Are you wondering what will happen to the Sydney property market over the balance of 2021 and into next year?

Well… based on how the market has been performing so far it’s likely that will see high double-digit Sydney house price growth in 2021, with most segments exhibiting strong price appreciation other than the inner city and high-rise apartment market.

And despite Sydney’s lockdowns, buyers and sellers are still transacting and Sydney property values:

- rose 0.5% in the last week and auction clearance rates were at boom-time levels over the weekend

- increased 2.0% over the month of July, and

- increased 18.2% over the last year.

And there is still plenty of growth left, as Sydney property values only recently exceeded their previous 2017 peak levels.

What a turnaround from all the pessimistic forecasts all the banks made in the middle of last year.

Of course, the Sydney property market has been one of the strongest and most consistent performers over the last four decades.

However, the rate of growth is slowing and it’s likely that the lockdowns will slow the number of new properties coming onto the market as sellers put their plans on hold till the lockdowns are lifted.

Having said that, moving forward extremely strong demand for houses in Sydney, particularly in the inner and middle-ring suburbs, is likely to continue with demand for apartments is likely to remain softer.

But let me clarify that…while well located, family-friendly apartments in Sydney’s inner suburbs are likely to perform strongly due to increasing demand from owner-occupiers and investors, apartments in high-rise towers are likely to continue to languish.

Real estate in Sydney’s larger regional locations, and in particular in lifestyle locations like Byron Bay, the Central Coast, the Hunter Valley, Wollongong, New South Wales south coast should perform strongly this year with beachside suburbs likely to outperform the wider overall market,

The resurgence of buyer interest in the Sydney property market has meant that auction clearance rates have consistently been in the high 80% range suggesting there are more buyers than there are sellers and this always leads to higher property prices

More investors are getting into the Sydney market now recognising that there are no bargains to be found, but that in 12 months time the properties they purchase today will look like a bargain.

SYDNEY DWELLING PRICE TRENDS – Source: Corelogic July 2021

The strength of the Sydney property market is also highlighted by the consistently strong auction clearance rates exhibited every weekend this year.

Sydney property buyers have been lured back into the market by low-interest rates, government tax cuts and other incentives and the easing of coronavirus restrictions, as well as a strong rebound in consumer confidence, boosted by the federal budget, success in containing the coronavirus and the prospect of further interest rate cuts.

Despite dwelling values holding their own, rents have declined over the year across several regions of Sydney.

The largest rental value declines were across the City and in the South Sydney region, where rental values were down 4.1% over the last quarter.

So…is it the right time to get into the Sydney property market?

Sydney property prices have been climbing at a breathtaking pace in 2021 with more growth expected as strong demand from buyers outpaces the volume of new listings coming onto the market.

This has been good news for homeowners but heartbreaking for house hunters.

At the same time, there have been mixed messages in the media about what’s ahead.

Of course, there’s always the Negative Nellies wanting to tell anyone who is prepared to listen to them the market is about to crash, but other more solid commentators are suggesting our property market is slowing down.

And I agree, I believe the pace of capital gains has peaked, but I’m not suggesting home values are about to dip, far from it.

Rather I believe we’ve moved from a peak rate of growth to a pace of capital gain that will be more sustainable and there’s plenty of life left in the Sydney real estate market with property values likely to keep increasing throughout 2022 and into 2023.

Australia’s economy has experienced the V shape recovery everybody has been was hoping for, but nobody really expected such strong economic growth, employment growth and this financial security will underpin Sydney property market moving forward.

Currently, economic green shoots are appearing with the recession now over, many new jobs being created and over 90% of the jobs lost in the early part of the pandemic now restored.

However, some sectors of the Sydney property market will still languish this year.

The sectors of the Sydney real estate market likely to underperform most moving forward will be:

- Apartments in high-rise towers – in fact, this is these properties are likely to be out of favour for quite some time.

- Off the plan apartments and poor quality investments stock (as opposed to investment-grade) apartments, particularly those close to universities.

- Established homes in the outer suburban new housing estates, where young families are likely to have overextended themselves financially and with many people will be out of work for a while. Currently, many first home buyers are taking advantage of the various incentive packages including HomeBuilder to buy newly constructed homes, leaving established houses in these locations languishing.

Now read: Latest property price forecasts revealed. What’s ahead in the next year or two?

This means that you can’t just buy any property and count on the general Sydney property market to do the heavy lifting over the next few years, so careful property selection will be critical.

To help give you a better understanding of what’s really going on I’m going to explore the nitty-gritty behind Sydney’s market trends, the areas where long-term growth is still likely, and the impact of shifting demographics on the city’s future performance.

