Are you wondering what will happen to the Brisbane property market moving forward?

Well… based on how the market has been performing so far it’s likely that will see high double-digit Brisbane house price growth in 2021, with most segments exhibiting strong price appreciation other than the inner city and high-rise apartment market.

And despite Covid related challenges buyers and sellers are still transacting and Brisbane property values:

- rose 0.5% in the last week and auction clearance rates were at boom time levels over the weekend

- increased 2.0% over the month of July, and

- increased 15.9% over the last year.

And there is still plenty of growth left, as Brisbane property is still very affordable compared to the other east coast capital cities.

What a turnaround from all the pessimistic forecasts all the banks made in the middle of last year.

Currently, the Sunshine State capital is shining but it’s not too late to be early in this cycle – there is plenty of growth ahead – for the right properties.

Outstanding demand for lifestyle areas as well as extremely strong demand for detached houses in Brisbane, particularly in the inner and middle ring suburbs has delivered 5.3% overall growth in the last 3 month, with Brisbane’s more expensive properties outperforming.

The resurgence of buyer interest in the Brisbane property market has meant that auction clearance rates have consistently been in the 70% range, which is unusual for Brisbane considering this city is not known for its auction culture like its southern cousins, but this is just another suggestion that there are more buyers than there are sellers and this always leads to higher property prices.

At Metropole’s Brisbane office we are noticing more investors are getting into the Brisbane market recognising that while there are no bargains to be found, in 12 months time the properties they purchased today will look like a bargain.

Not that long ago Westpac Bank updated its forecasts and tipped Brisbane prices to surge 20 percent between 2022 and 2023, meaning Brisbane is likely to be one of the best performing property markets over the next few years.

Of course, while some locations in Brisbane have strong growth potential, and the right properties in these locations will make great long-term investments, certain submarkets should be avoided like the plague.

Increased demand for Brisbane houses has been underpinned by increasing consumer sentiment, historically low-interest rates, and internal migration considering the relative affordability of houses in Queensland compared to Sydney and Melbourne.

Similarly, popular areas of the Gold Coast and Sunshine Coast have enjoyed strong demand considering the increased flexibility of being able to work from home and commuting to the big smoke less frequently.

At the same time, property investor activity has been strong, particularly for houses, not only coming from locals but from interstate investors who see strong upside in Brisbane property prices as well as favourable rental returns.

But be careful…there is not one Queensland property market, nor one south-east Queensland property market, and different locations are performing differently and are likely to continue to do so.

Houses remain a firm favourite of prospective home hunters, with demand rising post-lockdown and it remains significantly elevated compared to last year.

However, apartment demand has been sliding and, in general, apartments in Queensland are a higher risk investment than houses, particularly due to a high supply of apartments that are unsuitable for families or owner-occupiers.

To help you make an informed investment decision, I’m going to examine what’s going on in the Sunshine State in detail in this article.

But be warned…it’s a little longer than normal, so if you’re looking for a particular element of the Brisbane property market, use these links to skip down the page.

There are multiple markets in the diverse sprawling city of Brisbane; divided by geographic location, price point, and property type.

And just to make things clear…I’m talking about the property market in Brisbane – not the Queensland property market.

That’s a very different animal!

If you’ve been following my property investment strategy, you’ll know I only invest in capital cities and that’s why I avoid the Sunshine Coast, the Gold Coast, and Queensland’s regional markets which have very different (and fewer) growth drivers than Brisbane and are therefore more volatile.

And not all Brisbane properties will perform well.

In Queensland, houses are the preferred style of accommodation over units, and investors who buy rental apartments in high supply areas are taking high risk with both equity and cash flow risks materially increasing over buying the right house.

So…is it the right time to get into the Brisbane property market?

Anyone who buys an A-grade home or investment-grade property in Brisbane now will look back in a couple of years’ time and recognise they bought a bargain, as this new property cycle still has some years to run.

There is a perfect storm of positive growth drivers that will have Brisbane house prices performing strongly in 2021 and 2022 and the recent announcement of Brisbane winning the 2032 Olympic games will underpin strong infrastructure growth, economic growth and population growth over the next decade.

This suggests that South East Queensland will continue to be a preferred destination for many Aussies from interstate due to lifestyle, health, and affordability reasons.

But, as I have explained, there are multiple housing markets within Brisbane, based on price point, geography, and type of property and as always, you can’t just buy any property and count on the general Brisbane property market to do the heavy lifting over the next few years, so careful property selection will be critical.

Now read: Latest property price forecasts revealed. What’s ahead in the next year or two?

Fast facts about the Brisbane property market

1. Brisbane House Prices

CoreLogic reports that Brisbane’s dwelling values are up 10.6% over the last year and are now at new highs, but as always the housing market in Brisbane is very fragmented.

Digging deeper into the stats some properties have far outperformed others and freestanding Brisbane houses with 5-7 km of the CBD or in good school catchment zones have grown in value strongly.

It’s really a tale of 2 cities- while some properties overperform, while others underperform.

The worst performing segments of the market are:

- apartments in high-rise towers and new and off-the-plan apartment sales.

- properties in the blue-collar areas and new housing estates where young families are likely to have overextended themselves financially and with many people will be out of work for a while.

Over the last few years there was a real acceleration in interstate migration towards Queensland and generally speaking, Brisbane is the first port of call in Queensland.

Population growth that saw the Sunshine State gain a net 7237 people from interstate in the September quarter of 2020– while NSW shed 4110 and Victoria lost 3749 – has compounded a recovery that was already underway after the apartment-building boom triggered a private rental market vacancy rate that REIQ figures show peaked at 4.1 per cent in December 2016.

Realestate.com reported a significant increase in property searches in Queensland earlier this year but this has slowed down a little now.

2. Brisbane’s Property Market Trends

Now don’t get me wrong. Not all Brisbane property values will rebound strongly moving forward.

