What’s the outlook for the Australian property markets for the rest of 2021 and beyond?

This is a common question people are asking now that our real estate markets are up and running again.

Westpac has recently revised their outlook for dwelling values for the balance of this property cycle.

Back in February Westpac was one of the first of the banks to do an about-face and at that time boldly predicted a 20% increase in values over 2021 and 2022.

Since then all the other major banks have fallen in line with some economists suggesting property values could increase up to 30% over this cycle.

Westpac now says a stronger than expected surge over the first half of 2021 is now expected to see prices up 18% in this year alone.

Lockdowns will see some loss of momentum in the third quarter, particularly in the Sydney market, but an eventual easing in restrictions should see activity rebound swiftly and price growth lifts again into year-end.

Westpac believes our regulators will step in and slow down the market.

They feel the evidence of an 18% lift in prices nationally – including a 22% gain in Sydney – and a 7% increase in housing credit will set the scene for prudential policy tightening in the first half of 2022.

ANZ Bank similarly predicts at the national level Australian house prices will rise by a strong 17% through 2021, before slowing to 6% growth in 2022.

They see

- Sydney house prices increasing by up to 19% by the end of the year

- Melbourne house prices rising by over 16% over the year

- Brisbane house prices rising by 16% this year

- Adelaide house prices rising by over 13% over the year

- Perth house prices rising a whopping 19% in 2021

- Canberra house prices rising by over 16% in 2021, and

- Darwin house prices rising by over 16% this year.

What a turnaround from all the pessimistic forecasts all the banks made in the middle of last year.

Another strong forecast

Christopher Joye from Coolabah Capital Investments (CCI) is predicting substantial property price growth through to the end of 2023, as well as similar gains in real residential investment.

Using the Reserve Bank of Australia’s model of the housing market, the forecast, predicts house prices growth of 8 per cent over 2021, then an additional 9 per cent in 2022, before a final spike of 8 per cent in 2023.

This takes the cumulative growth through to end-2023 up to 25 per cent.

Capital city dwelling prices rose 2.2% over the month of May to be 10.6 % higher over the current year but, of course, there are multiple housing markets around Australia.

Here’s what’s been happening to Australian house prices over the last year…

Source: CoreLogic August 2nd, 2021

In fact, the modest coronavirus-induced housing correction came to an end in the middle of October 2020, and that our housing markets are clearly on the move again.

Source: NAB and Corelogic August 16th 2021

Is a second Australian recession now a ‘genuine risk.

Australia has experienced the “V-Shaped” economic recovery that no one thought it could, with our GDP now being higher than it was at the beginning of the pandemic.

Way back at the beginning of the pandemic Scott Morrison said he was going to build a bridge to get us across the other side, and it looks like he’s done that and it seems that we are standing on the other side now.

But to have our biggest state, New South Wales, in lockdown is a big blow to our economy.

Economists are now pondering whether the extended lockdowns around Australia could throw us into a double-dip recession.

Calculations say each week Sydney is locked down could cost $2 billion loss in gross domestic production (GDP).

And if we lose 12 weeks to a lockdown, we could lose $24 billion worth of GDP.

However, with the state progressively being shut down and other states closing borders, the knock-on effects could be more weighty

It seems very likely that the economy will contract in the September quarter, but fortunately, most economists agree that there will be a big bounce back in December, as vaccinations extend to a majority of Australians.

Overall, 2021 is proving to be a year of economic recovery after a challenging end to 2020, and the speed of the post-COVID recovery continues to surprise all the economists.

In fact, the ANZ research now forecasts wages growth of 3% and inflation above 2%, suggesting it “would not be out of the question that the RBA could tighten earlier than the second half of 2023”.

Inflation and wage growth increase before 2023

This reflects Australia’s successful management of the health crisis alongside enormous fiscal and monetary stimulus.

That said, Australia has performed comparatively well through the pandemic.

While China is ahead, Australia is one of the few developed countries with GDP back above pre-pandemic levels.

Over the next couple of years, ongoing high levels of monetary and fiscal stimulus are expected to support a continued robust Australian economic recovery.

Consequently, ANZ research has upgraded its forecast outlook to a 5% rise in GDP through 2021, and 3.5% in 2022.

Growth in GDP per capita to stay well above trend

“With population growth much lower than usual these growth rates are substantially stronger than a trend,” ANZ research says.

NOW READ: Seven reasons for optimism about our economic recovery.

And, in turn, our housing market has picked up considerably…

Source: NAB August 2nd, 2021

What’s ahead for our property markets and the economy?

