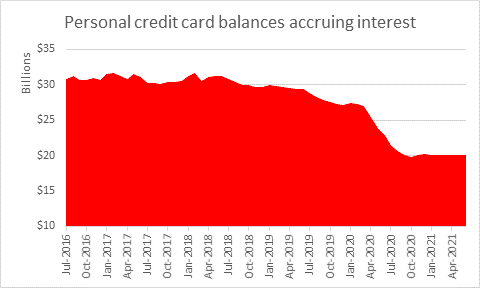

Australia’s credit card debt has now stubbornly hovered at around $20 billion for eleven months in a row.

The latest RBA data for personal credit card accounts shows a slight month-on-month decrease of 0.3 per cent in June, taking the total credit card debt accruing interest to $20.01 billion, in original terms.

While credit card debt has remained relatively steady for 11 months in a row, the number of credit card accounts has dropped by 751,916 in the last year, to the lowest number since February 2007. However, the rate at which people are closing accounts has slowed, compared to a year ago.

After adding almost $100 million in debt accruing interest in May, credit cardholders were able to pay back just $52 million in June.

The efforts to repay credit card debt are likely to get tougher in the coming months as the full impact of recent COVID-19 related lockdowns is realised.

Credit card spending desperation may have been spared in June but the outlook for July looks bleak, explains Canstar’s Group Executive, Financial Services, Steve Mickenbecker.

“Having paid down credit card debt from the early release of superannuation through 2020, Australian credit card holders are finding it tougher to stick to the diet in 2021,” said Mickenbecker.

“Looking forward, fewer opportunities to spend during lockdown will mean less physical use of the plastic, but more of us have, by necessity, discovered online shopping and will substitute spending.

“The longer the lockdown, the more unemployment will likely start to drive up credit card debt. The risk is that credit card debt piled on in desperation will be even harder to shift.

“When people can get back into work, the journey out of debt incurred during COVID-19 lockdowns should become a priority.

RateCity.com.au research director, Sally Tindall, said:

“Millions of Australians appear to be stuck in a credit card debt rut.”

Debt accruing interest has hovered around $20 billion for almost a year,” she said.

However, debt accruing interest could climb next month if lockdown affected households have reached for the credit card to help pay the bills.”

In June, Melbourne was locked down for a week, while greater Sydney’s restrictions started on 26 June. The July data, due out next month from the RBA, will be a better indication of how Australians are using their credit cards in lockdown, with multiple states affected that month.

If you’re struggling to pay the bills, pick up the phone and ask for help instead of reaching for the credit card,” she said.

Putting your bills on the credit card or taking out a payday loan could make a bad situation worse.

There are support packages from the government, loan deferrals, rate reductions and fee waivers from the banks, crisis payments from Centrelink and hardship programs from essential service providers,”

Anyone struggling with debt can call the National Debt Helpline for free financial counseling. National Debt Helpline: 1800 007 007

from Property UpdateProperty Update https://propertyupdate.com.au/credit-card-debt-lingers-at-20-bn-in-june-but-outlook-for-july-is-bleak/

No comments:

Post a Comment