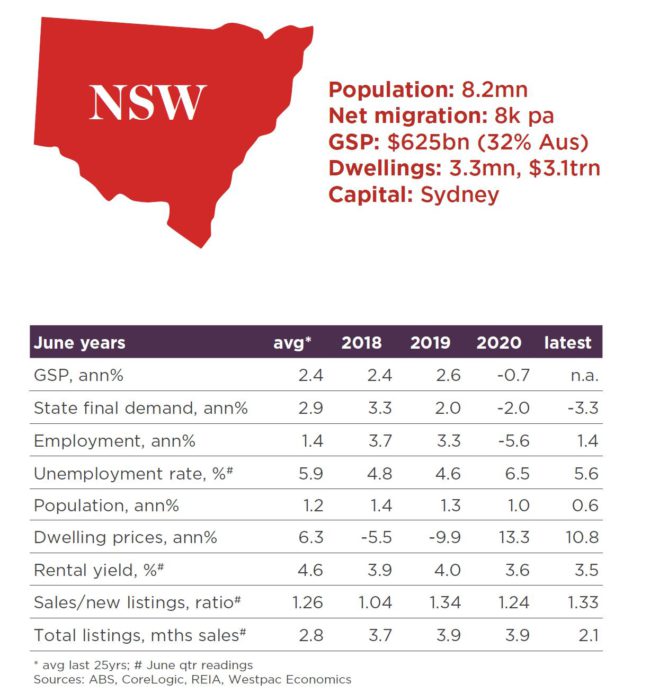

Fast facts about the Sydney Property Market

Sydney House Prices

During the pandemic Sydney housing prices dropped by only 2.2%, demonstrating some resilience in the face of uncertainty.

And now in 2021, we are seeing the Sydney property market soar ahead.

The following chart shows the strong increase in buyer demand as reflected by buyer enquiry on property portal www.realestate.com.au

However, some segments of the Sydney real estate market are really suffering.

Many of those who purchased off the plan a few years ago are now going to have trouble settling with valuations coming in on completion at well below contract price at a time when banks are more reluctant to lend on these properties.

Rental markets are likely to see weaker conditions due to the reduction in migration rates and less student demand, as well as a short-term rental stock transitioning into the permanent rental pool.

Sure there are fewer good properties for sale at the moment, and almost all the good ones are for sale off-market, however, if you’d like to know a bit more about how to find these investment gems give the Metropole Sydney team a call on 1300 METROPOLE or click here and leave your details.

To help you understand what’s ahead for Sydney property I’m going to provide you with a lot of detail but the bottom line is Sydney is a world-class city, which is landlocked with limited room to grow to accommodate all those moving to Sydney looking for somewhere to live.

Changes in Sydney property prices over the past two years

The research reveals that across Sydney, from the trough of early 2019 through to the end of 2020, prices fell in almost every Sydney suburb.

But any house price fall instigated by the coronavirus pandemic was short-lived.

By the end of 2020, the median hit a new record high of $1,211,488, which is just over $13,000 above the previous peak mid-2017.

Over the past two years, property prices have risen across almost all Sydney suburbs, with 94% enjoying property price growth, and a huge 43% of suburbs even seeing double-digit annual growth.

Leading the suburbs seeing the greatest growth was Alexandria with prices soaring by 30.6%.

Meanwhile far behind the pack was Sydney’s suburb of Marsfield which suffered a 10.1% decline in property prices over the same period.

Elsewhere, Blackheath and Palm Beach are the only two suburbs that have shown stable and continued annual growth over the past two years.

Other suburbs have shown very minor annual price falls, largely Central Coast suburbs such as Charmhaven, Hamlyn Terrace and Wadalba, the research reveals.

Sydney houses are outperforming apartments

Sydney is seeing a record high in the difference between house and unit medians at 52.4% as of June.

The difference in median house and unit values has skyrocketed since September 2020, as the housing market saw a recovery trend following eased social distancing restrictions across the city.

Unit values continued to decline through to January 2021, as low levels of investor participation, and subdued rental conditions saw less interest in unit stock.

As the Sydney lockdown reinforces the lasting impacts of COVID-19 on large cities, and monetary policy remains accommodative, Sydney-siders who can afford it may still be willing to fork out a premium for detached housing in the months ahead.