Let’s have a look at 6 property trends that I think will occur in 2021.

- Property demand from home buyers is going to continue to be strong

Currently, home prices are surging around Australia, auction clearance rates remain high, and the media keeps reminding us we’re in a property boom.

The result is emotions are running high at the moment, with FOMO (fear of missing out) being a common theme around Australia’s property markets.

One of the leading indicators I watch carefully is finance housing approvals, and these are suggesting that more Aussies are looking at getting into property and we will have strong ongoing demand from owner-occupiers and investors over the next 6 months.

Now, with borrowing costs lower than they ever have been, the reassurance that interest rates won’t rise for a number of years, it is likely that buyer demand will remain strong throughout the year.

In fact, this is a self-fulfilling prophecy…

As property values increase and the media reports more positively about our property markets, FOMO will mean more buyers will be keen to get in the market before it prices them out.

2. Investors will squeeze out first home buyers

While there were many first-time buyers (FHB’s) in the market in the first half of the year, buoyed by the many incentives being offered to them, now demand from FHB’s is fading and property investors re-enter the market and property values rise.

Of course over the last few years investor lending has been low, but with historically low-interest rates and easing lending restrictions, investors are back with a vengeance.

3. Property Prices will continue to rise

While many factors affect property values, the main drivers of property price growth are consumer confidence, low-interest rates, economic growth and a favourable supply and demand ratio.

As always, there are multiple real estate markets around Australia, but in general property values should increase strongly throughout 2021.

As always, there are multiple real estate markets around Australia, but in general property values should increase strongly throughout 2021.

However certain segments of the market will still continue to suffer, in particular in the city apartment towers and accommodation around universities.

It is unlikely these segments of the market will pick up for some time and the value of these apartments is likely to continue to fall as there just won’t be buyers for secondary properties.

At the same time, some rental market will remain challenging. In particular, the inner-city apartment markets are reliant on students, tourists (AirBNB) and overseas arrivals.

But overall, Australia’s low mortgage rates continue to underpin very strong growth in property prices throughout the country.

House prices will rise further

Ongoing strength in housing finance, elevated auction clearance rates, and continued low stock levels suggest housing prices will continue to rise solidly through 2021.

4. People will pay a premium to be in the right neighbourhood

If Coronavirus taught us anything, it was the importance of living in the right type of property in the right neighbourhood.

In our new “Covid Normal” world, people will pay a premium for the ability to work, live and play within a 20-minute drive, bike ride or walk from home.

In our new “Covid Normal” world, people will pay a premium for the ability to work, live and play within a 20-minute drive, bike ride or walk from home.

They will look for things such as shopping, business services, education, community facilities, recreational and sporting resources, and some jobs all within 20 minutes reach.

Residents of these neighbourhoods have now come to appreciate the ability to be out and about on the street socialising, supporting local businesses, being involved with local schools, enjoying local parks.

5. More expensive properties will outperform

The current property cycle was initially characterised by all segments of the market rising – other than inner-city high-rise apartments.

But now the high end of the market is leading the growth in property values

According to Corelogic, the high tier is the top 25% of property values in any given region.

As of February, this refers to dwelling values at around $960,000 or higher for the combined capitals, with a typical value in the high tier around $1.2 million.

Over February, the top 25% of values in the combined capital cities jumped 2.7% in value. This was up from an increase of 0.5% in January.

The middle 50% of dwelling values (the mid-tier) increased 1.5%, and the ‘low’ end of property values (the low tier) increased 1.2%.

6. This is a cycle dominated by upgraders

The current property and economic environment, plus the scars left on many of us after a year of Covid related lockdowns have meant that Aussies are looking to upgrade their lifestyle.

- Many tenants are no longer happy to live in small dingy apartments and with an oversupply of rental units available in many areas, they are taking the opportunity to upgrade their accommodation.

- Other tenants who have managed to save a deposit are taking advantage of many of the many incentives available and are becoming first home buyers.

- With record low-interest rates and surging property markets, many existing homeowners or upgrading their accommodation to larger homes in better neighbourhoods. In fact, a recent survey suggested that one in three homeowners are looking to sell their home in the next five years.

- While small group homeowners are upgrading their lifestyle and moving out of the big smoke to regional Australia, more Aussies are looking to upgrade their lifestyle by moving to a better neighbourhood. As mentioned above, they love the thought that most of the things needed for a good life are just around the corner.

