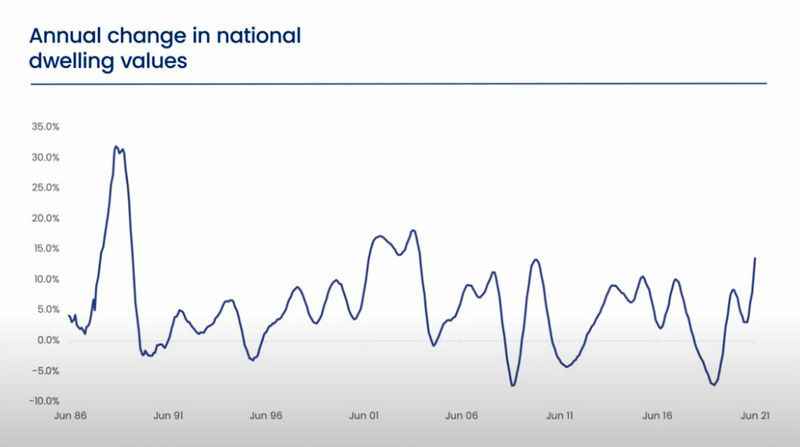

The housing market ended the financial year on a high note, with Australian dwelling values rising 1.9% over the month, taking housing values 13.5% higher over the year.

The highest annual growth rate since April 2004, when the early 2000’s housing boom was winding down after a period of exceptional growth.

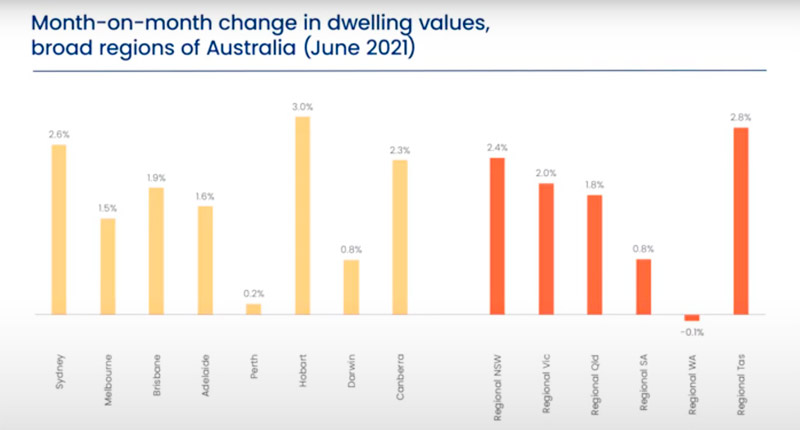

Each of the capital cities saw an uplift in dwelling values in June, ranging from a 3% rise in Hobart to a more subdued 0.2% lift in Perth.

Values also trended higher across the regional areas of each state, apart from regional Western Australia where the market slipped by 0.1%.

Darwin maintained the highest annual rate of growth across the capital cities increasing 21% in value over the financial year, followed by Hobart at 19.6% and Canberra, where values were up 18.1%.

Melbourne recorded the softest annual growth, reflecting a larger downturn in housing values through the third quarter of 2020 due to the extended lockdown period, along with a softer growth trajectory in 2021.

Across regional Australia, regional New South Wales recorded the highest annual growth in dwelling values up 21.2% followed by regional Tasmania at 20.8%.

Regional Western Australia recorded the softest conditions with a rise of 2.2% over the year.

Despite another month of strong gains, there are some signs that the heat is coming out of the market.

The 1.9% rise in Australian home values through June sits well above the decade average of 0.4%.

However, this month’s growth rate is down 30 basis points from the previous month, and 90 basis points lower relative to the recent peak rate of monthly growth back in March earlier this year.

The deceleration in housing value growth can be seen across most of the capital cities and regional markets.

It can probably be attributed to worsening affordability as housing values rise at a substantially faster pace than household incomes.

Saving for a deposit and funding transactional costs are becoming larger barriers to entry for many prospective buyers.

Softer growth rates are also emerging at the higher end of the market across the top 25% of capital city dwelling values, growth in the June quarter was 8%, down from 9.2% in the three monks to May.

While this 8% uplift was still the highest seen amongst the values tiers, the growth rate also had the largest month-on-month deceleration.

The easing and the pace of growth at the top end of the marketplace is another clear sign of a shift in momentum.

The rest of the market tends to follow movements at the high-end, and this is the first time in nine months that the high-tier growth rate has not accelerated.

