There are more interesting articles, commentaries and analyst reports on the Web every week than anyone could read in a month.

Each Saturday morning I like to share some of the ones I’ve read during the week.

The weekend will be over before you know it, so enjoy some weekend reading.

Banking royal commission to put liar loans in the spotlight, but what are they?

The time is up for liar loans – with a heavy crackdown on the way.

According to this article on abc.net.au the banking royal commission has begun it’s investigation into liar loans, with no loan safe from the magnifying glass.

The banking royal commission kicks off in earnest today, with the first hearings that will examine evidence and see witnesses questioned.

And what better place to start than looking at home loans.

It’s by far the biggest business in Australian banking, with more than $1.7 trillion in residential mortgages outstanding.

That’s about two-thirds of all the money lent by Australian financial institutions, dwarfing personal loans, credit cards and business borrowing.

Aside from making up the bulk of banking in Australia, the mortgage sector to date has been one of the less investigated areas in financial services.

Known knowns, known unknowns and unknown unknowns

To borrow a phrase from former US defence secretary Donald Rumsfeld, there are known knowns, known unknowns and unknown unknowns.

Given the royal commission’s limited timeframe, commissioner Kenneth Hayne can’t afford to waste time looking at the known knowns, that is scandals that have already been investigated (such as Storm, CommInsure or money laundering), or looking for the unknown unknowns.

We know there are some dodgy loans issued based on false information and fraudulent documents provided by mortgage brokers.

Since it assumed responsibility for enforcement in this area in July 2010, the Australian Securities and Investments Commission (ASIC) has undertaken more than 100 investigations, resulting in 15 criminal convictions and 60 personal bans or restrictions on providing financial services, many of which related to mortgage brokers.

‘Liar loans’ could be worth $500 billion

But that’s the tip of the iceberg if research from UBS proves to be accurate.

The investment bank’s research department has surveyed about 1,000 recent home buyers each year for the past two years.

Only 67 per cent of respondents to last year’s survey said their mortgage application was “completely factual and accurate” — that leaves one third who admitted to telling some kind of porky.

Most of those appear to have been white lies, with about a quarter of respondents saying their application was “mostly factual and accurate”.

But that still leaves 8 per cent who said their loan documents were only “partially factual”, and 1 per cent who refused to say.

If you multiply Australia’s $1.7 trillion home loan balance by a 33 per cent fraud rate, with a few adjustments here and there, you get to the attention grabbing headline that there might be $500 billion in what UBS calls “liar loans”.

The most common mistruth in the applications was understating living expenses, which makes sense because it is something that’s very difficult for a bank to verify.

That’s why banks are supposed to use a conservative benchmark for expenses as a baseline.

The problem is many banks have been, and some still are, using a poverty line measure of household expenses.

It just doesn’t make sense to expect a household earning more than $200,000 a year to have the same living costs as people surviving on the minimum wage.

This is something ASIC is currently taking Westpac to court over, and therefore an issue the royal commission will probably avoid going into for now.

Borrowers encouraged to lie, statistics suggest

Understating other debts, overstating income or overvaluing existing assets each accounted for about 15 per cent of the misrepresentations.

The rate of inaccurate applications went up dramatically for people who went through mortgage brokers compared to those who applied directly through the bank, suggesting many

brokers are encouraging their clients to lie.

More than 50 per cent of loans are now obtained through a mortgage broker, so this is a worrying possibility.

In each of these cases, the royal commission will also need to consider whether the bank should have picked up the lies if it had done proper checks.

UBS is concerned that the documentation required to verify information such as the borrower’s income is inadequate.

In a case around car financing, the Federal Court has already found that relying on a few payslips may not be sufficient evidence to satisfy responsible lending laws.

Read the full article here

Investor loans in decline

When it comes to investor loans – things seem to be declining.

