House prices have increased again across all capital cities as the perfect storm for Australia’s property market continues to roll out.

Australia’s national median house price has climbed exceptionally close to the million-dollar mark at $955,927 – which is a huge 18.8% increase over the year, or 5.8% over the June quarter, according to Domain’s latest quarterly House Price Report.

Australia’s national median house price has climbed exceptionally close to the million-dollar mark at $955,927 – which is a huge 18.8% increase over the year, or 5.8% over the June quarter, according to Domain’s latest quarterly House Price Report.

In fact, 6 Aussie states have high record highs for their third consecutive quarter, while the other two are again at their highest point in several years.

House prices in Canberra recorded the biggest jump in prices, at 29.2% in just one year, or 10.4% over the June quarter, to a new median of $1.015 million.

The Tasmanian capital of Hobart also saw an impressive jump, with house prices climbing a whopping 28.4% over the year and 6.6% over the June quarter.

Hobart’s median house price now sits at $646,301.

Sydney’s house prices also continue climbing steeply, with a 24% year-on-year and 8.2% quarter-on-quarter increase to a new median of $1.41 million.

Darwin was another capital city that saw house price increases in the 20s, recording an impressive 22.4% year-on-year and 8.9% quarter-on-quarter price hike to a new median price of $608,519.

The house price surge has been so strong that Australia now has a new most-affordable capital for houses – Perth.

Capital city median house prices for the June quarter

Australia’s unit prices aren’t immune

While units might be seen as a more affordable option for many trying to buy a home, they too have seen surges in prices nationwide.

While units might be seen as a more affordable option for many trying to buy a home, they too have seen surges in prices nationwide.

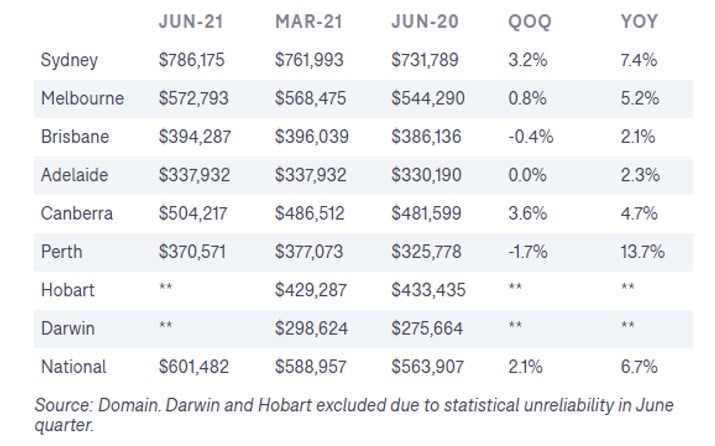

The national unit price has risen 6.7% over the year, or 2.1% over the past quarter to a new median of $601,482.

Unit prices have increased in Melbourne to a record high and also rose in Canberra and Sydney, where median unit prices are now higher than the median house price in Brisbane, Adelaide, Perth, Hobart, and Darwin, despite their recent rapid gains.

And the price gap between the median-priced house and the median-priced unit in each capital city had never been larger.

Capital city median unit prices for the June quarter

Unit prices marginally softened in Perth and Brisbane over the June quarter, but news that the Olympics will be hosted there in 2032 is expected to reverse years of apartment oversupply and pull up the city’s median.

“We are now seeing a golden moment when Brisbane will host the Olympics in 2032, but for housing, it will not be the Olympic period that will have the impact; it will be the years leading up to it,” according to Domain chief of research and economics Dr. Nicola Powell.

“Big spending from government and investment in the city will have a flow-on impact on jobs and economic growth and will be another drawcard for interstate movers, particularly in construction.”

Sydney prices in focus

Sydney house prices soared by almost $1,200 a day over the June quarter, a total rise of $107,000, to a new record $1.41 million, the data shows.