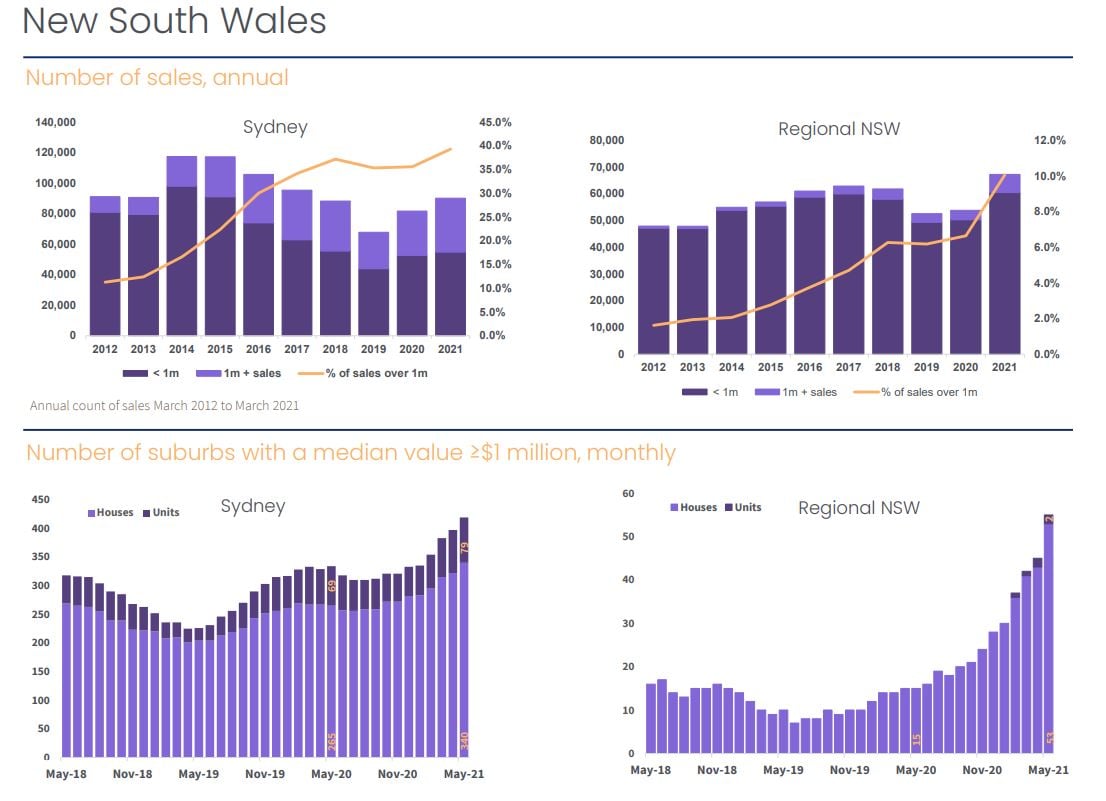

Sydney’s Million Dollar Suburbs

In Sydney, there are 340 house and 79 unit markets with a current median value of $1m or higher at May 2021; 25.4% more than one year earlier.

In Regional NSW, 55 suburbs (53 houses and 2 units) have a median value of ≥$1m; 267% higher than a year.

Over the year to March 2021, around 40% of sales across Sydney sold for at least $1m.

Bellevue Hill houses in Sydney’s eastern suburbs was the most expensive market, with a current median house value of $7,616,288. Byron Bay houses are NSW’s most expensive regional market with a median value of $2,343,546.

In terms of million-dollar newcomers, houses in North Avoca on the Central Coast have deemed Sydney’s strongest newcomer with a median value now at $1,466,568 (up from $991,507 a year ago).

In Regional NSW, houses in Lennox Head in the Richmond-Tweed region top the newcomers with a median value at $1,402,024 (up from $990,798).

NOW READ: Is now a good time to buy property?

Sydney’s Property Market Trends

Historically, the city’s property market has gone from strength to strength.

Over the last 40 years, Sydney’s average capital growth was 7.4% meaning many properties doubled in value every decade.

And now the Sydney housing market is on the move as can be seen by the rise in asking prices:-

Source: SQM Research

The following chart shows how well Sydney dwelling fared through last year’s CoronaVirus pandemic.

Sydney property market short term trends

Sydney and regional NSW have been among the ‘top performing’ housing markets through the start of 2021 in terms of value change.

This follows a peak-to-trough fall in Sydney values of -2.9% between April and September of 2020, and a dip of just -0.1% in May 2020 across regional NSW.

Through the calendar year to April 2021, Sydney dwelling values have risen 9.3%, and regional NSW dwelling values are up 9.0%. Both dwelling markets are at record highs.

Within these regions, growth has largely been driven by the ‘high-end’ of the market.

This is reflected in CoreLogic tiered hedonic indices, which show the top 25% of Sydney values have increased 12.0% compared with a 5.4% rise at the ‘low’ end of the market since the start of 2021 through to April.

It is also reflected regionally, where quarterly increases have been positively correlated with median dwelling values.

With such rapid growth rates across already expensive markets, affordability constraints are likely to become most pressing across Sydney.

When adjusted for the median dwelling value, the rate of increase since the start of the year equates to a rise of over $80,000 in the median Sydney dwelling value, and almost $46,000 for the rest of NSW.

The uplift is also very broad-based. The only SA3 market across NSW recording a loss in the three months to April were Liverpool units, where values declined -0.8% in the period.

The Sydney Apartment Market

On the other hand, apartments in high supply areas present a significant risk to property investors.

This trend already occurred prior to COVID-19 where certain areas in Sydney experienced major unit oversupply.

It seems the property investors are slowly understanding the risks associated with high-rise tower apartments in Sydney including potential construction defects, high vacancy rates, lack of scarcity, lack of capital growth and the challenges of buying in buildings that are predominantly owned by investors, and often many overseas investors.

On the other hand, family-friendly apartments in medium and low rise buildings within Sydney’s inner and middle-ring suburbs are likely to perform well as investments.

With capital growth in houses outperforming apartments so far this year, the pricing gap between houses and apartments is around 50%, so I see increasing demand for these more affordable apartments moving forward.

This will be partly driven by investors returning to the market, so by first home buyers who are being priced out of standalone houses in Sydney.

Prior to Covid-19 metropolitan Sydney required about 41,000 additional dwellings per annum to accommodate its population growth which was underpinned by overseas and interstate migration.

