Are you wondering what will happen to the Melbourne property market over the balance of 2021 and into next year?

Well… based on how the market has been performing so far it’s likely that will see high double-digit Melbourne house price growth in 2021, with most segments exhibiting strong price appreciation other than the inner city and high-rise apartment market.

While Melbourne housing values suffered because of its extended lockdown which severely impacted market activity in 2020 since late October the Melbourne property market has rebounded strongly despite it’s intermittent Covid related shutdowns.

Melbourne property values:

- rose 0.4% in the last week and auction clearance rates were at boom time levels over the weekend

- increased 1.3% over the month of July, and

- increased 10.4% over the last year.

And there is still plenty of growth left, as Melbourne property values have only recently reached their previous 2017 peak levels.

Currently, Melbourne’s house price growth is stronger than unit growth, and while most sectors of the market have been enjoying strong demand, the more expensive properties are now outperforming Melbourne’s less expensive properties.

Looking back the Melbourne property market has been one of the strongest and most consistent performers over the last four decades.

Over the last 40 years:

- The median Melbourne house has increased by 7.9% per annum

- The median Melbourne unit/apartment price has increased by 7.73%per annum

Obviously this wasn’t the same each and every year, as the Melbourne property market worked its way through the typical property cycles.

Over the last few decades, Melbourne won the mantle of the world’s “most liveable city” more times than any other city in the world.

Needless to say, the Covid related lockdowns endured by Melbourne led to some challenging times, but now both buyers and sellers are back, consumer confidence has picked up strongly and property transaction numbers have increased and house, auction clearance rates are strong and prices are rising, however, Melbourne’s inner-city apartment market still looks in bad shape.

Auction clearance rates in Melbourne have been very high – actually boom-time levels.

While there is a shortage of quality housing in popular areas across Melbourne, the lower-than-expected population growth has led to an oversupply of housing in some outer suburban new estates.

A prime example of this is Melbourne’s western suburbs where an additional 18,800 houses are expected to be built over the next 24 months.

Villa units, townhouses, and family suitable apartments will be seen as affordable alternatives to houses in the highly sought-after inner eastern and south-eastern suburbs of Melbourne.

On the other hand, high-rise apartments in the many Melbourne CBD towers or close to universities are likely to underperform, remain vacant for a long time, and keep decreasing in value.

Houses in regional Victoria with easy access to the capital city are also in strong demand and should continue to increase in value.

Fast facts about Melbourne and its property market

Here’s the list of some vital points you would want to consider:

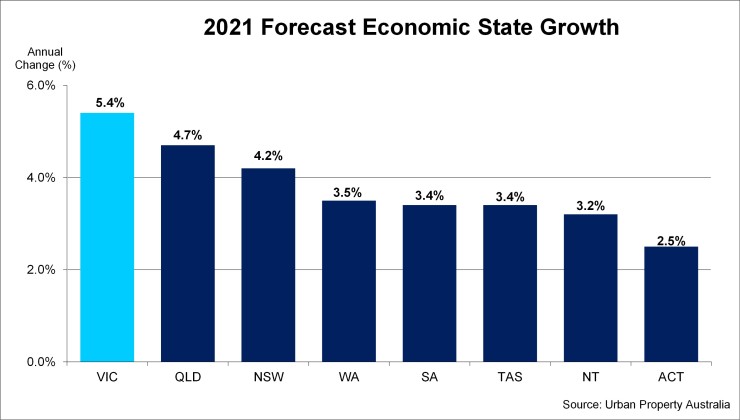

The Victorian economy is booming

For years the Victorian economy has been Australia’s strongest State economy creating more (and typically higher-paying) jobs than other states and once we get across the proverbial bridge the government has built for COVID-19, Victoria’s economy will surge again.

The Victorian economy was hit hardest by the COVID-19 pandemic due to the State’s extended lockdowns last year.

As a result the Victorian economy contracted by 6.1% over 2020, compared to -2.8% for the national economy.

But now the Victorian economy is rebounding and is likely to outperform the other states this year.

Source: Urban Property Australia

- First home buyers are back in the market buoyed by the HomeBuilder grant, historically low interest rates and the newly announced stamp duty concessions

- Melbourne’s population was growing at around 120,000 people per annum. That’s like adding a Darwin or a Ballarat each year to Melbourne’s population. Sure this will stop for a while due to the closing of our borders caused by Coronavirus, but will resume in due course.

- International and interstate migration will return once we get through these challenging times.

- There has always been strong foreign interest in Melbourne from tourists, migrants, investors and developers and in time this will return.

But remember… Melbourne is not one property market…

There are multiple markets in this diverse sprawling city.