Properties located in the inner ring suburbs, particularly in gentrifying locations, will outperform cheaper properties in the outer suburbs.

Properties located in the inner ring suburbs, particularly in gentrifying locations, will outperform cheaper properties in the outer suburbs.

The reason being, Covid19 has adversely affected low-income earners to a greater extent than middle and high-income earners who are likely to recover their income back to pre-pandemic levels more quickly, while many have not been hit at all.

High-rise apartment towers in and near the Brisbane CBD which were already suffering from the adverse publicity of structural problems prior to Covid19, will now become the slums of the future as they are shunned by home-owners and investors.

And like after every downturn, there will be a flight to quality properties and an increased emphasis on liveability.

As their priorities change, some buyers will be willing to pay a little more for properties with “pandemic appeal” and a little more space and security, but it won’t be just the property itself that will need to meet these newly evolved needs – a “liveable” location will play a big part too.

To many, liveability will mean a combination of:

- Proximity – to things like parks, shops, amenities, and good schools

- Mobility – access to good public transport (even though this may be less important moving forward) or a good road system

- Access to jobs

The bottom line is that for those with a secure job and who have their finances under control, now could be the best opportunity in a decade to set themselves up for the opportunities that will present themselves as our property market head into a perfect storm with a confluence of growth drives in 2021-22.

Changes in Brisbane property prices over the past two years

During the height of Covid-19, Brisbane’s housing market defied the odds, shone through, and even came out relatively unscathed.

Sure the markets are moving forward strongly now, but not all properties are going to increase in value at the same rate – and some sectors of the market will continue to languish.

Currently, there are more buyers for A grade homes and investment-grade properties than there are properties for sale in Brisbane meaning we are in a strong seller’s market where asking prices keep rising:-

Source: SQM Research

Brisbane has seen a distinct outperformance of house values relative to units.

Since the onset of COVID-19, house values across Brisbane have increased 15.5%, compared to just 5.0% across units.

Since the onset of COVID-19, house values across Brisbane have increased 15.5%, compared to just 5.0% across units.

But the gap between house and unit values has risen fairly consistently since mid-2015, and 5 years annualised growth rates sit at 4.3% for houses, compared with a -0.1% decline in units.

Unit construction across Brisbane rose substantially through to late 2016, creating an overhang of stock when investor activity began to decline off the back of changes to macroprudential policy in late 2017.

The house price premium across Brisbane shows little sign of slowing down, as monthly growth rates over June continued to show a bigger uplift in houses (2.2%) compared to units (0.7%).

This could also reflect interstate demand for relatively affordable Brisbane houses, as the normalisation of remote work through COVID has promoted more movement from Melbourne to Queensland over 2020.

Source: Corelogic 29th July 2021

Brisbane housing market’s drivers

There are multiple factors that have contributed to an increase in demand across the state alongside low mortgage rates.

Interstate migration to Queensland has remained a tailwind for housing demand.

Migration data suggests that the Sunshine state has been particularly popular since the onset of COVID-19.

The latest (provisional) data for the December 2020 quarter suggests that net interstate migration to Queensland reached 9,763, the highest volume since December 2003.

More detailed data on recent quarters of interstate migration suggests that 27.5% of the quarterly increase in arrivals came from Melbourne.

Together, Melbourne and Sydney’s departures accounted for 42.5% of interstate arrivals to Queensland in the December quarter.

Affordability is another key driver

Another appeal of housing markets across Brisbane and the rest of Queensland is that values remain relatively low, particularly relative to the recent acceleration of values across the other east coast cities of Canberra, Melbourne, and Sydney.

With typical mortgage rates at record lows, CoreLogic estimates around 41 % of properties across Greater Brisbane would be cheaper to service a mortgage than rent.

This compares to 30.3% of properties across the ACT, and just 3.3% of properties across Melbourne, and 2.1% of properties across Sydney.

The high share of properties that may have cheaper mortgage serviceability than rent is also a function of fairly robust growth in rents across Brisbane, where house rents increased 6.4% in the 12 months to April, and unit rents increased 2.1%.

Strong economic conditions across the state have also helped to fuel demand in a range of housing markets.

Across Wide Bay, a recent uplift in domestic tourism, coupled with a desirable lifestyle offering for owner-occupiers, has led to the highest year-on-year uplift in sales volumes of the regional Queensland markets.

As tourism operators try to attract staff to the region, the vacancy has reportedly become so low that employers are trying to source rental accommodation for employee share house living arrangements.

The outlook for Queensland housing markets remains strong throughout the rest of 2021.

There are pockets of relatively weak performance associated with resource markets, but these may eventually pick up amid the general rise in commodity values.

Brisbane’s Rental Yields

Record-low rates, government support, and stimulus measures, and the pandemic-driven rush north by Melburnians and Sydneysiders have turbo-charged the recovery underway in Brisbane’s rental market, pushing the vacancy rate down to a near nine-year low.

Greater Brisbane’s rental vacancy rate fell to 1.5 per cent last month from 1.7 per cent in January and was well down from 2.2 per cent a year earlier, according to SQM Research, driving the overall rate in the Queensland capital to a level it last touched in July 2012.

Source: SQM Research

Traditionally in Brisbane, vacancy rates have been tight; hovering well below the level of 2.5% vacancies, which traditionally represents a balanced rental market.

But as you can see from the graph below, vacancies in Brisbane rose over the last few years in response to the significant oversupply of apartments, but vacancy rates have since fallen as this oversupply was slowly soaked up.

However, with the recent lockdown, social distancing, travel restrictions, the shutdown of immigration and the return of many properties that were previously let as Airbnb to the rental market will lead to higher vacancy rates and rental falls of as much as 10% in some locations.

