There are more interesting articles, commentaries and analyst reports on the Web every week than anyone could read in a month.

Each Saturday morning I like to share some of the ones I’ve read during the week.

The weekend will be over before you know it, so enjoy some weekend reading…and please forward to your friends by clicking the social link buttons.

What now for Sydney property prices? Five economists give their predictions

The Sydney property market has made many headlines lately for it’s soaring property prices.

But what does the future hold?

This article from Domain.com.au shres the predictions of 5 economists, analyzing where the market is now, and where it may go.

After five years of soaring property prices the question on the lips of Sydney’s buyers and sellers is clear: will booming prices continue?

Domain asked five top Australian economists to provide their forecasts for price growth in Sydney over the next 12 months.

Each of them had a unique take on the market – some expected prices to be relatively flat, others anticipated falls in the median price.

But the majority agreed on at least one point: Sydney’s double-digit growth days are over.

Most of them cited concerns about increased restrictions on investor activity, more apartment development and the market simply running out of steam.

Although there were significant differences in the forecasts, the outlook for the apartment market is clearly bleaker than the housing market, due to pockets of oversupply potentially putting downward pressure on prices.

And, depending on whose viewpoint you subscribe to, the difference in next year’s median price could be as much as $100,000.

The panel

- AMP Capital chief economist Shane Oliver

- Market Economics managing director Stephen Koukoulas

- Compass Economics chief economist Hans Kunnen

- BIS Shrapnel managing director Robert Mellor

- Domain Group chief economist Andrew Wilson

Apartment outlook

- Three expect prices to fall.

- Two expect prices to increase.

- Highest outlook: Growth of 5 per cent

- Lowest outlook: Fall of 7 per cent

There was a definitive split on where apartment prices are heading in the next 12 months – with two in the panel predicting rises and three expecting falls.

The most bearish of the lot was AMP Capital chief economist Shane Oliver, who forecasted a 7 per cent decline for the next 12 months.

Market Economics’ Stephen Koukoulas tipped a 2 per cent drop, while BIS Oxford Economics managing director Robert Mellor expected a 1 per cent decline.

If the bears have it right, by June 2018 Sydney’s current apartment median of $758,000 could drop to anywhere between $705,000 to $750,000.

Dr Oliver’s 7 per cent decline was based on unchanged interest rates for the next 12 months, but a likely increase of 25 basis points for bank mortgage rates on interest-only loans for investors.

He was also expecting another round of tightening measures from the Australian Prudential Regulatory Authority, and a cooling of offshore demand.

“This, along with a surge in the supply of units, will likely result in falls in unit prices and a slowing in home price gains,” he said.

Mr Koukoulas pointed to supply-side pressure and a tightening on loans from the banks, which also led him to predict 0 per cent price growth for houses.

“Throw all these things into the melting pot and it appears as though the long-overdue cooling in Sydney and Melbourne is poised to happen,” he said.