To meet this demand the delivery of new apartment projects was vital, particularly as affordability pressures, demographic trends, changing household types and lifestyle preferences drive the need for more diverse housing options.

And then came CoVid19…

But the new apartment market was already feeling the effects of a downturn in Off-the-Plan (OTP) purchaser demand.

The following graphics from valuers Charter Keck Kramer give a good picture of what’s currently happening in Sydney’s apartment market

The closure of international borders has caused a significant reduction in tenant demand as net overseas migration inflows effectively fell to zero.

So far, the owner-occupier market is holding up, supported by low-interest rates, which have improved affordability for those with jobs.

First, home-buyer demand is being encouraged by stamp duty concessions.

In turn, this is supporting demand for affordable apartments that are suitable for owner-occupiers.

Both upgraders and downsizers remain active where they are transacting within the same market.

Over the last few years, an apartment oversupply and other regulatory and non-regulatory factors have resulted in the collapse of investor demand for Sydney “off the plan” apartments.

The reduced sales volumes have made it more difficult for developers to achieve the pre-sale hurdles required by the banks to finance developments, and a few new projects are on the drawing board.

This means that undersupply of apartments is looming.

But be careful – many of the new Legoland apartment high-rise towers will always remain secondary quality and become the slums of the future – steer clear of these.

The looming undersupply of new projects will lead to lower vacancy rates, rental growth, and eventually, property price growth of these new apartments and in turn, will help fuel increase price growth of well-located establish a purpose in Sydney.

Sydney’s Rental Market

While over the long term rentals have grown in line with property values, more recently rental growth has slumped, in part due to the influx of rental properties that were previously let on short-term leases such as AirBnB and student accommodation.

As a consequence, overall yields have declined as can be seen from the following chart from SQM Research.

Traditionally in Sydney, vacancy rates have been tight; hovering well below the level of 2.5% vacancies, which traditionally represents a balanced rental market.

However currently the overall vacancy rate in Sydney has crept up to close to 4%, but this varies in different locations.

At Metropole Property Management our vacancy rate is less than half this rate, in part because our clients have chosen investment-grade properties, but we’d like to think it also has a bit to do with our proactive property management policies.

Sydney’s Average Capital Growth

In 1993, the average house price in Sydney was $188,000.

However, dwelling price growth in Sydney has been very fragmented.

While some suburbs has just chugged along others are strongly outperforming.

You see…Sydney is comprised of dozens of smaller markets, each of which has its own drivers and supply/demand issues.

Sydney’s more affluent inner eastern, Lower North Shore, and inner western suburbs have well outperformed these averages.

Houses: In September 2019, only 5% of Sydney suburbs had a median house value lower than $500,000, compared with 22% five years ago.

The proportion of suburbs with a median house value of $1 million or higher was 47% in September 2019, up from 34% five years ago.

Units: 29% of Sydney suburbs recorded a median unit value of $500,000 or less in September 2019, down from 49% five years ago.

The proportion of suburbs with a median value of $1 million or higher jumped from 2.9% five years ago to 14.4% in September 2019.

Overall Sydney is a city in gentrification, with the fingerprints of a younger demographic upping the desirability of the city lifestyle.

Houses and apartments in Sydney’s easter, inner west and lower North Shore suburbs offer the best prospects of long term capital growth as this is where there are more Skill Level 1 worker – those who earn higher incomes, often having multiple sources of income.

Fact is, the rich are getting richer and they are able to and prepared to pay more for their homes

In its relatively short history, Sydney experienced near starvation, rebellion attempts, a gold rush, trade booms, the Great Depression, two world wars, and hosted the Summer Olympics.

6 reasons to choose Sydney

1. Sydney’s demographics

Sydney is Australia’s most populous city and is also the most populous city in Oceania.

ABS statistics showed the population of Greater Sydney, which includes the Blue Mountains and Central Coast, reached 5,005,400 at the end of June 2016 after adding a million people in just 16 years.

That was an increase of almost 83,000 in the previous year, and the city’s fifth-largest annual population increase in absolute terms since 1901 with Sydney absorbing 78 per cent of NSW’s total population increase in 2015-16.

Sydney’s population grew by 1.7 per cent last financial year while the rest of NSW grew by 0.8 per cent giving the State an overall annual population growth of 1.6%.

Of course with our borders currently closed, immigration is going to be virtually non-existent in 2020 and probably in 2021, but once we reopen our borders, it is likely that Australia’s appeal to overseas immigrants is only going to be stronger and Sydney has always been a preferred destination.

Firstly it is an iconic world-class city, but also Sydney offers strong job opportunities.

It took the harbour city almost 30 years, from 1971 to 2000, to grow from 3 million to 4 million people but only half that time to pile on its next million.

This makes Sydney Australia’s only global city and a key city within the Asia-Pacific region.

Today Greater Sydney’s population is estimated to be 5.57 million people.

Interestingly around half of its population were born overseas, making Sydney the world’s most multicultural and ethnically diverse city, with over 250 spoken languages.