- Many Baby Boomers are looking to upgrade their accommodation by moving out of their old, tired family home into large family-friendly apartments or townhouses. But they’re not looking for a sea change or tree change, they’re keen to live in “20-minute” neighbourhoods close to their family and friends.

What’s ahead for our economy

The Australian economy has rebounded solidly out of the COVID-19 pandemic, due largely to significant monetary and fiscal stimulus and looks set for continued strong growth in 2021.

Here are 8 reasons to feel positive about our economic future

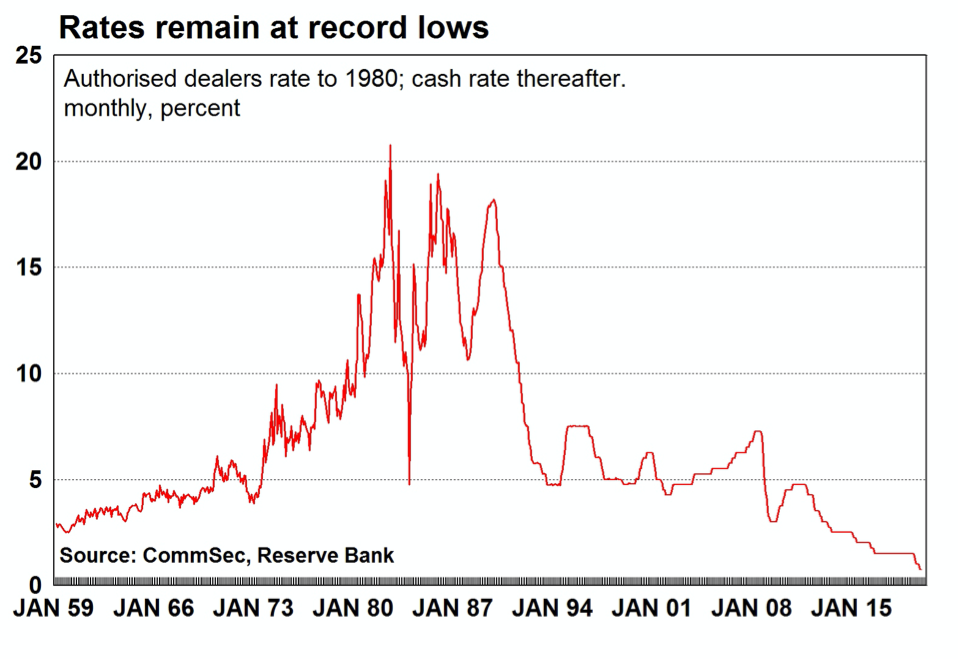

- The Reserve Bank Governor has committed to leaving the cash rate at 0.1 per cent till 2024. Bond purchases are being employed with the hope of reducing longer-term yields.

2. Underlying inflation is expected to broadly hold near 1-1.5 per cent over 2021.

3. Unemployment is the focal point of all monetary and fiscal policy actions.

And despite the concerns of what could happen to unemployment with the removal of job keeper, Australia’s unemployment rate keeps falling and has now hit 5.5%

While Australia’s recession is now over, the economic road back to recovery will take years.

There will continue to be some hiccups with virus case numbers in Australia, but as we move our way through 2021 we’re doing so with plenty of optimism.

4. The Westpac consumer sentiment index is at decade highs while business confidence is at 31-month highs.

Compared to prior downturns, the recovery in consumer sentiment is the sharpest seen in the history of the series and reminds us of the unusual nature of this shock and the extensive government support provided to households and businesses.

5. The success in suppressing the virus has enabled our states and territories to ‘re-open’ their economies.

6. Governments, the Reserve Bank, commercial banks, and regulators have provided all the necessary support and stimulus to ensure as many businesses as possible to stay in business and workers hold onto jobs.

7. Borrowing costs for businesses, households, and governments are at ‘rock bottom’.

8. The additional boost to confidence and future prospects comes from the prospect of a vaccine.

Risks to to our economy include further waves of virus cases; setbacks with vaccines; policy mistakes on the removal of support measures; and an extended delay in the re-opening of foreign borders.

Compared to prior downturns, the recovery in consumer sentiment is the sharpest seen in the history of the series and reminds us of the unusual nature of this shock and the extensive government support provided to households and businesses.

The major banks regularly report their internal data on credit card spending and consumer activity which has lifted strongly over the last few months in part due to the opening up of Victoria but consumer spending is also strong in other states.

Going forward, consumer spending faces headwinds from elevated unemployment, weak wages growth, tapering income support, and weak population growth.

