First home buyer affordability has declined for the second consecutive quarter, reinforcing the latest ABS data that revealed first home buyer numbers – although still strong – have fallen over recent months.

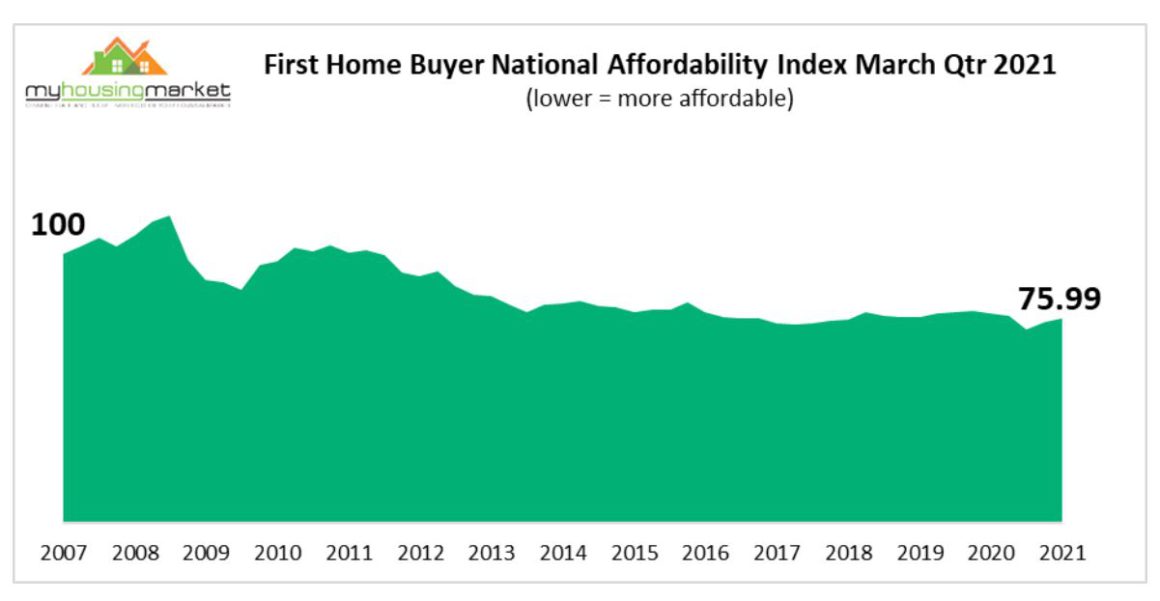

The My Housing Market National First Home Buyer Affordability Index increased again over the March quarter following a similar increase over the previous December quarter and is now well above the record low recorded over September 2020.

The National First Home Buyer Affordability Index measures average first home buyer loan weekly repayments as a proportion of average weekly earnings on a quarterly basis – a lower Index result equals higher affordability.

Loan repayment models are derived from ABS home loan series data and RBA published bank average standard variable home loan rates over 25 years. Income data is derived from the ABS average weekly earnings series.

The March quarter Index revealed that national first home buyer affordability – the income proportion of home loan repayments – had declined to 75.99 from the 74.75 recorded over the previous December quarter and now well above the record low 71.95 reported over the September quarter 2020.

All states with the exception of NSW reported falls in affordability over the March quarter with VIC the worst performer with the Index increasing by 4.59% and closely followed by TAS up 4.50% and SA up 4.37%. First home buyer affordability by contrast improved in NSW with the quarterly Index down by 2.02%

Although NSW was the only state where first home buyer affordability improved over the March quarter, it nonetheless clearly remains the least affordable market for first home buyers, reflecting the high-priced Sydney housing market.

The First Home Buyer Relativity Index reports that NSW first home buyers require the highest proportion of incomes to service new loans – 17% higher than the national average with WA the most affordable – nearly 20% lower than the national result over the March quarter

First home buyer affordability and associated first home buyer activity levels are set to continue to decline over the remainder of 2021 with booming home prices and increased activity from investors likely to result in first home buyers having to borrow more – if they can – to secure a property.

Aware of the impact of recent and likely ongoing runaway home prices on first home buyer activity, the federal government is set to announce new Budget initiatives to directly assist first home buyers to enter the market.

Although these policies are timely and will be welcomed by those seeking the Great Australian Dream, they are nonetheless narrowly focused and will likely fail to halt a sharp decline in activity from this group generally over 2021.

The best news for first home buyers struggling with stagnant income growth is lower home prices, and that isn’t going to happen anytime soon – anywhere.

from Property UpdateProperty Update https://propertyupdate.com.au/government-to-the-rescue-as-first-home-buyer-affordability-declines/

No comments:

Post a Comment