In fact, more than 70 percent of the state’s population growth comes from overseas migration.

In fact, New South Wales represents around 32% of Australia’s total population.

The median age of Sydney residents was 35 years, and households comprised an average of 2.7 members.

But drilling down deeper, within the CBD, the majority of dwellings are occupied by two adults without children, with the average age of residents reducing to 32.

With distinct areas of trendy, modern districts, Sydney has undergone incredible change since its early days as a settlement city.

Formerly gritty housing zones, originally built for labourers, are being revived and modernised, increasing their allure for those after a modern city lifestyle.

The Rocks is an excellent example of an area going through gentrification, with prime waterfront government housing transitioning to private dwellings.

These types of renewal projects are sure to bring new life – and growth.

Similarly, gentrification is changing the face of Sydney’s Inner West.

Looking back European settlement in Sydney began in 1788, and in 1800 Sydney had around 3,000 inhabitants.

It took time for its population to grow – in 1851 its population was only 39,000, compared with 77,000 in Melbourne.

Sydney overtook Melbourne as Australia’s most populous city in the early twentieth century and reached the million inhabitants milestone around 1925.

The opening of the Sydney Harbour Bridge helped pave the way for further urban development north of Sydney Harbour.

Post-war immigration and a baby boom helped the population reach two million by 1962.

Read more: There’s a 6 month moratorium on evictions – what should I do?

2. Sydney’s layout

One of the largest cities in the world, the metropolitan area has about 650 suburbs that sprawl about 70 km to the west, 40 km to the north, and 60 to the south.

Greater Sydney extends from the coast at the east back to the foothills of the Blue Mountains, with a relatively compact CBD located around i ts famous harbour.

ts famous harbour.

South of the harbour is the desirable inner suburbs and densely populated beaches, including Bondi Beach.

North Sydney, connected to the CBD by the Sydney Harbour Bridge and tunnel, is home to a thriving business district and some of Sydney’s most affluent suburbs, including the Upper and Lower North Shores.

Plans are underway to build a motorway link to open up access between the pricey eastern suburbs and the western district, which makes up the majority of metropolitan Sydney.

Changes in the positioning of major companies to outlying ‘mini-cities’ like Parramatta may see a shift in buyers heading to these cheaper housing areas and employment opportunities.

Developers have anticipated this, but as is often the case, they’ve gone overboard and there is now a significant oversupply of new and off the plan apartments in Parramatta

3. Sydney’s infrastructure

With leading universities, premier shopping districts, iconic landmarks and lively urban flavour, it’s clear why Sydney is considered one of Australia’s most desirable cities to live in.

Built around the world’s largest natural harbour, Sydney offers three efficient modes of transport in, around, and out of the city: road, rail and ferry.

Anyone who lives in Sydney knows all too well that driving more than an hour each way to and from work is the norm.

But this is likely to change with light rail playing an important part in the future of transport in Sydney providing quick transportation around the CBD.

Further construction is underway to connect outlying suburbs to existing rail lines, with plans to extend the light rail system to the Eastern suburbs.

Sydney Airport, the busiest in Australia, handles over 35 million passengers a year, is located only 8km from the city and connects directly to 100 destinations around the world.

Proximity to major highways and rail systems can either boost capital growth or hinder it, and all aspects must be taken into account when considering any property purchase.

4. Sydney’s economy

Largely a manufacturing city in its heyday, Sydney has evolved into a metropolis of high-end, knowledge-based jobs in the business and financial services sector, earning itself the title of Asia-Pacific’s economic hub.

Tourism and hospitality are its next leading employment industry.

Of course, job creation and rising confidence also lead to population growth, which further fuels the property market.

Of course, job creation and rising confidence also lead to population growth, which further fuels the property market.

Inner-city employees earn an average individual wage of $888 per week, compared with $619 for those working in the Greater Sydney area.

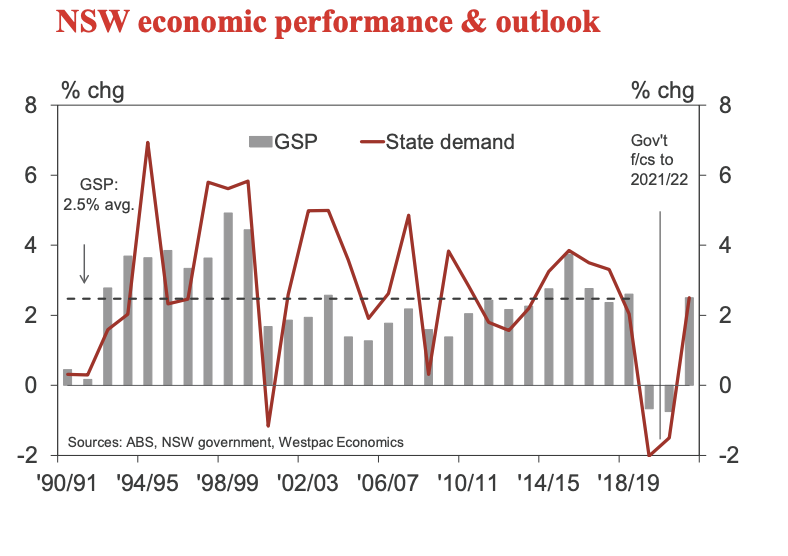

However due to COVID-19 output in the New South Wales economy contracted in the 2019 20 financial year, declining by 0.7%. That was the first contraction in decades, with the state reportedly avoiding the early 1990s recession.