At Metropole Property Management our vacancy rate is less than half this rate, in part because our clients have chosen investment-grade properties, but we’d like to think it also has a bit to do with our proactive property management policies.

According to the SQM, Brisbane’s gross rental yield for houses is currently around 4.0 per cent and for units is around 5.2 per cent

Overview of the Brisbane Capital growth

Like Australia’s other large capitals, the more expensive properties in Brisbane are out performing middle and lower price properties with regards to capital growth.

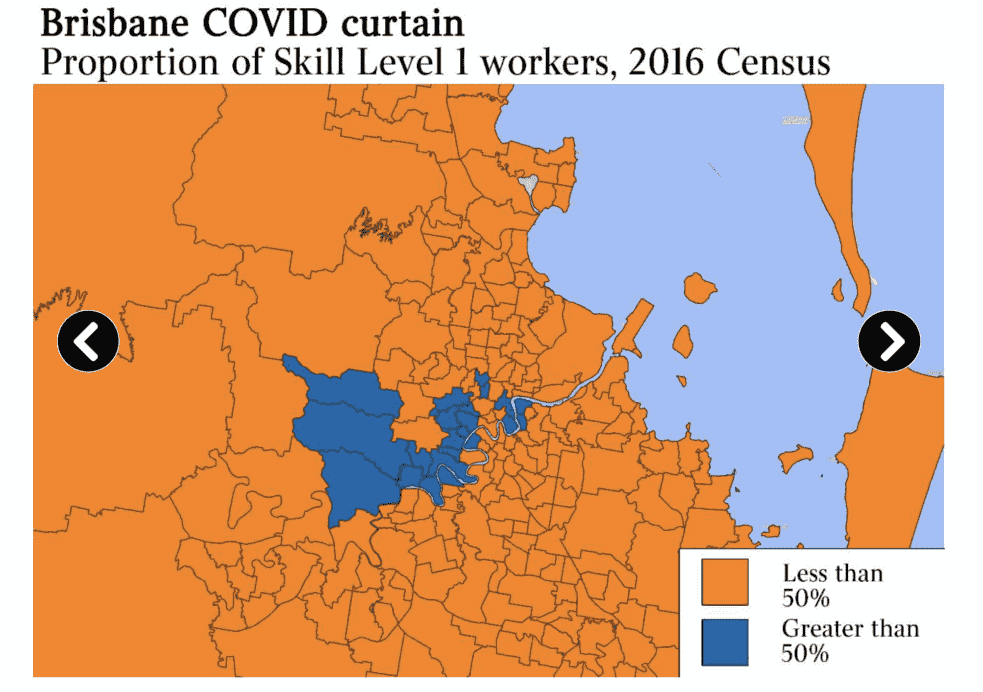

Moving forward, houses in Brisbane’s inner and middle ring suburbs offer the best prospects of long term capital growth as this is where there are more Skill Level 1 workers – those who earn higher incomes, often having multiple sources of income.

Fact is, the rich are getting richer and they are able to and prepared to pay more for their homes

6 reasons to choose Brisbane

1. Brisbane’s demographics

According to the Australian Bureau of Statistics 2016 Census the population of Greater Brisbane which encompasses the local government areas of Brisbane, Logan, Ipswich, Redcliffe and Moreton Bay is 2,270,000.

This is less than half the population of its southern east coast cousins – Sydney and Melbourne.

According to the 2015 Intergenerational Report, the population of Australia is expected to almost double by 2055, with Queensland also becoming home to more than seven million people over the next 40 years.

Given its sub-tropical climate, the region is well known for its laidback lifestyle and enviable weather.

Greater Brisbane also has far more affordable property than the southern cities of Melbourne and Sydney.

2. Brisbane’s layout

Brisbane is a sprawling city with outlying suburbs up to one hour drive from the city centre.

Sprawling along the Moreton Bay floodplain, Brisbane stretches from Caboolture in the north to Beenleigh in the south, and as far as Ipswich in the west.

Winding around the Brisbane River the city is rather hilly, with prominent rises including Mt Coot-tha, Enoggera Hill, Mount Gravatt, Toohey Mountain, and Highgate Hill to name a few.

The Central Business District itself is fairly well laid out but it can be tricky to navigate through with all the one way.

If you ever get confused a golden rule for the CBD is that the streets with female names (Margaret, Ann, Queen, etc.) run parallel to each other and the streets with male names (Edward, George, etc.) also run parallel to each other.

The CBD is still in the original settlement location in a curve of the river about 23 kilometers upstream from Moreton Bay.

The river acts as a natural divide with the city colloquially broken into two sections, namely “north of the river” and “south of the river”.

The inner-ring of suburbs of Brisbane is classed as between zero and five kilometers from the CBD, the middle-ring from five kilometers to about 12 kilometers, and the outer-ring from the point to the start of the borders of its Greater Brisbane’s regional councils.

In spite of the hilly areas of Brisbane, much of the city exists on the low-lying flood plains, with several suburban creeks throughout the suburbs joining the Brisbane River.

These low-lying areas on the water’s edge increase the risk of flooding.

3. Brisbane’s infrastructure

Economic growth in Queensland is projected to accelerate from 2.5% last financial year to 3% by Financial Year 2019, supported by the biggest infrastructure spend since the 2011 flood recovery

This was announced in the FY19 Budget in June 2018.

There are many multi-million dollar projects happening in and around Brisbane at the moment, that are starting to create jobs and more importantly get the economy rolling again.

One of the biggest would have to be the addition of a second runway to the Brisbane Airport and you would hope so too, at a total cost of around $1.3billion.

The project is due for completion in 2020 and after 8 years in the making, will become Australia’s largest aviation construction project.

It has already provided hundreds of construction jobs and by 2035, it is expected to generate up to 8,000 new jobs and generate an additional $5billion dollars to the Brisbane Economy.