Read the full article here

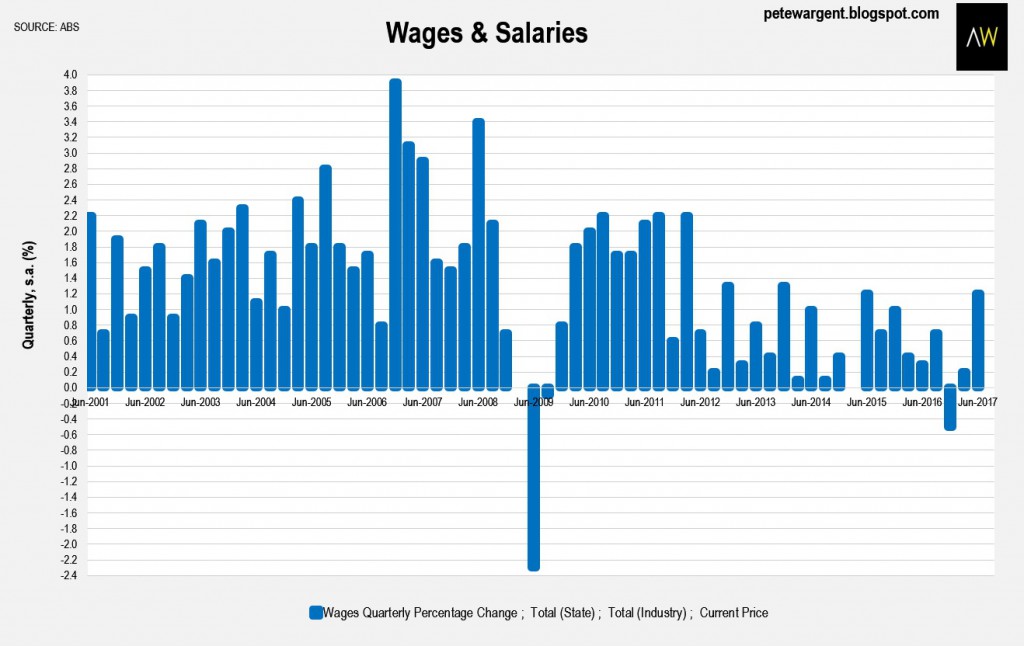

Wages & salaries equal best result since 2013

Whne ti comes to our wages and salaries – it looks like thing are picking up.

This Blog by Pete Wargent shows the statistics behind the results.

Wages & salaries pick up

Another prod or two in the eye for the record mortgage stress meme today.

Firstly job ads have fired up to their highest level in 6½ years, while shifts in capacity utilisation rates suggest that this rally can potentially continue towards 2018.

And then there’s the improving outlook for Western Australia.

Furthermore, the business indicators results for June 2017 showed wages and salaries recording their equal best quarterly result since 2013.

The seasonally adjusted estimate for wages and salaries increased by +1.2 per cent in the June quarter, following a string of poor results.

The gains were largely driven by swelling pay packets in the healthcare (+2.8 per cent), administrative and support services (+2.2 per cent), and professional, scientific, and technical services industries (+2.0 percent).

This release does not measure the same thing as the wage price index – rather this is a measure of gross earnings before tax, plus employee entitlements – although many similar trends are mirrored over time.

What the figures show is a tremendously weak period over recent years.

But a quarterly lift of +1.2 per cent is not too shabby at all, though we’ll need to wait and see whether the rebound is sustained as the year rolls on.

Don’t get me wrong, I’m the first to have a good old whinge when things aren’t looking so bright, but at the moment most indicators are generally improving.

Read the full article here

This analyst says the RBA looks set to hike interest rates, and far sooner than most people think

Interest rates shave remained on hold for quite some time now – but is that all leading up to one big change?

According to this article from Business Insider one analyst believes we’re in for one massive hike.

The Reserve Bank of Australia (RBA) looks set to hike interest rates, and far sooner than what most people think.

That’s the view of HSBC’s Australian economics team, led by Paul Bloxham, who say that a rebound in economic growth will lead to a pickup in wage and underlying inflation in the coming quarters, paving the way for the RBA to hike rates in early 2018.

Yes, early next year.

“If, as we expect, by early 2018, growth is running at an above trend pace, underlying inflation is back in the 2-3% target band and wages growth is past its trough, the RBA may see little need to maintain its highly accommodative monetary policy stance, particularly given its ongoing concerns about the exuberance in the housing market,” the bank wrote in a note released today.

“We see the first hike as likely to arrive a bit earlier than the market is currently pricing.”

Helping to underpin a pickup in wage and inflationary pressures, HSBC says that annual GDP growth will lift to an above-trend 3.3% by the end of this year, a view bolstered by a swathe of strong economic data in recent months.

Source: HSBC

“Most of the timely indicators of domestic economic activity suggest that growth is set to pick up pace in coming quarters,” it says.

“Key amongst these indicators are surveyed business conditions, which are around decade highs, and employment growth, which has picked up recently with sufficient momentum to push the unemployment rate lower.”

That, along with an unusually-large increase in Australia’s minimum wage rate at the beginning of July, should lead to a modest lift in wage pressures.

“We expect wages growth to pick up modestly in the second half of 2017, due to a boost to the minimum wage and the impact that the lift in corporate profitability typically has on wages growth,” HSBC says.

“This should mean that domestic inflation is past its trough, and we see the underlying inflation measures lifting back into the bottom part of the 2-3% target band in coming quarters.”

On the elevated Australian dollar, a factor many point to as a reason why the RBA should leave rates on hold for a considerable period, the bank says that this merely reflects that commodity prices are increasing and that global growth is picking up — two factors that usually benefit Australia’s trade-exposed economy.