While some headwinds still remain, the state’s economic performance has increased as can be seen in the following chart.

Population growth in New South Wales has come to a standstill as a result of international border closures.

The foreign student sector and international tourism, which are key sectors in New South Wales have been hard-hit.

With the recent boom in property prices, many buyers are finding themselves locked out of the property market, which may signal an increase in long-term rentals.

More than 55% of dwellings in the city are rentals, where occupants – primarily single professionals and couples without children – are willing to pay a premium to live in the heart of the city near to their work and all the action.

5. Sydney’s growth

Since the 1970s, Sydney and Melbourne have been locked in a head-to-head race for the highest population growth, with both cities adding 1.7 million new residents over 40 years.

Overall, Australia’s growth rate is amongst the highest in the world, with the Australian Bureau of Statistics estimating that 66% of residents live in our capital cities.

With an estimated population of 8,046,070 persons, the population has increased by 123,813 persons or 1.6% over the past year, which is in line with the national rate of growth.

The 123,813 person increase was the greatest since September 2017 and was made up of a natural increase of 53,711 persons, net overseas migration of 91,999 persons, and a loss of 21,897 persons due to net interstate migration.

The natural increase of 53,711 persons was the greatest on record while the 91,999 persons increase due to net overseas migration was the largest increase in 12 months.

The loss of 21,897 residents due to net interstate migration was slightly lower than the previous quarter but up from 19,299 persons a year earlier.

The NSW government is planning extensive additions to its transport infrastructure to support future growth, with new motorway extensions providing an uninterrupted connection from Sydney’s south to the north and major road expansions on the plans to ease city congestions.

Outlying suburbs such as Parramatta and Liverpool are developing into regional cities, and with improved infrastructure in the works, there is the likelihood we will see significant population growth in these areas further from the CBD.

6. Sydney’s culture

Sydney is truly a global city, welcoming a broad range of ethnicities from all over the globe.

Sydney is truly a global city, welcoming a broad range of ethnicities from all over the globe.

In fact, nearly half of the people who call Sydney home were born overseas, creating the most dynamic and culturally diverse metropolis in the world.

Each year Sydney celebrates its famous multiculturalism with the month-long Living in Harmony festival, which brings its residents together to celebrate and promote cross-cultural understanding.

Housing in the inner city is attractive to those who love the city life, with tenants looking for properties that include the following features:

- Location – above all.

- Security.

- Storage space.

- Amenity including balconies.

- With street noise generally a given in city living, smart tenants are looking for added features – like double-glazed windows – to minimise the city sounds.

- Cooling – especially over summer

- Technology

- Healthy mobile phone signals

- Great WiFi connectivity.

- Multiple power points

The most prominent Sydney areas

1. Upper North Shore

Statistically one of Sydney’s safest areas, with beautiful parks, large land sizes and an easy train commute to the city, the prestigious suburbs of the Upper North Shore have seen a stable increase in pricing over the years.

Incorporating Pymble, Turramurra, Wahroonga, Warrawee, Killara, Lindfield and Roseville, the Upper North sees a ‘generational’ cycle, with wealthy families moving in to gain access to esteemed private education and excellent public schools. The family moves on once children are out of school, thus allowing the next generations of young families to begin the cycle again.

This trend has maintained steady supply and demand, making the Upper North Shore area one to consider for stable growth, particularly as it sits in the middle ring of the CBD.

2. Lower North Shore

Located just over the Sydney Harbour Bridge and featuring a boon of waterfront properties overlooking the Sydney Harbour, Middle Harbour and Lane Cove River, the Lower North Shore is considered one of Sydney’s most desirable places to live.

While the Upper North Shore attracts families due to the larger land lots and houses, the Lower North has a higher population density with a greater proportion of apartments and units, making it appealing to young professionals who work in the CBD.

The Lower North Shore consists of the suburbs of Mosman, Castle Cove, Cremorne, Neutral Bay, Kirribilli, Milsons Point, McMahons Point, Wollstonecraft, Greenwich, Longueville, Riverview, Linley Point, Lane Cove West, and Chatswood.

3. City and East

Recently positioning itself at 6th on Sydney’s best-performing auction rankings, with a median dwelling value of just over $1 million, the suburbs in East Sydney and the city centre are home to Australia’s highest property earners, including Edgecliff, Rushcutters Bay, Darling Point and Point Piper.

Densely populated and with land at a premium, most properties are small terraced housing or units/apartments, with a higher proportion of renters in the Eastern suburbs than elsewhere in the city.

Suburbs in the city’s inner ring such as Darlington, Chippendale and Darlinghurst have shown interesting changes in their demographic make-up recently, revealing a very high proportion of young, single residents who have populated the area for the social scene and city lifestyle.