The government recognises that consumer spending is a key driver of economic activity and that’s one of the reasons it is so keen to reduce unemployment and support our economy.

Property markets are booming

When Australians feel comfortable and confident about the value of their homes, their castle, they experience a wealth effect that encourages them to spend more.

The Stock Market is Rallying

Rising stock prices are important for several reasons – they show investors are confident in the earnings and profits of the business sector and they boost the wealth of shareholders which underpins confidence and spending.

A vaccine rollout is happening and boosting confidence

What about house prices?

Interestingly all the bank economists agree that it is likely that all our capital cities will experience strong house price growth over the next couple of years with house prices rising 20% to 30% over this property cycle.

Of course, there isn’t one Australian property market, or one Melbourne or Sydney property market so certain segments of the market will outperform.

In particular, the more affluent suburbs of our capital cities where residents have higher wages growth and more cash stashed away from the Covid pandemic are likely to outperform.

Of course, at times like this, forecasting median house values are of little value.

Instead, one needs to get more granular to really understand what is really going on.

Each state is divided into multiple markets, by geography, price point and type of accommodation.

Each of our capital cities has an inner and near CBD property market, an inner suburban market, a group of middle-ring suburbs, and outer suburban property markets.

And then there are apartments – either high-rise or medium-density – townhouses, villa units, and houses.

There are also new and establish property markets.

And each of these market segments behaves differently.

Currently, most of the property sales occurring are in the lowest price points with few discretionary sellers in the more established suburbs and higher bracket suburbs.

This means that the palette of properties currently being sold is generally in the lower price bracket and this alone will bring down reported median home values.

But this doesn’t accurately reflect the value of particular properties in any specific market, but more of the types of properties being sold.

We regularly report buyer demand as being shown by realestate.com.au’s Weekly Search Report and as you can see from the chart below, buyer demand is considerably higher than a year ago, even though this chart shows how enquiries have slowed down and we’ve moved from a “white-hot market” to a “red hot” market.

Moving forward some areas will strongly outperform others

The coronavirus pandemic has forced all Australians to reevaluate how we live our lives.

Offices were shut, lockdowns were in place, and moving forward people are likely to continue working at home more than ever.

This means gone are the days where our ‘home’ was simply the place we rest our heads and enjoy some downtime between work and our social lives – the coronavirus social distancing has put an end to life as we once knew it.

If social distancing and the Covid-19 environment have taught us anything, it has taught us the importance of the neighbourhood we live in.

If you can leave your home and be within walking distance of, or a short trip to, a great shopping strip, your favourite coffee shop, amenities, the beach, a great park, the recently implemented coronavirus restrictions might seem a little more palatable than if you had none of that on your doorstep.

That’s why choosing the right neighbourhood is important for property investors?

In short, it’s all to do with capital growth, and we all know capital growth is critical for investment success, or just to create more stored wealth in the value of your home.

Sure there is always the opportunity to add value through renovating your property or making a quick buck when buying well.

But these are one off’s and won’t make a long-term difference if your property is not in the right location because you can’t change its location.

This is key because we know that 80% of a property’s performance is dependent on the location and its neighbourhood.

In fact, some locations have even outperformed others by 50-100% over the past decade.

And it’s likely that moving forward, thanks to the current environment, people will place a greater emphasis on neighbourhood and inner and middle-ring suburbs where more affluent occupants and tenants will be living.

These ‘liveable’ neighbourhoods with close amenities are where capital growth will outperform.

How do we identify these locations?

What makes some locations more desirable than others?

A lot has to do with the demographics – locations that are gentrifying and also locations that are lifestyle locations and destination locations that aspirational and affluent people want to live in will outperform.

It’s well known that the rich do not like to travel and they are prepared to and can afford to pay for the privilege of living in lifestyle suburbs and locations with a high walk score– meaning they have easy access to everything they need.

So lifestyle and destination suburbs where there is a wide range of amenities with 20 minutes walk or drive are likely to outperform in the future.

At the same time, many of these suburbs will be undergoing gentrification – these will be suburbs where incomes are growing, which therefore increase people’s ability to afford, and pay higher prices, for property.

A good neighbourhood means different things to different people, but there are some key factors that help to determine which locations have the potential to grow in value faster in the future.

Generally, a good neighbourhood is determined by the physical location, suburb character, and its close proximity to amenities such as a shopping strip, park, coffee shops, education, and even some jobs.