To put that into perspective that is almost half the economic output of a Regional town like Toowoomba or more than a third of the output of the Sunshine Coast economy.

The huge project will increase Aircraft capacity to around a staggering 110,000 movements per hour and Brisbane is set to become the gateway to the rest of the country, in particular Asia.

Capitalising on opportunities from the Asian Century, there are many major tourism projects with a combined value of $30 billion scattered up and down Queensland’s coastline.

New resorts – and upgrades of existing resorts – are slated for Brisbane, Ipswich, the Gold and Sunshine coasts, Rockhampton, Mackay and Cairns.

While new infrastructure is an important element for investors to consider, it doesn’t necessarily lead to property price increases and sometimes can be detrimental to an area through increased traffic, noise or pollution.

4. Brisbane’s economy

Brisbane is Queensland’s economic engine room – a growth city with a strong history of economic performance and significant infrastructure investment.

All the economic key pointers are heading in the right direction.

Brisbane’s economy is being underpinned by major projects like Queen’s Wharf, HS Wharf, TradeCoast, Cross River Rail, the second airport runway, and the Adani Coal Mine, but jobs growth from these won’t really kick-off for a few more years.

Despite global uncertainty, the economy is predicted to be worth more than $217 billion by 2031, according to the Brisbane City Council Economic Development Plan 2012-2031.

Source: Charter Keck Cramer Valuers

5. Brisbane’s Population Growth

The population growth that saw the Sunshine State gain a net 7237 people from interstate in the September quarter of 2020– while NSW shed 4110 and Victoria lost 3749

Brisbane’s 2019 population is now estimated at 2,372,335.

In 1950, the population of Brisbane was 441,718.

Brisbane has grown by 159,446 since 2015, which represents a 1.75% annual change.

These population estimates and projections come from the latest revision of the UN World Urbanization Prospects.

And the population of Greater Brisbane is expected to continue to experience solid growth over the coming 10 years according to a report by Place Advisory.

The Australian Bureau of Statistics has predicted strong population growth at an average of 62,410 people in Brisbane per year over this period.

Underpinned by continued overseas and interstate migration, metropolitan Brisbane requires approximately 23,000 additional dwellings each year to accommodate its growth.

Greater Brisbane Population Projections

Whilst, family households are expected to see the largest increase over the next 10 years, the Australian Bureau of statistics projects that lone person households will have the highest growth rate leading into 2028, averaging a 2.4% increase per annum.

This is followed by family households which have a projected average growth rate of 1.8% per annum over the same time frame.

Group households are set to see the smallest growth rate at an average of 1.4% per year.

Greater Brisbane Household Projections

6. Brisbane’s culture

Given its sub-tropical climate, Brisbane is well-known for its outdoor lifestyle, especially the plethora of dining options along the Brisbane River in residential and restaurant precincts such as Teneriffe, Bulimba, New Farm, and West End.

Brisbane is no longer a “big country town” in fact it’s a veritable hotbed of cultural and creative offerings, festivals, and events, according to experts.

Exclusive blockbuster exhibitions and inspiring theatre productions sit alongside independent and emerging local performances, outdoor cinema, street art, and intimate gallery and performance spaces.

Lovers of comedy, musicals, live theatre, and dance head to the Brisbane Powerhouse and QPAC.

The Queensland Museum and QAGOMA offer free entry to permanent exhibitions.

Fortitude Valley and West End are go-to destinations for local live music gigs and DJs, while international acts visit the Brisbane Entertainment Centre or Suncorp Stadium.

And while Brisbane is Australia’s third-largest city, tenants don’t necessarily want the same features as renters in Sydney and Melbourne.

The most promising Brisbane areas

So where should an investor start looking?

Like everywhere else in Australia, the Brisbane property market will be driven by demographics – where people want to live, how they want to live, and how much they can afford.

That’s why I only invest in areas where the locals’ income is growing faster than the national average.

These tend to be the “established money” areas or gentrifying suburbs.

Think about it… in these locations, locals will have higher disposable incomes and be able to and should be prepared to pay a premium to live in these locations.

Many of these locations in Brisbane are the inner and middle-ring suburbs which are gentrifying as these wealthier cohorts move in.

There are great investment opportunities in these suburbs in houses and townhouses.

And now post Covid neighbourhood will be more important than ever – something people call the “Third Place.”

Our first place is home and our second place is work or the office, but during Covid for many around Australia the ability to go to a third-place that was taken away.

It may be a favourite café, a gym or a place of worship and even local shops and pubs.

They missed that feeling and connection to others, having an outlet to take a break from family or colleagues for a short period to reset.

A gym or exercise center has been substituted for a favourite walking or cycling path with green space and fresh air.

So, all these features combined will be a major requirement and will create huge demand moving forward.

These are all features of the 20-minute neighbourhood, that will be built around convenience.

Wouldn’t it be nice is all the things you need in a day would be just a short walk away.

In urban planning circles, it’s a concept known as the 20-minute neighbourhood.

Understanding these factors forms part of the research data we use at Metropole to help our clients find investment-grade properties or A-grade homes for owner-occupation.

If you’d like to get the independent, award-winning team at Metropole on your side to help you through the maze of mixed messages about the Brisbane property market, please click here and leave us your details or call us on 1300 METROPOLE

Overall the various suburbs in Queensland show a dramatic range in performance, highlighting both the diversity in housing stock around the State and no doubt that the next twenty-five years will show an equally diverse result

Consider school zones

There’s no doubt that proximity to popular education catchments influences property prices in Brisbane.

This is true of both primary and secondary school catchment zones, which have in general outperformed the market and are likely to continue to do so.

Education is a long-term consideration and, whether you are planning a family, have children already enrolled in school, or are an investor looking to attract long-term, quality tenants, it may be beneficial to consider school catchment zones when you are determining suburbs of interest.

