Australia’s economic fortunes have improved according to the ANZ Bank’s most recent Stateometer -it’s quarterly assessment of the economic state of our States.

As housing construction keeps economies humming in the south east, resources construction in the west and north comes close to bottoming, and labour markets and trade improve nationwide, the ANZ Stateometer paints a picture of an economy moving closer to its trend rate in the June quarter.

Today we look at their finding for the W.A. economy who’s tumultuous ride appears to be settling, with the ANZ Stateometer suggesting the state is running below its trend rate, but with positive momentum.

The index shows a sharp improvement in the labour market over the past three months – along with a rise in the household component – was the main driver of the pickup in the index.

Business developments were also positive contributors to WA growth in the June quarter, while the trade inputs were mildly negative.

Figure 1. ANZ Stateometer

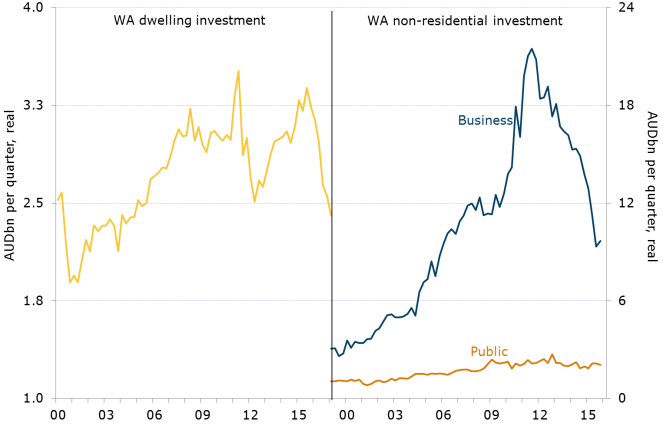

INVESTMENT DECLINE TAPERS OFF

With the last of the major LNG projects, Wheatstone and Prelude, approaching completion, the business investment numbers should become less of a negative influence on economic growth going forward.

The recent increase in commodity prices – particularly iron ore – may also be assisting some operational expenditure.

But after the recent construction boom, no major new investment is likely.

Longer term, the outlook for resource- related construction remains subdued.

Figure 2. WA investment

MORE JOBS BUT STILL UNDERUTILISATION

There has been renewed jobs growth in the state following more stable conditions, and possibly also because of higher commodity prices.

Employment growth of 2.3% in the year to July 2017 brought the unemployment rate down to 5.4%.

The participation rate also remains higher than all the states, but not the two territories, at 67.8%.

Spare capacity in the labour market remains, with measures of labour under-utilisation still elevated.

When the commodity price boom began, WA wages growth overtook that of all other states and territories and the level has remained higher.

Figure 3. Wage price index

HOUSING SIGNALS REMAIN NEGATIVE

Residential investment has weakened substantially as house prices have fallen in the state with few signs that this market is yet settling.

Mining areas, unsurprisingly have been worst hit.

The dramatic swings in housing have been impacted by the swift turns in population growth.

Interstate arrivals are only around two-thirds of what they were at the peak of the mining boom while departures are around a third more.

That means net interstate movements have been negative for around three years.

Net overseas migration remains positive, but only around 10% of what it was at the peak of the boom.

Figure 4. Motor vehicle sales

SPENDING SLOW

With falling house prices and a volatile job market, consumer spending has been sluggish according to June quarter retail sales data.

It showed just 0.3% growth in WA retail sales in nominal terms over the three months.

Motor vehicle sales have stopped declining but are 18% below their peak in July 2014.

All other states and territories recorded increases over this period.

A STAND OUT EXPORTER

Despite the last quarter’s negative influence from trade, the external sector is where WA (and Queensland and NT) will outperform due to their new productive capacity.

In the most recent financial year, WA exported one-third of the national total and that is set to grow.

You may be interested in…

from Property UpdateProperty Update https://propertyupdate.com.au/western-australia-economy-2017/

No comments:

Post a Comment