It’s obvious then that in our new ‘Covid’ world, people will want to be in a location where everything they need is in short 20-minute proximity – whether that is on public transport, bike ride or walks – to their home.

In planning circles, this concept is known as the ‘20-minute neighbourhood’.

Many inner suburbs of Australia’s capital cities and parts of their middle suburbs already meet the 20-minute neighbourhood tests, but very few outer suburbs do because there is a lower developmental density, less diversity in its community, and less access to public transport.

Supply and demand

Rising property prices are the result of two basic economic concepts: “Supply and Demand” and “Inflation”.

However, there is a sub-component of Demand, called “Capacity-to-Pay”, which is often overlooked.

Understanding how these concepts work together to affect real estate is crucial to one’s belief or doubt about whether real estate values will rise.

In a free-market economy, prices of any commodity will tend to drop when supply is high and demand is low.

In other words, when there is more than enough of something, it is said to be a “buyer’s market” because sellers must compete, typically by lowering the price, to attract a buyer.

Conversely, when supply is low and demand is high, prices will tend to rise as buyers bid up pricing to compete for the limited supply. This is called a “seller’s market”.

Let’s look at it this way….

- With regard to supply…. they aren’t making any more real estate in the most desirable areas and by this, I’m talking about the dirt, not the buildings.

- With regards to demand, Australia has a business plan to increase of population to 40,000,000 people in the next 30 years.

For the last few decades, continued strong population growth has been a key driver supporting our property markets.

Australia’s population was growing by around 360,000 people per annum, meaning we needed to build around 170 to 180,000 new dwellings each year to accommodate all the new households.

Since 60% of our growth is dependent on immigration, in the short-term population growth will fall, but they should increase again as soon as overseas immigrants will be allowed to come to our shores.

However, more and more ex-pats are returning to Australia.

At the same time, the number of new properties listed for sale in our capital cities is falling creating an imbalance of supply and demand

Source: Corelogic August 16th, 2021

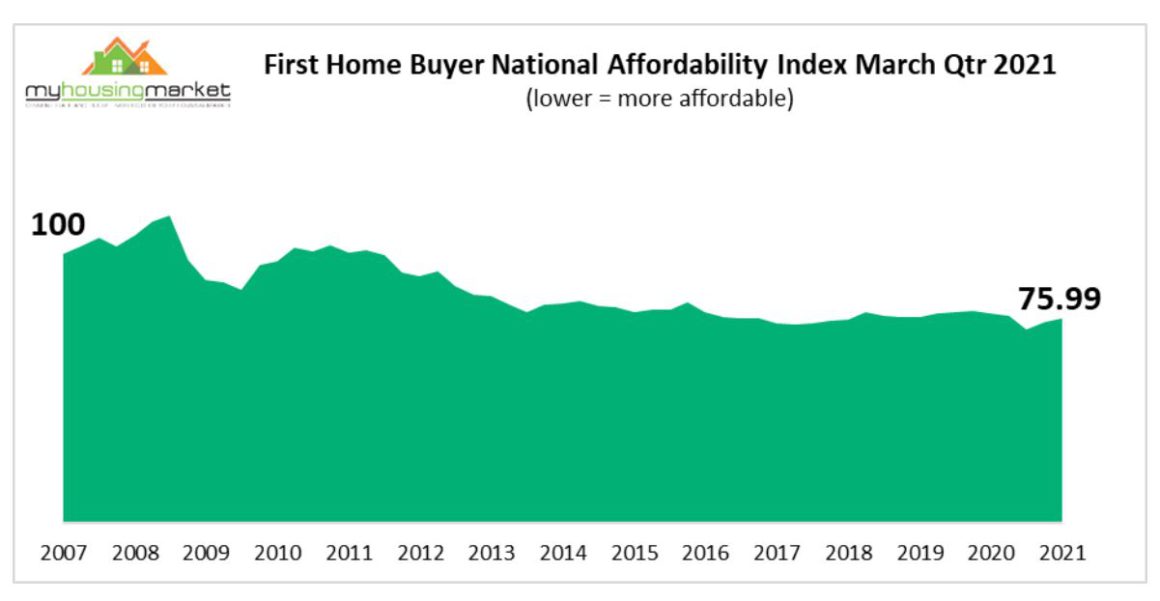

What about affordability?

With interest rates at historic lows, housing affordability is as cheap as it ever has been.

I’m not saying the properties are cheap – they never have been if you want to live in great locations in major world-class cities.

