Land tax is levied on the value of an investor’s landholdings on 31 December each year.

It is an insidious tax as any land tax is relatively small when you initially purchase an investment property but typically increases each year.

It is an insidious tax as any land tax is relatively small when you initially purchase an investment property but typically increases each year.

As such, the problem is that it can become quite costly by the time you reach retirement – a time when it’s preferable to pay less tax, not more.

There may be several opportunities to minimise land tax which are discussed in this blog.

Land value is a vital attribute of an investment-grade property

The value of property comprises the value of the underlying land plus the dwelling’s value (i.e. improvements that are permanently located on the land).

Typically, land appreciates in value over time whereas buildings depreciate.

Therefore, to maximise your property’s rate of capital growth, you must invest in properties that have a high land value i.e. more than 50% of the property’s value should be in the land.

There are a couple of consequences of investing in high land value properties:

- High land value properties tend to produce low rental yields. That’s because renters don’t really care about the value of the underlying land. Renters are more impressed by the size and quality of the accommodation; and

- High land value properties attract higher land tax liabilities.

Remember, the power of compounding capital growth more than compensates investors for these disadvantages.

In the past, it hasn’t been wise to own property in a company but…

One of the major disadvantages of owning investments in a company is that a company is not entitled to the 50% capital gains tax discount.

If you realise a capital gain in your personal name of $100, you can discount that gross gain by 50% if you have held the investment for 12 months or longer.

As such, the investor will be taxed on a net gain of $50 at their marginal tax rate.

If they earn over $180,000 p.a., their rate of tax is 47%, so they will pay $23.50 in tax.

In short, the maximum rate of tax in respect of CGT in their personal name is 23.5%.

If a company makes a capital gain of $100, it will pay tax on the whole gain as the 50% discount is not available.

As the corporate tax rate is 30%, it will pay $30 of tax.

In this situation, the investor that uses a company pays a high tax rate of 6.5% (i.e. 28% more in tax).

As such, companies used to be an unattractive ownership structure (also because negative gearing losses are trapped).

But the company tax rate has been reduced in some situations

Companies that meet the eligibility of ‘base rate entities will be taxed at the flat rate of 25% from this financial year onwards.

A company is a base rate entity if its turnover is less than $50 million and 80% or less of its income is passive income (which includes rental income).

This could create a good opportunity for self-employed taxpayers if they are able to distribute business income into a corporate beneficiary so that the non-trading investment company meets the ‘base rate entity’ definition.

In this case, the rate of CGT would be 25% versus 23.5% in a personal name.

This is a far more palatable outcome, especially if a company ownership structure helps reduce land tax liabilities, as discussed below.

State-based tax regime

Land tax is a state government tax, and each state has different rules.

Principal places of residence do not attract land tax.

But any properties in addition to your principal places of residence, such as holiday homes and investment properties, typically do attract land tax.

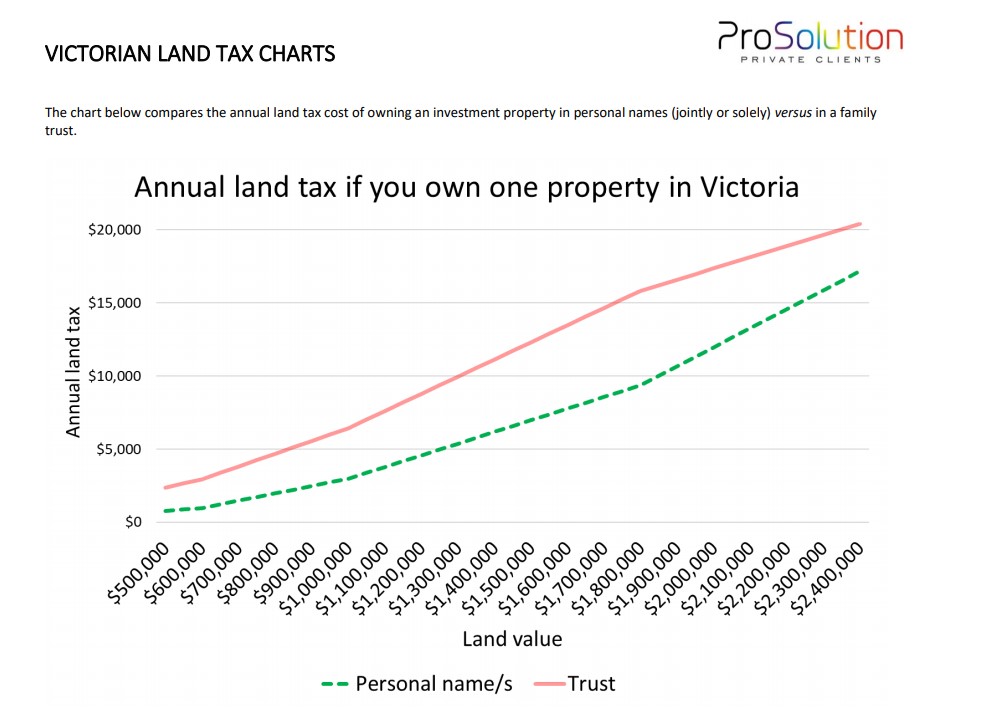

Land tax in Victoria

In Victoria, investors incur a land tax liability if the value of land holdings exceeds $250,000.

It has a marginal tax rate system which means the more land you own, the higher rate of tax you pay.

It has a marginal tax rate system which means the more land you own, the higher rate of tax you pay.

It is noteworthy that the land tax-free threshold of $250,000 hasn’t changed since 2009, despite the median house price almost doubling since then!

Joint owners share one land tax-free threshold.

Therefore, if you own two investment properties, purely from a land tax liability perspective, you are better off for each spouse to own one property each, rather than jointly.

