Australia’s economic fortunes have improved according to the ANZ Bank’s most recent Stateometer -it’s quarterly assessment of the economic state of our States.

As housing construction keeps economies humming in the south east, resources construction in the west and north comes close to bottoming, and labour markets and trade improve nationwide, the ANZ Stateometer paints a picture of an economy moving closer to its trend rate in the June quarter.

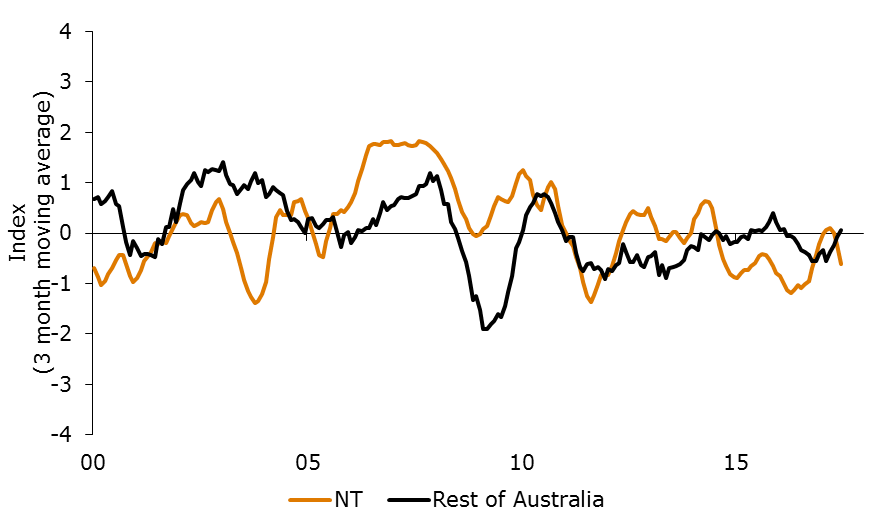

Today we look at their finding for the Northern Territory’s economy, which continues to be volatile and dominated by construction related to the resources sector.

The ANZ Stateometer reflects this, with all sub-indices, except trade negative over the June quarter as the globally significant Ichthys LNG Project’s construction phase comes to an end.

Figure 1. ANZ Stateometer index – NT

RESOURCES CONSTRUCTION TAILS OFF

An estimated AUD 8.2bn will have been added to the NT economy over the six year construction span of the Ichthys LNG project.

From here its largest contribution will be export revenue.

As the project’s construction tails off it is heavily affecting this small economy, which represents just 1.4% of the national total.

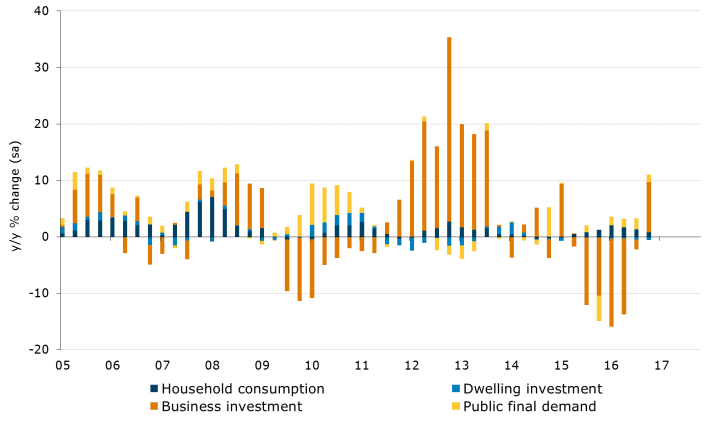

Business investment has fallen sharply from its peak at the end of 2014, and employment, housing and population statistics have shown similar patterns.

State final demand shows the substantial impact of business investment on the state’s domestically sourced growth through 2012 and 2013 and then its decline over the two-and-a-half years since (notwithstanding a positive figure in March quarter 2017).

Figure 2. NT – State final demand

OIL AND GAS EXPORTS YET TO RAMP UP

Trade is an important contributor to the NT economy, and while exports are dominated by live animals and ores, they will soon be dominated by oil and gas after the first production from Ichthys is scheduled to commence in March 2018.

At its peak, the project will produce 8.9m tonnes of LNG and 1.6m tonnes of LPG a year and 100,000 barrels of condensate each day.

Darwin benefits as gas and condensate from the Ichthys field are moved to onshore facilities for processing via the 890km pipeline.

Figure 3. NT employment vs rest of Australia

HOUSEHOLD SECTOR STRUGGLES

As job opportunities dried up with the declining construction at Ichthys, workers responded.

Population growth slowed to an annual rate of 0.3%, from more than 2% during peak construction.

So while the NT unemployment rate has remained very low (and was the lowest of all the state and territories at 3.2% in July 2017), the NT labour force has shrunk over the past two years.

We note though that because the labour force data estimate employment on a place-of-residence not place-of-employment basis, overall the number of people

working in NT tends to be underestimated.

Some project workers, Australian Defence Force and overseas military personnel working in the NT are not captured in the figures.

As employment and population have shrunk, so have dwelling prices and housing construction.

Quarterly housing completions in the NT in March 2017 were just over half of their level at the peak in mid-2014.

Dwelling prices have fallen 7% over the past year and by even more in regional areas.

We expect dwelling prices in Darwin to continue to fall, in line with the remaining decline in mining investment, before steadying next year.

Figure 4. State house price forecasts

You may be interested in…

from Property UpdateProperty Update https://propertyupdate.com.au/northern-territory-economy-2017/

No comments:

Post a Comment