But for those first home buyers wanting to get a foot on the property ladder, or established home buyers wanting to upgrade, or investors looking to hold onto a property, the holding costs are less than they ever have been.

And the RBA has declared that the interest rate will not increase until unemployment is back to within its preferred range of around 4.5%.

They have said this will be unlikely to occur in the next three years.

In other words, we are in unprecedented times where we don’t have to worry about rising interest rates in the foreseeable future

Of course, rising property prices are an increasing issue for First Home Buyers who are not bringing a “trade-in” to the market.

As opposed to an established homebuyer who has a “trade-in” that is increasing in value, if first home buyers wait to get into the market they’re finding the market moving faster than they can save, so they’re hopping on board the property train as quickly as they can.

First home buyer affordability has declined for the second consecutive quarter according to Dr. Andrew Wilson, reinforcing the latest ABS data that revealed first home buyer numbers – although still strong – have fallen over recent months.

Australian house price forecasts

In the medium term, property values will be linked to the extent that our economic recovery affects income, employment, borrowing capacity, and credit availability.

However, I’m comfortable with the underlying long-term fundamentals supporting our property markets in the medium to long term.

Let’s look at a couple of them…

- Population growth

As I said, in the short-term population growth will fall, but this should increase again as soon as overseas immigrants will be allowed to come to our shores.

Australia is likely to be seen as one of the safe haven’s in the world moving forward.

- Declining housing supply

The oversupply of dwellings in many Australian locations is now dwindling and there are very few new large projects on the drawing board.

Considering how long it takes to build new estates or large apartment complexes, we’re going to experience an undersupply of well-located properties in our capital cities in the next year or two.

- Interest rates are low

The prevailing low-interest-rate environment is making it easier to own a home, either as an owner-occupier or investor.

In fact, it’s never been cheaper for investors to own a property with the “net outlay” – the out-of-pocket expenses – being the lowest they’ve been for decades considering how cheap finance is today.

- Smaller households are becoming the norm

Sure many people live in a multigenerational household, but pretty soon Millennials will make up one-third of the property market and their households tend, in general, to be smaller as are the households of the booming 65+ year old demographic.

More one and two people households mean that moving forward, we will need more dwellings for the same number of people.

- More renters

Soon 40% of our population will be renters, partly because of affordability issues but also because of lifestyle choices.

The government isn’t providing accommodation for these people. That’s up to you and me as property investors.

- First home buyers are back

First home buyers are back with a vengeance, in part thanks to the many incentives to encourage them, but also because of cheap finance and rising property values.

- The underlying fundamentals are strong

Our economy recovery is unprecedented, unemployment is falling quickly as new jobs are being created.

And Australia’s banking system is strong, stable, and sound.

And Australia’s banking system is strong, stable, and sound.

Even though a few home buyers have overcommitted themselves financially, there should be no real concern about household debt because, in general, it is in the hands of those who can afford it.

There is currently a very low rate of mortgage default of mortgage to increase.

Sydney House Price Forecast

Extremely strong demand for houses in Sydney’s inner and middle-ring suburbs is likely to lead to double-digit Sydney house price growth over the next 12 months.

In fact, Sydney housing prices grew 8.2% in the second quarter of 2021.

While well located, family-friendly apartments in Sydney’s inner suburbs are likely to perform strongly due to increasing demand from owner-occupiers and investors, apartments in high-rise towers are likely to languish.

Sydney has embraced apartment living more than any other Australian capital and family suitable apartments are seen as an affordable alternative to houses and units in popular areas such as Sydney’s eastern suburbs and Northern Beaches, where they are likely to enjoy continuing strong demand which will result in a strong increase in values.

On the other hand, apartments in high supply areas present a significant risk to property investors.

This trend already occurred prior to COVID-19 where certain areas in Sydney experienced major unit oversupply.

It seems the property investors are slowly understanding the risks associated with high-rise tower apartments in Sydney including potential construction defects, high vacancy rates, lack of scarcity, lack of capital growth, and the challenges of buying in buildings that are predominantly owned by investors, and often many overseas investors.

Real estate in Sydney’s larger regional locations, and in particular in lifestyle locations like Byron Bay, the Central Coast, the Hunter Valley, Wollongong, New South Wales south coast should perform strongly this year with beachside suburbs likely to outperform the wider overall market

The resurgence of buyer and seller interest in the Sydney property market has meant that auction clearance rates have consistently been in the high 70% – 80% range suggesting there are more buyers than there are sellers and this always leads to higher property prices

More investors are getting into the Sydney market now recognising that there are no bargains to be found and that in 12 months time the properties they purchased today will look like a bargain.