It is divided by geography price points and type of property into many submarkets – this means you can’t just buy any property and count on the general Melbourne property market to do the heavy lifting for you over the next few years, so careful property selection will be critical.

So to help you better understand what’s going on in Australia’s second-largest property market are 29 things you should know if you’re considering investing in Melbourne property:

Melbourne House Prices

Over the last 4 decades, Melbourne property values have risen at the fastest pace of all capital cities.

Last year Melbourne house prices and market activity were adversely affected by its extended lockdowns but now Melbourne property is on the move again with dwelling price growth for the year to date of 8.8%.

The stats below for Melbourne price growth for the past year are low because of a number of very flat months during the 2020 lock downs, but as these months fall off the rolling 12 month stats, capital growth for Melbourne will show up as very strong figures.

The following chart from Real Estate.com.au shows how buyers are actively back into the Melbourne property market.

At Metropole we’re finding that on-the-ground sentiment has changed completely with strategic investors and homebuyers already starting to feel a little FOMO (fear of missing out).

However, while house prices have been resilient, Melbourne rental rates are experiencing weaker conditions due to a higher supply of rental properties, and less demand.

At the same time is more buyers being active in the market, there is currently a shortage of good quality stock on the market.

Changes in Melbourne property prices over the past two years

Similar to the market in Sydney, despite the economic shock to the Covid-19 extended lockdown in Victoria, Melbourne’s housing market defied the odds with any price decline being short-lived.

By the end of 2020, the median hit a new record high of $936,073 which is $28,000 above the previous record in early 2020.

Dr. Nicola Powell, Senior Research Analyst at Domain explained:

“First-home buyers became active, utilising incentives, low mortgage rates and a deeper savings pot as Covid restrictions reduced discretionary spending.

Upsizing buyers were enticed by cheaper credit and altered their wish-lists post-lockdown.”

Over the past two years, 91% of Melbourne’s suburbs enjoyed house price growth as buyers continue to be attracted by affordability, with price growth even spread across outer areas.

All suburbs that Domain mapped in the North East of Melbourne rose annually, while 97% of suburbs in the West (Niddrie and Maddingley the exceptions) and 95% of suburbs in the South East (apart from Sandhurst and Dandenong) also enjoyed a price hike.

By December, Blairgowrie took the title as the suburb with the largest property price increase across Melbourne with a 24.8% rise.

Although substantial price rises were also recorded in Portsea, Flinders, Ventnor, McCrae, and San Remo on the Mornington Peninsula.

“[The data shows] lifestyle and holiday locations are beginning to accelerate in price as working remotely becomes normalised and international borders remain closed,” Dr Powell said.

Suburbs including Bacchus Marsh, Capel Sound, Darley, Diggers Rest, Manor Lakes, Mickleham, The Basin, Werribee, Wollert and Yarra Glen, have also continued to show annual growth over the past two years.

Melbourne houses are outperforming apartments

Melbourne has seen a record high in the difference between house and unit medians at 52.4% as of June.

Melbourne has also seen the weakest rental market performance since the onset of COVID-19, and as a large portion of rental stock are units, this has dampened demand across the segment.

Melbourne has also seen the weakest rental market performance since the onset of COVID-19, and as a large portion of rental stock are units, this has dampened demand across the segment.

This also likely explains some of the weakness in the Sydney unit market, where rental demand was similarly affected by a lack of overseas migration.

Unlike Sydney however, Melbourne has seen similar rates of disparity through the 2017 and 2018 calendar years, when the house price premium on units averaged 46.3%.

A prolonged period of high unit supply, and development of high-density stock, kept unit values relatively low through this period.

This dynamic may shift through the remainder of 2021, as ABS data points to a fall in construction of units, and a rise in the construction of new houses.

Furthermore, affordability constraints across the housing segment, which could be amplified by the end of HomeBuilder and temporary stamp duty discounts, may guide more first home buyers back to the unit segment of Melbourne.

So…is it the right time to get into Melbourne’s property market?

Melbourne property prices have been climbing at a breathtaking pace in 2021 with more growth expected as strong demand from buyers outpaces the volume of new listings coming onto the market.

This has been good news for homeowners but heartbreaking for house hunters.

At the same time, there have been mixed messages in the media about what’s ahead.

Of course, there’s always the Negative Nellies wanting to tell anyone who is prepared to listen to them the market is about to crash, but other more solid commentators are suggesting our property market is slowing down.

And I agree, I believe the pace of capital gains has peaked, but I’m not suggesting home values are about to dip, far from it.

Rather I believe we’ve moved from a peak rate of growth to a pace of capital gain that will be more sustainable and there’s plenty of life left in the Melbourne real estate market with property values likely to keep increasing throughout 2022 and into 2023.