Brisbane’s Best Performing Suburbs Over the Last 20 Years

This staggering amount of capital growth may surprise you, especially when you consider all the headwinds, Brisbane has faced over that time frame.

From economic events like the stock market crash in the early 2000’s to the Global Financial Crash to round out the previous decade and a mining downturn also didn’t help.

While most states went on to recover, Queensland faced a range of natural disasters from floods to cyclones that also took their toll on our economy.

So, despite all of that, these are very impressive figures.

While I am not suggesting the same amount of growth will occur in the next 20 years, I would certainly like to evaluate these suburbs and understand why they stood out.

What do these Suburbs Have in Common?

Here are the top 4:-

- 80% of these Suburbs are located within 10km of the Brisbane CBD.

- 80% of these suburbs have a train line

- 80% of these suburbs have a highly desirable school catchment

- All of these suburbs have incomes well above the Queensland average

For those that know these suburbs more than half of them have all 4 of these key drivers – so why fight the big trends when looking for your next investment property?

Some advice for new Brisbane investors

1. Look for Brisbane’s best properties in the inner- and middle-ring suburbs.

Research shows that those suburbs close to the city center generally perform better than all others over the long term.

Our research at Metropole Brisbane shows that (in general) properties closer to the CBD and closer to water increased in value faster than those further from the CBD and further from water.

And this general trend has again been confirmed by a paper by the Australian Housing and Urban Research Institute, which found that both in percentage terms and in absolute terms over the long haul suburbs located reasonably close to the CBD, where demand is high, close to employment and where the most people want to live and where there’s no land available for release, outperformed the outer suburbs.

One of the significant changes to occur in Australian cities over the past 50 years, and which has pushed up inner- and middle-ring suburb property values, is gentrification.

Interestingly this wasn’t caused by deliberate planning policy but resulted from a set of demographic changes that have occurred in most major capital cities around the world.

The exodus of industry, migrants, and many workers made way for gentrification of our inner suburbs where initially house prices and rents were cheaper than in the suburbs.

Later, our changing demographics with declining household size, in part because we were getting married later and having fewer children, meant that small inner suburban dwellings or apartments provided ideal accommodation for the expanding cohort of professionals who worked in or close to the CBD.

Gentrifiers were initially drawn to these inner suburbs by the diversity of jobs, educational opportunities, and lifestyle and this trend continues today as more and more Australians are swapping their back yard.

You may also want to watch this video: 5 Important Things Interstate Investors Need To Know Before Investing In Brisbane.

2. Four Suburbs that MUST be on your radar

With leading Economists tipping Brisbane to lead the nation for capital growth over the next few years, I suggest you do your research before jumping on in!

BIS Schrapnel has predicted 13% growth for Brisbane out until 2021 and a recent report by QBE Insurance has predicted 11%.

BIS Schrapnel has predicted 13% growth for Brisbane out until 2021 and a recent report by QBE Insurance has predicted 11%.

Whatever the outcome, it is clear that Brisbane will continue to tick over with steady growth, while the rest of the nation takes a breather.

While Brisbane houses have only averaged around 25% growth over the last 5 years (or 5% per annum), these suburbs have outperformed and will continue to do so:

2.1. The Entry Level Suburbs

Budgets starting $530,000 – $600,000

Yes, my Sydney and Melbourne friends, it is possible to buy a house within that budget!

We have been buying in Keperra and Chermside West now for a number of years and for a number of reasons.

These suburbs sit around 9-10km from Brisbane and are the furthest out we recommend buying.

Let’s take a look at some of the data*:

Keperra

The appealing thing about Keperra for us gets down to the Demographics.

Firstly, nearly two-thirds of people own or are paying off a mortgage, a high owner occupier percentage.

Weekly Family Income has continually hovered above the Queensland average but in recent years, it has started to move even further ahead.

The most common Occupation in this location is Health Care and Social and according to the Queensland Government, this is going to be the fastest-growing sector in Brisbane over the next few years and with our aging population, there will always be work.

The most common Occupation in this location is Health Care and Social and according to the Queensland Government, this is going to be the fastest-growing sector in Brisbane over the next few years and with our aging population, there will always be work.

These higher incomes and job certainty, mean that people will have more to spend on their homes and be much more comfortable in doing so.

Adding to that, Keperra is also a train station suburb and according to Matusik research, suburbs close to rail have grown 40% more in value over the last decade in Brisbane.

In the last 5 years, while Brisbane has averaged around 25%, Keperra has almost 30% in the same time.

The future is bright and if you know where to find the superior pockets, you will be handsomely rewarded.

Chermside West

Chermside West has very similar Demographics.

Income and Occupation are very similar and the owner-occupier percentage is almost 80%!.

We are seeing this suburb really gentrifying as social housing and retirees move out, they are being replaced by younger professionals who are targeting the nearby Craigslea State School catchment.

The suburb also boasts two hospitals that draw health care professionals to the area and it benefits from the development of neighbour Chermside into a type of Satellite City.

The suburb also boasts two hospitals that draw health care professionals to the area and it benefits from the development of neighbour Chermside into a type of Satellite City.

While many investors are attracted to Chermside, we would prefer Chermside West, with its favourable Demographics, higher owner occupier percentage, and superior school zone.

You also get all the benefits of all the Chermside upgrading without having high rise and business on your doorstep.

The numbers tell the story here also with a rise of 36% over the last 5 years, well above the Brisbane average.

Other Entry-level suburbs to keep an eye on;

- Stafford Heights

- Mitchelton

- Everton Park

2.2. Middle Ring

2.2. Middle Ring

Budgets starting from $650,000+

Starting to get closer in now and there are a number of good suburbs that sit around 6 or 7km to the Brisbane CBD.

Our pick currently is Cannon Hill.

Here is some of the research:

Cannon Hill

Weekly Incomes in Cannon Hill have soared dramatically over the last few decades.