Sure there are fewer good properties for sale at the moment, and many of the good ones are for sale off-market, however, if you’d like to know a bit more about how to find these investment gems give the Metropole Sydney team a call on 1300 METROPOLE or click here and leave your details.

Melbourne House Price Forecast

Melbourne House Price Forecast

While Melbourne house prices suffered because of its extended lockdown which severely impacted market activity in 2020, commencing in late October the Melbourne property market has rebounded strongly and is likely to deliver double-digit capital growth over the next 12 months with houses outperforming apartments.

Melbourne housing prices are now at new record highs having increased 4.6% in the last quarter.

Houses in regional Victoria with easy access to the capital city are also in strong demand.

Auction clearance rates in Melbourne have been very high – actually boom-time levels.

While there is a shortage of quality housing in popular areas across Melbourne, the lower-than-expected population growth has meant an oversupply of housing in some outer suburban new Estates.

A prime example of this is Melbourne’s western suburbs where an additional 18,800 houses are expected to be built over the next 24 months.

Villa units, townhouses, and family suitable apartments will be seen as affordable alternatives to houses in the highly sought-after inner eastern and south-eastern suburbs of Melbourne.

On the other hand, high-rise apartments in the many Melbourne CBD towers or close to universities are likely to underperform and keep decreasing in value.

RiskWise reports that certain apartment locations should be avoided because of the risk of oversupply. Examples include:

- Melbourne West with 4,267 units in the pipeline (8.4 per cent increase to the current stock),

- Melbourne – Inner East with 4,523 units in the pipeline (7.2 per cent increase to the current stock) and

- Melbourne – Inner with 11,579 units in the pipeline (4.7 per cent increase to the current stock).

While buyer sentiment has improved substantially, Riskwise state that the realisation of risks associated with high supply areas including price movements, construction defects, and now high vacancy rates, make these Properties, which are generally bought by investors, a higher risk endeavour.

At Metropole we’re finding that strategic investors and homebuyers looking to upgrade are actively out picking the eyes out of the market.

While overall Melbourne property values likely to increase by double digits in 2021, like all our capital cities there is not one Melbourne property market, and A-grade homes and investment-grade properties are likely to exhibit double-digit capital growth.

Sure there are fewer good properties for sale at the moment, and many of the good ones are for sale off-market, however, if you’d like to know a bit more about how to find these investment gems give the Metropole Melbourne team a call on 1300 METROPOLE or click here and leave your details.

If you’d like to know a bit more about how to find investment grade properties in Melbourne please in the balance of this year give the Metropole Melbourne team a call on 1300 METROPOLE or click here and leave your details.

Brisbane House Price Forecast

Brisbane’s house prices remained resilient over 2020 when other markets were impacted by the economic impact of COVID-19.

Now, moving forward, the Sunshine State will shine with strong demand for homes, particularly in lifestyle areas, likely to deliver double-digit capital growth over the next 12 months.

Brisbane house prices have increased 5.7% over the last quarter alone

Westpac Bank recently updated its property forecasts, with Brisbane prices tipped to surge 20 per cent between 2022 and 2023.

Increased demand for Brisbane houses has been underpinned by increasing consumer sentiment, historically low-interest rates and internal migration considering the relative affordability of houses in Queensland compared to Sydney and Melbourne.

Similarly, popular areas of the Gold Coast and Sunshine Coast have enjoyed strong demand considering the increased flexibility of being able to work from home and commuting to the big smoke less frequently.

At the same time, property investor activity has been strong, particularly for houses, not only coming from locals but from interstate investors who see strong upside in Brisbane property prices as well as favourable rental returns.

However, there is not one Queensland property market, nor one south-east Queensland property market, and different locations are performing differently and are likely to continue to do so.

Houses remain a firm favourite of prospective home hunters, with demand rising post-lockdown and it remains significantly elevated compared to last year.

However, apartment demand has been sliding and, in general, apartments in Queensland are a higher risk investment than houses, particularly due to a high supply of apartments that are unsuitable for families or owner-occupiers.

In summary…

Brisbane is likely to be one of the best performing property markets over the next few years, but while some locations in Brisbane have strong growth potential, and the right properties in these locations will make great long-term investments, certain submarkets should be avoided like the plague.

Now read: Brisbane property markets forecast for string growth

Our Metropole Brisbane team has noticed a significant increase in local consumer confidence with many more homebuyers and investors showing interest in a property.