Australia’s economy has experienced the V shape recovery everybody has been was hoping for, but nobody really expected such strong economic growth, employment growth and this financial security will underpin Melbourne’s property market moving forward.

Currently, economic green shoots are appearing with the recession now over, many new jobs being created and over 90% of the jobs lost in the early part of the pandemic now restored.

However, some sectors of the Melbourne housing market will continue to languish this year.

The sectors of the Melbourne real estate market likely to underperform most moving forward will be:

- Apartments in high-rise towers – in fact, this is these properties are likely to be out of favour for quite some time.

- Off-the-plan apartments and poor quality investments stock (as opposed to investment-grade) apartments, particularly those close to universities.

- Established homes in the outer suburban new housing estates, where young families are likely to have overextended themselves financially and with many people will be out of work for a while. Currently, many first home buyers are taking advantage of the various incentive packages including HomeBuilder to buy newly constructed homes, leaving established houses in these locations languishing.

NOW READ: Is now a good time to buy property?

Long Term Melbourne Property Market Trends

In 1966, the median house price in Melbourne was just $9,400.

Values have doubled more than six times since then, with the median crashing through the $100,000 barrier in 1988, and pushing through the half-million-dollar mark in 2010.

Today one in three Melbourne suburbs have a median house price of at least $1 million, with 90 percent of suburbs within 10km of the CBD have a million-dollar median house price and almost 50 percent of suburbs in the middle ring also in the million-dollar club.

And changing demographics are playing a big role in driving shifting market trends.

The big house on a big block is no longer a sure-fire strategy for success, as single-person homes and households without children are increasingly favouring living in medium-density inner-city and waterfront apartment properties.

Meanwhile, families are trending towards locations that offer effective transport infrastructure, with access to amenities and quality education.

Upgrades to major highways and new rail links may close the gap between suburbs that were previously closed off by poor infrastructure.

Currently, there are 5.1 million people living in Melbourne. The

Victorian government has a business plan to increase Melbourne’s population by 2050 to 8 million people, and at that time Victoria will have a population of 10 million people.

But long before that Melbourne will become Australia’s largest capital city, likely to overtake Sydney within the next decade.

Over the next 30 years Melbourne is likely to require:

- 1.5 million more dwellings which will be made up of

- 530,000 detached houses

- 480,000 apartments and

- 560,000 townhouses

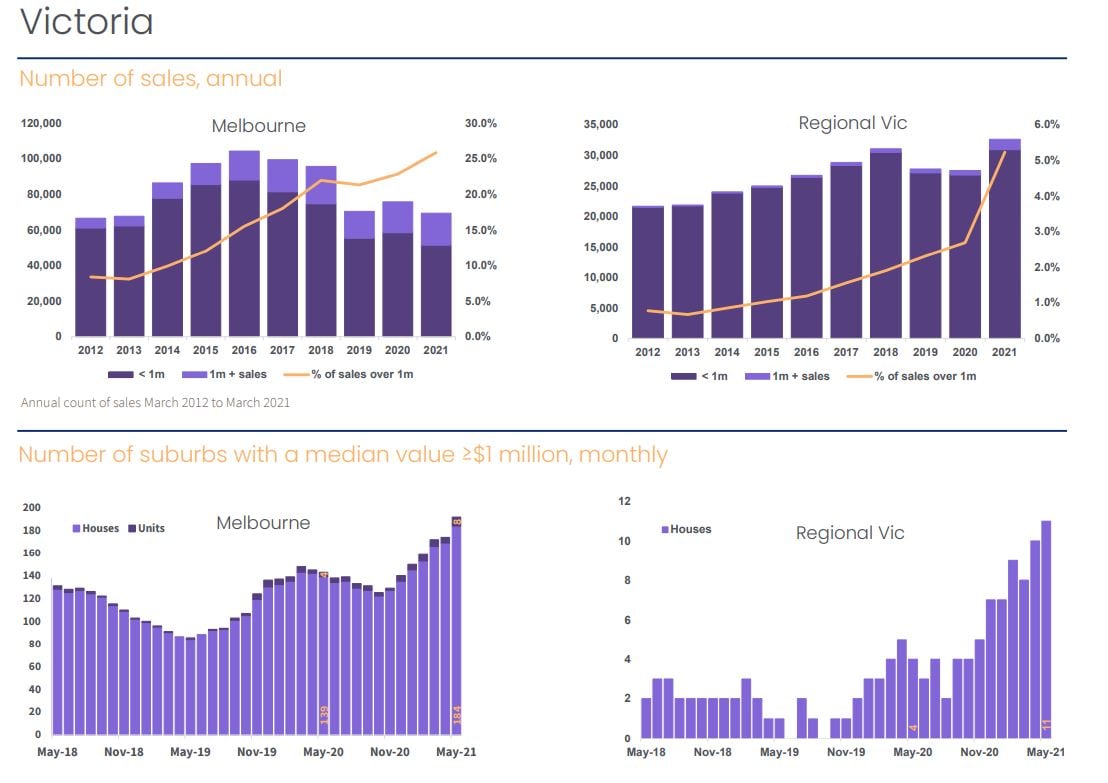

Currently, the number of property sales in Melbourne is growing week by week, and asking prices are holding up well:-