Eastern Sydney is also highly desirable, as the home of the famous beachside suburbs of Bondi, Tamarama and Coogee.

While there is no train access to these coastal neighbourhoods, there are strong bus networks.

Read more (and watch the video): How will COVID-19 impact on your banking and loans?

4. Inner West

There is no end of demand from home buyers and investors who want to live in Sydney’s gentrifying inner Western suburbs.

In suburbs like Annandale, Croydon Park, Dulwich Hill, Enmore, Lewisham, Lilyfield, Marrkickville, and Newtown.

The suburbs within the region are characterised by medium to high-density housing and while they’ve been subject to gentrification, this process will continue for decades as the older workers and migrants make room for upwardly mobile high-income earners.

Best advice for new Sydney investors

1. Look for Sydney’s best properties in the inner and middle-ring suburbs

The importance of neighbourhood.

Being locked in a Coronavirus Cocoon has shown us the importance of our neighbourhood.

Social distancing during the COVID-19 pandemic made us experience many painful losses.

Among them were the so-called “third places” – the restaurants, bars, gyms, houses of worship, barbershops, and other places we frequent that are neither work nor home.

If social distancing through coronavirus taught us anything, it taught us the importance of neighbourhood.

If you can walk out of your home and you’re in walking distance of, or a short trip to a great shopping strip, your favourite coffee shop, amenities, the beach, a great park, you will appreciate the benefit of the third-place – the importance of your neighbourhood.

While some people will move to regional Australia to have more space, the majority of Australians will want to continue living in our capital cities, but in lifestyle, destination locations which have great third places.

And it’s likely that in our new “Covid Normal” world, people will love the thought that most of the things needed for a good life could be within a 20-minute public transport trip, bike ride or walk from home.

Things such as shopping, business services, education, community facilities, recreational and sporting resources, and some jobs.

In planning circles, it’s a concept known as the 20-minute neighbourhood, and many inner suburbs of Australia’s capital cities and parts of their middle suburbs already meet a 20-minute neighbourhood test.

However, very few of the outer suburbs would do so and are unlikely to easily do so because it’s about more than walkability.

Tenants, too, will have similar wish lists, and savvy property investors will strive to cater to this.

We know that location will do 80% of the heavy lifting in your property’s performance and that some locations outperform others by 50% to 100% over a decade with regard to capital growth and it’s likely to be those liveable locations that will be highly desired.

A review by the Australian Housing and Urban Research Institute has found that suburbs located within 5 to 15 km of the CBD consistently see a level of capital growth that outperforms suburbs.

These inner and middle-ring suburbs continue to see long-term increases in value because:

- They are close to employment nodes.

- They offer a desirable city lifestyle.

- There is no further land available for release, keeping supply in check and demand high.

Gentrification has changed the look and stigma of ‘ugly duckling’ areas into increasingly attractive places to live.

Sometimes, changes to an area, such as improved road and rail access or a change in demographic, can spur on the gentrification process in a neighbourhood, transforming it into an area that enjoys a steady increase in desirability.

While a rising tide lifts all ships and house prices have risen throughout Sydney, in general, the outer and western suburbs have not had the same level of capital growth as Sydney’s inner and middle-ring suburbs.

2. Steer clear of the new high rise Sydney apartment towers

We’ve seen an oversupply of newly built apartments happen in Sydney.

The problem is not all apartments are the same.

Some will make great investments increased substantially in value over the long term, but many of the high-rise towers built in the last fifteen years will continue to underperform with poor, if any, capital growth in the foreseeable future.

Of course, these Lego Land apartment blocks never made good investments.

They offered little scarcity and had no owner-occupier appeal having been built with investors in mind, and often overseas investors who didn’t fully understand the needs of the local market.

Worse still… because of the high developer margins and marketing costs, many investors paid too much to start with and have since found that on completion their properties were worth considerably less than their contract price.

The sad reality for these investors is that today, in light of the many media reports of structural problems in some of these high rise towers, there is a crisis of confidence with apartment owners concerned about what unknown issues and liabilities may lie ahead for them and potential purchasers are holding back not wanting to buy themselves futures problems.

This sector of the property market has lost the trust of the buying public and confidence will take quite some time to restore as various stakeholders including state and local governments as well as the construction industry including building surveyors and certifiers scramble to shore up the building sector.

You see…there tend to be three major types of building issues faces by apartment owners:

- Structural defects – These are the ones that grab the headlines but, in reality, major structural issues only relate to a small number of buildings.

- Fire issues – These often relate to inferior cladding used during construction. Cladding audits are ongoing, but so far 629 affected buildings have been identified in Victoria alone.

And now it’s been revealed that there’s a list of nearly 450 buildings across the state of NSW with potentially flammable cladding that the State Government is keeping it secret due to security concerns. The list, developed by the cladding task force and provided to State Parliament, was given public interest immunity, which restricts public access.NSW Police Counter Terrorism Command advised the addresses should not be published due to safety concerns. The unit said the information risked prejudicing the interests of building and apartment owners. - Water issues – These are very common and occur to some extent in almost every new building – things like leaking balconies, showers and roofs. While these are a nuisance and can be expensive, they can usually be rectified.