Read the full article here

The best ways to add value to your home

If you’re looking to sell your home – one thing you would want is to get the best possible price, right?

One of the best methods to do that is adding value to the property.

But if you don’t know where to start – don’t panic!

An article on News.com.au looks at the best ways to add value to your house before you sell.

IT’S what any savvy seller wants to know.

How do you add thousands of dollars to your home? Is it a pool? Another bedroom? A car space? A granny flat?

The experts reveal to news.com.au what DIY additions will make you the big bucks on auction day.

DITCH THE POOL, BUT DIVE INTO ‘EXTRAS’

The first rule for resale is to invest in home additions that add profit to your bottom line, not neutralise it or leave you swimming in debt … like a pool can.

“Swimming pools are quite hit and miss — as lovely as they are in summer, they come with so much maintenance and without a heater, aren’t used much at all over the whole year,” said Sydney interior designer Natalie Bacic.

“They are great to have and use, but costly to install and unless they are for your own use, are not worth putting in just for resell value.”

“A garage for at least two cars is always a wanted addition for buyers, as is an ensuite and walk in robe.

“Butler’s kitchens and pantries have also made a huge comeback and appeal to many buyers.

A LICK OF PAINT AND BOB’S YOUR BUYER

Ms Bacic, of Nat Bacic Interiors, said the cheapest and most effective way to modernise a property was a fresh coat of paint and simple changes like old tapware or bench tops.

“New paint and carpet can really make all the difference,” she said.

“They can update the oldest of homes and without much effort, and that’s the key to anything you want to do in the home — to get the maximum benefit for minimal expense.

“New decor like cushions, lamps and throws can also make a big difference, and Kmart or Big W have some fantastic things that are inexpensive and can change your whole house.

GRANNY FLATS NOT JUST FOR OLD-TIMERS

With property prices constantly rising and affordable housing out of reach for the majority of Australian families, granny flats — like those included in the new season of Nine’s hit reality renovation show The Block — can become huge assets on auction day, according to real estate agents.

“We tend to find the best results come from the addition of a granny flat,” said Ray White Willoughby agent Rebecca Mikellides.

FORGET LOCATION, LOCATION, LOCATION — IT’S PRESENTATION THAT COUNTS

“In relation to renovations that can add to the appeal to the home, I always recommend small updates to the bathroom, kitchen and the facade of the property which is your primary attraction and last impression of the property,” Ms Mikellides continued.

“Should it be a cute picket fence, a full rendering of the facade or modern bathroom updates, it will all mean significant increases in price during a sale.

“And styling and paint are worth their weight in gold — presentation during a sale process can net you 20 per cent more should it be un-styled.”

Read the full article here

What’s your financial personality?

Are you a saver or a spender?

Did you know that there’s more than just 2 financial personalities?

In fact, according to this article from Yahoo Finance we have four… which one applies to you?

When it comes to spending habits, you’re either a tightarse or a splurger, right?

Well, not exactly.

Australians have as many as four financial personalities – from an ambitious ‘Go-getter’ to a ‘Cruiser’ who lives in the moment with little thought for the future, according to Australia Financial Planning Association (FPA).

Here’s a run down of the four financial personalities.

Which one are you?

- One in three Aussies are ‘Daydreamers’ – they love to dream about their future but struggle to act out the plans in real life (trip to Vegas, anyone?). Almost half of Daydreamers

are Generation Y – which makes sense as they have many years ahead to fulfil their goals – and have less money than Gen X. Overall, this group are more likely to be female, say the FPA.

- Another third of us are ‘Go-Getters’ – not only big dreamers but are actually prepared to act out their plans. Like Daydreamers, Go-Getters are mostly Generation Y’ers. They most likely live in a city rather than a regional area, have a degree and work full-time.

- One in five of us are ‘Cruisers’ – who sail through life and prefer to enjoying life than planning for or worrying about the future. Cruisers are often single and Baby Boomers.

- The remainder of Australians (16%) are ‘Builder’– who prefer to act immediately, and rarely spend time dreaming about the future. This eager beaver group are more likely to be Gen X and be in a family household without children than any other group.

Click here for the full article

Weekend video: 9 Proofs You Can Increase Your Brain Power

from Property UpdateProperty Update https://propertyupdate.com.au/weekend-reads-must-read-articles-from-the-last-week-26/

No comments:

Post a Comment