From almost being level with the Queensland average back in 1991, the last decade has seen a dramatic increase in wages and our expectation is that this will continue.

Again, it has a greater level of owner-occupiers with around 70% either paying off a mortgage or owning their property outright.

It also has a lot of the tick boxes a family is looking for with access to good schools, green space, a bus and train line, and easy access to our bugger employment hubs.

It also has a lot of the tick boxes a family is looking for with access to good schools, green space, a bus and train line, and easy access to our bugger employment hubs.

There is also a big trend to low maintenance living and with many bigger blocks having been subdivided over the years, the land is now at a premium.

We have chosen Cannon Hill for its access to our ever-expanding CBD, but also is the closest southern suburb to benefit from the Brisbane Airport precinct expansion.

The suburb has also seen around 30% growth over the last 5 years on average.

Other middle ring suburbs to keep an eye on;

- Holland Park

- Tarragindi

- Toowong

- Kedron

2.3. The bulletproof 5km ring

2.3. The bulletproof 5km ring

Budgets starting from $800,000+

Suburbs within the 5km ring are starting to resemble all the traits and pricing of some of our southern capitals, but one suburb that still offers value is Ashgrove.

Ashgrove is around 4km from the Brisbane CBD and has an excellent reputation for being a popular family suburb.

Here is some of the data:

Ashgrove

The Demographics and Incomes here are increasingly very strong, with many in the professional and services-based industries and incomes heading toward twice the Queensland average.

The suburbs average age is 40 – 59, so families generally come first in this suburb, there is no surprise to see some of Brisbane’s best and most highly sought-after schools scattered throughout the streets.

It has a very leafy, green feel with walking paths and tracks and plenty of green space, and combined with a number of larger character homes that have been restored and renovated it has found a great balance for an inner-city location.

Adding to that the easy access to shops and lifestyle precincts with high walkability will remain in high demand moving forward and has already seen more than 36% growth over the past 5 years.

Other inner ring suburbs to keep an eye on;

- Auchenflower

- Bardon

- Wilston

With Brisbane tipped to lead the nation for capital growth over the shorter term, it will see interest rise in the Brisbane market.

With Brisbane tipped to lead the nation for capital growth over the shorter term, it will see interest rise in the Brisbane market.

While there will be opportunities available for almost every budget, it is important to understand the intricacies of each suburb.

Even within these locations, I have mentioned, I would be reluctant to buy in some streets and pockets within these suburbs.

It takes on the ground knowledge and some content to understand the less desirable areas, the flood locations, and undulating areas.

On the flip side, if you get the location right, you will be rewarded with above-average capital growth and be able to set yourself up for the next stage of the property cycle, while others tread water.

* Sources Domain / SQM Research

Brisbane apartment market oversupply

Apartment living in Brisbane came late to the party compared to Sydney and Melbourne and, in general, houses make better long-term investments than apartments in Brisbane.

While many apartment towers have been built in the Brisbane CBD and surrounding suburbs, the recent building boom created an oversupply which is only now being slowly taken up.

However, moving forward after coronavirus, and with fewer international students and tourists in the next little while, I can see high rise apartment tower living falling out of favour.

People are going to be more wary and not want to share lifts and stairwells and press the same elevator buttons that others are.

In 2019, 5,000 apartments were completed in Brisbane, a decrease from the 5,600 apartments completed in 2018.

As you can see from the following chart apartment completion is across metropolitan Brisbane peaked over 2016 and 2017 when approximately 11,000 apartments were built each year.

With a few apartment complexes in the pipeline, oversupply will slowly be absorbed.

As mentioned, with fewer people wanting to live in high-rise apartment towers in Brisbane’s CBD and inner ring, there is little prospect of capital growth or rental growth in Brisbane’s apartment market in the near future.

I can see the situation where some off-the-plan purchasers will have to wait up to a decade for capital and rental growth.

Big mistake made by interstate property investors in Brisbane

Currently, the Brisbane property market is being infiltrated by interstate investors ‘buying blind’.

With Sydney and Melbourne property prices have risen strongly over the last few years and now that these markets have slowed down from its frenetic pace, these high prices plus tighter banking regulations limiting investor’s budgets has caused many southerners to follow the sun north and look for property investment opportunities in Queensland but many are making a big mistake.

According to an article in Domain Sydney investors are increasingly buying properties in Brisbane solely on photographs and skipping inspections.

And they’re buying the wrong properties in the wrong location based on price.

Agents quoted in Domain say these southern investors are buying up in Brisbane suburbs considered “unfavourable” by locals and boosting house prices

One agent was quoted as saying:

“…blind-buying Sydney investors had flooded into the Logan market.

“Out of every 10 sales, five will be investors, and two will not have viewed the home, and that is a modest estimate.

“Often it seems as the investors have no idea about the area’s reputation.”

Domain quoted another agent as saying:

“We are seeing about 70 per cent of Sydney investors buying without seeing the homes,”

The lesson – don’t buy sight unseen:

It’s incredible what you can achieve, and the unsightly features you can avoid showcasing, when you’re using a good camera and exploit the right camera angles.

I’ve heard horror stories of people who have bought sight unseen thinking their investment property had an incredible view (it did – but only from the toilet) or who didn’t realise huge powerlines dominated the streetscape, because they relied on agent photos only.

The moral of the story is don’t risk purchasing site unseen unless you have a trusted representative review the property on your behalf.

Key points to help you choose a strong investment property in Brisbane

1. Buy a property for below its intrinsic value

I’m a big believer in buying property for below its intrinsic value – that’s why I avoid new and off-the-plan properties, which generally attract a premium price tag.

Remember, though, that you’re not looking for a ”cheap” property (there will always be cheap properties around in secondary locations).

You’re looking for the right property at a good price.

Properties to consider may be ones that are a little ugly or untidy but have good “bones” and are in good or superior locations.