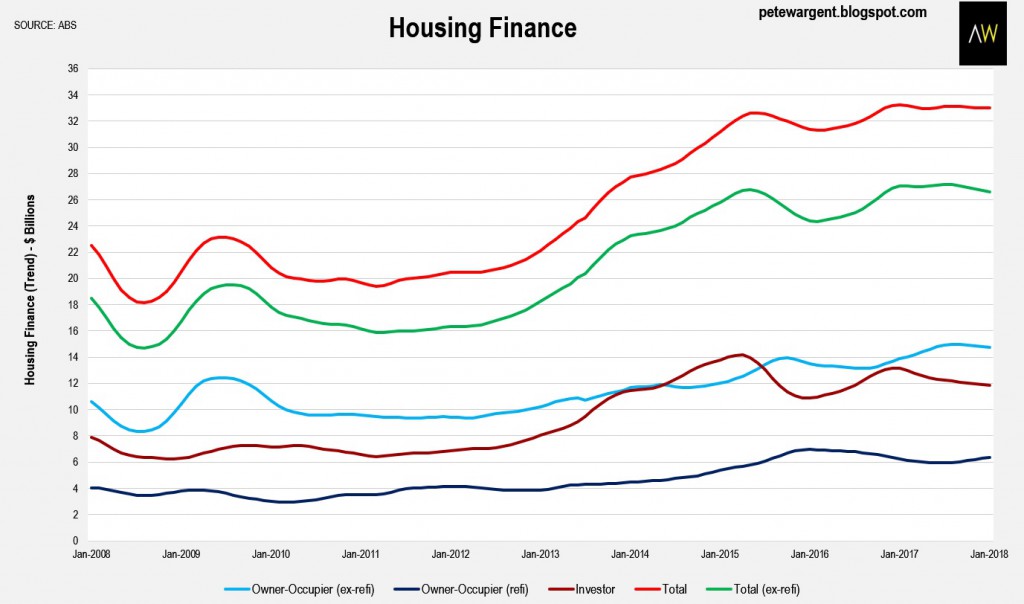

This Blog by Pete Wargent shows the statistics.

Investor loans still easing

A quick look at half a dozen of the more interesting housing finance slides for January 2018.

Total housing finance increased by +0.7 per cent in seasonally adjusted terms to $33 billion, but was pretty flat in trend terms, with investor loans continuing to decline and owner-occupier lending growing at +7 per cent per annum to fill the breach.

January is generally a quiet month due to summer holidays, but first homebuyers continue to be drawn into the market by concessions, now accounting for a market share of 18 per cent in the month.

Read the full article here

Growth slows but not in top tier suburbs

While there have been signs of a growth slowdown in out property markets – it would seem not everyone is affected.

In this article for Switzer, John McGrath looks at the suburbs that are still very much performing.

Along the East Coast, our capital city markets were characterised by a substantial decrease in the rate of property price growth in Sydney and Melbourne, with a much smaller decline in Brisbane.

In 2017, Sydney house prices went up 2.1% compared to 16.7% in 2016, according to CoreLogic figures.

Melbourne house values rose by 9.1% in 2017, which was well off the 15.1% recorded in 2016. In Brisbane, price growth declined just a little – it was 3.1% in 2017 compared to 4% in 2016.

In citywide terms, the boom markets of Sydney and Melbourne began to cool in 2017 but plenty of suburbs still experienced great growth, as shown in CoreLogic’s Best of the Best Report 2017.

What we tend to see at the end of booms is a declining rate of growth citywide but ongoing demand and strong prices still being achieved in the best suburbs for the better-quality properties.

The best suburbs could be defined as those offering a great lifestyle, close proximity to jobs or affordability.

At this time in the cycle, buyers become more discerning and are less willing to compete for ‘B’ or ‘C’ grade properties.

For example, Sydney house prices might have only grown by 2.1% overall last year but in the blue ribbon harbourside suburb of McMahons Point on the Lower North Shore, they went up by 45%.

McMahons Point offers a great lifestyle with plenty of cafes, restaurants, shops and sought-after schools close by.

It also has excellent transport links for the 10 minute commute into the CBD.

