Declining vacancies and higher rents continued to characterise capital city rental markets over July, with increased Covid restrictions set to again disrupt activity.

House rents have soared over the past year with the exception of Melbourne where an exodus of Covid refugees may have acted to reduce demand for tenancies.

House rents have soared over the past year with the exception of Melbourne where an exodus of Covid refugees may have acted to reduce demand for tenancies.

Increased demand for larger premises driven by rising work-from-home requirements and a lack of supply reflecting the collapse in investor activity of recent years, has resulted in sharply falling vacancy rates.

All capitals with the exception of Melbourne have vacancy rates below 2.0% with current trends indicating continuing tight conditions for the foreseeable future.

Melbourne house vacancy rates are however by contrast now trending upwards.

Despite sharply increasing rents over the past year overall, gross rental yields remain low and continue to fall in most capitals, reflecting strong increases in prices driven by continuing boomtime conditions.

Overall total gross investment returns inclusive of capital growth and rental income remain elevated and continue to rise as a result of booming prices growth.

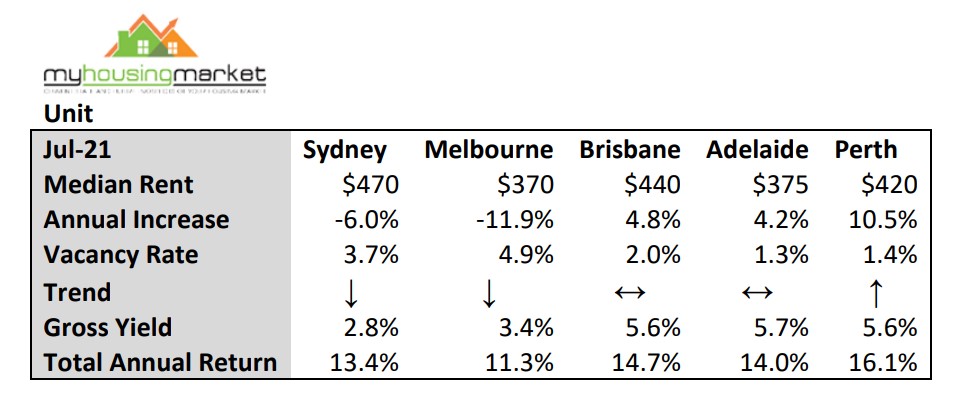

Capital city unit rental markets are also tightening with most capitals reporting a fall in vacancy rates over July.

All capitals reported an increase in unit rents over the month with the exception of Melbourne where rents were steady.

Annual unit rents have also increased in most capitals and although Sydney and Melbourne are the clear exceptions with sharply lower annual rents, the rate of rental declines in those capitals is now clearly trending downwards.

High unit vacancy rates in Melbourne and Sydney and lower annual rents primarily reflect continued elevated vacancies in local inner-suburban and CBD markets.

This is a result of a surge in new supply over recent years and a sharp decline in demand from first home buyers, students, tourists, and business travelers due to closed borders.

Similar to houses, recent strong prices growth continues to push gross yields for units downwards with declines in rents in Melbourne and Sydney adding to lower yields.

However, yields in Brisbane, Adelaide, and Perth remain encouraging for investors with higher rents offsetting higher prices.

Similar to houses, total annual investment returns for units remain elevated, driven by recent strong prices growth.

Current lockdown restrictions will act to subdue rental market activity although underlying shortages of available homes generally will continue to place a floor under rents – particularly for houses.

Closed borders will also likely halt the recent sharp reduction in unit rental vacancies in Inner Sydney and Melbourne CBD as a result of falling interstate demand.

from Property UpdateProperty Update https://propertyupdate.com.au/amazing-property-investment-returns-as-rents-rise-and-vacancies-fall-over-lockdowned-july/

No comments:

Post a Comment