Melbourne’s Million Dollar Suburbs

In Melbourne, there are 184 house and 8 unit markets with a current median value of $1m and above; 34.3% more than one year earlier.

Regional Victoria now has 11 house markets reaching the million-dollar median value list, compared to only four a year.

Over the year to March 2021, over 25% of sales across Melbourne were $1m or more.

Brighton is Melbourne’s most expensive house market with a median value of $3,316,986.

Connewarre came in with the highest median house value across Regional Victoria, with a median of $1,671,374.

For the newcomers, Mount Macedon now has a median house value of $1,319,881 (up from $961,495 a year ago).

Houses in Jan Juc in the Geelong region now have a median value of $1,321,185 (up from $954,495 in May 2020).

Short term Melbourne Property Market Trends

The Melbourne economy has undoubtedly been the most impacted by COVID-19 in Australia, both because of the second major outbreak in case of numbers through the September quarter, and because international migration has been a key component of population growth across the state, and thus an important contributor to aggregate demand, and housing demand.

The charts below compare various economic indicators across Australia and Victoria.

State final demand fell -3.4% over the 2020 calendar year compared with a -1.1% decline in National GDP.

Employment levels are higher in Victoria compared with pre-COVID levels, more so than in the whole of Australia, but the state suffered a larger contraction in employment through late 2020.

Housing values across the combined capital cities are now 7.4% above February 2020, and while Melbourne property values are at record highs, they have not made the same gains as other capital cities, sitting just 2.4% higher due to the more significant reduction in housing values through the extended lockdown period.

The chart below summarises the sub-market performance of dwellings across SA4 regions of Victoria.

Each region has seen an increase in values in the 3 months to April, and all but two markets are higher in value over the year.

Regional Victoria continued to show a significantly faster pace of growth in housing values relative to Melbourne over the past twelve months.

The lingering impact of COVID-19 is felt geographically in the inner city region of Melbourne, where closed international borders have a significant negative impact on demand for a rental property in particular.

CoreLogic estimates that Inner Melbourne housing markets account for 45.9% of investment unit stock across the greater Melbourne metro

Melbourne’s Rental Market

Traditionally in Melbourne, vacancy rates have been tight; hovering well below the level of 2.5% vacancies, which traditionally represents a balanced rental market.

At Metropole Property Management our vacancy rate is less than half this rate, in part because our clients have chosen investment-grade properties, but we’d like to think it also has a bit to do with our proactive property management policies.

While over the long term rentals have grown in line with property values, more recently asking rents have fallen, in part due to the influx of rental properties that were previously let on short-term leases such as AirBnB and student accommodation.

The lower yield investors have been achieving is a reflection of higher capital growth and the value of Melbourne properties.

As a consequence, overall yields have declined over the past few years as can be seen from the following chart from SQM Research.

6 reasons to choose Melbourne

1. Melbourne’s demographics

In fact, Melbourne has been ranked the world’s most liveable city for 7 years in a row, up until 2018 when it was just pipped to the post by Vienna, Austria.

As Australia’s second-largest city, Melbourne is home to around 4.82 million people which accounts for 19.05% of the national population.

Plan Melbourne expects Melbourne’s population to grow to 8 million people by 2050.

More than 70% of Victorians live in Melbourne, making it a much more urban state in Sydney and Brisbane

Since Melbourne is Victoria’s business, administrative, cultural, and recreational hub of the state prior to Covid, o n an average day around 854, 000 people use the city, and each year Melbourne was host to over a million international visitors.

n an average day around 854, 000 people use the city, and each year Melbourne was host to over a million international visitors.

The culturally diverse and creative city is home to residents from an estimated 180 countries, who speak over 233 languages and dialects and follow more than 100 religious faiths.

Interestingly Melbourne has the highest number of restaurants and cafes per number of people than any other city in the world!

Of the 130,000-odd thousand people who live in Melbourne’s inner-city (the CBD), more than half are aged between 15 and 34, and they are generally living in single-person households or as couples without children.

According to Census data, this is strongly influenced by the high number of higher education students (both domestic and international) that reside in the city.

