How will the Delta Coronavirus impact our housing markets?

That was the subject of a recent Westpac Housing Pulse report.

Given the lags involved, both for impacts and data collection, Westpac believes it will be several months yet before we get a clear view of how the latest COVID disruptions have impacted our property markets.

However, Westpac believes we can glean some early guidance from the timeliest data available covering auction markets, listings, and prices.

In their report weekly auction market information was available up to Aug 22 and provides good coverage of the Sydney and Melbourne markets hit hardest by the latest outbreak – the latter also offering a useful point of comparison with last year’s ‘second wave’ lock-down.

Auction volumes are already showing a clear impact.

This Westpac chart shows these against total monthly turnover (including non-auction transactions) scaled to a consistent base so that auctions can be viewed as a guide to broad activity.

Turnover, auctions: Sydney, Melbourne

The latest weekly data suggests turnover in the Sydney market is down about 30% on its May level, a hefty fall but milder than the 50% slump seen during last year’s national lock-down and the further fall seen during Melbourne’s ‘second wave’ outbreak.

Remarkably, turnover is still above the avg levels seen in 2019.

Well over 500 properties are still going to auction each week in Sydney.

About half are selling prior with about 150-200 proceeding to auction online, the remainder being withdrawn.

Auctions: withdrawal adjusted clearance rates

Westpac believes that adjusting for auction withdrawals provides a useful clearance-based measure of market conditions.

These also show a marked cooling in Sydney, but again quite resilient reads overall, close to Sydney’s long run avg.

On this basis, the Melbourne market looks to have seen a more material weakening during its recent restrictions.

New listings: Sydney, Melbourne

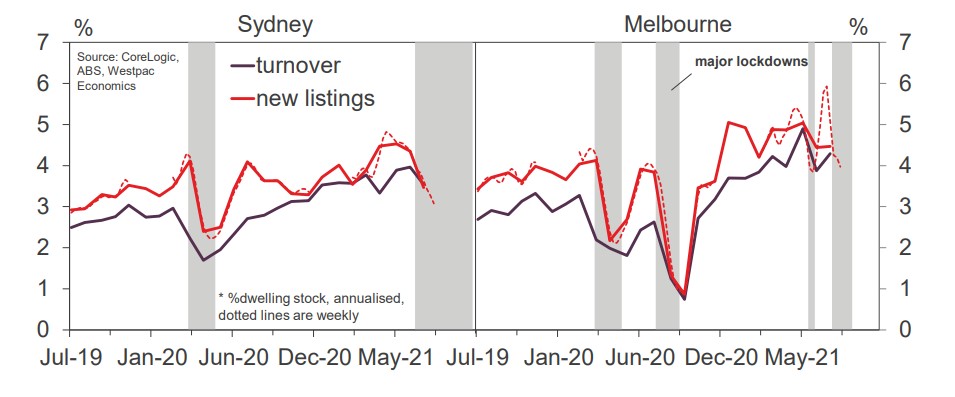

Data on listings is also reasonably timely with figures available weekly (albeit as a 28-day rolling average) according to the Westpac report.

For Sydney, these broadly corroborate the picture from auction volumes, with new listings down 32% from their May level but still comfortably above last year’s lows.

Listings have shown a milder decline in Melbourne although the on-again-off-again pattern of lockdowns in recent months has generated big swings.

Dwelling prices: Sydney, Melbourne

Around prices, CoreLogic’s daily measure points to some moderation in prices gains in Sydney, albeit from a very strong starting point over the first half of the year and still running at a monthly pace in the 1.4-1.8% range – still a strong double-digit annual pace.

Evidence of a slowing is even more marginal for Melbourne with daily measures still showing gains running at a 1-1.4% monthly pace.

There is clearly considerably more inertia to prices according to Westpac.

Whereas market activity shows big swings during lockdown disruptions, prices look to be less affected.

Melbourne’s ‘second wave’ lock-down last year saw a slightly more prolonged period of price weakness compared to other Australian cities but did not prevent the city from entering a price recovery once restrictions eased.

Disruptions since then have had even less effect.

Much of this likely comes back to sentiment according to Westpac.

If disruptions are seen as temporary and medium-term prospects are still viewed as positive – as they are now – then prices are much less likely to be affected.

If disruptions are seen as temporary and medium-term prospects are still viewed as positive – as they are now – then prices are much less likely to be affected.

This notion will be tested as the ‘delta’ lock-down drags on, especially as household finances become more stressed.

However, with the availability of vaccines providing fundamental support to medium-term expectations, Westpac expects prices to remain well-anchored.

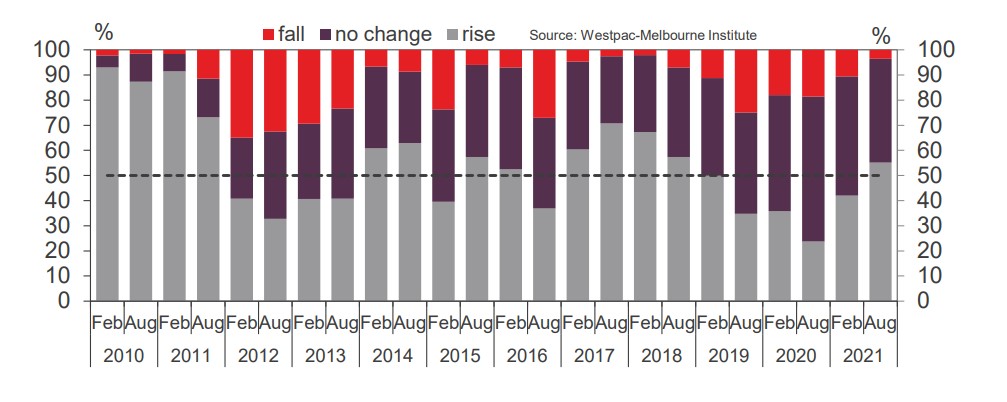

Consumer expectations for mortgage rates

Westpac Consumer interest rate expectation

Westpac says that consumers appear to be somewhat confused about the outlook for interest rates.

Every six months the bank asks respondents about their expectations for mortgage rates over the next year.

The August results show just over a quarter of consumers just ‘don’t know’ – easily the highest reading for this category and nearly double the 13.3% read back in Feb.

Amongst those with a view, 55% expect mortgage interest rates to rise over the next year, 41% expect no change, and 4% expect rates to decline.

Westpac’s general impression is that most consumers understand rates are at the bottom of the cycle but that there is a high degree of uncertainty about when they might start to move higher.

from Property UpdateProperty Update https://propertyupdate.com.au/the-early-indicators-of-deltas-impact-on-housing-according-to-westpac/

No comments:

Post a Comment