It was the No 1 suburb for house price growth nationally last year.

Let’s look at the other best performing suburbs for both house and apartment price growth in 2017.

SYDNEY

Best growth in median values – Houses

- McMahons Point 45%

- North Sydney 36.5%

- Kemps Creek 36.4%

- Cammeray 35.3%

- Bringelly 34.6%

Best growth in median values – Apartments

- McMahons Point 45.6%

- The Rocks 45.1%

- Birchgrove 37.7%

- Beecroft 31.7%

- North Sydney 31.4%

MELBOURNE

Best growth in median values – Houses

- North Melbourne 41.6%

- Frankston North 37.6%

- Ardeer 37.1%

- Jacana 33.7%

- Broadmeadows 32.8%

Best growth in median values – Apartments

- Watsonia 36.7%

- Ardeer 34%

- Clarinda 33.8%

- Fitzroy 33.3%

- Capel Sound 32.2%

BRISBANE

Best growth in median values – Houses

- Yeronga 25.4%

- Mount Mee 25.2%

- Sheldon 17.3%

- Taringa 17.2%

- Yeerongpilly 15.6%

Best growth in median values – Apartments

- Ormiston 15.7%

- Rochedale South 12.8%

- Caboolture South 11.5%

- Raceview 11.2%

- Corinda 11.2%

Some other figures in CoreLogic’s Best of the Best Report are also worth analysing…

Read the full article here

New cities to help house our booming population? It’s an idea worth thinking about for Australia

It’s no secret that out population continues to grow at a fast pace – leaving much concern as to where everyone will live.

So what’s the solution?

An article on Domain.com.au looks at the idea of creating new cities to help the booming population.

Is there a case for revisiting the idea of new cities for Australia in the light of recent population projections and resurgent debate about the implications of a big Australia?

By big we’re talking in the order of another 12 million people by mid-century.

That’s said to be equivalent to adding a Canberra every yearfor the next 30 years.

But, on business-as-usual projections, three-quarters of that growth will be accommodated in our four biggest cities: Sydney, Melbourne, Brisbane and Perth.

According to the Australian Bureau of Statistics, this could mean a Sydney of almost 9 million people and Melbourne of almost 10 million by just after 2050.

The last time the nation seriously confronted the reality of sustained and accelerated population growth was in the early 1970s.

And there was a mood to do something decisive.

In 1972 an Australian Institute of Urban Studies task force emphatically recommended:

“…efficient and humane alternatives to overconcentrated growth … A massive new-cities program needs to be started NOW.”

The Whitlam government obliged with a national growth centre program. Undertaken jointly with the states, this produced some positive outcomes.

These included an expanded Albury-Wodonga and systematic longer-term planning for Campbelltown in southwest Sydney and eventually Joondalup in northwest Perth.

Admittedly there were some duds, such as the tri-city Bathurst-Vittoria-Orangeand Monarto outside Adelaide, now a free-range zoo.

Funding and enthusiasm trailed off. This more or less reflected trends globally, certainly in the UK, heartland of new town thinking, where the Commission for New Towns was abolished by 1998.

But Paris carried on and even the private sector in the US developed new communities, bringing innovation to the design process.

Other nations with high population growth, such as China, maintained engagement.

Now even Britain is returning to new-look garden cities as models of sustainable growth.

So what’s going on in Australia?

If Australia had a fair dinkum national urban and population policy, then future patterns of national settlement would be firmly in its sights.

But we don’t, and those hopes of a new era under Prime Minister Malcolm Turnbull just haven’t ignited.

Instead, we mostly have a scattershot of initiatives, incentives and deals on offer within an overall economistic rhetoric of smartness and value capture.

Infrastructure Australia’s recent report, Future Cities: Planning for our growing population, is not much help.

It concentrates on the largest cities only, and reiterates the conventional wisdom of their evolution towards higher-quality, higher-density cities.

It is worth asking why existing – and presumed inevitable – patterns of growth are the equivalent of a new city, but new urban places are not tabled as viable options.