Immigration from China and India accounted for 32% of overall growth in population numbers, making Mandarin the second most commonly spoken language in the city.

2. Melbourne’s Layout

A well-planned city that is amply serviced by a range of public transport options, Melbourne is laid out under the ‘Hoddle Grid’, so named after its designer Robert Hoddle, which runs roughly parallel to the Yarra River.

As with most large cities, greater Melbourne is divided into ‘east’ and ‘west’ neighbourhoods; those in the east are more established and generally considered more affluent, while those in the west are more affordable, newer suburbs with less established reputations.

3. Melbourne’s Infrastructure

Melbourne residents enjoy the use of some of Australia’s most advanced and well-connected systems of road, rail, and tram infrastructure, which give locals plentiful options when deciding how to get around the city and its surrounding suburbs.

The city received a perfect score of 100 for its world-class infrastructure in the 2013 EIU Liveability Report, where ongoing investment in Melbourne’s infrastructure was highlighted as being one of the factors that keep Melbourne at the top of the index.

And the State government is spending a lot on infrastructure recognising that good infrastructure is not an end in itself, but an enabler of better social, economic, and environmental outcomes.

Melbourne’s new Suburban Rail Loop is a city-shaping project that will transform Victoria’s public transport system, revitalise Melbourne’s middle suburbs and create a long pipeline of jobs.

The 90-kilometer Suburban Rail Loop will link every major rail line from the Frankston line to the Werribee line, via the airport, better connecting Victorians to jobs, retail, education, health services, and each other.

The $54 billion costs of this project arguably make it Australia’s largest infrastructure project and are likely to be a game-changer as it will open up Melbourne’s employment hubs and middle ring suburbs with better transport – much like London’s Tube provide to ring around that city.

Meanwhile, Melbourne Airport, which is Australia’s largest curfew-free airport, handles more than 30 million passengers annually along with 350,000 tonnes of air freight, making it Australia’s largest air freight hub.

And Melbourne seaport – The Port of Melbourne– is the largest port for containerised and general cargo in Australia.

The city is also home to a number of world-renowned universities.

However as Melbourne suburbs sprawl further and further out from the CBD, the difference in the level of amenities between the inner suburbs and the poorly serviced outer suburbs is becoming more glaring, causing people to pay a premium to leave closer to the CBD and the better serviced inner suburbs.

4. Melbourne’s Economy

As a cosmopolitan, creative city that is served by a number of industries, Melbourne residents enjoy employment in diverse industries, from tourism, hospitality, and entertainment to commerce, industry, and trade.

Almost half the jobs created in Australia over the last decade have been created in Melbourne and Sydney.

Over the last 10 years, more than 500,000 new jobs were created in Melbourne as Victoria is transitioning from a manufacturing state to one driven by service industries, which is creating strong job growth and resultant overseas and interstate migration.

At the same time, the momentum of the Melbourne property market is creating a “wealth effect” for many of its residents have higher-paying jobs at a time that they are feeling wealthier as the value of their homes keeps increasing.

As you can see from the chart below, Melbourne’s economy slumped in 2020 due to multiple coronavirus lockdowns, however, it’s now growing strongly again in 2021

5. Melbourne’s growth

Victoria remains the nation’s population growth powerhouse but growth has started to slow a little.

Currently, Victoria represents around 26 percent of Australia’s population, and 3 out of 4 Victorians live in Melbourne making it Australia’s least decentralised state.

Melbourne’s population now stands at over 5 million people and Melbourne is still the fastest-growing city in the country, growing at around 2.4% per annum.

The estimated population increased by 2.2% over the 2018 calendar year taking it to 6,526,413 persons with an increase of 139,430 persons over the past year.

The 139,430 person population increase consisted of a natural increase of 40,256 persons, net overseas migration of 85,965 persons, and net interstate migration of 13,209 persons.

Although the population continues to increase rapidly, both net overseas and net interstate migration are lower than they were a year ago and natural increase is higher than a year ago but lower than the previous quarter.

Of course, there will be little immigration to Melbourne over the next year or so, putting a temporary halt to its substantial population growth.

However there is still an element of natural population growth (more births and deaths) and it is likely that population growth will surge once our borders are opened again, the popularity of Melbourne together with the fact it is the economic hub of Australia,

Like most housing markets in Australia, dwelling markets across Victoria now face new challenges in the wake of Coronavirus.

The chart below shows Melbourne’s population increase attributable to net overseas migration in the year to June 2019, alongside the four latest four-quarter average of the workforce employed in accommodation and food services and arts and recreation services.

Clearly, these areas of employment are likely to suffer more as we are cocooned by coronavirus.