While all Sydney regions reached a new record high house prices, mid-priced areas such as Baulkham Hills and Hawkesbury, Sutherland, Ryde, and the southwest saw the strongest quarterly growth.

Sydney unit prices increased $24,000 over the June quarter to $786,175, slightly below the mid-2017 price peak.

The price difference between houses and units is at an all-time high, as houses continue to outperform, making units a more affordable option for first-home buyers.

Melbourne prices in focus

Melbourne house prices have joined the $1 million club jumping by almost $41,000 over the June quarter.

Melbourne house prices have joined the $1 million club jumping by almost $41,000 over the June quarter.

Since Melbourne emerged from lockdown late-2020, house prices have risen rapidly, producing three-quarters of consecutive growth above 4% – not seen since the city’s post-GFC rebound.

This has resulted in the strongest annual increase in 11 years, up 16.2% or $142,000.

Unit prices have reached a new record high at $572,793, up to $4,000 over the June quarter.

The rate of growth is subdued relative to houses, creating the biggest divergence in prices on record.

Brisbane prices in focus

Brisbane house prices reach a new record of $678,236, after raising almost $33,000 over the last three months and almost $78,000 over the last year.

Brisbane house prices reach a new record of $678,236, after raising almost $33,000 over the last three months and almost $78,000 over the last year.

This 13% annual price lift is the strongest annual increase in 13 years.

Unit prices dipped almost $1,800 over the June quarter to $394,287, remaining around $22,000 below the mid-2016 price peak.

The underperformance of unit prices has been a consistent trend for a number of years as a result of increased development, but that seems to have stabilised in recent quarters as interstate buyers continue to flock to south-east Queensland, drawn to the affordability and lifestyle.

Adelaide prices in focus

For the past year, Adelaide has consistently hit a new record high house price, and over the June quarter, a new benchmark was set, surpassing $600,000 for the first time in what was an unusual acceleration for Adelaide.

House prices surged 5.4% over $32,000 over the June quarter and are 16.3% higher than last year.

This $88,000 jump is higher than the average South Australian wage.

All regions have reached new record highs over June, with the premium end of the housing market recording the strongest rates of growth and buyer demand has been so strong that the city has seen the highest volume of sale transactions ever to be recorded.

But unit prices flatlined over the quarter, remaining close to last year’s record high.

The price difference between houses and units is at an all-time high, this value gap could begin to narrow as affordability bites for first home buyers and investors resurface.

Canberra prices in focus

Canberra house prices have joined the $1 million club, reaching a new record high of $1.016 million.

Canberra house prices have joined the $1 million club, reaching a new record high of $1.016 million.

Prices soared by almost $1,054 a day over the June quarter, a total rise of $96,000 in what is the steepest price acceleration in almost three decades.

Unit price growth has been more restrained as the development boom of recent years contains prices, although they are edging closer to a record high, up a more modest $18,000 (or 3.6%) over the June quarter to $504,217.

Canberra’s higher average income, large public sector employment base, lifestyle, and a turnaround in internal migration continues to buoy the local housing market, Domain’s report explains.

Buyer demand is high across Canberra with supply unable to keep pace.

This is despite sellers defying the winter slowdown, with 127% more auctions scheduled over June compared with the June decade average, strong auction performance, and heightened buyer the supply of new homes up for sale has hit a multi-year low.

Perth prices in focus

Perth house prices reached a six-year high over the June quarter, following a more modest $6,000 increase to $595,823 meaning the city has had the strongest annual increase in 11 years, up 12.3% or $65,000.

Perth house prices reached a six-year high over the June quarter, following a more modest $6,000 increase to $595,823 meaning the city has had the strongest annual increase in 11 years, up 12.3% or $65,000.

For the first time in 28 years, Perth is Australia’s most affordable city to buy a house as prices rapidly rise across the other cities.

Unit prices bucked the trend and fell over the June quarter to $370,571, but mainly due to a stronger performance in prior quarters, annually, unit prices made the steepest jump in 14 years, up 13.7%.