Some of Brisbane’s middle-ring suburbs may be worthwhile considering given they often have solid homes on land sizes ranging from 405 to 600 square metres.

2. Buy a property that outperforms the averages

Look for an area that has a long, proven history of strong capital growth and is one that is likely to continue to outperform the averages.

This is largely because of the demographics in the area.

These suburbs tend to be those where a large number of owner-occupier’s desire to live in the area, because of lifestyle choices of the offer.

I look for suburbs where wages (and therefore disposable income) are increasing above average.

This translates to being an area where locals are able to and prepared to pay a premium price to live there, putting a financial floor under your investment property.

This is also considered to be gentrification.

So what we’re seeing is high-income people moving into particular locations, which perhaps used to be considered blue-collar, and spending their money there in new cafes and on renovating their homes.

In Brisbane, for example, there are a number of inner-city suburbs where there is occurring such as Annerley and Woolloongabba on the south side.

3. Buy a property with a “twist”

An investment must have something unique, or special, or different or scarce – some ‘X-factor’ that makes it stand out from its neighbours – in order to land on my shortlist.

So when your looking at the Brisbane property market, consider properties that are “special” because of their design, e.g. perhaps Queenslanders or art deco apartments or properties in desirable locations.

Although you must keep in mind that sometimes these unique properties are more expensive to buy and to maintain, but history shows us they usually have stronger capital growth

Remember that more demand than supply always means higher prices, because of that scarcity factor.

4. Buy a property where you can manufacture capital growth

An ideal investment is one in which you can manufacture capital growth through refurbishment, renovations, or redevelopment.

For example, there are tens of thousands of properties out there that could all have their values increased through simple renovations.

While I don’t believe that investors should subscribe to the “buy, renovate, sell” philosophy, because the opportunity to profit is not great, what works really well, if done correctly, is a buy renovate and hold your investment property.

Here you buy a property with renovation potential, renovate and then keep it as a long-term investment that has added value.

This added value will give you improved rentability – your property will be more attractive to a wide range of tenants – as well as achieving a higher rent and you will have “manufactured” some equity.

So what does all this mean?

To me, the picture is clear.

Brisbane’s property market is ripe for investment – its economy is improving, the population is growing, infrastructure is being added and property remains affordable.

Your biggest challenge is to find the right property to buy, but that’s what the Brisbane team at Metropole specialise in.

Why not click here now and have a chat with us and discuss your options.

Brisbane Property Top Performers 2020

2020 was a challenging year for all our property markets due to COVID-19 and a recession, but Brisbane’s property values remained resilient over the year and is now forecast to perform strongly in 2021.

During recent months houses in Brisbane have enjoyed improving demand and the number of transactions in the Brisbane housing market is higher and they were pre-Coronavirus.

Of course, there is not one “Brisbane property market” and some segments outperformed others.