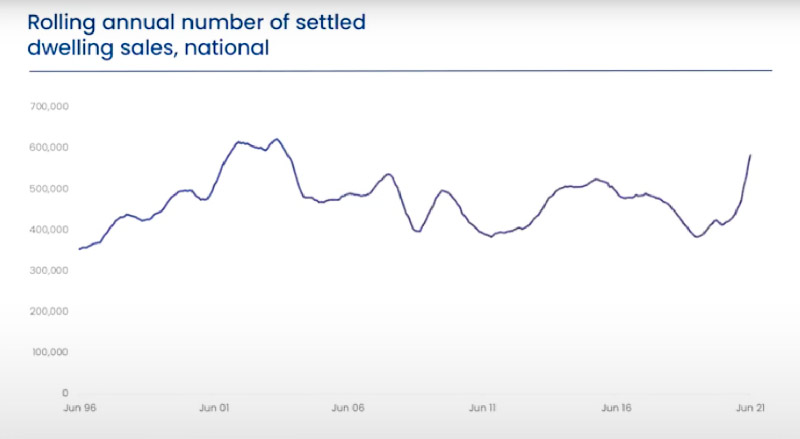

Sales volumes have remained elevated through to the end of the financial year.

CoreLogic estimates there were approximately 582,900 house and unit transactions nationally over the financial year.

That’s the highest number of sales annually since February 2004.

Every capital city and rest of the state double-digit growth in annual sales with the exception of Hobart where sales activity fell by -0.6% over the year, and regional Tasmania where annual growth rate in sales was 8.6%.

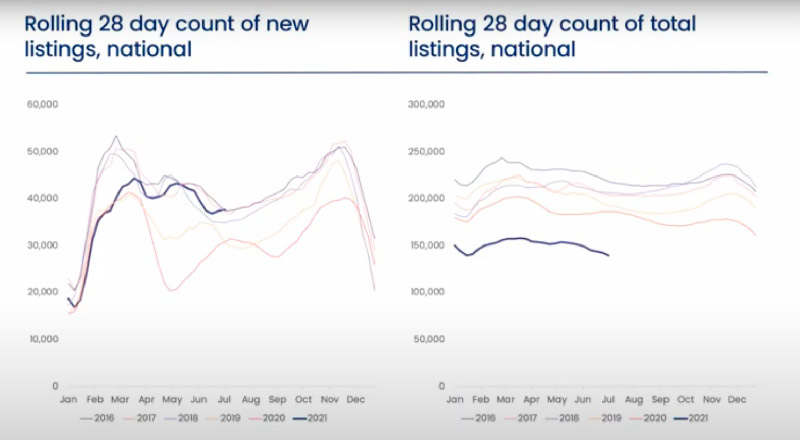

New listings have risen alongside prices and buying activity but the total amount of stock on the market remains low.

CoreLogic estimates there were approximately 130,000 fresh listings added to the market over the three months to June, almost 8% физму the five-year average.

However, in the same period, there are around 170,000 sales.

The dynamic of sales out-stripping new listings has been a persistent trend throughout the year.

The result is total advertised stock levels remaining approximately -25% below the five-year average.

With demand from buyers outweighing advertised supply, the market dynamic continues to favor vendors over buyers.

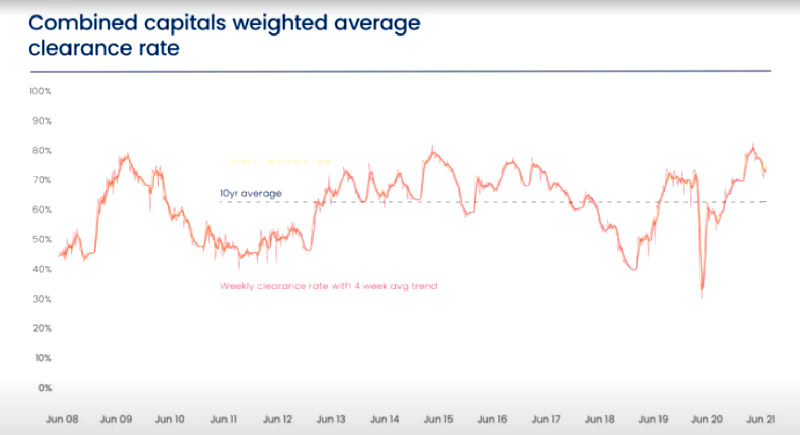

Auction clearance rates remain well above average, although they have reduced from the highs of late March.

Typical selling time for homes sold by private treaty remained close to record lows, averaging 29 days, up from a recent low at 25 days, and vendor discounting rates remain very tight at -2.7%.

from Property UpdateProperty Update https://propertyupdate.com.au/national-housing-market-update-australia/

No comments:

Post a Comment