Family trusts attract higher rates of land tax, and their land tax-free threshold is only $25,000.

As such, it is often worthwhile to establish a separate family trust to hold each property, rather than having multiple properties in one trust.

Companies are taxed at the same rate as individuals.

Therefore, if you are self-employed and can distribute business income into a corporate beneficiary, a company could be a good ownership structure.

I have prepared some financial projections which compare various ownership structures depending on whether you own one, two, or three investment properties.

The image below shows this analysis.

Land tax in NSW

NSW provides a land tax-free threshold of $755,000.

This threshold is increased each year, which is a fairer system than Victoria.

This threshold is increased each year, which is a fairer system than Victoria.

The value of land that exceeds the threshold is taxed at a flat rate of 1.6%.

The land tax-free threshold is available to individuals, companies, and self-managed super funds, but not family trusts.

That means a property investor that uses a trust to hold property in NSW will always pay $12,080 more inland tax each year if the value of its land holdings exceeds $755,000 (being 1.6% of $755,000).

As such, where possible, it is better to own property in personal name/s or, if you are self-employed, a company (subject to the discussion above).

NSW has announced that it will seek to reform property taxes by replacing stamp duty with an annual tax.

Whether this will have an impact on land tax is unknown.

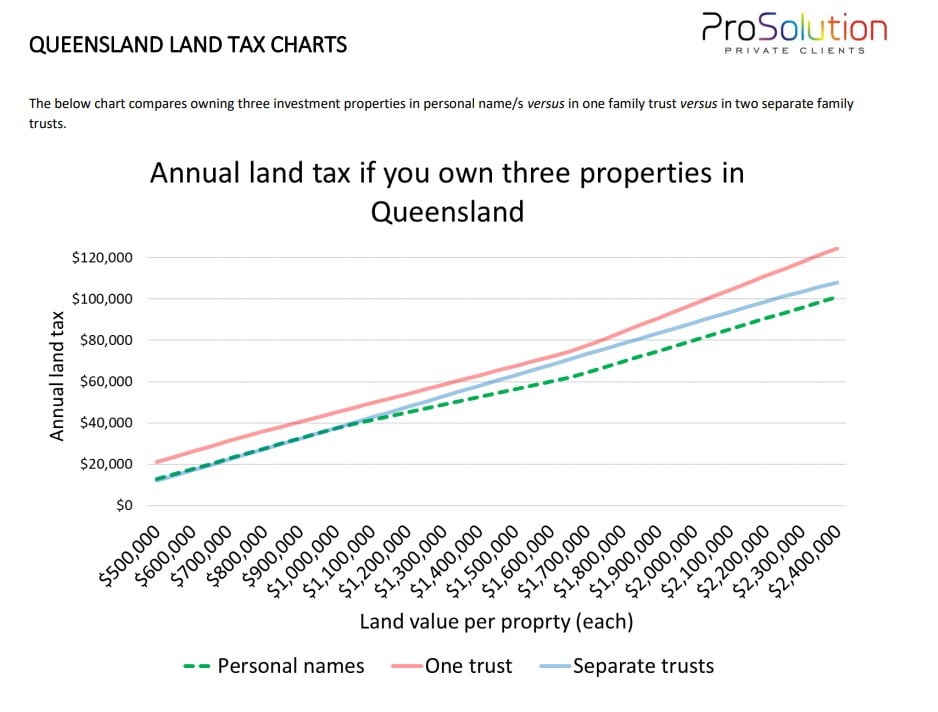

Queensland land tax

Queensland’s land tax regime is like Victoria’s, in that it has a land tax-free threshold (of $600,000) and levies a marginal rate of tax.

Queensland’s land tax regime is like Victoria’s, in that it has a land tax-free threshold (of $600,000) and levies a marginal rate of tax.

Trusts, companies, and self-managed super funds attract a lower tax-free threshold of $350,000 and higher rates of tax.

Depending on your situation, it might be wise to spread property ownership across multiple trusts, as discussed above for Victoria.

Just like I did for Victoria, I have prepared some financial projections which compare various ownership structures depending on whether you own one, two, or three investment properties.

Geographical diversification can help minimise land tax

Because land tax is a state-based tax, it may be possible to benefit from the tax-free threshold in each state.

As such, owning three properties in three different states will result in a materially lower annual tax liability than owning three properties in one state.

Other factors to consider

When contemplating investment property ownership options, it is important to recognise that land tax is only one of many considerations.

There are many financial and non-financial considerations to weigh up including:

Capital gain tax and income tax e.g. negative gearing benefits;

Capital gain tax and income tax e.g. negative gearing benefits;- Asset protection;

- Estate planning i.e. transfer of wealth;

- Compliance costs e.g. accounting fees, set-up costs, and ASIC fees; and

- Ability to borrow (e.g. maximise borrowing capacity, if applicable).

Some of these factors can be just as important, or more important than land tax outcomes.

Also, it is very important to acknowledge that tax rules can change at any time.

In fact, if you plan to own the property for a few decades, then it is very likely that tax rules will change over this period.

That is why it’s important not to be too tax-focused.

An ownership structure should provide many advantages including the ability to minimise taxes.

It’s too late to change now.

Changing the ownership of a property that you currently own is often cost-prohibitive as it can give rise to capital gains tax and/or stamp duty liabilities.

Therefore, it is important to seek independent financial and taxation advice well in advance of acquiring an investment property to avoid any costly mistakes.

As I wrote at the beginning, land tax is insidious – it will sneak up on you.

Therefore, you must consider ways to minimise it and you can only do that if you have a well-defined plan.

from Property UpdateProperty Update https://propertyupdate.com.au/land-tax-minimisation-elimination-strategies/

No comments:

Post a Comment