Fact is, the buildings with major problems requiring mass evacuation are the outliers, but for those involved their losses will be significant as they will have hefty repair bills and have no real market for the sale of their apartment in buildings that could well become the slums of the future.

Two tiers of apartments in the future

These issues will lead to a flight to quality, meaning well constructed, medium density apartments and townhouses will continue to be strongly sought after and will keep increasing in value, making them great investments.

At the same time, tighter future construction standards will lead to increased building costs and therefore higher eventual asking prices for the next round of apartments to be built, underpinning the future value of soundly built established apartments.

Similarly, the solidly build older established two and three-story walk-up apartments built in the ’60s and 70’s that used to be called “flats” have stood the test of time and will continue to make good investments.

On the other hand, owners of poorly constructed high-rise apartments in the many “me too” buildings built in the last decade or two will find the value of their properties will languish.

While some of these owners may be keen to cut their losses, they will find their properties difficult to sell and many will not be prepared to or financially able to crystalize their losses, just like many of the unfortunate investors who bought in mining towns during the mining boom are still finding they are stuck with underperforming properties which are worth considerably less today than they paid for them many years ago.

3. Consider making the most of investing in Sydney properties

Sydney properties have exhibited strong capital growth over the long term and are likely to do so in the future.

But with their current low yields comes the challenge of negative gearing.

While this understandably concerns many first-time investors, I see it as a cost of doing business.

Here’s a quick explanation of negative gearing:

A property is negatively geared when the costs of owning it – interest on the loan, bank charges, maintenance, repairs and depreciation – exceed the income it produces.

Since the costs of producing an income are generally deductible against the taxpayer’s other income, property investors can effectively offset some of the interest expense against their wages.

This has made some argue that other, less fortunate, taxpayers help these property investors meet their costs.

Why would you buy a property that makes a loss?

Generally, it’s because property investors hope that their income losses will be more than offset by their capital gains when they eventually refinance or sell their property.

And in Australia capital gain is not taxed unless you sell your property, and then it is concessionally taxed; again evoking the argument that it favours wealthy landlords.

The truth is that negative gearing is more favourable for taxpayers who earn high incomes.

Imagine an investor had excess interest expenses of $10,000.

If they were on a marginal tax rate of 15 cents in the dollar they could use their loss and reduce their tax by $1,500.

But to a taxpayer in a higher tax bracket, one who pays 30 cents in the dollar tax, they could reduce their tax by $3,000.

So the benefits of negative gearing are greater the more you earn and the higher your tax rate.

While negative gearing has its critics, in my mind property investment is about capital growth of your assets rather than cash flow.

Cash flow will keep you in the game, but capital growth will get you out of the rat race.

In the long term, well-located properties in the inner and middle-ring suburbs of Sydney will continue to be highly sought after and keep increasing in value-creating wealth for their owners, be they homeowners or real estate, investors.

And in the current low-interest rate environment, and the Sydney housing market at the lowest they ever have been.

A strategic approach to choosing a strong investment property in Sydney

If I accept that in the short term I’ll be negatively geared, then I must ensure I buy an investment grade property that will outperform the market averages with regards to capital growth, and to do this I use my 6 Stranded Strategic Approach.

- I would only buy a property that would appeal to a wide range of owner-occupiers.

Not that I plan to sell my property, but because owner-occupiers will buy similar properties pushing up local real estate values.

This will be particularly important in the next few years as the percentage of investors in the market is likely to diminish.

- I would buy a property below its intrinsic value – that’s why I avoid new and off the plan properties which come at a premium price.

- In an area that has a long history of strong capital growth and that will continue to outperform the averages because of the demographics in the area.

This will be an area where more owner-occupiers will want to live because of lifestyle choices and one where the locals will be prepared to and can afford to, pay a premium price to live because they have higher disposable incomes.

In general, these are the more affluent inner and middle-ring suburbs of our big capital cities - I would buy a property with a high land to asset ratio.

- I would look for a property with a twist – something unique, or special, different or scarce about the property, and finally

- I would buy a property where I can manufacture capital growth through refurbishment, renovations or redevelopment rather than waiting for the market to deliver me capital growth.

How can I stay on top of current information?

Get news, updates and advice by email

The easiest way to stay current with all the changes happening in our real estate markets is to receive the latest news in your inbox.

Currently, over 115,000 Australians subscribe to my daily newsletter, which delivers in-depth analysis, articles, and commentary by a team of expert writers with a varied knowledge base in real estate, investment, and finances – all essentials for successful property investing.

But if you have a voracious appetite, I recommend you subscribe to my daily market commentaries by clicking here.

Every day at least 8 commentaries, blogs and articles are published featuring leading experts in the field of property investment, property investment finance, tax, economics and personal finance.

It’s a great way to keep up to date – subscribe now by clicking here.

And why not subscribe to the Michael Yardney Podcast where you’ll learn something new about property, success, and money in around 20 minutes each week

from Property UpdateProperty Update https://propertyupdate.com.au/property-investment-sydney/

No comments:

Post a Comment