There is nothing approaching a coherent vision of national urban system planning.

This scale of thinking has largely dropped out of the policy realm.

The rise of design-driven planning has brought many benefits in balancing public and private interest, but these are usually played out at the local scale.

Metropolitan planning strategies display more comprehensive thinking but are jurisdictionally constrained.

They also inevitably converge on the same suite of aspirations – growth management, housing supply and affordability, employment, density, mixed-use activity centres and transit-oriented development.

And, as we see in Melbourne, the progressive liberalisation of urban growth boundaries to allow greater expansion misses opportunities for more radical rethinks.

Metropolitan governance is the order of the day, without doubt, but what spatial framework does that sit in?

The Greater Sydney Commission is proving its worth in this direction and organising local authorities into a co-ordinated assemblage.

But its strategy has almost nothing to say about the rest of the state.

Read the full article here

The DIY Mistakes Interior Designers Wish You’d Stop Making

Let’s face it, ever since shows like The Block came on air, everyone thinks they’re an interior designer.

But often that’s not the case…

This article from The Huffington post looks at the mistakes professional designer wish people would stop making.

Deep down, we all fancy ourselves as a bit of an interior design/DIY guru. After all, pretty cushions are pretty cushions, and when it comes to painting a wall, how hard can it be? Right?

RIGHT?

But if you take the time to watch pretty much any renovation reality show, you’ll quickly realise even the most capable (or not-so-capable) DIY decorators aren’t immune to making some pretty epic stuff-ups.

So we spoke to three Aussie interior designers at the top of their game to find out the most common DIY mistakes they see on a day-to-day basis… in other words, what NOT to try at home.

I truly believe the biggest mistake DIY’ers make is not setting a brief.

By working out exactly what they need to achieve, what their family requires and what they need to add or subtract from the home to make it work properly as well as considering things like style, mood and budget, people are able to create a plan and plot a path.

“Without the briefing process and having a document to adhere to along the way you can end up with a completely different, or at worst a completely disparate, result than you intended.”

- Don’t just dive in head first without a plan.

- Don’t spend more than you have or more than you should

- Don’t worry about what your friends think if you love it

- Don’t please only yourself if you plan to sell your property within the next 2 years.

- Don’t fall in love with one solution. there are always myriad options and plan b is often better than your first intention.

- Don’t be timid. Use your character and personality to inform decisions and commit to them wholeheartedly. It’s not the risks you take that you regret, it’s the chances you missed that keep you awake at night so just have faith, plan and commit to a bold solution that you are passionate about.

“The most common DIY decorating mistake that I see is not taking the time to space plan and draft a furniture floor plan before buying ‘big ticket items’ like a sofa.

Furniture needs space to “breathe” and often I see a too-big-for-the-room sofa pushed up against a wall because that’s the only way it will fit in the space or coffee tables that are difficult to navigate around.

“Pushing furniture away from walls and allowing the right amount of space to move freely makes a big difference to how a room feels.

“What you don’t have in a room is just as important as what you do have and a floor plan can help you work through any space planning issues by experimenting on paper before committing to the real deal.”

“I think something many people get wrong is being in rush! When you move house or decide to make over a room, it is so tempting to want it all done in a week.

We have all become too used to have things immediately!

“The worst thing you can do is go out shopping one Saturday (or worse, online) with the mission to get everything you need for your new kid’s bedroom or living room.

It will end in disaster!

Even worse if you try and get everything from the same shop.

“Great, authentic, unique interiors which you’ll love coming home to, take time.

The best decisions are the ones you sit on for a couple of weeks or even months and keep going back to.

This also gives you the time to save up for the couch you really want rather than making do with the cheaper one just because it’s on sale. So my top decorating tip is always to take your time and buy things you really love.

Read the full article here

Weekend video: Success at School vs Success in Life

from Property UpdateProperty Update https://propertyupdate.com.au/weekend-reads-must-read-article-from-the-last-week-3/

No comments:

Post a Comment