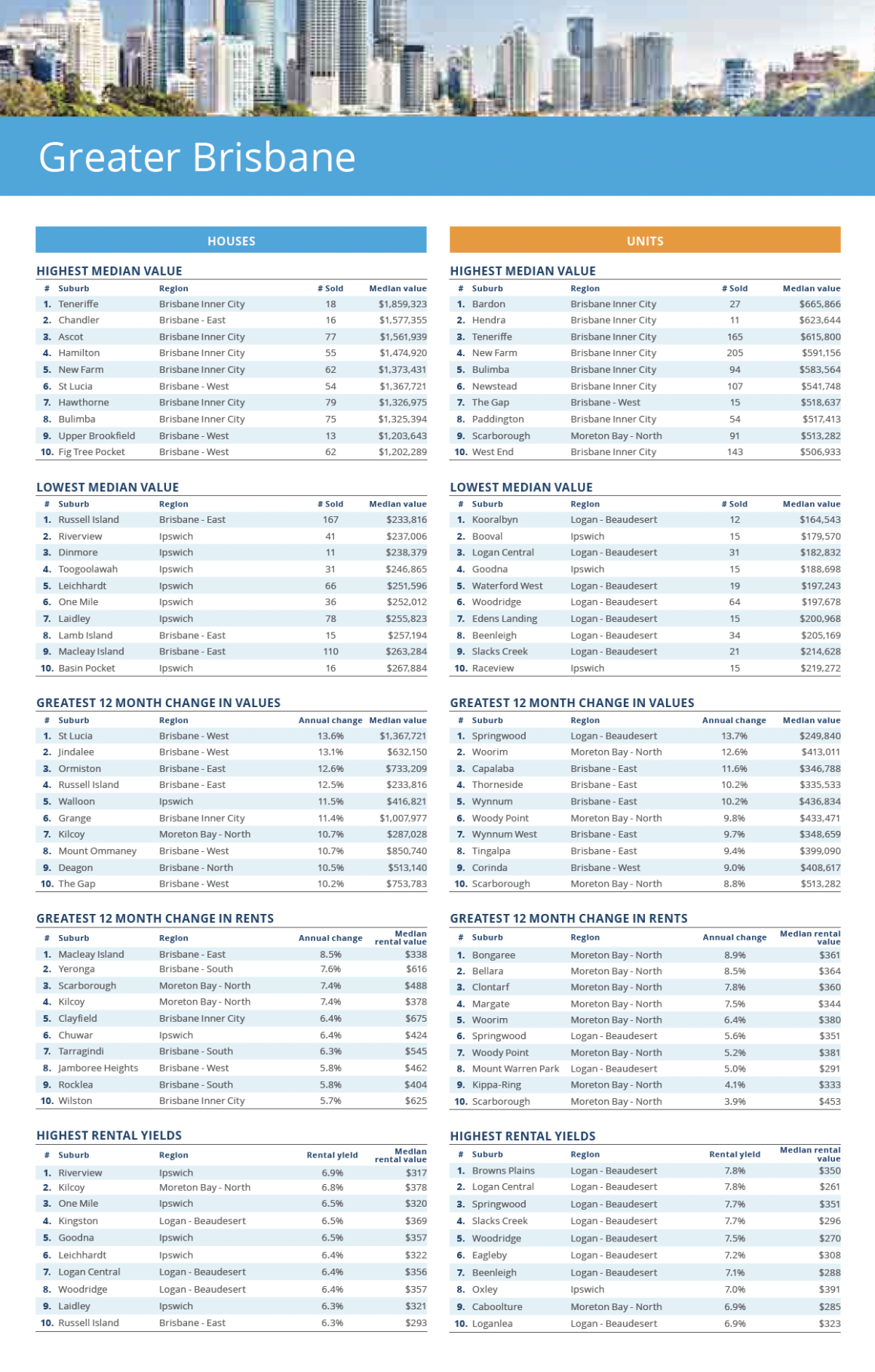

Here are some of the best of the best for Brisbane’s housing markets in 2020:

These are the Brisbane Suburbs with the top sales in 2020

These are the Brisbane Suburbs with the top sales in 2020

The best of the best in Brisbane property markets

As Australia’s second largest city, Melbourne’s housing markets are vast and diverse.

These are some of the best performing segments…

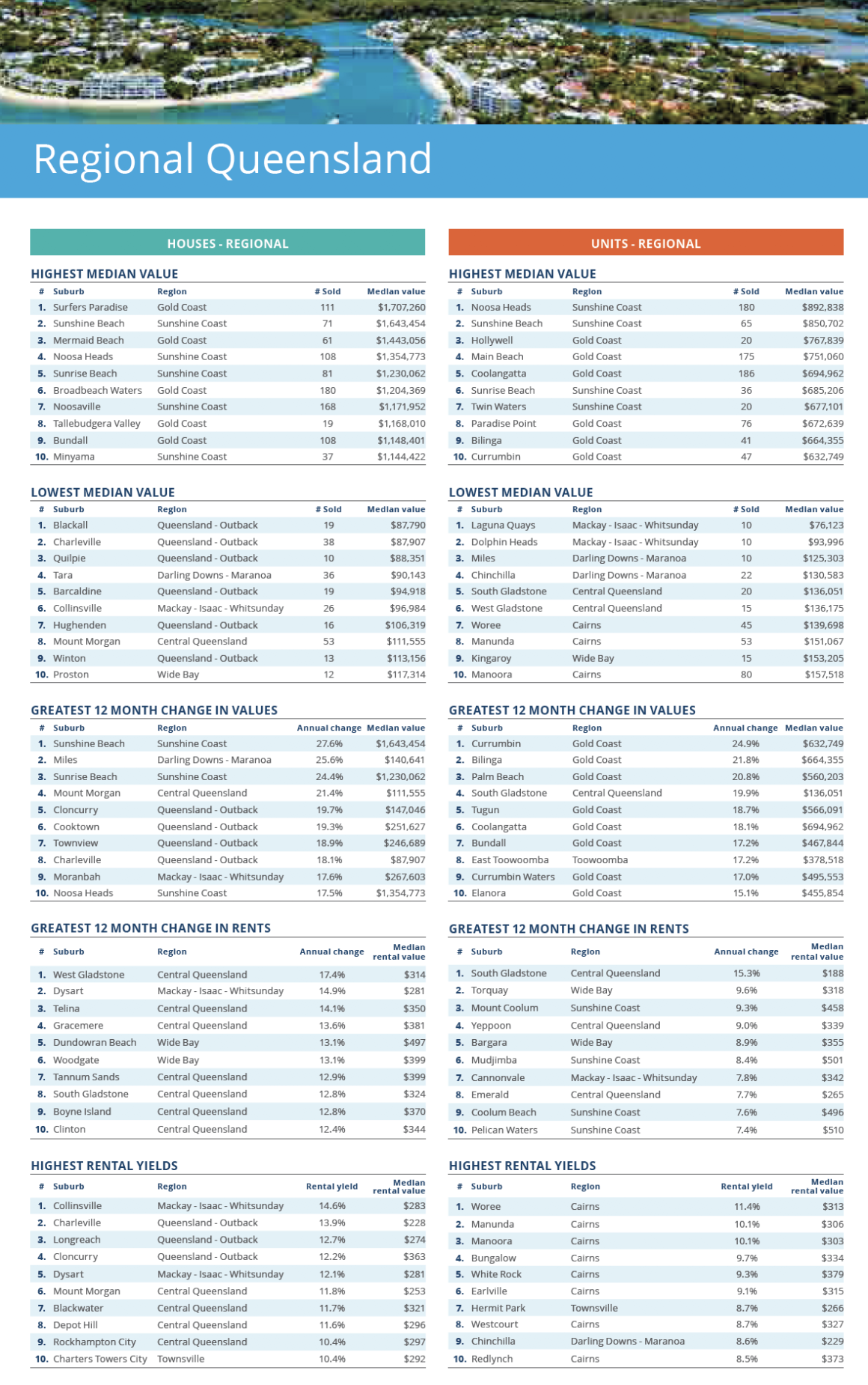

And these are Regional Queensland’s top-performing locations.

Wonder, how to stay on top of current information?

Get news, updates, and advice by email

Are you interested in keeping up to date with the latest Brisbane property market news?

There is so much information available about various Housing Market Trends, strategies, and market information that it can be overwhelming knowing where (or how) to get started.

Subscribe to Michael Yardney’s Property Update and get a daily dose of insightful commentary in your inbox each morning.

Join here; this is free and you’ll see we’ve been voted the world’s #1 property blog for the last 4 years in a row.

from Property UpdateProperty Update https://propertyupdate.com.au/whats-ahead-brisbanes-property-market/

No comments:

Post a Comment