Buyer demand in Perth is still very high, with June being the busiest quarter since 2014 for houses and units based on properties sold.

Investors are also back in the market, seeking Perth’s affordability factor, tight rental market, and future capital growth prospects.

Hobart prices in focus

Hobart house prices hit a new record at $646,301, leaping another $40,000 over the June quarter.

Hobart house prices hit a new record at $646,301, leaping another $40,000 over the June quarter.

House prices are $143,000 higher compared to this time last year, or 28.4%, the steepest increase in 17 years.

While the rate of quarterly growth has eased, house prices are expected to continue to rise.

All price points are rising with all Hobart regions having reached a new record house price in June.

But there is no relief in sight for first-home buyers as entry-level house prices experience the biggest jump over the quarter and year.

Meanwhile, supply remains low compared to buyer demand which is ultimately placing continued pressure on prices.

Darwin prices in focus

Darwin house prices have now reached the highest point in almost four years, at $608,519.

Darwin house prices have now reached the highest point in almost four years, at $608,519.

House prices jumped by almost $50,000 over the June quarter or 8.9%, but they still sit $70,000 lower than the late-2013 peak, with the price gap rapidly closing.

If the pace of quarterly growth continues, Domain expects that Darwin house prices could surpass this peak by early 2022.

Darwin is no longer the most affordable city to purchase a house as prices overtake Perth’s, a title it had held since the beginning of 2020.

What is causing the house price surge?

The results from Domain’s latest quarterly House Price Report again highlighted the perfect storm for rising house prices: low-interest rates, low housing supply versus against strong demand and government stimuli.

The combination is expected to further aggravate prospective first-home buyers and upgraders who continue to be blocked out of the market as rising prices make buying property out of reach for many prospective buyers.

But on the flip side, the increase could possibly urge more sellers into the market – provided they aren’t put off by the lack of supply or inhibited by rising prices.

But on the flip side, the increase could possibly urge more sellers into the market – provided they aren’t put off by the lack of supply or inhibited by rising prices.

Because a contrasting issue we’re already aware of is that short market supply and the inability to find a better property to move into is causing many homeowners to drag their feet when it comes to the possibility of selling up.

This is putting even more pressure on supply and driving prices up even further.

Baby boomers in particular are less inclined to move homes and despite having many empty bedrooms, because of the lack of large resizer apartments in the right location, they are choosing to renovate instead.

Ultimately, the rising market, combined with household wealth is making the idea of downsizing far less attractive for this pocket of Australians.

And the housing shortage and therefore the price surge issue is only set to get worse as the number of new building approvals for new homes lags the previous 3 years and our population climbs.

Property price growth is ‘unsustainable’

While the climbing numbers are impressive to watch, according to Domain chief of research and economics Nicola Powell, they are unsustainable.

“This is a very unusual rate of growth. Unusual circumstances create extraordinary outcomes,” she said.

Of course, the ‘unusual circumstance’ she is referring to is the Covid-19 pandemic which has forced everyone to re-evaluate how they live their lives and what they want from their homes.

Now, more people than ever are working from home as new variant outbreaks force whole areas, cities, or even states into harsh lockdowns.

This means we are spending more time than ever in our homes – and are using them differently.

At the same time, increased savings (in the case of full-time workers who aren’t able to go out and spend their money) are giving some people more buying power.

We already know Australia has been building the biggest homes in the world, but the coronavirus seems to have accentuated the thirst for bigger homes.

And Powell said the shifting market dynamics and surging house prices meant we were seeing the disruption of the “Great Australian Dream” of a quarter acre block as a first home.

“That is unattainable,” she said.

Many instead would have to look at units – perhaps out of necessity rather than choice.

from Property UpdateProperty Update https://propertyupdate.com.au/house-prices-hit-record-highs-across-australia/

No comments:

Post a Comment