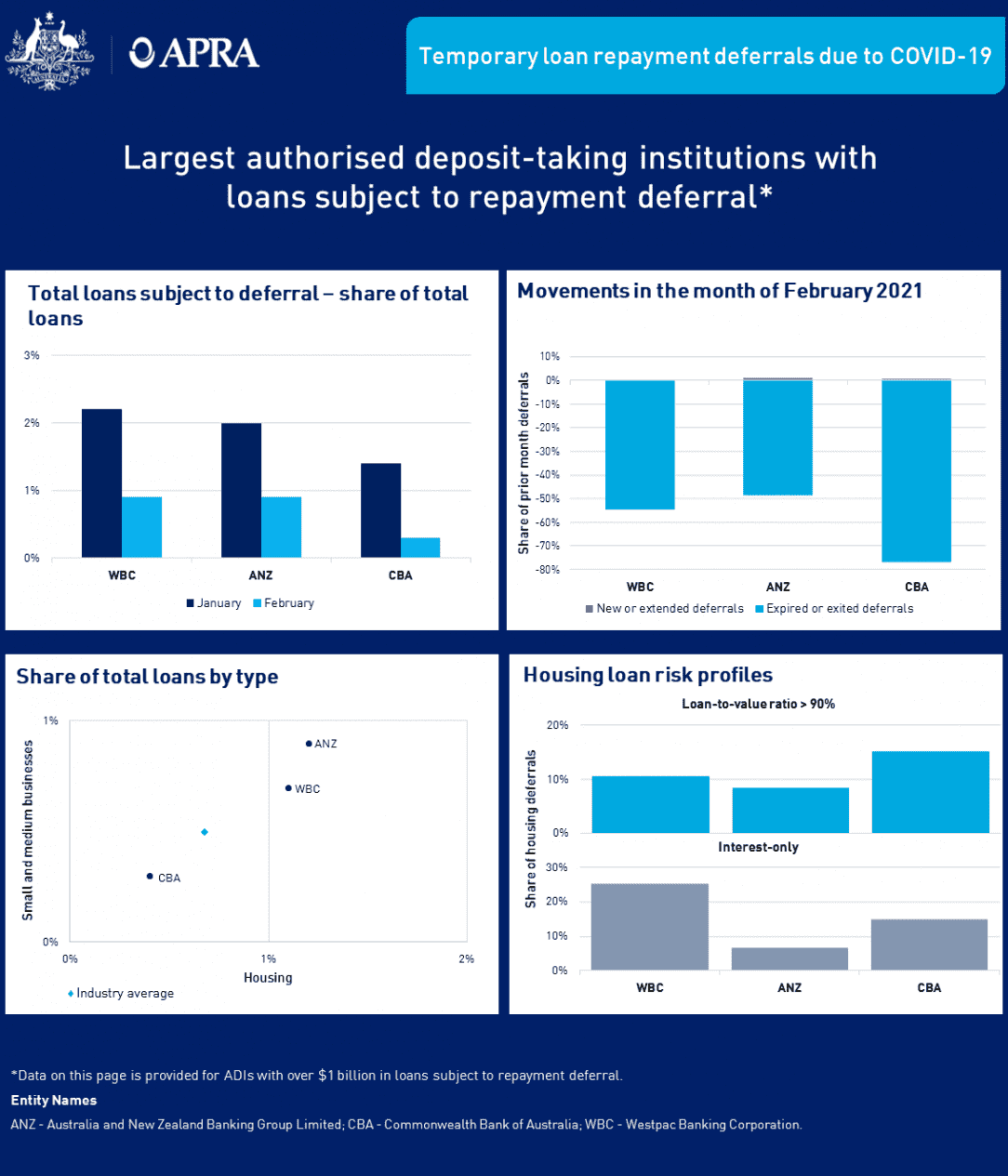

However APRA report that as at 28 February, a total of $14 billion worth of loans are on temporary repayment deferrals, which is around 0.5 per cent of total loans outstanding, down from $37 billion (1.4 per cent of total loans outstanding) in January.

Sure lots of homeowners and property investors took advantage of the safety net, but didn’t need to use it and are now repaying their debts.

So we’re not falling off of fiscal cliff, and our banking system is sounding stable – it’s a pity the Negative Nellys created so much stress amongst those who listened to them last year.

Housing loans make up the majority of total loans on repayment deferral and have a higher incidence of deferral, with 0.7 per cent of these loans subject to deferral, compared to 0.5 per cent of SME loans.

As expected, exits from deferral continue to significantly outweigh entries into deferral, with $22 billion in loans expiring or exiting deferral and less than $500 million entering or being extended.

Victoria remains the state with the highest proportion of loans subject to deferral, at 0.7 per cent compared with the rest of the country at 0.4 per cent, though this difference tightened in February.

from Property UpdateProperty Update https://propertyupdate.com.au/what-happened-to-the-fiscal-cliff-march-has-come-and-gone-and-were-still-here/

No comments:

Post a Comment