The graphs above highlight that Victoria’s change in population is trending lower due to quite large declines in natural increase and net interstate migration and a more moderate fall in net overseas migration.

However, Victoria still records the largest raw number increase in the population of all states and territories in Australia

As you can see from the graph below, more than three-quarters of net overseas migration has been into NSW and Victoria, most of this coming from China and India.

Most of these permanent migrants are coming for jobs and are of household formation age.

Many initially rent the homes, but many want to eventually buy a home as part of their “status” of being an Australian.

A large chunk of this population growth is happening in Melbourne’s outer west, where the number of residents has increased by a figure equal to the population of Hobart over the last decade.

In fact, seven of the country’s top 10 growth areas were outer suburbs of Greater Melbourne, with international migration a big driving force behind Melbourne’s population growth.

The ripple effect of house price growth caused significant house price growth in Melbourne’s outer suburbs over the last few years.

Similarly, some regional centers including Geelong have performed well, but moving forward it is likely that the more affluent middle-rings suburbs which are going through gentrification are likely to exhibit the best property price growth.

![]()

By the way…

Just because there is significant population growth in these areas doesn’t mean there is strong capital growth of property values in these areas.

In fact, there isn’t!

That’s why I would avoid investing in these new outer suburbs as they lack the demographic and economic drivers to push up property values as opposed to the inner and middle-ring suburbs where there is more “old money.”

Melbourne is set to overtake Sydney and become Australia’s largest city by the 2030s according to demographer Bernard Salt.

And that’s not really that far away, is it?

If these forecasts pan out, and they are likely to be correct, they will underpin the strength of the Melbourne property market and deliver surety to investors who own property in the right locations.

Why is Melbourne attracting more growth than Sydney?

Melbourne offers what Sydney cannot or will not offer: access to affordable housing on the urban fringe.

Melbourne planned for growth from the Kennett years resulting in the formation of a plan for five million residents in 2030 and announced in 2002.

Either way, Sydney’s lead is now closer to 350,000 but is narrowing at a rate of 20,000 a year.

If the present rates were to continue Melbourne would replace Sydney as Australia’s largest city at some point in the 2030s.

6. Melbourne’s culture

The city of Melbourne is nothing if not multicultural, with dozens of different cultures and nationalities – 140 to be exact – living side-by-side.

The city’s Multicultural Hub was launched as a friendly, supportive environment for Melburnians of all cultures to get together and work, share and learn, while the city’s diverse and awarded restaurant scene is highly influenced by immigrants from diverse backgrounds including Chinese, Italian, Greek and Lebanese.

5 types of well-performing properties in Melbourne

1. Melbourne Houses

Decades ago, the Australian property market was dominated by demand for freestanding houses.

The appetite for ‘the Australian dream’, complete with a comfortable home on a big block with a picket fence and a pet dog, was insatiable, and home buyers, as well as investors, flocked to houses as a preferred investment type.

Today, the concept that land goes up in value is still well recognised, but not all land is created equal.

What’s more, changing demographics and evolving family situations have shifted dynamics to the point where more Melbournians are trading backyards for courtyards and balconies meaning apartments, units, and townhouses can be just as highly sought as freestanding homes.

With median house values in Melbourne virtually doubling in the last decade, many people can’t afford freestanding homes, so they smartly start their home buying or investment journey with apartments instead.

2. Melbourne Town Houses

The term townhouse originally referred in British usage to the city residence of a member of the nobility, as opposed to their country estate.

Today the term refers to medium density (often multi-story) dwellings that maybe, but not necessarily, terraced (row housing) or semi-detached.

In fact, the 2016 Census showed an 11% increase in the number of people living in townhouses – a popular style of Melbourne accommodation where people live in modern accommodation on compact blocks of land close to amenities in the middle ring suburbs.

Yes, Melburnians are trading their backyards for courtyards and balconies.

3. Melbourne Units

Units (sometimes called villa units) are the name given to single-story, older-style dwellings, mainly built in the 1960s and 70s.

Today, developers rarely build in this style because it’s not as profitable as building ‘up’.

This style of property makes an attractive investment, as they are increasingly popular with small families and young tenants, who enjoy the privacy with no one above or below and the small yard.

4. Melbourne Flats / Apartments

If an overseas visitor returns to Melbourne for the first time today after a decade, they wouldn’t recognise the skyline which is now listed with mini high-rise apartment towers.

Many were built for investors, particularly overseas investors, but they have proven to be poor investments with no capital growth for many years, and more recently falling prices and high vacancy rates.

Demand for off-the-plan apartments is now very weak, and as the graphic below from Charter Keck Kramer shows there is poor demand for new apartments and few new developments in the pipeline.