At the same time we are getting more enquiries from interstate investors there we have for many, many years.

If you’d like to know a bit more about how to find investment grade properties in Brisbane please give the Metropole Brisbane team a call on 1300 METROPOLE or click here and leave your details.

Canberra House Price Forecasts

Canberra’s property market has been a “quiet achiever” with dwelling values reachING a new peak after growing 18.1% over the last year.

Considering a large percentage of Canberra population is employed by the government or industries supporting the public sector, Canberra’s property market has not really felt the effects of the upcoming recession like our other capital cities did.

Moving forward, this resilient property market will continue to enjoy solid but slower property price growth, and apartments will continue to underperform the housing market in Canberra.

The apartment market in the ACT suffering from an oversupply of new dwellings relative to its population growth.

At the same time, there is an overall preference for houses as opposed to apartment living in Canberra, and even though units in the ACT have performed well, they pose a higher risk than houses in Canberra.

Perth House Price Forecast

Perth’s long-awaited recovery was interrupted by COVID-19 with values falling in the middle of last year but now Perth’s housing market is back on a recovery trajectory, with home values posting a 2.1% increase in the last quarter.

Perth continues to be the most affordable capital city for houses in the country and this along with a record-low mortgage rate, improving economic conditions and government incentives are some of the factors supporting renewed price growth.

Perth house prices could increase in the range of 6 to 10% over the next year, particularly for mid to high-end properties.

Lower priced properties are not likely to perform strongly in there is little demand for housing in regional Western Australia.

Rental markets are amongst the tightest of any capital city, with the lift in rents through the COVID period to the date the highest amongst the capital cities.

But this does not mean that investors should jump into the Perth property market – there are better opportunities in other parts of Australia.

The problem is the Western Australian economy is too dependent on one industry – the mining industry, and much of this dependant on China.

Without structural changes to the W.A. economy, it is unlikely to be able to deliver the significant number of higher-paying jobs and the substantial increase in population growth required to keep driving strong housing price growth in the medium to long term.

Hobart House Price Forecast

Hobart was the darling of speculative property investors and the best performing property market in 2017- 8, and while dwelling values reached a record high in February 2020, its boom interrupted by Covid-19.

Hobart property values are moving up again with values up to new record levels up 19.6% over the past year.

Adelaide House Price Forecast

Adelaide’s housing market has moved from strength to strength over recent month, with home values reaching new record highs – up 13.9% over the next year.

Relatively low housing prices and the stimulus of low-interest rates are likely to be the main factors behind the growth in housing values.

With housing affordability in Adelaide substantially better than the other states, combined with the fact that the current low mortgage rates make it cheaper to buy them to rent, it is likely strong demand for houses will continue to push up Adelaide property values in 2021

It is likely that overall Adelaide house prices could increase by 5 to 8% in the next 12 months.

On the other hand, despite good affordability, the demand for apartments in Adelaide is generally low and they are not considered popular dwelling option amongst families

Now is the time to take advantage of the opportunities the current property markets are offering.

Sure the markets are moving on, but not all properties are going to increase in value. Now, more than ever, correct property selection will be critical.

You can trust the team at Metropole to provide you with direction, guidance, and results.

Whether you’re a beginner or an experienced investor, at times like we are currently experiencing you need an advisor who takes a holistic approach to your wealth creation and that’s exactly what you get from the multi-award-winning team at Metropole.

We help our clients grow, protect and pass on their wealth through a range of services including:

- Strategic property advice. – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more

- Buyer’s agency – As Australia’s most trusted buyers’ agents we’ve been involved in over $4Billion worth of transactions creating wealth for our clients and we can do the same for you. Our on the ground teams in Melbourne, Sydney, and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment-grade property. Click here to learn how we can help you.

- Wealth Advisory – We can provide you with strategic tailored financial planning and wealth advice. Click here to learn more about we can help you.

- Property Management – Our stress-free property management services help you maximise your property returns. Click here to find out why our clients enjoy a vacancy rate considerably below the market average, our tenants stay an average of 3 years, and our properties lease 10 days faster than the market average.

You may also be interested in reading:

- What can history teach us about what’s ahead for property

- How to Choose a Property Advisor

- What’s ahead for Brisbane’s property market?

- Property Investment In Sydney – 20 Market Insights

- Property Investment In Melbourne – 29 Real Estate Market Tips

from Property UpdateProperty Update https://propertyupdate.com.au/property-predictions-for-2022-revealed/

No comments:

Post a Comment