On the other hand, family-friendly apartments in low-rise developments located in lifestyle suburbs are proving very popular with young families and downsizes and make great investments.

5. Commercial, Retail and Industrial properties

Commercial properties, (retail shops, factories, warehouses, and office spaces) are in a very different league residential property and out of the domain of the everyday investor.

Whilst there are many benefits of investing in commercial properties, they are more suitable for the sophisticated and experienced investor, particularly as they are more yield-driven than capital growth-driven.

Consider it this way: for most advanced investors, your job is to build your asset base.

Once your portfolio is big and robust enough, you begin transferring into a cash flow strategy, and at this point, a commercial property can be a good investment.

Overview of Melbourne’s areas

1. Inner City

Melbourne’s inner city core has a population of around 29,450 people, a figure that is expected to double to 59,900 over the next 20 years.

As a result, there is much more property development activity in Melbourne CBD than anywhere else in the larger metropolitan area, with the majority of these developments comprising of high-density high-rise apartment buildings.

The area of Southbank, just south of Melbourne’s CBD, currently boasts over 9,000 distinct dwellings, the majority of which are family households (45%).

The number of residential properties is set to rise to more than 26,000 over the next 20 years.

Currently, I’m worried by a large number of poorly built inner-city apartments on the market or planned for completion.

Many, in fact, most of these are being bought by overseas investors, and these are likely to become the slums of the future.

Just to make things clear…I would avoid this segment of the Melbourne property market.

2. Bayside and South-Eastern Suburbs

Melbourne’s south-eastern suburbs boast distinct communities, neighbourhood attributes, and differing property growth cycles.

However while intricate, they’re considered by many to be the best Melbourne property investment suburbs.

The inner south-eastern and bayside suburbs of Melbourne make great locations to invest.

3. Eastern Suburbs

These include some of the most affluent areas of Melbourne – the residents of the eastern suburbs enjoy a median personal income of $1,164 per week, according to ABS figures.

Around 33% of properties are owned outright or mortgaged here, with 20% of housing comprised of townhouses or semi-detached homes, and only 33% of residential properties being high-rise apartments.

This is a dramatic difference from the inner city, where apartments are the dominant dwelling type.

The inner eastern suburbs of Melbourne also boast some great investment locations.

4. Western & Northern Suburbs

While the outskirts of Melbourne’s west and north is home to several of the city’s fastest-growing outer-suburban areas including Truganina, which increased by 18%, Tarneit (16%), Point Cook (12%), Melton South (11%), and Wyndham Vale (10%).

However, these more blue-collar areas have lower average wage growth and therefore lower ability to sustain capital growth.

While these areas are experiencing strong population growth and they have enjoyed strong capital growth over the last few years as the rising tide of the strong Melbourne property market lifted all ships, now that the cycle has reached its mature stage, many of these locations, especially the blue-collar suburbs will struggle.

In general, there are better investment opportunities in Melbourne’s inner eastern and south-eastern suburbs.

Melbourne has high standards

Melbourne has been named as the world’s most liveable city by the Economist Intelligence Unit’s liveability survey for 7 years in a row and for very good reason!

Boasting excellent healthcare services, premium education facilities (including world-class universities), a stable and diverse economy, a solid investment in infrastructure, and a thriving, creative culture, it’s easy to see why Melbourne received an overall score of 97.5 out of 100.

With such a high standard of living and ready access to good quality facilities and amenities, it comes as no surprise that people continue to choose to call Melbourne home.

In addition, with over 120 suburbs with a median house price of over $1million, Melbourne has the second-highest median price in the country (behind Sydney).

Advice for Melbourne aspiring property investors

1. Avoid Melbourne’s poor-quality apartments

Just because Melbourne has a well-deserved reputation for quality, that doesn’t mean the city is flawless – far from it.

In fact, the Melbourne CBD (Central Business District) is riddled with poor quality apartments, with one report stating that an estimated 55 percent of the city’s tallest apartment buildings are of “poor” quality, with common design flaws.

No one wants to live in a sub-standard apartment, regardless of how affordable it is, and there are only so many people who would find a hotel-sized apartment appropriate for full-time living.

The fact that an estimated 40 percent of apartments in Melbourne are smaller than 50 square meters, according to the Melbourne City Council’s planning department, shows just how big this issue has become – particularly when you consider that the minimum size a single bedroom apartment can be in Sydney, London and Adelaide is 50m2 or above.

Not only are the apartments lacking in breathing room – literally – they’re also flawed in a number of other ways, with kitchens placed in hallways, a lack of ventilation and natural light, and poor storage.

All of these design faults make these types of developments less attractive to potential tenants, which reduces the desirability of these properties.

Investors would be well advised to steer clear of apartments that don’t tick all the boxes.

Shoebox-sized living spaces, alongside common design flaws in the building itself, should raise some serious red flags for buyers.

The problem is many overseas buyers are purchasing these properties which will become the slums of the future.

2. Look for Melbourne’s best properties in the inner and middle-ring suburbs

Studies – and time – have shown that properties close to the city’s CBD (but not in it) and in bayside suburbs close to the water will increase in value more quickly than other properties and suburbs.

The demand for property is higher in these regions, as there is no land available for release, but the areas remain close to employment or desired locations.

Not only are properties closer to the CBD closer have better access to amenities and more employment opportunities, but transport costs are often lower and, as a result, people are willing to pay a premium to live there.

The end result for property investors in Melbourne is that the inner and middle-ring suburbs will (generally) out-perform the averages for suburbs located further from the city.

3. Be mindful of a Melbourne inner-city apartment oversupply

Melbourne’s property market has been typified by strong population growth and to keep up with surging housing demand, there have been a huge number of new developments – mostly in the form of high-rise apartment buildings, in and around the CBD – that have been approved.

While the population growth, Mainly from overseas migrants, was soaking up soaking up much of this new dwelling stock, the CBD is now over-supplied with too many new apartments.

With too many development projects either completed, begun or approved in recent years, the risk for property investors in Melbourne is that there is currently an oversupply of properties in and around Melbourne’s CBD.

And until our international borders are open, and tourists and in particular students return, it is likely that this oversupply will be soaked up meaning there will be no capital growth and sluggish rental growth on your investment – so avoid Melbourne CBD and near CBD properties.

4. Make the most of Melbourne properties through negative gearing

While most investors understand the concept of negative gearing, just in case you’re not up to speed, here’s a quick refresher:

A property is negatively geared when the costs of owning it – interest on the loan, bank charges, maintenance, repairs, and depreciation – exceed the income it produces.

A property is negatively geared when the costs of owning it – interest on the loan, bank charges, maintenance, repairs, and depreciation – exceed the income it produces.

Since the costs of producing an income are generally deductible against the taxpayer’s other income, property investors can effectively offset some of the interest expense against their wages.

Why would anyone go into a business deal to make a loss?

Generally, it’s because property investors in Melbourne hope that their income losses will be more than offset by their capital gains when they eventually sell (or refinance) their property.

And in Australia capital gain is not taxed unless you sell your property, and then it is concessionally taxed; again evoking the argument that it favors wealthy landlords.

Of course, negative gearing is more favorable for taxpayers who earn high incomes, and just to make things clear…

Negative gearing is not an investment strategy – it’s just the way a property is financed at a particular point in time.

A strategic approach to choosing an investment property in Melbourne

We believe that 80% of your property’s performance is related to its location (one that outperforms the averages ) and 20% or so is related to buying the right property in that location.

Here are some of the factors to look for when selecting an investment-grade property:

1. Buy a property below its intrinsic value

I’m a big believer in buying property below its intrinsic value – that’s why I avoid new and off-the-plan properties, which generally attract a premium price tag.

I also look for properties with a high Land to Asset ratio – but remember apartments have an attributable land value underneath them

2. Buy a property in a location that outperforms the averages

In other words in an area that has a long, proven history of strong capital growth and one that is likely to continue to outperform the averages, and this is largely because of the demographics in the area and the future economic prospects for the area.

These suburbs tend to be those where a large number of owner-occupiers desire to live in the area, because of the lifestyle choices of the offer.

I look for suburbs where wages (and therefore disposable income) are increasing above average.

This translates to being an area where locals are able to and prepared to pay a premium price to live there, putting a financial floor under your investment property.

3. Buy a property with a twist

An investment must have something unique, or special, or different or scarce – some ‘X-factor’ that makes it stand out from its neighbours – in order to land on my shortlist.

4. Buy a property where you can manufacture capital growth

An ideal investment is one in which you can manufacture capital growth through refurbishment, renovations or redevelopment.

How can I stay on top of current information?

Get property news, updates, and advice by email

There is so much information available about various property investing trends, strategies and market information that it can be overwhelming knowing where (or how) to get started.

Join the 120,000-plus Australians who subscribe to my weekly newsletter, which offers a diverse range of analysis, articles and expert commentary that is essential for successful property investing.

Why not subscribe to the Michael Yardney Podcast where each week you’ll learn something new about property, success, and money in around 20 minutes

You can also sign up for my personal market updates by getting a daily dose of insightful commentary in your inbox each morning.

Join here; this is free and different from our newsletter subscription.

from Property UpdateProperty Update https://propertyupdate.com.au/property-investment-melbourne/

No comments:

Post a Comment